SanR.App

SanR.App - On-chain crypto market forecasting competition for everyone!

Share crypto trading signals, watch the signals of others, practice your trading skills in a safe environment and earn SAN token rewards!

Each competition cycle, called an “epoch”, begins every two weeks along with the lunar cycle. You open price predictions and your forecasting skills are measured in three “leagues”... i.e., by three different aspects of your “trader DNA”.

Every SanR participant is evaluated in all three leagues at once:

Qilin League - Average positive performance (awards overall intuition)

Dragon League - Total positive performance (awards the lucky strike!)

Phoenix League - Total negative performance (awards the contrarian position)

Forecasters placing 1 through 10 in each league are awarded $SAN tokens after all signals are closed for each epoch.

All activities occur inside our proprietary SanR Sidechain within the intelligence layer of Ethereum blockchain. We use meta-transaction technology, so all actions on the platform are free and don't require you to pay for gas.

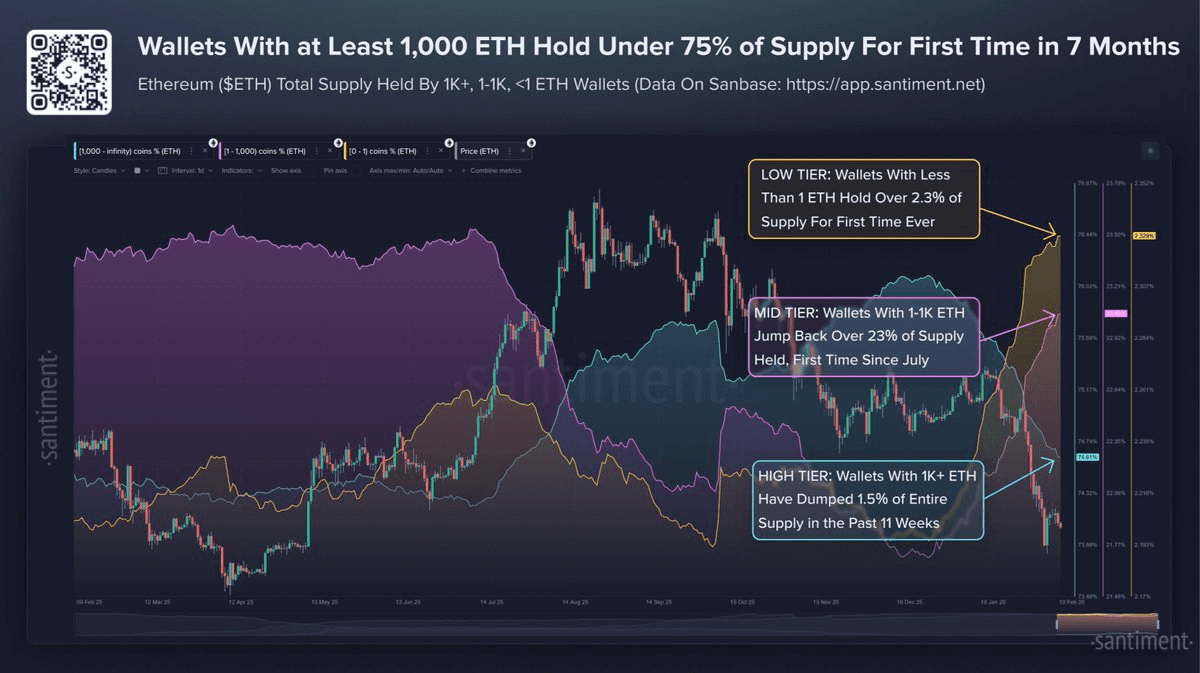

🐋 Ethereum Whales Dump 1.5% of Supply Since Christmas as Small Holders Hit Record High

