Summer.fi

Summer.fi is a platform for decentralized finance. It can be used to borrow stablecoins against users’ favorite cryptocurrencies, increase exposure against them using Multiply, or Earn a competitive yield. This can be done across multiple protocols and Layers — all in one place. Summer.fi’s mission is to provide the most trusted entry point to deploy capital into DeFi. The team is made of passionate thinkers and builders driven to create a better user experience for all while being able to maximize returns.

Summer.fi Governance Recap: USDC Vault Upgrade Live on Arbitrum

Thu 14th Aug 2025

**Active Proposal**

- [SIP1.1.1] **USDC Vault upgrade** on Arbitrum is live for voting

- Deploys full 11-Ark fleet with cross-chain governance via LayerZero

- No bridged tokens required

**Forum Discussions**

Multiple RFCs propose expanding yield sources:

- **USDC Mainnet**: Clearstar reactors, MidasRWA vaults, Upshift strategies

- **ETH Mainnet**: Clearstar Reactor ETH, Ether.fi Liquid ETH

- **Base USDC**: Clearstar reactors, 40acres Finance, Universal.fi

- **Arbitrum USDC**: Clearstar USDC Reactor

- **MIDAS integration**: Evaluating RWA vaults for Mainnet and Base

- **ExtraFi XLend**: Adding ETH pool to Base Lower-Risk vault

**Key Features**

- Sustainable yield via OP/EXTRA incentives

- Multi-account lending architecture

- Automated risk controls

These proposals will shape upcoming vault upgrades across the protocol.

🤖 Weekend Check

Thu 6th Nov 2025

**DeFi markets don't sleep** - even as traders prepare for the weekend, automated systems keep working.

**Lazy Summer's AI Keepers** continue monitoring conditions across major protocols:

- Morpho

- Euler Finance

- Frontier

- Moonwell DeFi

- Dozens of other platforms

**Weekend reminder**: Now's a good time to review your vault exposure settings before markets potentially shift over the weekend.

The protocol's **automated rebalancing** means your positions adjust to changing yield conditions without manual intervention.

[Check your vaults](https://summer.fi/earn)

Lazy Summer DAO Hits $182.7M TVL as $SUMR Token Audit Nears Completion

Thu 2nd Oct 2025

**Lazy Summer Protocol** achieved significant milestones in September with **TVL growing $34M to $182.7M** and the $SUMR token transferability moving into audit phase.

**Key Developments:**

- $SUMR token and Governance V2 now in Sherlock audit (ends Oct 7)

- **Target: Enable transferability by end of October**

- DAO Treasury grew to $186K with liquidity incentives ready

**Growth Metrics:**

- **SUMR holders:** 5,536 (+490)

- **Delegates:** 521 (+7)

- **SUMR delegated:** 360.5M (+7M)

**Chain Performance:**

- Ethereum: +$31M to $143M

- Base: +$3M to $25M

- Arbitrum: +$3.4M to $9.8M

The protocol deployed **26 new strategies** across chains while processing multiple expansion proposals including Plasma Network integration and new vault strategies.

Summer.fi Launches Vault Switch for Single-Transaction Portfolio Rebalancing

Mon 29th Sep 2025

**Summer.fi introduces Vault Switch**, a new feature enabling users to rotate between different vaults in a single transaction without downtime.

**Key Features:**

- Switch between ETH and stablecoins instantly

- Maintain continuous yield generation during transitions

- Adapt to market conditions without exiting protocols

- Available on Mainnet, Base, and Arbitrum

**Use Cases:**

- **Risk-off moves**: Rotate from ETH to stables during market uncertainty

- **Risk-on positioning**: Move back to ETH when momentum returns

- Keep earning $SUMR rewards throughout transitions

**Benefits:**

- No missed opportunities during portfolio adjustments

- Continuous compounding of real yield

- Instant market adaptation in seconds

- No idle capital sitting unproductive

The feature addresses a common DeFi pain point where users lose yield during position changes. Future updates will include higher-risk USDC and BTC vault options.

