Lazy Summer DAO Governance Update - August 14, 2025

Lazy Summer DAO Governance Update - August 14, 2025

🗳️ Your Votes Are Getting Lonely

Key Updates:

MERKL Rewards proposal (SIP3.7) has passed and will be enabled across all vault markets

5 new proposals are active for voting until Aug 17/18:

- Base: LowerRisk fleets for USDC and WETH

- Ethereum: HigherRisk USDC Fleet

- Arbitrum: LowerRisk fleets for USDT and USDC

3 major forum discussions ongoing:

- Optimism Mainnet USDC/ETH Fleet onboarding

- Core protocol ARKs update on mainnet

- MorphoLabs ARKs support on Arbitrum

Take Action: Review proposals and cast your votes at gov.summer.fi before the deadline.

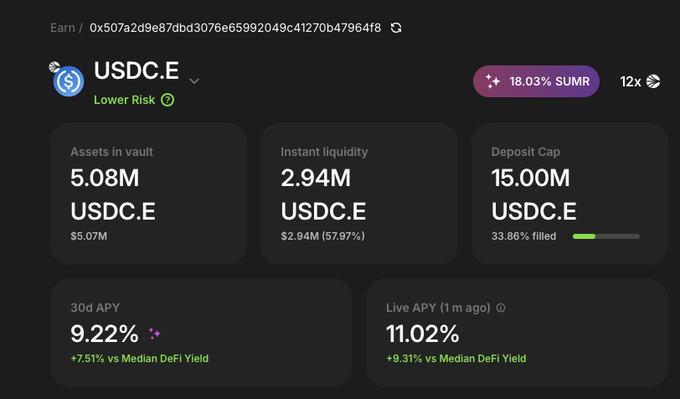

📊 Market Watch Monday: Lazy Summer Vault Spotlight New week. Same mission: smarter yield. The USDC.e Vault on @SonicLabs is keeping it stable and rewarding $SUMR Rewards: 18.03% SUMR Assets in Vault: 5.08M USDC.e Best for: Optimized lending yield 🔗 Try it:

🗳️ Governance Update: Lazy Summer DAO Voting is now live until August 3rd, 2025 gov.summer.fi/dao Here’s what’s on the table this week 🧵

Lazy Summer Protocol Now Live with 5 Automated Strategies Across 77 DeFi Protocols

The Lazy Summer Protocol has launched with **5 automated yield strategies** currently operational. These strategies are: - **Fully automated** with continuous rebalancing - **Risk-managed** within predefined caps - Built on a **diversified DeFi infrastructure** spanning 77 supported protocols This follows the recent announcement of DAO-managed vaults coming in February 2026, designed for users seeking higher risk-reward profiles while maintaining the protocol's "Do Less" philosophy. The protocol enables standardized access to curated DeFi yield sources, with SUMR token holders earning up to 35% real yield in USDC through staking. The platform continues expanding its yield source coverage while maintaining institutional-grade vault architecture and independent risk management.

DeFi Shifts Focus from Yield Chasing to Real Utility and Revenue Sharing

The DeFi landscape is experiencing a notable shift in priorities. The community is moving away from: - Yield chasing strategies - Memecoin speculation - Deceptively high APYs Instead, the focus is turning toward: - **Real utility** in protocols - **Revenue sharing** models - **Productive assets** that generate sustainable returns This trend reflects a maturing market where users are prioritizing long-term value creation over short-term gains. The emphasis on productive assets suggests a move toward more sustainable DeFi practices.

20% of SUMR Token Supply Locked for Nearly Two Years on Average

**Key Statistics:** - One-fifth of all $SUMR tokens are currently locked and removed from circulation - Average lock period: nearly 2 years - Platform emphasizes long-term holder commitment **Market Positioning:** The platform's current valuation shows a significant gap between its Fully Diluted Valuation (FDV) and Total Value Locked (TVL). *Hypothetical scenario:* If TVL reaches $500M and the market values it similarly to comparable lending infrastructure, the implied market cap could be approximately 5x higher than current levels. The locking mechanism rewards users who demonstrate conviction in the protocol's long-term value proposition.

Onchain Vaults Positioned as Next Major DeFi Growth Sector After Stablecoins

Following stablecoins' validation of onchain money in 2025, industry analysts predict onchain vaults could experience 10x growth as the next evolution in asset management. **Key Projections:** - Estimated onchain vault growth: 50-200% - Market share considerations: 0.5-5% - Valuation framework includes TVL, revenue projections, and standard multiples The analysis suggests comparing projected metrics against current fully diluted valuations to assess potential opportunities in the emerging onchain vault sector. Investors are encouraged to apply the framework independently when evaluating projects in this space.

Lazy Summer Prioritizes Product Over Token in DeFi Shift

Most DeFi protocols launch tokens first, treating products as secondary. **Lazy Summer reverses this approach** by building the product before the token. The platform offers: - Automated, rules-based rebalancing and risk management - Revenue-sharing token linked to actual protocol activity - Institutional-grade vault infrastructure accessible to all users This structure positions Lazy Summer for institutional adoption while maintaining benefits for retail users through the same infrastructure.