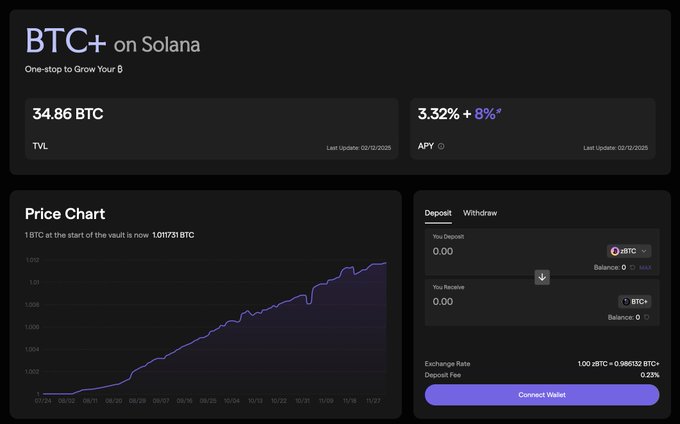

Solv Protocol continues expanding on Solana with significant traction in their BTC+ Vault strategy.

Key Metrics:

- $3.4M worth of productive BTC now earning yields

- Double-digit APYs available through BTC+ Vault

- Building toward largest on-chain BTC treasury

Recent Progress:

- Native integration completed on Solana network

- Up to 13% APY offered on various BTC tokens including $SolvBTC, $cbBTC, $zBTC, $xBTC, and $WBTC

- 100 BTC+ deposit cap for eligible users

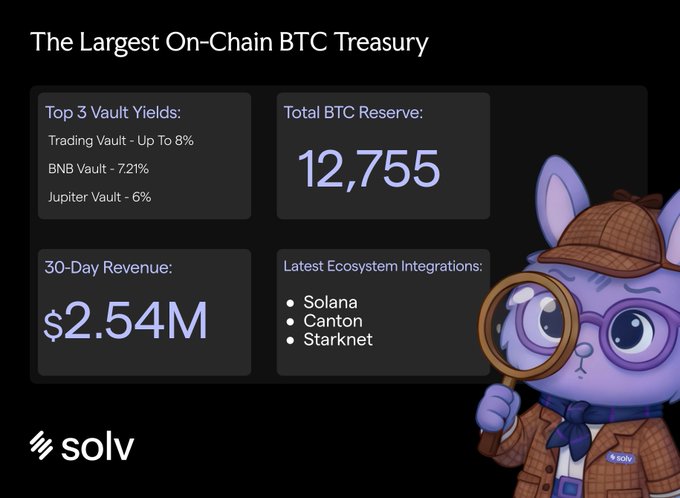

The protocol has been steadily growing across multiple ecosystems including Solana, Canton Network, and Starknet. Their treasury currently holds over 12,755 BTC with recent 30-day revenue reaching $2.54M across 9 vaults.

Strategic Focus: Solv aims to capture all BTC-denominated yield opportunities while maintaining institutional-grade security through Chainlink collaboration.

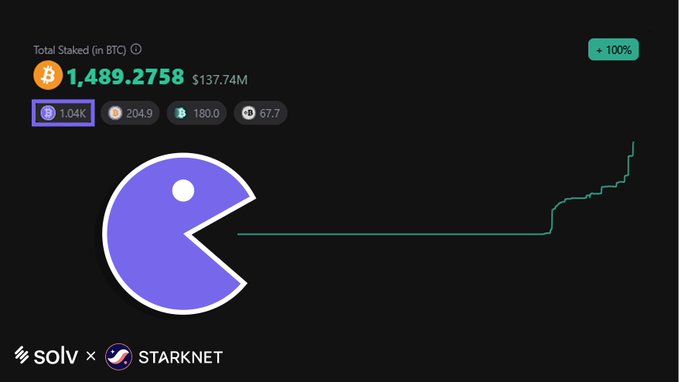

Over 1K+ SolvBTC is staked on Starknet. 👀 The largest on-chain Bitcoin Reserve also thrives in privacy. We'll eat all BTC-denominated Yields. TRUSTED. REGULATED. BUILT FOR INSTITUTIONS.