[Learn more about Vault Switch](https://blog.summer.fi/introducing-vault-switch-adapt-your-lazy-summer-position-to-any-market-with-just-one-transaction/)

Summer.fi Launches Modular DeFi Stack to Solve Institutional On-Chain Yield Complexity

Thu 18th Sep 2025

**Summer.fi addresses institutional DeFi pain points** with a comprehensive solution for on-chain yield access.

**The Problem:**

- Fragmented risk across protocols

- Complex integrations

- Heavy operational overhead

**The Solution - Modular Stack:**

- Front-end interface + vault infrastructure

- Independent risk curation

- Automated rebalancing with policy controls

- Single integration across EVM markets

- Audit-ready reporting

**Key Benefits:**

- **Scale without headcount:** Automated operations replace manual spreadsheet work

- **Policy compliance:** Vault logic encodes institutional mandates

- **Composability:** Works with existing custody solutions

Targeted at asset managers, crypto custodians, family offices, and fintech apps seeking streamlined DeFi yield access.

[Learn more about the institutional stack](https://summer.fi/institutions) or [book a consultation](https://calendly.com/summer-fi/summer-institutional).

AI Agents Transform DeFi Yield Farming

Thu 4th Sep 2025

**DeFi's complexity problem**: With 1,834 stablecoin pools across 460 protocols and 101 chains, manual yield optimization has become nearly impossible.

**The AI solution**: Autonomous agents now handle:

- Real-time yield scouting across multiple protocols

- Automatic portfolio rebalancing

- Risk-adjusted optimization

- Natural language goal setting

**Evolution from manual to smart**: Early DeFi required constant monitoring and manual transactions. Static yield aggregators improved this but couldn't adapt quickly to market changes.

**Key advantages of AI agents**:

- **Dynamic strategies** that learn and adapt

- **Reduced friction** - no more gas-heavy manual rotations

- **Better risk management** through continuous monitoring

- **Accessibility** via simple language interfaces

**Industry momentum**: dForce calls this shift "DeFAI" - the fusion of AI and DeFi representing the natural evolution of onchain finance.

This represents a fundamental shift from reactive to proactive yield optimization, similar to how algorithmic trading transformed traditional finance.

[Read the full analysis](https://blog.summer.fi/how-ai-defi-creates-always-on-yield-strategies/)

**DeFi Integration Crisis: Why Institutions Can't Access Yield Efficiently**

Mon 25th Aug 2025

**Major institutional barriers plague DeFi adoption**, despite promises of transparent, borderless yield opportunities.

**Key problems identified:**

- Protocols operate in complete isolation

- Capital rotation requires inefficient 2-3 leg trades (withdraw, bridge, deposit)

- Maintenance costs escalate with each new connection

**The impact:** Banks, hedge funds, and DAO treasuries face partial market exposure, high operational overhead, and missed opportunities.

**Current reality:** Instead of seamless innovation, institutions battle constant integration challenges that prevent them from scaling DeFi operations effectively.

Read the full analysis at [blog.summer.fi](blog.summer.fi/why-instituti)

Summer.fi Institutional Simplifies DeFi Access for Professional Allocators

Thu 14th Aug 2025

**Summer.fi Institutional** addresses the complexity barrier that keeps institutions out of DeFi yield markets.

**The Problem:**

- Fragmented liquidity across protocols and chains

- Multiple costly integrations required

- Constant upgrades and high risk exposure

**The Solution:**

Summer.fi Institutional offers a **single integration** to access all major yield markets for stablecoins, ETH, and BTC.

**Key Features:**

- Customizable institutional-grade vaults

- Automated rebalancing and yield optimization

- Compliance and transparency built-in

- Expert technical support tailored to risk frameworks

- Access to both on-chain and off-chain markets

**Target Users:**

- Asset managers

- Crypto custodians

- Family offices

- Crypto funds

- Fintech applications

The platform utilizes DAO-managed vaults with risk expertise from Block Analytica and offers SDK integration for branded yield products.

