🏦 Major Banks Embrace Crypto as Vanguard Opens ETFs to 50M Clients

🏦 Major Banks Embrace Crypto as Vanguard Opens ETFs to 50M Clients

🏦 Banks finally cave

Major institutional shift underway as traditional finance embraces crypto:

- Vanguard reverses stance: $11 trillion manager now allows 50M+ clients to trade Bitcoin, Ethereum, XRP, and Solana ETFs starting today

- Bank of America follows: Will permit wealth advisers to recommend 1%-4% crypto allocation starting January 2026

- SEC Chair Paul Atkins announces crypto innovation exemption launching January 2026 for qualified firms

Market developments:

- Ethereum prepares major Fusaka upgrade for enhanced scalability

- Tether mints $1B on Tron, signaling growing cross-chain liquidity

- Trump to make major announcement Tuesday at 2 PM EST

Mixed signals persist:

- Grayscale predicts Bitcoin will break four-year cycle, reach new highs in 2026

- Critics question MicroStrategy's strategy as Tidal invests $60M in MSTR shares

- Kevin Hassett named potential Fed Chair, adding policy uncertainty

These moves signal growing institutional acceptance and mainstream crypto adoption, despite ongoing market volatility and regulatory questions.

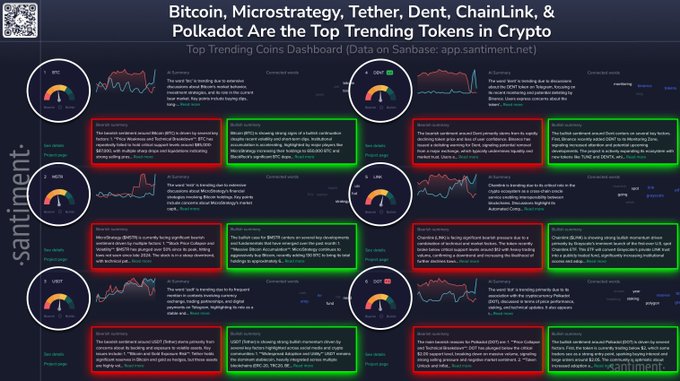

🗣️ According to social data, the coins grabbing the most attention across social media are: 🪙 Bitcoin $BTC: The word 'btc' is trending due to extensive discussions about Bitcoin's market behavior, investment strategies, and its role in the current bear market. Key points