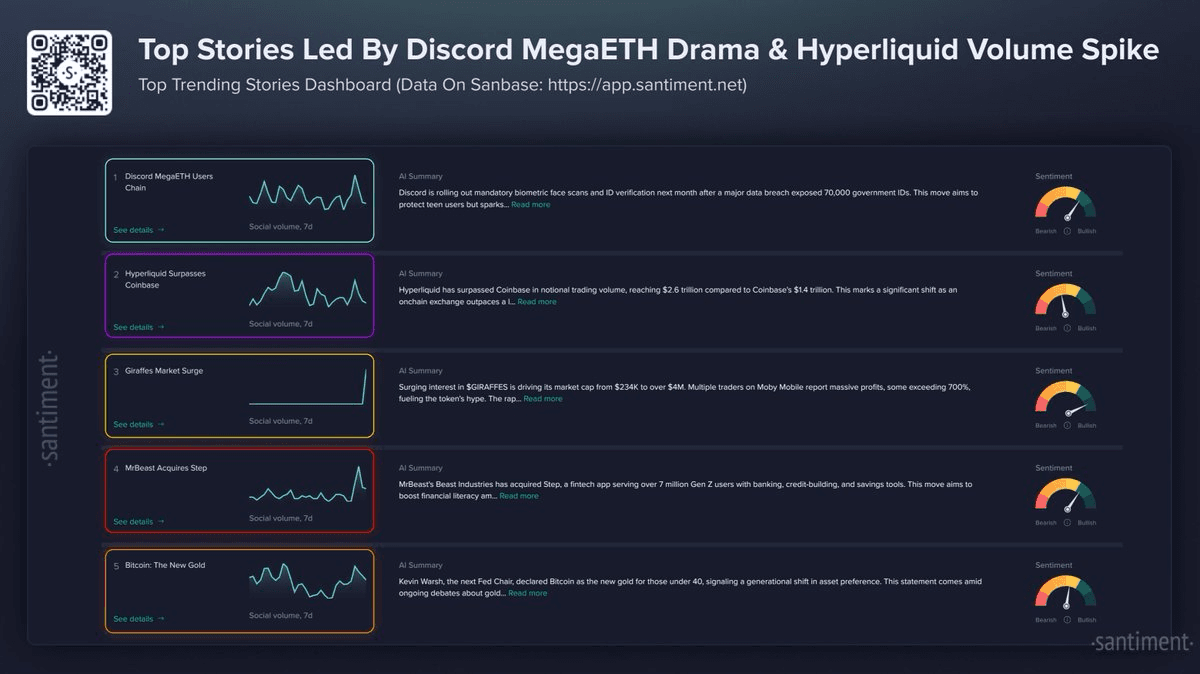

Hyperliquid Surpasses Coinbase in Trading Volume

🏦 Major Banks Embrace Crypto as Vanguard Opens ETFs to 50M Clients

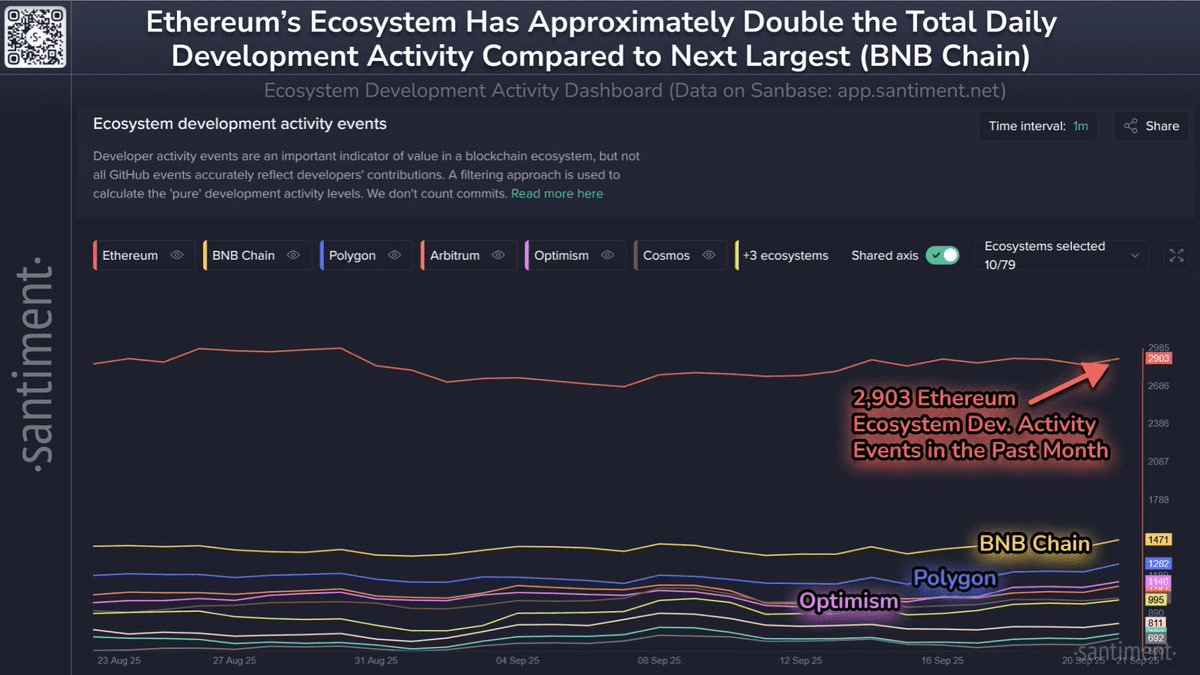