[Learn more about Summer.fi Institutional](https://summer.fi/institutions)

Lazy Summer DAO Governance Update - August 14, 2025

Mon 4th Aug 2025

**Key Updates:**

- MERKL Rewards proposal (SIP3.7) has passed and will be enabled across all vault markets

- 5 new proposals are active for voting until Aug 17/18:

- Base: LowerRisk fleets for USDC and WETH

- Ethereum: HigherRisk USDC Fleet

- Arbitrum: LowerRisk fleets for USDT and USDC

- 3 major forum discussions ongoing:

- Optimism Mainnet USDC/ETH Fleet onboarding

- Core protocol ARKs update on mainnet

- MorphoLabs ARKs support on Arbitrum

**Take Action:** Review proposals and cast your votes at [gov.summer.fi](https://gov.summer.fi) before the deadline.

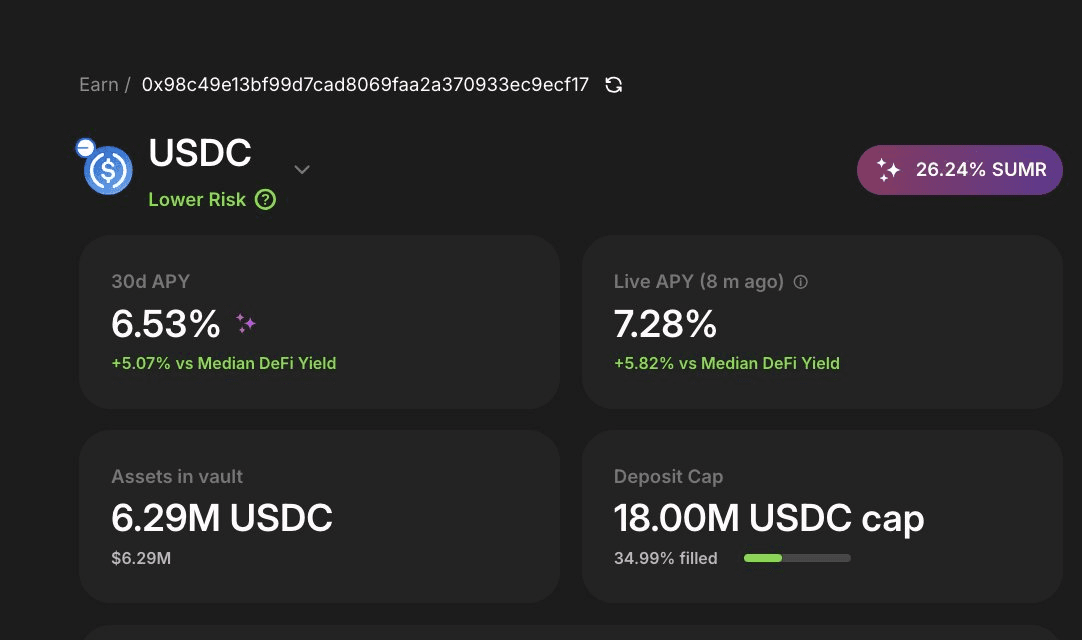

Market Watch Monday: USDC Vault on Base Chain Performance Update

Mon 14th Jul 2025

The USDC Vault on Base chain continues to demonstrate strong performance metrics:

- Current APY stands at 7.28% (5.82% above DeFi median)

- 30-day average APY: 6.53% (5.07% above median)

- Additional SUMR token rewards: 26.24%

- Total deposits: 6.29M USDC

- Vault capacity: 35% utilized (18M cap)

Compared to two weeks ago, while APY decreased from 9.14% to 7.28%, the vault maintains above-market yields. The vault focuses on automated, passive income generation through optimized lending strategies.

[Learn more about the vault](https://summer.fi/earn/base/position/0x98c49e13bf99d7cad8069faa2a370933ec9ecf17)