Summer.fi Governance Recap: USDC Vault Upgrade Live on Arbitrum

Summer.fi Governance Recap: USDC Vault Upgrade Live on Arbitrum

🗳️ Arbitrum vault upgrade

Active Proposal

- [SIP1.1.1] USDC Vault upgrade on Arbitrum is live for voting

- Deploys full 11-Ark fleet with cross-chain governance via LayerZero

- No bridged tokens required

Forum Discussions

Multiple RFCs propose expanding yield sources:

- USDC Mainnet: Clearstar reactors, MidasRWA vaults, Upshift strategies

- ETH Mainnet: Clearstar Reactor ETH, Ether.fi Liquid ETH

- Base USDC: Clearstar reactors, 40acres Finance, Universal.fi

- Arbitrum USDC: Clearstar USDC Reactor

- MIDAS integration: Evaluating RWA vaults for Mainnet and Base

- ExtraFi XLend: Adding ETH pool to Base Lower-Risk vault

Key Features

- Sustainable yield via OP/EXTRA incentives

- Multi-account lending architecture

- Automated risk controls

These proposals will shape upcoming vault upgrades across the protocol.

Lazy Summer Governance Recap – September 2025 September was big: $SUMR transferability moved into audit phase, TVL jumped +$34M, and the DAO kept shipping on new vaults, proposals & integrations. Your monthly catch-up 👇🧵

Why Institutional DeFi Integrations Are Broken (And How to Fix Them) For years, DeFi has promised institutional investors a transparent, borderless, and permissionless environment to access yield opportunities. But in practice, tapping into that potential yield at scale has been

Lazy Summer Governance Recap – October 2025 Fresh out the oven recap of the month of October! - 7 new RFCs, - 9 SIPs, - and 6 onchain votes via @tallyxyz forum.summer.fi/t/lazy-summer-… Not so Lazy tbf: $SUMR transferability & staking V2 getting very real. Your monthly catch-up 👇🧵

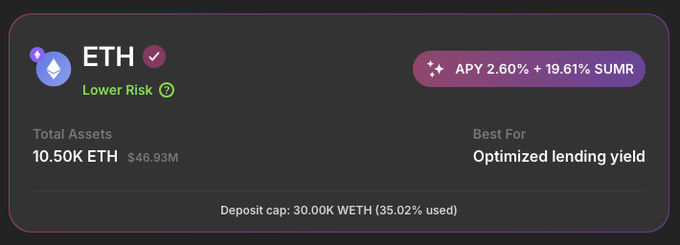

📊 Monday Market Watch Happy new month! 🌞 The Lazy Summer Protocol starts September with strength: Protocol TVL: $151.36M ETH (Lower Risk) Strategy total assets: 10.5K ETH Best for optimized lending yield 🔗 Explore strategies: summer.fi/earn #LazySummer #DeFi #ETH

Lazy Summer Weekly Governance Recap - Nov 7, 2025 Your one-stop update on what’s live via @tallyxyz, under discussion, and coming up next! 📢 5 ACTIVE PROPOSALS: gov.summer.fi Let’s dive in 👇🧵

Choosing a DeFi yield strategy shouldn't be a full-time job. Here’s how to pick the right Lazy Summer vault based on chain, asset, and risk. 📺 Watch full video: youtu.be/uAfSwLWNE7M #CryptoYield #ETH #YieldFarming

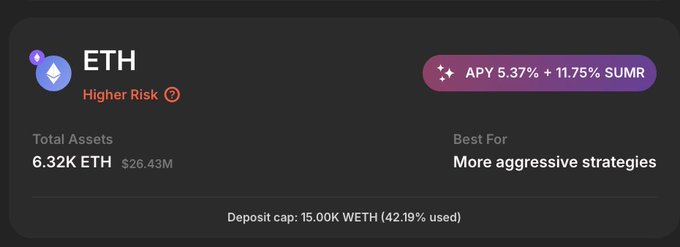

The ETH Lower Risk strategy is built for just this. Your idle ETH deserves better, but DeFi has so much to offer... The ETH Lower Risk vault on Summer.fi gives automated exposure to the best ETH Yield: @MorphoLabs @aave @compoundfinance @0xfluid @eulerfinance

a buddy of mine that has just held eth for a long time is looking for some low risk defi - where is the easiest way to park eth with great ux and a low risk?

