Solv Protocol

Solv Protocol is the decentralized platform for creating, managing, and trading Financial NFTs. As its first Financial NFT product, Vesting Vouchers are fractionalized NFTs representing lock-up vesting tokens, thus releasing their liquidity and enabling financial scenarios such as fundraising, community building, and token liquidity management for crypto projects.

Solv's plan is twofold: First, we will bring forth not just one, but a variety of FTVs(Financial Transaction Vouchers) to represent assets such as lock-up allocations, convertible bonds, accounts receivable, to name a few. Second, we plan to become the first and largest on-chain marketplace for all financial NFTs.

Website : https://solv.finance/home

Twitter: https://twitter.com/SolvProtocol

Telegram: https://t.me/SolvProtocol

- Discord: discord.gg/ewpb9jqzyD

- Contact: contact@solv.finance

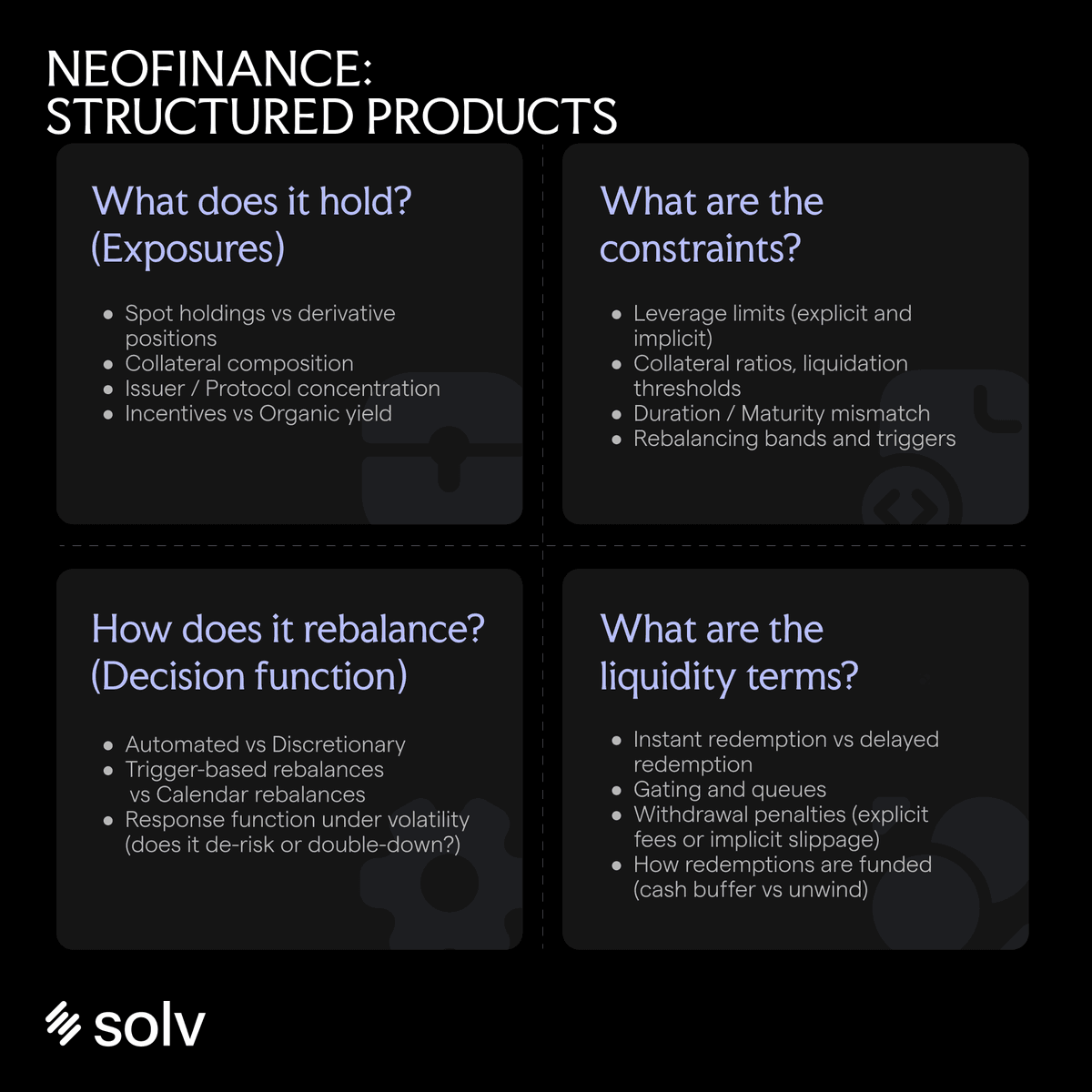

Evaluating DeFi Vaults as Market Volatility Shifts Capital to Structured Products

Solv Protocol Joins Canton Network as Validator, Bringing Bitcoin Liquidity to Institutional DeFi

🔮 a16z Commits to Decade-Long Bitcoin Vision

Protocol Highlights $600M+ in Active Collateralized Bitcoin Holdings

🛍️ Solv Protocol Launches Merchandise Store

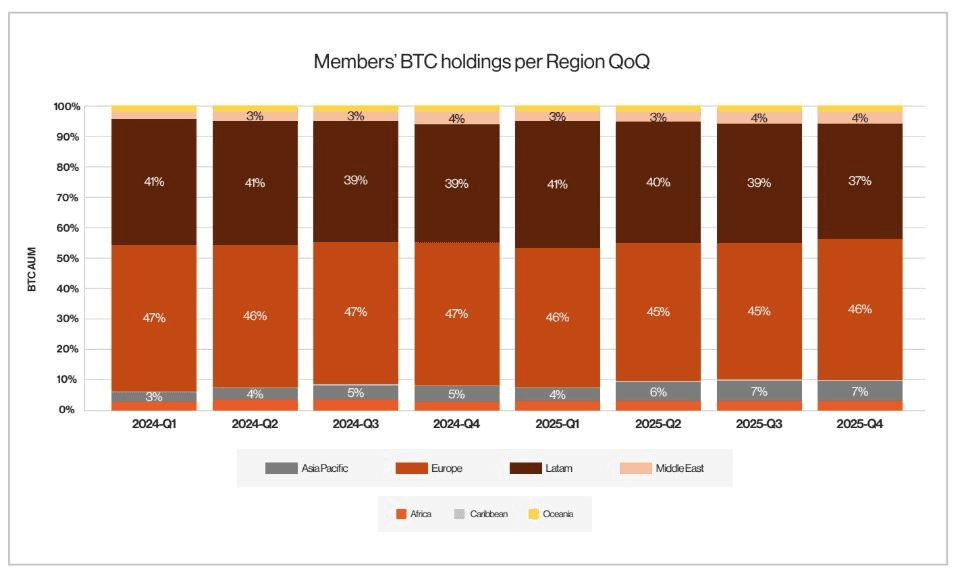

Solv Protocol Q4 Report Shows Strong Growth in Bitcoin Yield Platform Adoption

Solv Protocol Completes Security Audit for Largest Onchain BTC Reserve

Solv Protocol Launches Bitcoin-Backed RWA Yield Vault with Binance