Anchorage Digital now supports BTC staking on Starknet. Institutions can custody and stake SolvBTC, tBTC, WBTC, and LBTC directly through Anchorage Digital. Trusted. Regulated. Built for Institutions

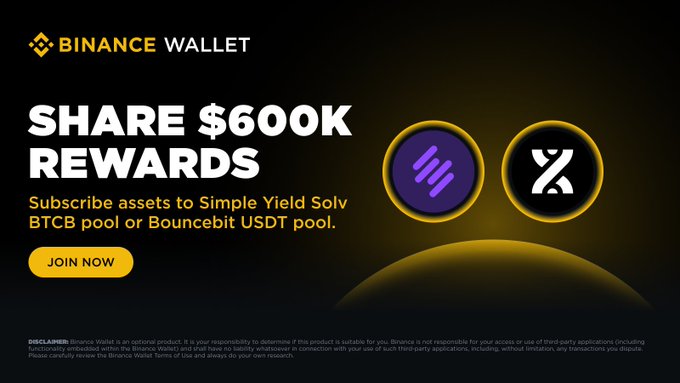

BNB DeFi Festival is officially here! Solv welcomes everyone to share $600K in rewards with @bouncebit. Half of which is in $SOLV that governs The Largest On-Chain BTC Treasury. Eat all BTC-denominated yield with Solv. 🫡 #SolvSZN

🚀BNB DeFi Festival Batch 1 is LIVE now! Here’s your chance to earn more with @SolvProtocol and @bouncebit in the BNB DeFi Festival! 💰Deposit BTCB to Simple Yield Solv BTCB pool, or deposit USDT to Bouncebit USDT pool to share $600,000 rewards in total with #BinanceWallet !

The Largest On-Chain BTC Treasury by the Numbers: Solv currently holds ₿12,755 netting a 30D revenue of up to $2.54M from 9 vaults including BTC+. Recent ecosystems include @solana @CantonNetwork @Starknet We'll eat all BTC-denominated yield.

Made it to the Ship.🚢 The largest on-chain BTC Treasury is launching in Solana.

May we ship you a weekly newsletter? 🚢 Charts did what charts do but Solana’s ecosystem ran through the mud to deliver. Synergy architects and devs alike put in work and the sun rose on a new listing platform. Here's everything we remember that happened: 📰 Headline News -

Slowly taking over the fast lane of @solana. 🏎️💨 There's Already $3.4M worth of productive BTC earning double-digit APYs with our BTC+ Vault. Grow the largest onchain BTC Treasury with us, and eat all BTC-denominated yield. 🫡 #SolvSZN

Still letting your Bitcoin sit idle? Drop your $zBTC into BTC+ and start earning double-digit APY ☄️ @SolvProtocol makes it easy to grow your $BTC 👇🏻 solana.solv.finance/btc+

1 more day, we couldn’t have done it without the full support of the ecosystem. The largest on-chain BTC Treasury's arrival in @Solana will now fully commence, deposits go live tomorrow. We’re ready to bring our A-game in the BTCFi Major League.

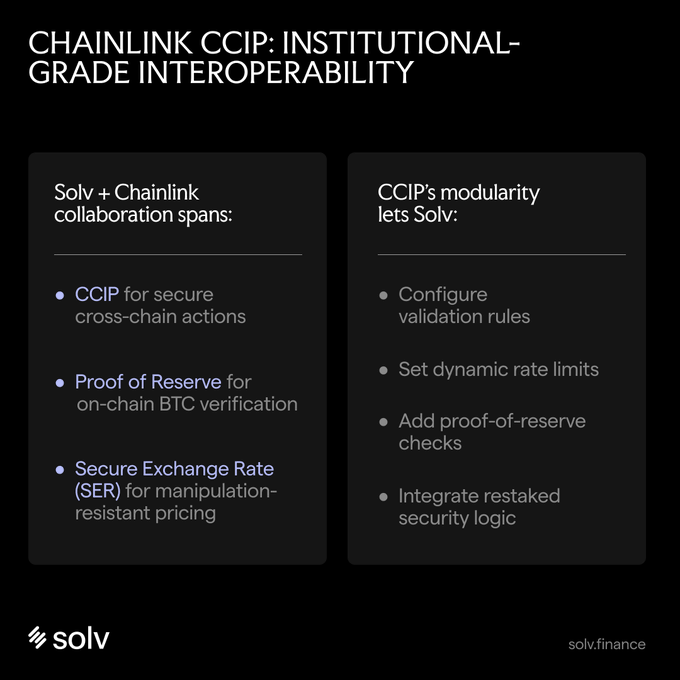

The Solv Standard. Our extensive collaboration with @chainlink is one way we're securing The Largest On-Chain BTC Treasury. As we journey towards eating all BTC-denominated yields, securing everything is paramount. DATs 2.0? Institutional Treasuries seeking BTC yield? The $2T

BTC+ is now Live in Solana. Deposit for up to 13% APY on your $SolvBTC, $cbBTC, $zBTC, $xBTC, and $WBTC. 👉 solana.solv.finance/btc+

Solv is now officially live in @solana! The Largest On-Chain BTC Reserve is starting up with a boost! 🥳 Eligible users will earn up to 13% boosted APR on Solv Strategies. Deposit Cap: 100 BTC+ Head over to solana.solv.finance/btc+

Solv is now officially live in @solana! The Largest On-Chain BTC Reserve is starting up with a boost! 🥳 Eligible users will earn up to 13% boosted APR on Solv Strategies. Deposit Cap: 100 BTC+ Head over to solana.solv.finance/btc+