🌞 Sunday = less screen, more sun. Meanwhile, Lazy Summer keepers are busy in the background ⚡ rebalancing ⚡ moving liquidity ⚡ chasing optimal yield So you don’t have to. Explore what’s happening under the hood: summer.fi/earn

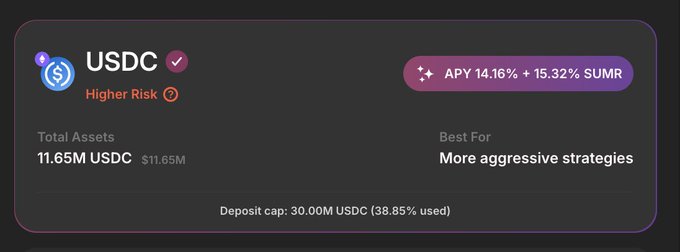

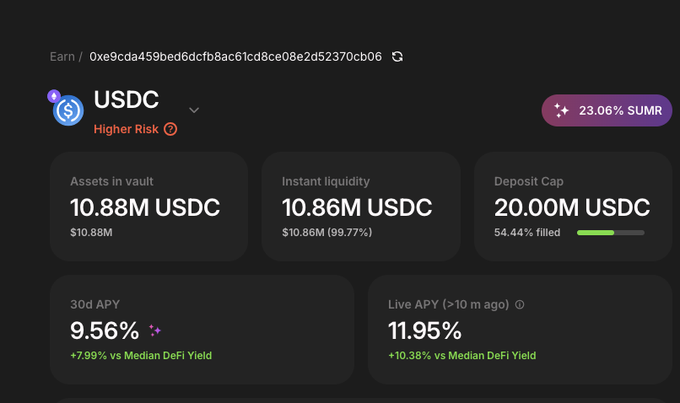

Market Watch | USDC Higher-Risk Vault Moves Up the Charts Capital rotation continues toward high-yield strategies and the USDC Higher-Risk Vault is leading the flow. - 14.16% Live APY (+12.11% vs median DeFi yield) - Deposit Cap: 38.85% filled out of $30M Built for more

Lazy Summer × @MorphoLabs Lazy Summer has onboarded a wave of new @MorphoLabs vaults from > @gauntlet_xyz > @avantgardefi > Alpha Core > @yearnfi > @TacBuild > @ExtraFi_io > @Re7Capital > @SteakhouseFi > @infinifi > @indexcoop > @SingularV__ Deposit once →

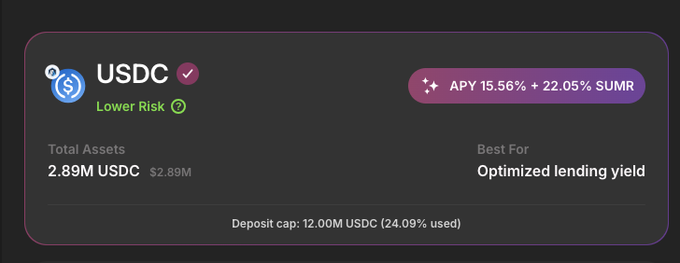

📊 Market Watch Monday: USDC Mainnet Higher-Risk Vault Assets in vault: 10.88M USDC Instant liquidity: 10.86M USDC (99.77%) 30d APY: 9.56% (+7.99% vs median DeFi yield) Live APY: 11.95% (+10.38% vs median DeFi yield) summer.fi/earn/mainnet/p…

Saturday or not, the market doesn’t pause. Missed the Lazy Summer community call? Here’s what it covered: - How recent DeFi stress events played out under the protocol’s parameters - The status of the USDC @arbitrum vault and its exposure - The @AerodromeFi Ignition option and

Lazy Summer Weekly Governance Recap – Nov 21, 2025 Your one-stop update on what’s live via @tallyxyz, under discussion, and coming up next! 📣 1 ACTIVE PROPOSAL: gov.summer.fi Let’s dive in 👇 🧵