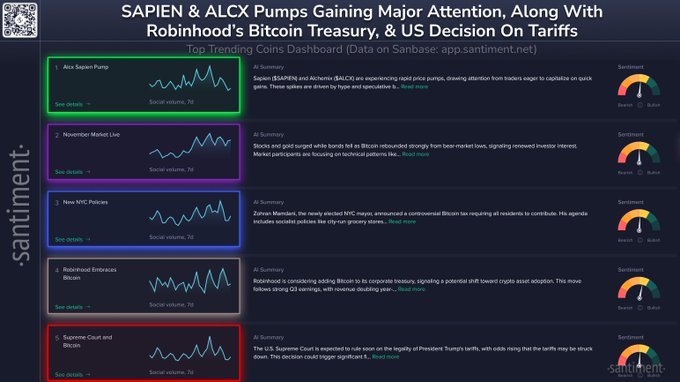

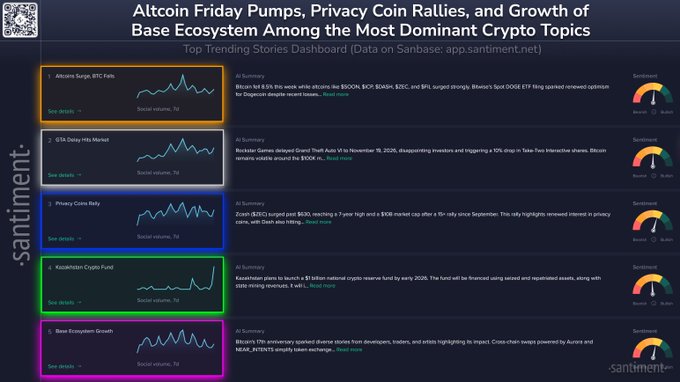

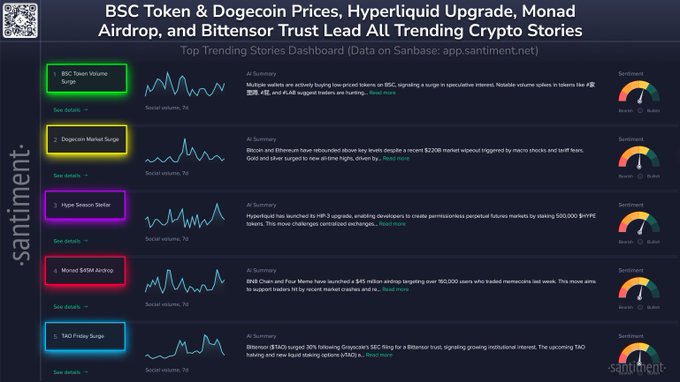

🗣️ These are the crypto topics gaining the most traction and driving markets as markets try to hang on to support levels: 📈 Alcx Sapien Pump: Sapien ($SAPIEN) and Alchemix ($ALCX) are experiencing rapid price pumps, drawing attention from traders eager to capitalize on quick

🗣️ The coins driving the highest level of interests across crypto circles are: 🪙 The word 'gme' is trending due to extensive discussions about the stock GameStop (GME) focusing on potential short squeeze scenarios similar to past events. Users compare GME to other stocks like

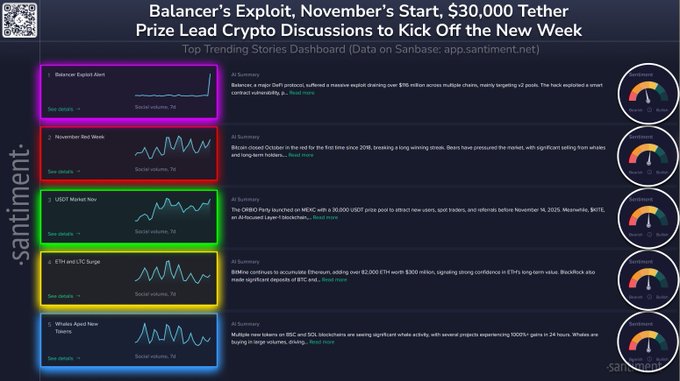

🗣️ According to social volume, here are the top trending topics circulating across cryptocurrency forums Monday: 🤹 Balancer, a major DeFi protocol, suffered a massive exploit draining over $116 million across multiple chains, mainly targeting v2 pools. The hack exploited a

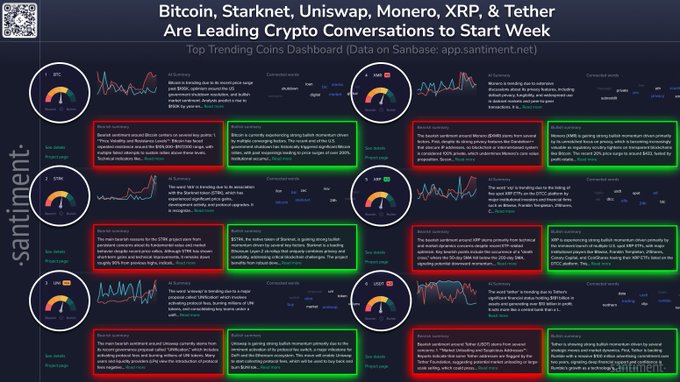

🗣️ The Top Trending Coins dashboard indicates the projects making the biggest waves across social media are: 🪙 Bitcoin $BTC: Trending due to its recent price surge past $106K, optimism around the US government shutdown resolution, and bullish market sentiment. Analysts

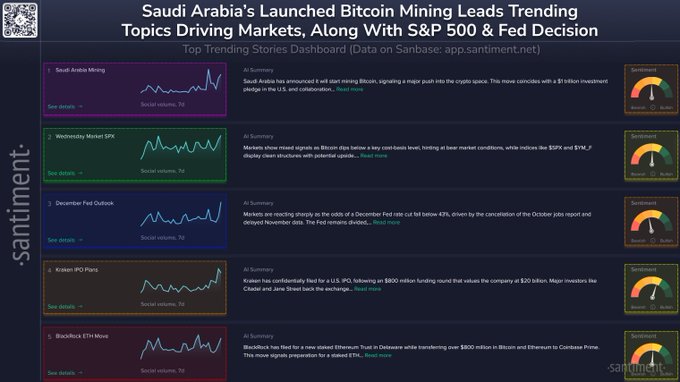

🗣️ Our social data indicates that the rising stories driving crypto markets Wednesday are: 🇺🇸 The Federal Reserve is set to announce its interest rate decision today, with markets nearly certain of a 25 basis point cut. Investors are focused on Fed Chair Powell's press

