SmartCredit.io

SmartCredit.io is an AI-driven self-custodial neobank. SmartCredit.io has 20'000 registered users.

Platform offers:

- Fixed-term, fixed-interest-rate collateralized loans for the borrowers

- Personal Fixed Income Funds for the lenders

- Effective use of Collateral via the Positions Monitoring System

- AI-driven predictive Crypto Fraud Score - free to use for everyone via https://smarttrust.io

- AI-driven Crypto Trust Score - for crypto lenders via https://smarttrust.io

- AI-driven Continuous Transaction Monitoring for the wallets, exchanges, and payment processors - for all crypto service providers(via https://smarttrust.io)

- Fiat on-ramp/off-ramp

- AI API and Borrow/Lend SDK's integrations for other wallets and platforms

- Staking and Rewards for the users

SmartCredit.io focus is on offering self-custodial solutions which are regulatory compliant. SmartCredit.io does not have bank run risks like Aave, Compound, or other Money-Market based lending systems.

The Vision of SmartCredit.io is to offer all the financial services which traditional banks offer. However, self-custodial.

SmartCredit Hosts DeFi Knowledge Quiz with Token Rewards

Fri 6th Feb 2026

SmartCredit.io is running a DeFi knowledge quiz on February 4, 2026 at 18:00 UTC in their Telegram community channel.

**Quiz Details:**

- 10 questions testing DeFi knowledge

- 15 SMARTCREDIT tokens awarded per correct answer

- Participants can earn up to 150 tokens for perfect score

The event takes place in the [SmartCredit Community Telegram](https://t.me/SmartCredit_Community). This represents a recurring community engagement initiative, with similar quizzes held previously in November 2025.

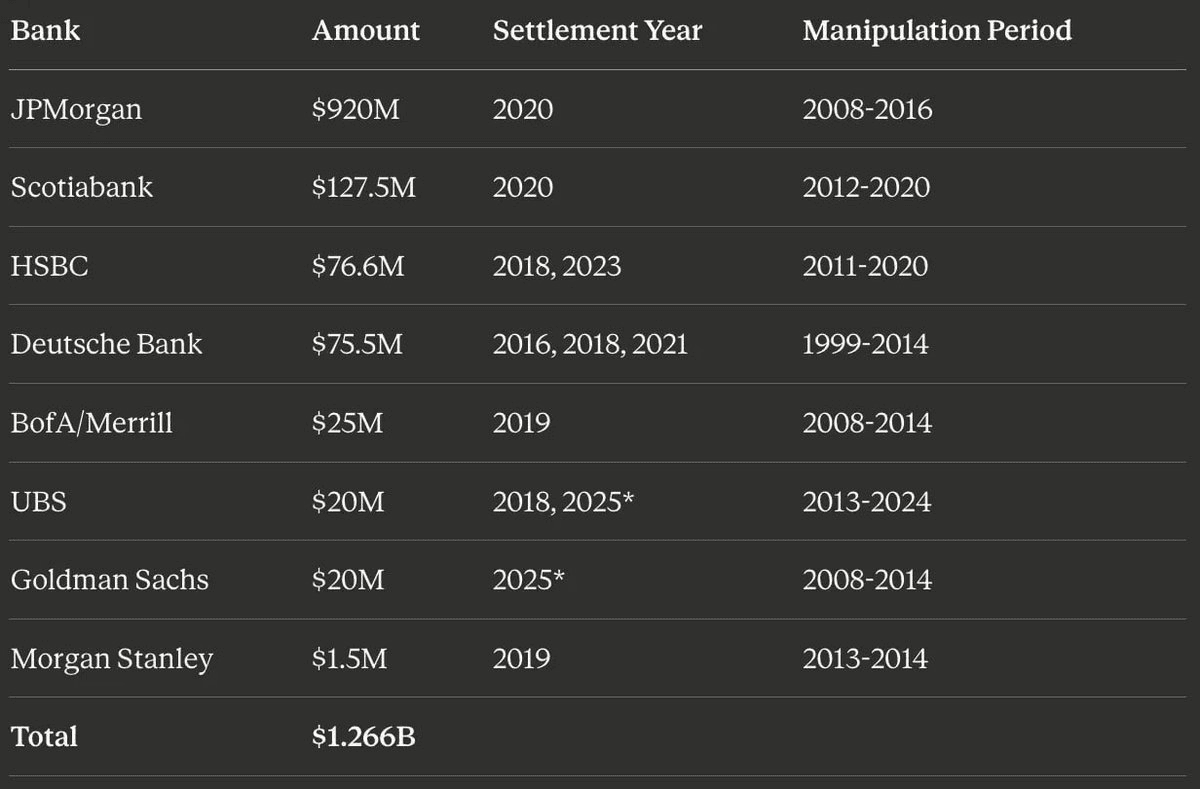

Eight Major Banks Fined $1.3B for Silver Price Manipulation

Fri 6th Feb 2026

**Major Financial Institutions Penalized for Market Manipulation**

Eight prominent banks have collectively paid $1.3 billion in penalties for manipulating silver prices. The fines represent regulatory action against systematic price fixing in precious metals markets.