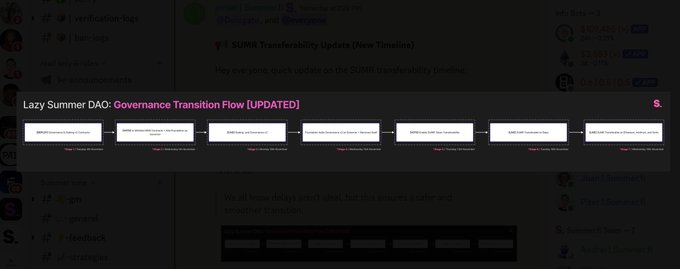

📅 The SUMR transferability countdown is on. Each stage builds the foundation for a liquid, productive SUMR. Governance V2 → Staking V2 → Transferability → Multi-chain activation Full timeline & details ↓

Weekend mode 🌴 Lazy Summer protocol auto-rotates your deposit across @eulerfinance’s best vaults with guardrails by @BlockAnalitica and cross-protocol context. Never miss Euler’s best markets. 👉 Read more: blog.summer.fi/how-lazy-summe…

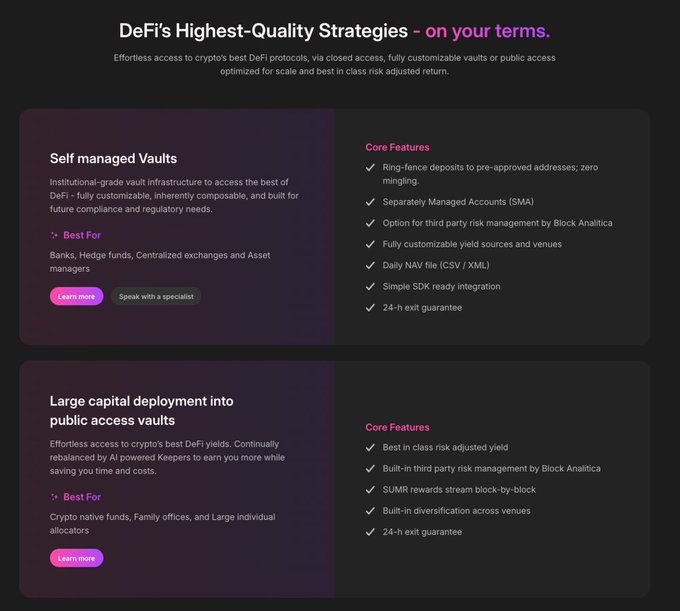

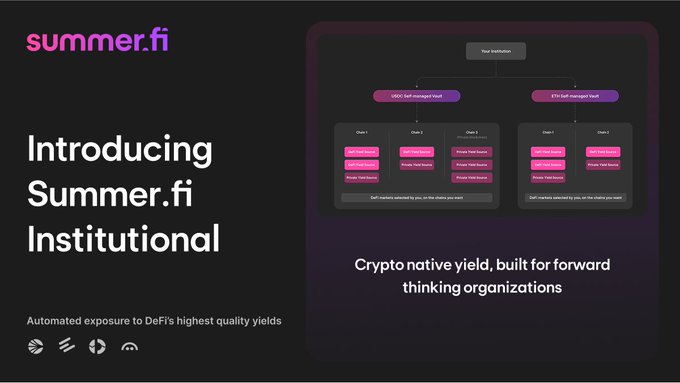

Institutions don’t need another generic yield product. They need vaults shaped around mandates, policy, and automation. That’s exactly what Summer.fi Institutional self-managed vaults enable: – Chain, asset, and venue selection – Policy + access controls – Automated

Set it and forget it Deposit into Lazy Vaults and let Summer.fi’s AI rebalance for you: steady yield, zero drama. Try it now. summer.fi/earn

_ @arbitrum TVL crossed $3.8B in October. Lazy Summer’s USDC Lower-Risk Vault on the Arbitrum network is performing strongly: → 24/7 on-chain rebalancing → Risk managed by @BlockAnalitica Full Market Watch ↓ (🔗 link in thread)