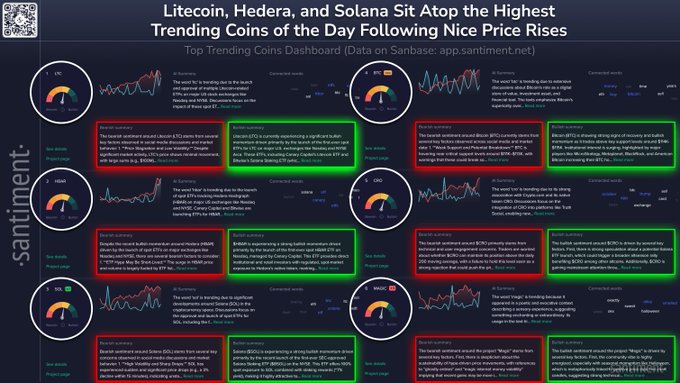

🗣️ According to our data, the coins generating the highest rises in social media discussions Tuesday are: 🪙 Litecoin $LTC: Trending due to the launch and approval of multiple Litecoin-related ETFs on major US stock exchanges like Nasdaq and NYSE. Discussions focus on the

📰 According to rising topics across social media, the top stories in crypto are: 📊 Vanguard Embraces Ethereum: Vanguard, managing $11 trillion, reverses its crypto stance by allowing 50M+ clients to trade spot Bitcoin, Ethereum, XRP, and Solana ETFs starting today. This move

🗣️ These are the top trending crypto social media topics circulating across X, Reddit, Telegram, 4Chan, Bitcoin, & Farcaster today: 🤑 Unification Fee Switch: Uniswap’s new “UNIfication” proposal aims to activate protocol fees and burn 100 million UNI tokens from the treasury,

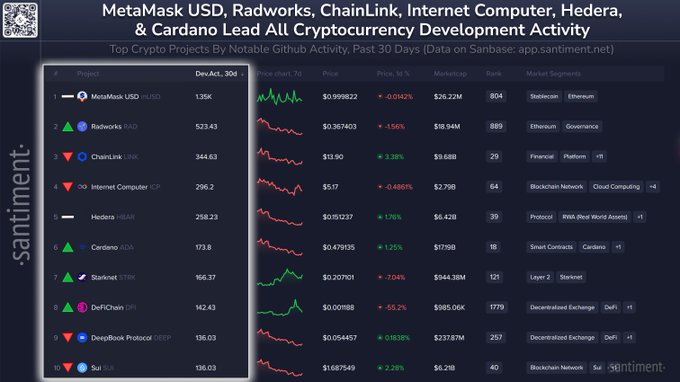

🧑💻 Here are crypto's top overall coins by notable development activity the past 30 days. Directional indicators represent each project's rank rise or fall since last month: ➡️ 1) @metamask $mUSD 🥇 📈 2) @radworks_ $RAD 🥈 📉 3) @chainlink $LINK 🥉 📉 4) @dfinity $ICP ➡️ 5)

🗣️ The top trending tokens in crypto, according to social volume, are: 🪙 Binance Coin $BNB: Trending due to extensive discussions about Binance Coin (BNB) across Reddit, Telegram, and Twitter. On Reddit, conversations focus on BNB's price performance, market manipulation

🗣️ The top trending stories driving markets as we drive toward Thanksgiving, are: 🇸🇦 Saudi Arabia Mining: Saudi Arabia has announced it will start mining Bitcoin, signaling a major push into the crypto space. This move coincides with a $1 trillion investment pledge in the U.S.

