ListaDAO

Lista DAO functions as a open-source liquidity protocol for earning yields on collateralized Crypto assets (BNB/ETH/Stablecoins) and borrowing of our decentralized stablecoin, lisUSD, also known as a "Destablecoin".

It uses and expands the proven MakerDAO model for a decentralized, unbiased, collateral-backed destablecoin.

The protocol consists of a dual token model (lisUSD and LISTA) and a set of mechanisms that support instant conversions, asset collateralization, borrowing, yield farming, etc. We are native to the BNB Chain ecosystem and have plans to expand to multiple chains in the near future.

The protocol is built by DeFi and smart contract experts with the aim to position the world-class revolutionary lisUSD Destablecoin as the most widely used one, by leveraging Proof-of-Stake (PoS) rewards and yield-bearing assets.

Lista DAO Explains Proof-of-Stake Staking for BNB Chain Beginners

Lista DAO Reduces slisBNB/BNB Borrowing Rate Cap to 4%

Lista DAO Votes on Returning $481K Liquidation Profits to Vault Suppliers

Lista DAO Adds Liquidation Price Display to Lending Interface

Allora Network $ALLO Supports slisBNB and slisBNBx for Binance HODLer Airdrops

Lista DAO Removes 30% Borrowing Rate Cap on Lending Markets

Lista DAO Releases lisUSD Strategy Guide

Lista DAO Passes LIP 20: PancakeSwap LP Integration Approved

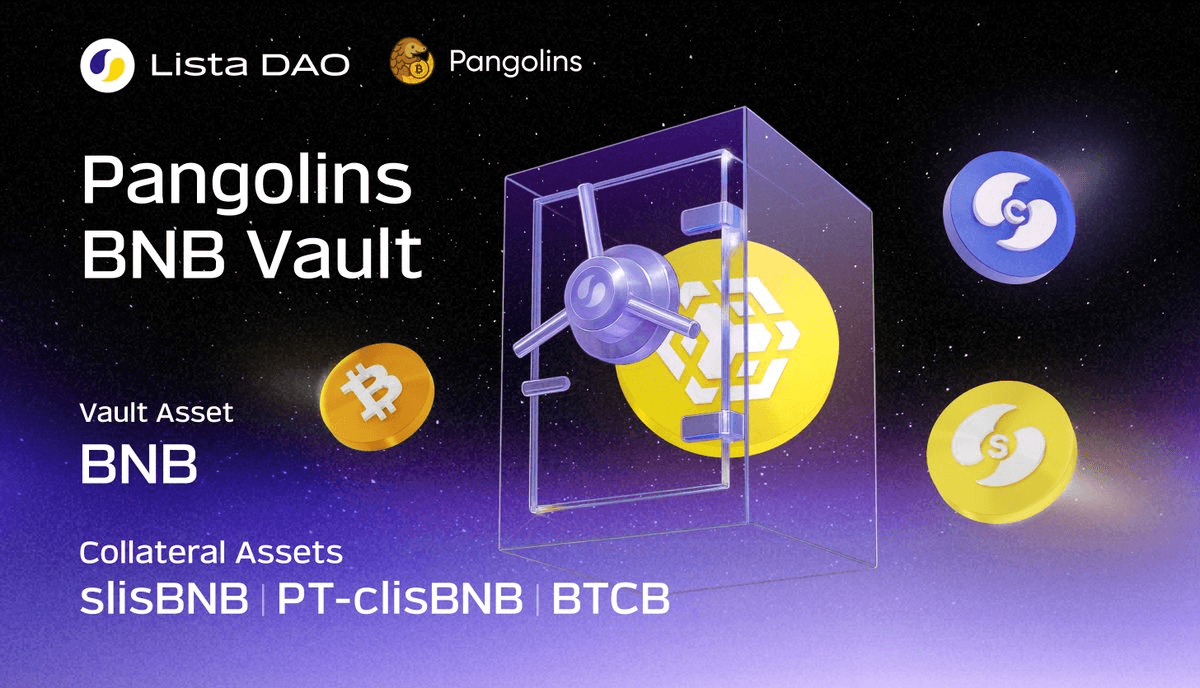

Lista Lending Alpha Zone Adds Three New Vaults