☀️ Weekend mode: ON. DeFi shouldn’t feel like a full-time job. With the Lazy Summer Protocol, your yield keeps working while you actually relax. Dive into how it makes DeFi yield totally chill: blog.summer.fi/how-lazy-summe…

🗳️ Governance Update: Lazy Summer DAO Voting is now live until September 7th, 2025 gov.summer.fi TLDR: - Lazy Summer DAO is now live on @ai_degov - new RFC up on the forum - several onchain votes to expand vault strategies. Let’s dive in. 👇🧵

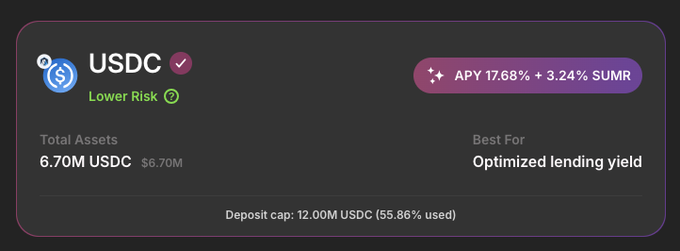

Lazy Summer Protocol= fewer choices, smarter strategies. Summer.fi broke down 3 vaults: - USDC Higher-Risk on Mainnet - USDC Lower-Risk on @base - ETH Lower-Risk on Mainnet Which one would you choose? 🎥 Watch the full video: youtu.be/j2YddqRthHg

🎉 TVL Milestone Reached: $160M+ The Lazy Summer Protocol has surpassed $160M+ in TVL. All positions are curated and risk-managed by @BlockAnalitica. This milestone highlights the continued growth of automated, risk-aware DeFi yield strategies. 👉 Explore strategies:

📊 #MarketWatchMonday USDC.e Vault (Lazy Summer) • Assets in vault ≈ $5.36M • Live APY ~11.37% • AI-powered keepers continuously monitor and rebalance within governance-approved markets (@apostroxyz, Varlamore, @SiloFinance), reallocating from lower- to higher-performing

Vault Switch = rotation without downtime Rotate between vaults in a single tx. ETH → stables in risk-off, or back to risk-on when momentum returns without exiting the protocol or sitting idle. That’s the point of Vault Switch. Learn more: blog.summer.fi/introducing-va…

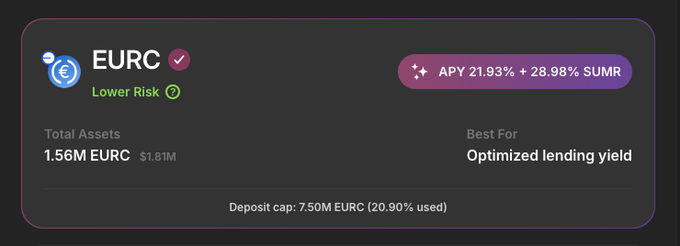

📊 Market Watch Monday DeFi opened the week steady, while automation kept moving. Lazy Summer Protocol → TVL: $167.92M → Instant Liquidity: $117.01M Top vault today: EURC (Lower-Risk) on @base Best for optimized lending exposure.

ETH yield isn’t just about staking anymore. Summer.fi’s ETH Higher Risk vault is putting ETH to work, and the numbers are worth watching. 👇

Picking a vault doesn’t have to feel like solving a puzzle. Lazy Summer cuts through the noise → fewer choices, smarter strategies. 🎥 Watch the full breakdown: youtu.be/j2YddqRthHg?si…

Most institutions in DeFi don’t have a yield problem. They have an operations problem. 📊 Endless spreadsheets ⏱ Manual rebalancing ⚠️ Fragmented risk oversight That’s not scalable.

📊 #MarketWatchMonday Top Live-APY vault → USDC Lower-Risk (@arbitrum) Assets in vault—6.46M USDC in vault Best for optimized lending yield This vault is composed of multiple DeFi protocols on @arbitrum, curated and risk-managed by @BlockAnalitica.