🗣️ These are the topics seeing the highest rises in discussion across crypto circles Thursday: 🇮🇳 Trump announced that India plans to reduce Russian oil imports to nearly zero by year-end, following discussions with PM Modi. This move signals a shift in global energy dynamics

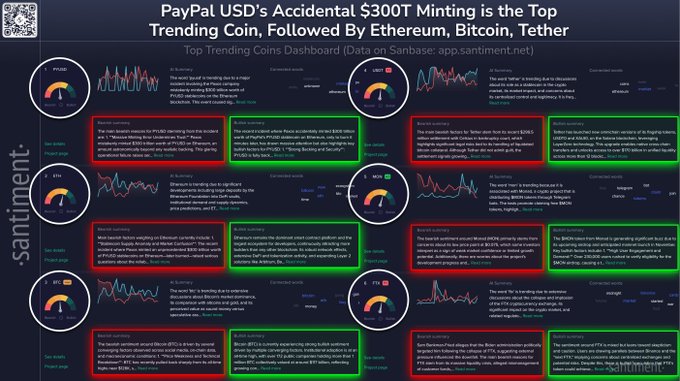

🗣️The top trending tokens in crypto across social media, based on the highest discussion rates above normal, are: 🪙 The word 'pyusd' is trending due to a major incident involving the Paxos company mistakenly minting $300 trillion worth of PYUSD stablecoins on the Ethereum

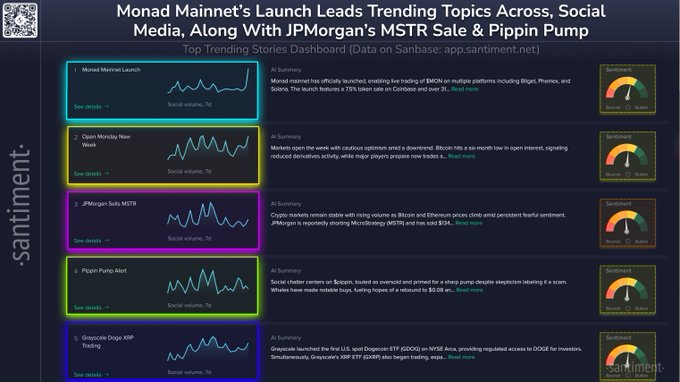

🗣️ According to social media data across X, Reddit, Telegram, 4Chan, BitcoinTalk, & Farcaster, these are the topics driving markets on a bullish Monday: 🥳 Monad Mainnet Launch: Monad mainnet has officially launched, enabling live trading of $MON on multiple platforms including

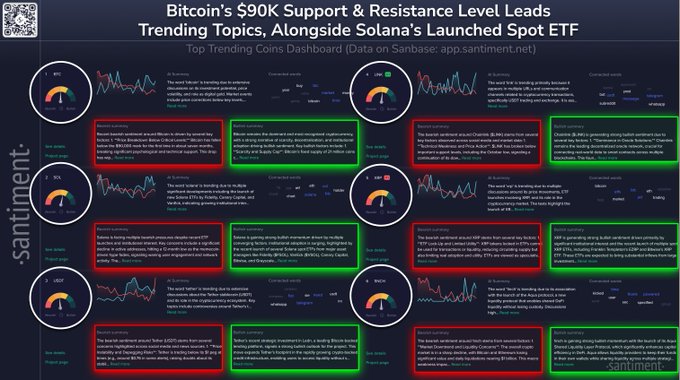

🗣️ According to social volume data, these coins lead all rising conversations across crypto social media: 🪙 Bitcoin $BTC: Trending due to extensive discussions on its investment potential, price volatility, and role as digital gold. Market events include price corrections

🗣️ According to our data, top trending tokens driving markets and circulating across social media are: 🪙 Bitcoin $BTC: Trending due to extensive discussions about Bitcoin's price cycles, investment strategies, and market predictions on Reddit, frequent mentions in flash

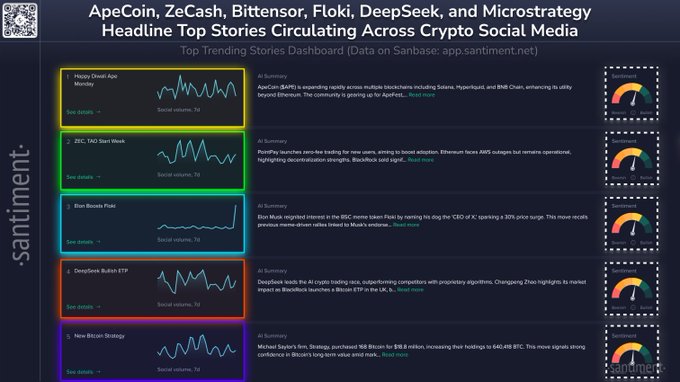

🗣️ Crypto's week has kicked off with tons of bullish movement. The discussions leading crypto X, Reddit, Telegram, 4Chan, Bitcointalk, & Farcaster are: 🐵 Happy Diwali Ape Monday: ApeCoin ($APE) is expanding rapidly across multiple blockchains including Solana, Hyperliquid, and

