SmartCredit introduces proactive liquidation alerts to prevent borrower losses.

Key Features:

- Telegram notifications trigger at 15% risk level

- Borrowers get advance warning to add collateral or repay

- System provides peace of mind for both lenders and borrowers

Why It Matters: Most DeFi platforms only notify users after liquidation occurs. SmartCredit's early warning system gives users time to react before reaching dangerous territory.

This represents a shift from reactive to proactive risk management in decentralized lending.

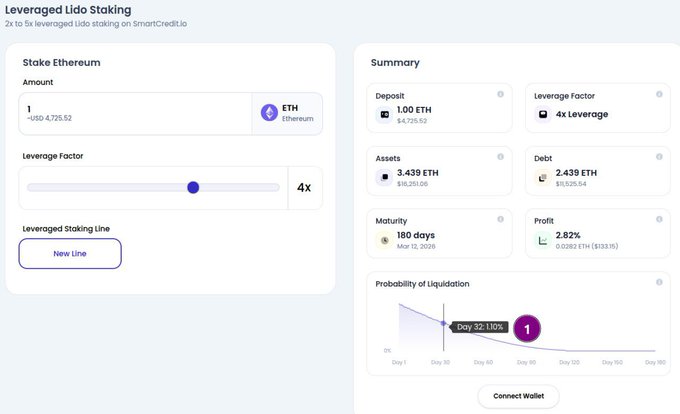

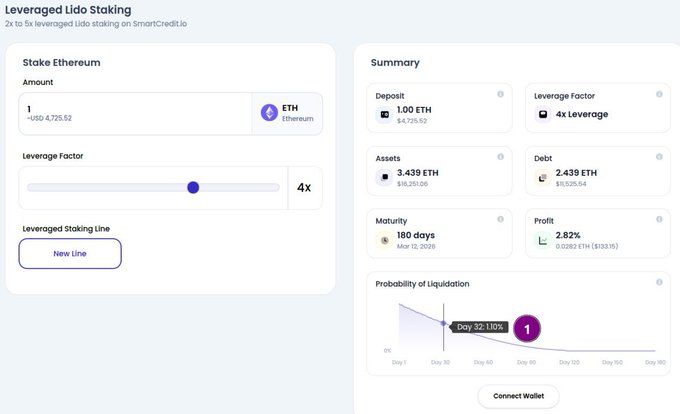

Most people loop stETH blindly. SmartCredit doesn’t let you fly blind. 🔹 Leverage stETH up to 5x 🔹 Track your health in real time 🔹 See your liquidation probability before it’s too late Control the risk. Keep the yield. → smartcredit.io/leveraged-stak…

Ever leveraged stETH and felt that “am I safe?” panic? 👀 With SmartCredit, you don’t guess… you know. 🚨 Liquidation Probability Calculator shows your % risk 📲 Telegram pings you before danger hits That’s how DeFi should work: transparent + protective.

You don’t need to stare at charts all day. 📉 SmartCredit’s Telegram Risk Alerts ping you when: ⚠️ Your loan health hits 15% risk ⚠️ Collateral ratio dips too low ✅ Giving you time to top up or repay early Stay ahead. Stay safe. → smartcredit.io

You already staked ETH. Now it’s time to loop it. ✅ Use stETH as collateral ✅ Borrow ETH ✅ Stake again ✅ Repeat up to 5x exposure SmartCredit lets you amplify staking yields with full risk visibility. → smartcredit.io/leveraged-stak…

SmartCredit Hosts DeFi Knowledge Quiz with Token Rewards

SmartCredit.io is running a DeFi knowledge quiz on February 4, 2026 at 18:00 UTC in their Telegram community channel. **Quiz Details:** - 10 questions testing DeFi knowledge - 15 SMARTCREDIT tokens awarded per correct answer - Participants can earn up to 150 tokens for perfect score The event takes place in the [SmartCredit Community Telegram](https://t.me/SmartCredit_Community). This represents a recurring community engagement initiative, with similar quizzes held previously in November 2025.

Eight Major Banks Fined $1.3B for Silver Price Manipulation

**Major Financial Institutions Penalized for Market Manipulation** Eight prominent banks have collectively paid $1.3 billion in penalties for manipulating silver prices. The fines represent regulatory action against systematic price fixing in precious metals markets. **Key Points:** - Multiple major banking institutions involved in coordinated manipulation - Total penalties reached $1.3 billion - Case highlights ongoing concerns about market integrity in commodity trading - Follows pattern of regulatory enforcement in precious metals sector The settlements underscore persistent challenges in maintaining fair pricing mechanisms within traditional financial systems. This case adds to a growing list of market manipulation penalties levied against established banking institutions. [Read full details](https://navnoorbawa.substack.com/p/eight-banks-paid-13b-for-silver-manipulation)

🧠 DeFi Quiz Tonight

**SmartCredit.io** hosts a DeFi knowledge quiz today at 18:00 UTC in their [Telegram community](https://t.me/SmartCredit_Community). **Quiz Details:** - 10 questions testing DeFi knowledge - 15 SMARTCREDIT tokens per correct answer - Multiple chances to earn rewards The AI-driven neobank regularly runs these educational quizzes to engage their community while rewarding participation. *Set your reminders and test your DeFi expertise.*

SmartCredit Launches Reusable Credit Lines to Cut Gas Costs

**SmartCredit introduces Credit Line feature** that eliminates the need to open new loans repeatedly. **Key benefits:** - One credit line supports multiple loans - Reusable collateral across borrowing cycles - Reduced gas fees by avoiding repeated setups - Streamlined on-chain lending experience The platform positions this as solving inefficiencies in current DeFi lending, where each loan requires a fresh start. Users can now borrow multiple times using the same collateral setup. **Previous features include:** - Rate comparison tool across major protocols - Fixed-term, fixed-rate loan structure - Balanced approach for both borrowers and lenders SmartCredit continues building tools focused on lending efficiency and user experience improvements in decentralized finance. [Learn more about Credit Lines](http://smartcredit.io)

🔒 Fixed Rates Finally

**SmartCredit.io** addresses a core DeFi lending problem: **variable interest rates** that change unpredictably. The platform offers: - **Fixed-term, fixed-rate loans** that remain stable throughout the loan period - **Predictable borrowing costs** without sudden rate spikes - **Simple stability** in an otherwise volatile crypto environment Unlike traditional DeFi protocols that optimize for one side, SmartCredit.io provides: - **Balanced approach** for both borrowers and lenders - **Protection through Loss Provision Fund** rather than profiting from liquidations - **Transparent, long-term focused** credit system The AI-driven platform eliminates the uncertainty of fluctuating rates, allowing users to plan and execute strategies without worrying about changing loan terms.