Lazy Summer Weekly Governance Recap – Nov 29, 2025 Your one-stop update on what’s live via @tallyxyz, under discussion, and coming up next! 📣 1 ACTIVE PROPOSAL: gov.summer.fi Let’s dive in 👇 🧵

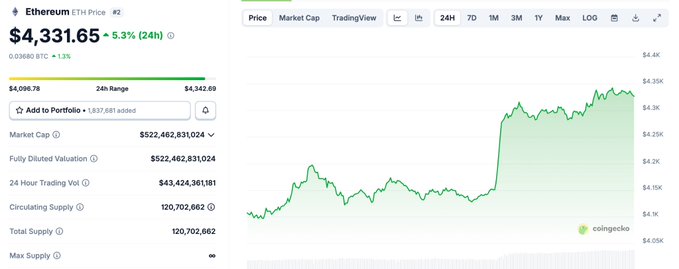

Ethereum is pushing past $4,300. 📈 In Lazy Summer Protocol, Vault Switching lets you move from stablecoin vaults into ETH strategies instantly, in-protocol.

ICYMI: Last week @DefiantNews covered the launch of Summer.fi Institutional A one-stop solution for professional allocators — customizable vaults spanning on-chain + off-chain yield, with automation, risk controls, reporting, and 24/7 support. 👇Read the full

SUMR is about to become one of DeFi’s most productive assets, transferability is the first step. SUMR aligns with protocol revenue mechanics, making it a rare DeFi token, enabling both participation in governance and in economic activity. ⚠️ Cryptoassets are high-risk and

Lazy Summer DAO Governance Call Recap: SUMR Transferability & Governance V2 Missed the call? Here’s the full recap of what’s changing, what’s coming, and why it matters for $SUMR holders. 🎥 Watch the full replay → youtube.com/watch?v=ChTvNR…

How did capital flow in Lazy Summer Protocol during August? A breakdown of where $150M+ in deposits rotated over the past 30 days ↓

🗳️ Governance Update: Lazy Summer DAO Voting is now live until August 17/18th, 2025. gov.summer.fi Here’s what’s on the table this week. 🧵

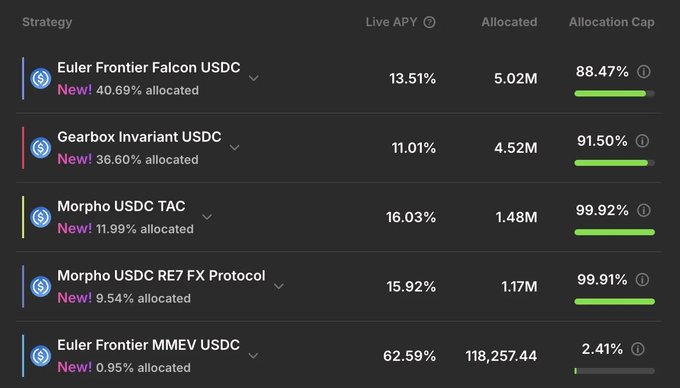

1/ The Lazy Summer protocol has onboarded a bunch of new @eulerfinance vaults. WETH: @Alterscope LRT, Frontier @upshift_fi , Frontier @puffer_finance USDC: Frontier MMEV, Falcon, @Hyperwavefi , @GetYieldFi + @arbitrum USDC Deposit once → we route you into Euler’s best

Lazy Summer July Recap — Governance, Metrics & New Proposals July was 🔥 and not just the weather. From vault expansions to protocol upgrades & the SUMR Transfer WG kickoff… here’s everything that went down in Lazy Summer DAO 👇