Ethereum Leads Development Activity Rankings for Second Consecutive Month

US-China Trade Agreement Announcement Sparks Market Rally

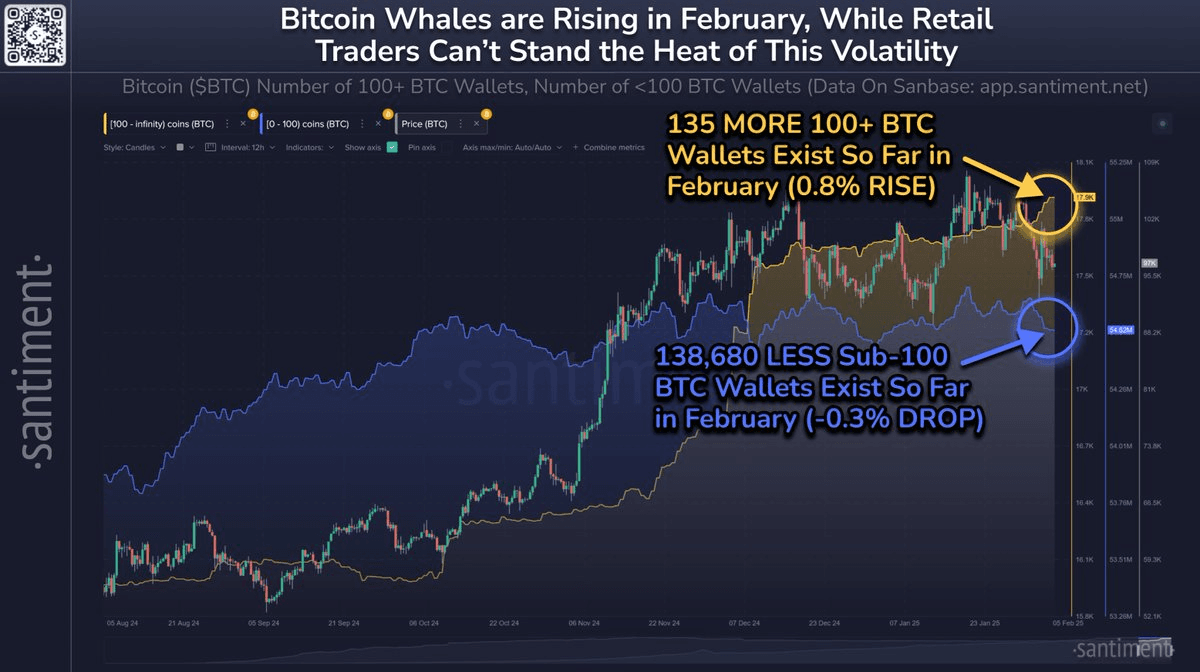

Bitcoin Whales Accumulate While Retail Traders Exit