Accelerate. Each product plays a role on our mission to eat all BTC-denominated yield. Now natively integrated in Solana. Study Solv, the largest on-chain BTC treasury.👇

then: users bridge to other chains to access new assets now: assets bridge to solana to access new users accelerate

Solv Protocol Q4 Report Shows Strong Growth in Bitcoin Yield Platform Adoption

**Alea Research has released comprehensive Q4 coverage of Solv Protocol**, highlighting the growing adoption of BTC+ as a streamlined Bitcoin yield platform. **Key developments include:** - Launch of Bitcoin-backed RWA Vault in partnership with Binance and BNB Chain, featuring Circle's USYC as underlying product - $6.5M in institutional deposits within days of vault launch - Protocol fees and revenue growth despite market volatility and DeFi exploit concerns - Integration with Anchorage Digital's institutional custody platform for compliant SolvBTC operations - Real-time data dashboards via Token Terminal showing Solv ranked 2nd in weekly fees growth among liquid staking protocols The report emphasizes Solv's position as the largest onchain BTC reserve manager, focusing on sustainable yield generation through tokenized real-world assets including Treasuries and investment-grade credit. The platform addresses Bitcoin's income generation challenge while maintaining institutional-grade security and compliance standards. [Read full Q4 report](https://solv.finance)

🏛️ Solv Protocol Secures MiCA License for EU Bitcoin Operations

**Solv Protocol has achieved MiCA compliance**, positioning its Bitcoin reserve for European expansion. **Key developments:** - Acquired MiCA license through Netherlands authorities - Enables operation in EU financial markets under regulatory framework - Anchors the largest on-chain BTC reserve to European regulatory standards **What this means:** The compliance marks a significant step for decentralized Bitcoin finance in Europe. Solv can now expand its Financial NFT platform—which enables trading of vesting vouchers and other tokenized assets—within EU markets under established regulatory oversight. This regulatory approval provides a foundation for institutional participation in on-chain Bitcoin products while maintaining compliance with European financial standards.

Multi-Protocol Strategy Offers 8%+ Returns on Bitcoin Holdings

A DeFi strategy enables Bitcoin holders to earn stablecoin yields while maintaining BTC ownership through a multi-step process: **The Strategy:** - Collateralize SolvBTC on Venus Protocol to borrow $U at 0.82% - Supply $U to $U/$USDT liquidity pool on Lista DAO earning 5.74% - Borrow $USDT against LP tokens at 2.5% - Deploy $USDT either back to Venus (6.11% APY via PRIME) or Lista DAO (5.74% APY) **Net Returns:** 8.16% to 8.53% annually **Additional Incentives:** - 240K in Lista DAO rewards - Venus Protocol PRIME benefits - Exclusive Solv merchandise - $300 in $U giveaway The approach allows users to generate stablecoin income from Bitcoin without selling their holdings, combining multiple protocols for optimized yields.

Alea Research Report Highlights Solv's Bitcoin Mobility via Chainlink CCIP

**Alea Research has published a report examining Solv Protocol's asset mobility infrastructure powered by Chainlink's Cross-Chain Interoperability Protocol (CCIP).** Key findings: - Solv operates the largest onchain Bitcoin reserve with enhanced productivity - Products integrated with Chainlink CCIP have processed over $1.3B in cumulative cross-chain transfer volume - The infrastructure combines CCIP for cross-chain transfers with Chainlink Proof of Reserve for transparent asset backing **Background Context** Solv's Bitcoin Finance infrastructure received recognition in the White House Digital Assets Report (EO14178) as critical infrastructure for stablecoins, tokenized funds, and digital assets. The protocol specializes in creating Financial NFTs that represent various crypto assets, including vesting tokens and lock-up allocations. The integration demonstrates practical application of cross-chain technology for Bitcoin-based financial products, enabling asset movement across different blockchain networks while maintaining security and transparency through oracle-based verification systems. [Read the full Alea Research report](https://twitter.com/AleaResearch)

Solv Protocol Upgrades to FROST Network for Bitcoin Threshold Signatures

Solv Protocol has completed a major infrastructure upgrade, transitioning from SAL to **FROST Network-based architecture** for Bitcoin-compatible threshold signing. **Key Technical Changes:** - FROST multi-signatures enable distributed custody and governance - No modifications required to Bitcoin's core protocol - Institutional-grade security through threshold cryptography **Benefits of the Upgrade:** - Enhanced security through distributed control - Improved accountability and auditability - Higher execution scalability for SolvBTC - Easier integration for DeFi ecosystems The upgrade positions SolvBTC as a more resilient Bitcoin execution layer, moving beyond basic staking abstractions to provide enterprise-grade infrastructure for institutions. [Read full details](https://blockchainreporter.net/solv-drives-frost-threshold-signatures-for-bitcoin-mainnet-execution/)