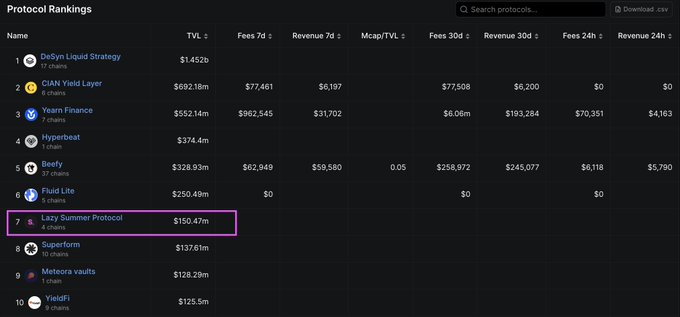

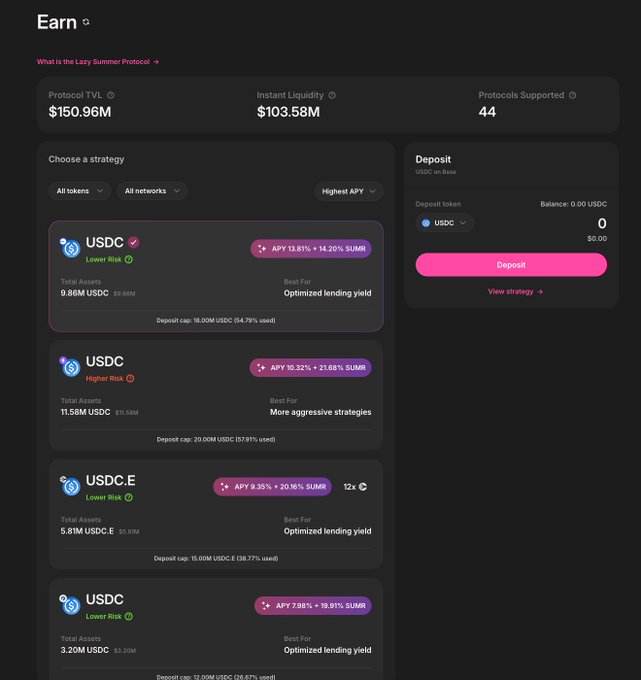

Lazy Summer Protocol on the Top 7 Yield Aggregators on @DefiLlama 🎉 $150M+ TVL secured across 4 chains Optimized yield strategies powered by automation From stablecoins to ETH strategies, Lazy Summer keeps capital working 24/7 so users don’t have to. 👉 Explore all vaults

🏖️ Lazy Summer Protocol Moves to @merkl_xyz for Reward Distribution Summer.fi is excited to announce that from Friday, 15th August, the Lazy Summer Protocol has moved over from it's own staking reward contracts to Merkl for SUMR rewards distribution and claiming

Thanks to everyone who joined the SUMR Transferability Community Call #2 The community explored what SUMR really represents, how locking works in Governance V2, and how value will soon flow back to token holders through the Lazy Summer DAO. Let’s recap 👇🧵

🗳️ Governance Update: Lazy Summer DAO Voting is now live until August 24th, 2025 gov.summer.fi Here’s what’s on the table this week 🧵

🚨 Summer.fi Featured in @stablecoininfo Institutional DeFi has been broken for too long fragmented integrations, manual processes, and zero real customization. Stablecoin Insider just covered how Summer.fi Institutional fixes that with self-managed

Institutions don’t need to wrestle with fragmented integrations or missed opportunities anymore. With Summer.fi Institutional allocators can access customizable vaults designed for compliance, transparency, and automated rebalancing. Thanks to @stablecoininfo for

📢 Community update on SUMR transferability An opportunity has emerged for SUMR to launch via Aerodrome Ignition, a program that could strengthen liquidity and enable trading on @coinbase markets from day 1. It would, however, mean a delay until January 2026 before transfers

3/ Stay tuned The $SUMR transferability phase is near; staking, rewards, and governance upgrades are moving fast. Follow @summerfinance_ and join the forum for deeper dives! forum.summer.fi

. @MorphoLabs 🤝 @summerfinance_ DeFi users continued to earn more, while saving time in July because of Lazy Summer's automated rebalancing. Of all the protocols supported, one really stood out this month. @MorphoLabs dominated stablecoin strategies, thieir USDC strategies

How AI + DeFi Creates Always-On Yield Strategies DeFi offers 1834 pools, 460 protocols, and 101 chains just for stablecoins. How do you stay optimized without manually chasing yields? Read more: blog.summer.fi/how-ai-defi-cr…