**Key Points:**

- Multiple major banking institutions involved in coordinated manipulation

- Total penalties reached $1.3 billion

- Case highlights ongoing concerns about market integrity in commodity trading

- Follows pattern of regulatory enforcement in precious metals sector

The settlements underscore persistent challenges in maintaining fair pricing mechanisms within traditional financial systems. This case adds to a growing list of market manipulation penalties levied against established banking institutions.

[Read full details](https://navnoorbawa.substack.com/p/eight-banks-paid-13b-for-silver-manipulation)

🧠 DeFi Quiz Tonight

Thu 4th Dec 2025

**SmartCredit.io** hosts a DeFi knowledge quiz today at 18:00 UTC in their [Telegram community](https://t.me/SmartCredit_Community).

**Quiz Details:**

- 10 questions testing DeFi knowledge

- 15 SMARTCREDIT tokens per correct answer

- Multiple chances to earn rewards

The AI-driven neobank regularly runs these educational quizzes to engage their community while rewarding participation.

*Set your reminders and test your DeFi expertise.*

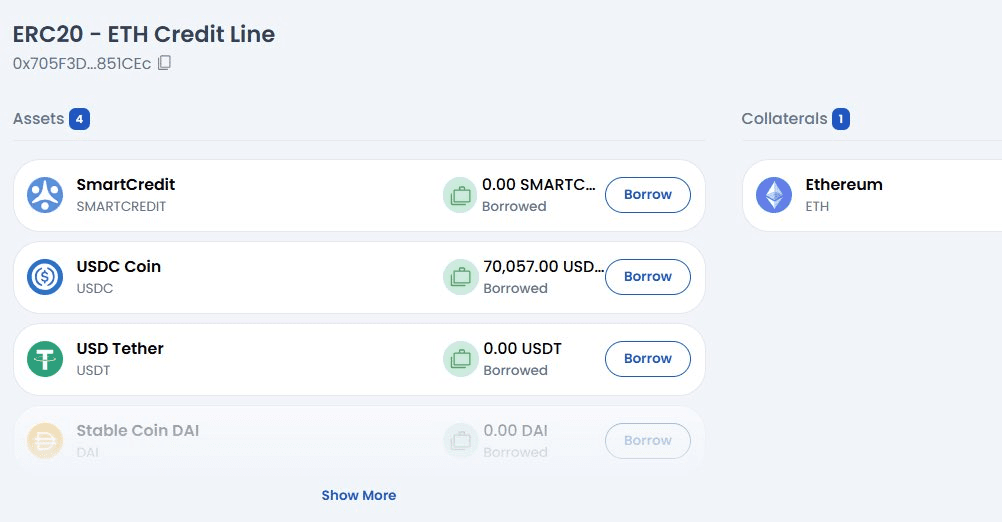

SmartCredit Launches Reusable Credit Lines to Cut Gas Costs

Thu 27th Nov 2025

**SmartCredit introduces Credit Line feature** that eliminates the need to open new loans repeatedly.

**Key benefits:**

- One credit line supports multiple loans

- Reusable collateral across borrowing cycles

- Reduced gas fees by avoiding repeated setups

- Streamlined on-chain lending experience

The platform positions this as solving inefficiencies in current DeFi lending, where each loan requires a fresh start. Users can now borrow multiple times using the same collateral setup.

**Previous features include:**

- Rate comparison tool across major protocols

- Fixed-term, fixed-rate loan structure

- Balanced approach for both borrowers and lenders

SmartCredit continues building tools focused on lending efficiency and user experience improvements in decentralized finance.

