Solv Protocol's BTC+ Vault is delivering impressive returns for Bitcoin holders.

- 650,000 BTC deposited in the vault

- Earning approximately 59 BTC daily (~$5.5M at current prices)

- Based on current BTC+ yield forecasts

The vault represents a significant opportunity for Bitcoin holders to generate passive income through Solv's decentralized Financial NFT platform.

Key metrics:

- Daily yield: ~59 BTC

- Dollar value: ~$5.5M daily

- Total vault size: 650,000 BTC

This performance demonstrates the growing adoption of yield-generating Bitcoin products in DeFi.

650,000 BTC in Solv's BTC+ Vault would earn ~59 $BTC daily. That's ~$5.5M at current prices with the current BTC+ Yield forecast. 🤯

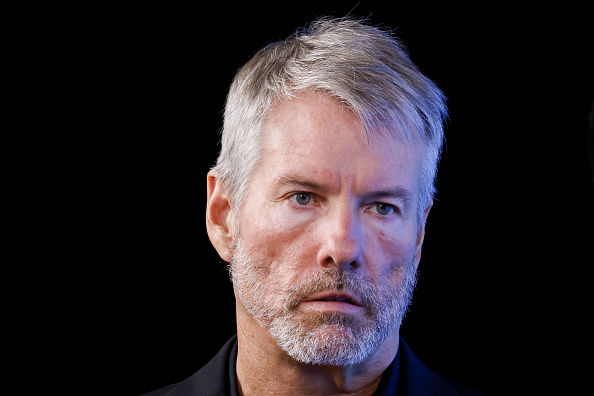

NEWS: A recent Bloomberg segment reveals Michael Saylor’s firm MicroStrategy is exploring Bitcoin-backed credit products, hinting at a possible future where $BTC holdings are used as lending collateral. #Strategy #Saylor $MSTR $BTC

Evaluating DeFi Vaults as Market Volatility Shifts Capital to Structured Products

Market volatility is pushing capital away from high-risk assets toward stable structured products that offer sustainable yields. The challenge now is evaluating DeFi Vaults that mirror traditional finance's structured products. **Key developments:** - Capital is flowing from risk-on assets to more stable, yield-generating products - DeFi Vaults are emerging as the crypto equivalent of TradFi structured products - Evaluation frameworks are needed to assess these new financial instruments This shift reflects a maturing DeFi ecosystem where investors seek both stability and returns, similar to traditional finance. The focus is on sustainable yields rather than speculative gains. [Learn more about evaluating DeFi Vaults](https://solv.finance/home)

Solv Protocol Joins Canton Network as Validator, Bringing Bitcoin Liquidity to Institutional DeFi

Solv Protocol, the largest onchain Bitcoin reserve, is joining [Canton Network](https://twitter.com/CantonNetwork) as a validator. This integration brings MiCA-compliant, FROST-secured Bitcoin liquidity to Canton's $6T+ institutional blockchain ecosystem. **Key developments:** - Solv positions itself as the institutional Bitcoin DeFi infrastructure - Enables BTC to be used for programmable yields in compliant, privacy-preserving finance - Canton Network partners include Goldman Sachs, HSBC, and Nasdaq - Supports tokenized collateral, settlement, and structured financial products This follows Solv's recent MiCA license acquisition through Netherlands authorities and a security audit with Offside Labs. The move accelerates institutional Bitcoin adoption within European regulatory frameworks. [Read the full announcement](https://insights.solv.finance/solv-joins-canton-as-validator-on-the-6t-institutional-network-bringing-mica-compliant-frost-secured-bitcoin-liquidity/)

🔮 a16z Commits to Decade-Long Bitcoin Vision

**Major crypto investor a16z announces 10-year commitment to Bitcoin ecosystem** Andreessen Horowitz (a16z), one of crypto's largest institutional backers, has signaled its willingness to maintain a decade-long investment horizon in Bitcoin infrastructure. The announcement comes as Bitcoin builders and ecosystem partners gather to discuss the network's long-term development trajectory. Key participants include: - Rootstock (RSK) - Bitcoin smart contract platform - Babylon Labs - Bitcoin staking infrastructure - Solv Protocol leadership The discussion focuses on **practical builder perspectives** rather than price speculation, examining how Bitcoin's infrastructure will evolve over the next 10 years. This patient capital approach contrasts with typical crypto investment timelines and suggests growing institutional confidence in Bitcoin's fundamental technology development beyond market cycles.

Protocol Highlights $600M+ in Active Collateralized Bitcoin Holdings

A decentralized finance protocol is drawing attention to its substantial Bitcoin collateral position, with over $600 million in active collateralized BTC. **Key Points:** - The protocol enables users to borrow against Bitcoin without wrapping tokens or using centralized custodians - Represents a non-custodial approach to Bitcoin-backed lending - Offers an alternative to traditional wrapped Bitcoin solutions This development highlights the growing infrastructure for Bitcoin utility in decentralized finance, allowing holders to access liquidity while maintaining control of their assets.

🛍️ Solv Protocol Launches Merchandise Store

Solv Protocol has opened an official merchandise store, expanding its brand presence beyond DeFi infrastructure. **Key Details:** - Store accessible at [solvstore.myshopify.com](https://solvstore.myshopify.com) - Follows broader trend of crypto projects offering branded merchandise - Comes after Solana Pay integration enabled crypto payments across hundreds of stores The launch represents a straightforward brand extension for the Financial NFT platform, allowing community members to purchase Solv-branded items. This follows the January announcement highlighting Solana Pay's growing merchant adoption, which enables purchases using SOL, USDC, BONK, and other tokens across various product categories including tech, merchandise, food and beverage, and lifestyle goods.