Many institutions trying to tap on-chain yield meet this: fragmented risk, tangled integrations, heavy operational overhead. Summer.fi built a stack that solves it everything you need: front end, vault infrastructure, independent risk curation, permissioned

Top5 USDC Vaults on Lazy Summer It’s Friday, let’s check where yields are actually flowing. Across @base, @arbitrum, @SonicLabs & Mainnet, USDC vaults dominate both inflows and APY this week Here are the top5 active vaults 🔽 👉 summer.fi/earn #LazySummer #DeFiYield

🗳️ Governance Update: Lazy Summer DAO SUMR Token Transfer Readiness Checklist is live on forum! + new strategies proposed are up for voting until August 24th, 2025 → gov.summer.fi Here’s what’s on this week 🧵

Lazy Summer Weekly Governance Recap - Nov 14, 2025 Your one-stop update on what's live via @tallyxyz, under discussion, and coming up next! 📣 2 ACTIVE PROPOSALS: gov.summer.fi Let’s dive in 👇 🧵

DeFi yield in 2025 isn’t about chasing APYs. 🚫 It’s about automation, risk-awareness & fit. 📊 $160M+ TVL | 59 protocols | AI keepers live on summer.fi/earn 🎥Watch breakdown: youtu.be/uAfSwLWNE7M #DeFi #Summerfi

🗳️ Governance Update: Lazy Summer DAO Another busy week in Lazy Summer DAO, with key updates from the transfer readiness, new vaults, liquidity plan, and onchain votes. Below is everything you need to know 🧵

🤙🤙🤙🤙 Attention SUMR holders and Lazy Summer Protocol users As SUMR transferability approaches, weekly governance calls will take place. Tomorrow - Thursday, 9 October will be the first SUMR Governance call focused on SUMR transferability. 12:30 – 1:15 PM UTC 2:30 –

How Lazy Summer makes it easy to earn from @MorphoLabs' top vaults blog.summer.fi/how-lazy-summe…

🌞 SUMR Transferability Update 🌞 Big milestone this month: Governance V2, along with the upgraded staking module, is now in @sherlockdefi audit. This is the final step before SUMR becomes transferable. Let’s dive in. 🧵

Weekend yield shouldn’t feel like a full-time job. ☀️ With Lazy Summer Protocol, AI keepers rebalance your capital across the best markets — automatically. Relax. Earn. Repeat. 🔗 Read: blog.summer.fi/how-lazy-summe… #DeFi #LazySummer #Automation #Yield

ICYMI 🏖️ Lazy Summer DAO held its first Governance Call It covered SUMR transferability, Governance V2, and the roadmap for SUMR becoming a productive governance asset, aligning community participation with protocol growth. Full recap below 👇

This past Thursday, the Lazy Summer Community held its first community call to discuss SUMR going live. Here are the key takeway's: 🔜 SUMR token transferability + Governance V2 almost live (audit wraps in late Oct) 🔒 New SUMR Locking to boost governance power & protocol

Introducing Summer.fi Institutional: Crypto-native yield, purpose-built for professional allocators and asset managers

🧭 SUMR Transferability Community Call #4 The Lazy Summer Community is hosting its fourth community call this Thu, Nov 13th, to discuss two big topics: - How the Lazy Summer protocol performed during last week’s DeFi incidents - Whether to launch $SUMR now or wait for

Fluidkey Integrates Lazy Summer Protocol: Yield That Starts Earning the Moment Funds Arrive @fluidkey has integrated the Lazy Summer Protocol into its auto-earn feature, unlocking instant access to curated, risk-managed yield opportunities. With the new Optimized Profile, every

DeFi is scattered. Managing @aave, @MorphoLabs, @compoundfinance + risk dashboards = endless tabs & gas fees. Summer.fi Institutional simplifies everything: - One vault - AI-powered rebalancing - Risk-curated strategies 👉 Read more: blog.summer.fi/one-vault-to-r…

. @maplefinance is quickly becoming one of the top protocols in DeFi. This past month, @maplefinance Syrup ranked second at ~8.8% of all stable coin TVL in Lazy Summer (USDC 6.4%, USDT 2.4%), ahead of other blue chip protocols like Spark USDC (3.4%) and Aave v3 (2.7%).