[Learn more about Credit Lines](http://smartcredit.io)

🔒 Fixed Rates Finally

Mon 17th Nov 2025

**SmartCredit.io** addresses a core DeFi lending problem: **variable interest rates** that change unpredictably.

The platform offers:

- **Fixed-term, fixed-rate loans** that remain stable throughout the loan period

- **Predictable borrowing costs** without sudden rate spikes

- **Simple stability** in an otherwise volatile crypto environment

Unlike traditional DeFi protocols that optimize for one side, SmartCredit.io provides:

- **Balanced approach** for both borrowers and lenders

- **Protection through Loss Provision Fund** rather than profiting from liquidations

- **Transparent, long-term focused** credit system

The AI-driven platform eliminates the uncertainty of fluctuating rates, allowing users to plan and execute strategies without worrying about changing loan terms.

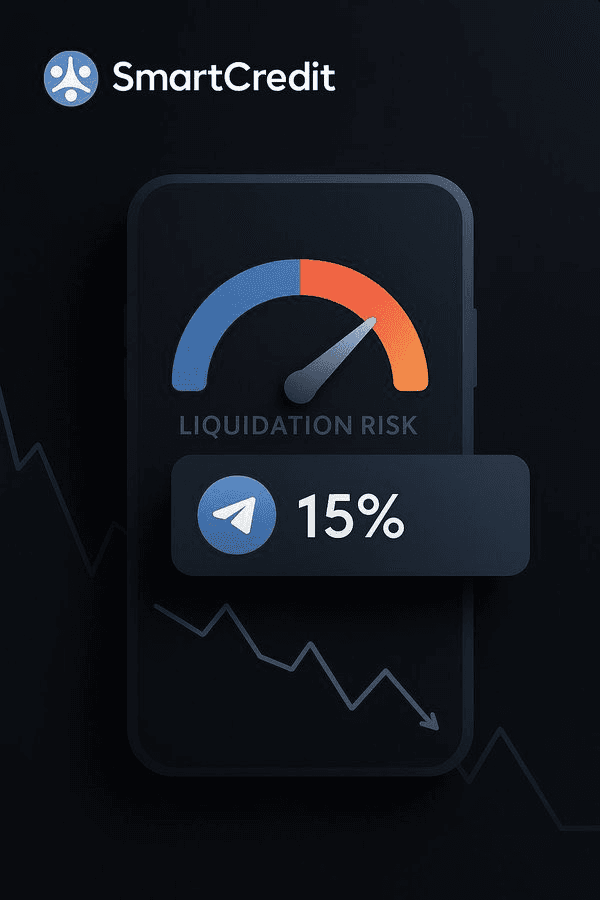

🚨 Early Warning System

Thu 18th Sep 2025

**SmartCredit introduces proactive liquidation alerts** to prevent borrower losses.

**Key Features:**

- Telegram notifications trigger at **15% risk level**

- Borrowers get advance warning to add collateral or repay

- System provides **peace of mind** for both lenders and borrowers

**Why It Matters:**

Most DeFi platforms only notify users after liquidation occurs. SmartCredit's early warning system gives users **time to react** before reaching dangerous territory.

This represents a shift from reactive to **proactive risk management** in decentralized lending.

SmartCredit.io Emphasizes Self-Custody and No Re-hypothecation in DeFi Lending

Thu 14th Aug 2025

SmartCredit.io differentiates itself in the DeFi lending space with a strict no re-hypothecation policy. Unlike other protocols where user collateral gets reused without their knowledge, SmartCredit ensures:

- Collateral remains locked in personal credit lines

- Full user control over assets

- Complete reusability after loan repayment

The platform combines fixed-term loans with AI-driven features including:

- Crypto Fraud Score

- Transaction monitoring

- Personal Fixed Income Funds

All services maintain regulatory compliance while eliminating traditional bank run risks.

SmartCredit.io Emphasizes Self-Custody in DeFi Services

Thu 5th Jun 2025

SmartCredit.io is positioning itself as a comprehensive DeFi platform focused on true self-custody. The platform offers:

- Custom income funds with fixed terms

- Collateralized lending without pool risks

- Audited smart contracts for secure vaults

- Direct control of credit lines and funds

The platform aims to provide traditional banking services while maintaining user sovereignty over assets. All operations run through verified smart contracts, eliminating intermediaries and pool-related risks.

[Learn more about self-custodial DeFi](http://smartcredit.io)

BarakaFi Launches First Web3 Islamic Finance Platform

Thu 9th Jan 2025

BarakaFi has launched as the first Web3-based Islamic finance system, introducing a significant innovation in decentralized finance.

Key features:

- Peer-to-peer transactions instead of traditional DeFi asset pooling

- Shariah-compliant financial services

- Secure blockchain infrastructure

- High-performance architecture

The platform addresses a key limitation of current DeFi systems by eliminating asset pooling, which conflicts with Islamic finance principles. This makes digital financial services accessible to users requiring Shariah compliance.