🗣️ The top trending coins in crypto, according to discussion frequency across social media, are: 🪙 Uniswap $UNI: Trending due to major developments around Uniswap (UNI), a leading DeFi protocol. Key proposals include activating protocol fees, burning 100 million UNI tokens,

🥇 Gold Crashes 8%, Silver Plunges 25% as Crypto Holds Steady

**Precious Metals See Historic Single-Day Collapse** In a stunning reversal, gold and silver experienced their worst single-day performance in recent memory: - Gold dropped more than **-8%** in one trading session - Silver plummeted over **-25%** on the same day - Bitcoin and altcoins remained **flat** despite the precious metals selloff **Context: The Great Rotation Debate** This crash comes after months of precious metals outperforming crypto: - Silver had gained **+214%** over the past year - Gold had risen **+77%** in the same period - Bitcoin had declined **-16%** during this timeframe Investors had been debating whether profits from gold and silver would eventually rotate into cryptocurrencies. The sudden collapse raises questions about whether this rotation is beginning, though crypto markets have yet to show significant gains from any potential capital flows. The precious metals rally was driven by safe-haven demand amid dollar weakness and geopolitical uncertainty, with gold recently surpassing $5,300 and reaching a $35 trillion market cap before Friday's dramatic reversal.

📺 This Week in Crypto Livestream: Navigating the Market Downturn

The crypto community is gathering for another **This Week in Crypto** livestream to discuss the recent market turbulence. **What's happening:** - Weekly livestream addressing the current market downturn - Discussion focused on analyzing the week's price movements - Community conversation about market conditions **Previous context:** - Similar market volatility discussions have been held in recent months - Past streams emphasized unemotional responses to market chaos The livestream provides a space for the community to process market events together and share perspectives on the current crypto landscape. [Watch the livestream](https://www.youtube.com/watch?v=prhpL4OJBtU)

Santiment Launches Metrics Explained Series on Hodl Waves Analysis

Santiment has introduced a new educational series called **'Metrics Explained'** focused on helping traders understand underutilized on-chain metrics. The inaugural piece examines **Hodl Waves**, a metric that reveals how crypto wealth is distributed based on holding duration. This analysis helps traders identify: - Long-term holder behavior patterns - Market sentiment shifts - Potential price correlations The series aims to provide practical guidance on using advanced metrics to improve trading decisions. Santiment previously released similar educational content on tracking whale wallet behavior and balance monitoring. [Read the full Hodl Waves guide](https://app.santiment.net/insights/read/metrics-explained-realized-market-capitalization-hodl-waves-10430?utm_source=x&utm_medium=post&utm_campaign=x_metrics_explained_hodl_waves_b_012926?fpr=twitter)

💸 Bitcoin ETFs Bleed $1.86B Ahead of Fed Decision

Bitcoin ETFs experienced substantial outflows in the lead-up to the Federal Reserve's FOMC decision. Over seven consecutive trading days since January 15th, the funds recorded **-$1.86 billion in net outflows**. This marks a continuation of investor caution around major monetary policy announcements. The outflows suggest market participants are reducing exposure to Bitcoin ahead of potential volatility from the Fed's interest rate decision. **Key Points:** - Seven straight days of negative flows - Total outflows: $1.86B since mid-January - Timing coincides with FOMC meeting anticipation For detailed tracking of Bitcoin, Ethereum, and Solana flows and trading volumes, view the [ETF dashboard](https://queries.santiment.net/dashboard/etf-volumes-728?utm_source=x&utm_medium=post&utm_campaign=x_btc_etf_outflows_b_012826?fpr=twitter). This pattern echoes November's massive $2.8B outflow period, indicating institutional investors remain sensitive to macroeconomic events.