This past Thursday, the Lazy Summer Community held its first community call to discuss SUMR going live. Here are the key takeway's: 🔜 SUMR token transferability + Governance V2 almost live (audit wraps in late Oct) 🔒 New SUMR Locking to boost governance power & protocol

🗳️ Governance Update: Lazy Summer DAO Voting is now live until October 12th, 2025 gov.summer.fi TLDR: - $SUMR transferability comms in motion - Delegate rewards distributed - New vault strategies (@eulerfinance + @MorphoLabs) - Referral payouts proposed Let’s dive

Where does DeFi yield come from? Summer.fi Product Manager @samehueasyou explains from lending & borrowing, to collateral quality, to farming rewards, and how it all works in Lazy Summer Protocol. 📺 Watch now: youtu.be/Jw-EvcXG6AM

Touch grass, not spreadsheets Lazy keepers handled thousands of rebalances so users don't have to do it. Lazy Summer Protocol does the bits; you keep Saturday. Explore: summer.fi/earn

Lazy Summer Protocol Now Live with 5 Automated Strategies Across 77 DeFi Protocols

The Lazy Summer Protocol has launched with **5 automated yield strategies** currently operational. These strategies are: - **Fully automated** with continuous rebalancing - **Risk-managed** within predefined caps - Built on a **diversified DeFi infrastructure** spanning 77 supported protocols This follows the recent announcement of DAO-managed vaults coming in February 2026, designed for users seeking higher risk-reward profiles while maintaining the protocol's "Do Less" philosophy. The protocol enables standardized access to curated DeFi yield sources, with SUMR token holders earning up to 35% real yield in USDC through staking. The platform continues expanding its yield source coverage while maintaining institutional-grade vault architecture and independent risk management.

DeFi Shifts Focus from Yield Chasing to Real Utility and Revenue Sharing

The DeFi landscape is experiencing a notable shift in priorities. The community is moving away from: - Yield chasing strategies - Memecoin speculation - Deceptively high APYs Instead, the focus is turning toward: - **Real utility** in protocols - **Revenue sharing** models - **Productive assets** that generate sustainable returns This trend reflects a maturing market where users are prioritizing long-term value creation over short-term gains. The emphasis on productive assets suggests a move toward more sustainable DeFi practices.

20% of SUMR Token Supply Locked for Nearly Two Years on Average

**Key Statistics:** - One-fifth of all $SUMR tokens are currently locked and removed from circulation - Average lock period: nearly 2 years - Platform emphasizes long-term holder commitment **Market Positioning:** The platform's current valuation shows a significant gap between its Fully Diluted Valuation (FDV) and Total Value Locked (TVL). *Hypothetical scenario:* If TVL reaches $500M and the market values it similarly to comparable lending infrastructure, the implied market cap could be approximately 5x higher than current levels. The locking mechanism rewards users who demonstrate conviction in the protocol's long-term value proposition.

Onchain Vaults Positioned as Next Major DeFi Growth Sector After Stablecoins

Following stablecoins' validation of onchain money in 2025, industry analysts predict onchain vaults could experience 10x growth as the next evolution in asset management. **Key Projections:** - Estimated onchain vault growth: 50-200% - Market share considerations: 0.5-5% - Valuation framework includes TVL, revenue projections, and standard multiples The analysis suggests comparing projected metrics against current fully diluted valuations to assess potential opportunities in the emerging onchain vault sector. Investors are encouraged to apply the framework independently when evaluating projects in this space.

Lazy Summer Prioritizes Product Over Token in DeFi Shift

Most DeFi protocols launch tokens first, treating products as secondary. **Lazy Summer reverses this approach** by building the product before the token. The platform offers: - Automated, rules-based rebalancing and risk management - Revenue-sharing token linked to actual protocol activity - Institutional-grade vault infrastructure accessible to all users This structure positions Lazy Summer for institutional adoption while maintaining benefits for retail users through the same infrastructure.