Ethereum Leads Development Activity Rankings for Second Consecutive Month

Ethereum Leads Development Activity Rankings for Second Consecutive Month

🥇 Ethereum Still Winning

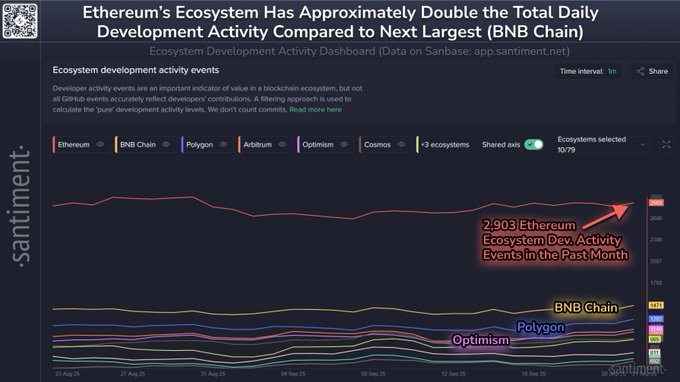

Ethereum maintains its position as the top blockchain ecosystem by development activity for the second month running, according to Santiment data.

Current rankings show:

- Ethereum takes first place

- BNB Chain holds second position

- Polygon secures third place

- Optimism and Arbitrum round out the top five

The rankings track total development activity events over a 30-day period, providing insight into which ecosystems are seeing the most active building and coding work.

Previous data from October 2024 showed all top 10 crypto ecosystems increased their development rates year-over-year, with Optimism leading growth at +45.6%.

Developers and investors can monitor ecosystem activity using Santiment's free development dashboard.

🧑💻 Here are the top ecosystems by total development activity events over the past 30 days: 1) Ethereum 🥇 2) BNB Chain 🥈 3) Polygon 🥉 4) Optimism 5) Arbitrum 🔖 Bookmark the free dev. activity dashboard to check on your favorite ecosystems any time: app.santiment.net/dev-activity?u…

DeFiChain Leads Yield Farming Development Rankings in New Santiment Screener

Santiment has launched a new screener tracking yield farming projects by development activity, measured through GitHub repository data. **Top 10 Projects by Development Activity:** - DeFiChain ($DFI) - Aave ($AAVE) - Yearn Finance ($YFI) - Beefy Finance ($BFI) - Gearbox ($GEAR) - ApeSwap ($BANANA) - Alchemix ($ALCX) - Yield Basis ($YB) - Inverse Finance ($INV) - QuickSwap ($QUICK) The screener uses Santiment's methodology for analyzing development activity across project repositories, providing insights into which teams are actively building. Rankings will be updated monthly to track movement on the leaderboard. [Learn about the methodology](https://medium.com/santiment/a-different-look-into-blockchain-ecosystem-development-activity-f34f32180482) [Access the screener](https://app.santiment.net/screener/yield-farming-38761?utm_source=x&utm_medium=post&utm_campaign=x_yield_farming_screener_b_020426?fpr=twitter)

Bitcoin Drops to $72.8K, Bounces After Government Shutdown Bill Passes

Bitcoin fell to **$72.8K** before recovering after the U.S. government passed a bill preventing a shutdown. The drop triggered **$30M in DeFi liquidations** across the ecosystem. **Key Points:** - Price volatility linked to political uncertainty around government funding - Quick recovery following legislative clarity - DeFi protocols experienced significant liquidation pressure - Market remains sensitive to regulatory and political developments The incident highlights ongoing correlation between traditional political events and crypto market movements. [Read the full analysis](https://app.santiment.net/insights/read/deep-dive-government-shut-down-no-more-10519?utm_source=x&utm_medium=post&utm_campaign=x_deep_dive_government_shut_down_no_more_b_020326?fpr=twitter) for what traders should watch next.

🏦 Major Banks Embrace Crypto as Vanguard Opens ETFs to 50M Clients

**Major institutional shift underway** as traditional finance embraces crypto: - **Vanguard reverses stance**: $11 trillion manager now allows 50M+ clients to trade Bitcoin, Ethereum, XRP, and Solana ETFs starting today - **Bank of America follows**: Will permit wealth advisers to recommend 1%-4% crypto allocation starting January 2026 - **SEC Chair Paul Atkins** announces crypto innovation exemption launching January 2026 for qualified firms **Market developments:** - Ethereum prepares major **Fusaka upgrade** for enhanced scalability - Tether mints **$1B on Tron**, signaling growing cross-chain liquidity - Trump to make major announcement Tuesday at 2 PM EST **Mixed signals persist:** - Grayscale predicts Bitcoin will break four-year cycle, reach new highs in 2026 - Critics question MicroStrategy's strategy as Tidal invests $60M in MSTR shares - Kevin Hassett named potential Fed Chair, adding policy uncertainty These moves signal **growing institutional acceptance** and mainstream crypto adoption, despite ongoing market volatility and regulatory questions.

US-China Trade Agreement Announcement Sparks Market Rally

US and China have announced reaching a trade agreement, with full details expected Monday. Markets have responded positively: - Bitcoin climbed to $104.1K - Ethereum surged above $2,500 - Stock markets showing strong gains **Key Points:** - Agreement framework likely discussed in Geneva - Official confirmation pending from White House - Potential immediate reduction in export/import impacts *Trading Considerations:* - Await official announcement before major positions - Exercise caution against buy rumor/sell news scenario - Monitor market reaction to tariff reduction details Previous 90-day tariff pause excluding China led to significant gains in crypto and stocks, suggesting markets remain highly reactive to trade news.