Roobee Finance

The decentralized part of the Roobee platform enables anyone anywhere in the world to access various DeFi-based financial products and services. With the help of Roobee.finance, users can perform the entire set of actions needed for interaction with crypto — make cross-chain transfers, trade and swap assets, or earn interest on their assets. Roobee.finance supports the Ethereum, BNB Chain, Polygon, Avalanche, Optimism, Arbitrum.

Roobee Explores Market Regime Shifts and Real-World Asset Investment Strategies

Mon 2nd Feb 2026

Roobee.finance published an analysis examining how different market phases require distinct investment approaches.

The piece focuses on:

- **Real-World Assets (RWAs)** and their unique behavioral patterns compared to traditional tokens

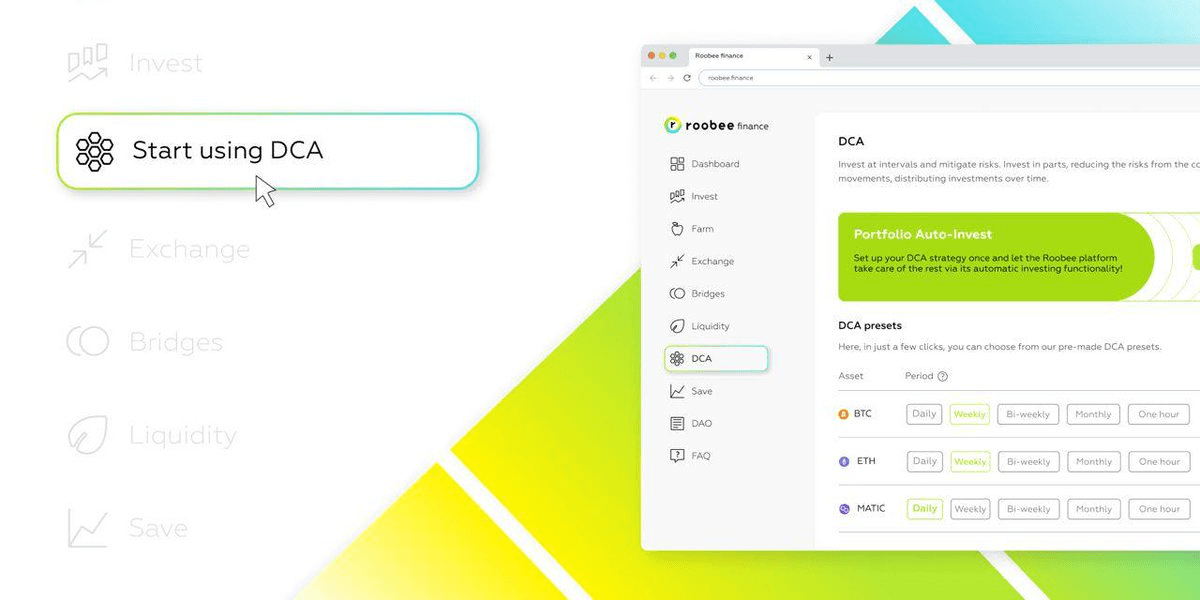

- **Dollar-Cost Averaging (DCA)** as a strategy across market cycles

- The importance of structural thinking over conviction-based trading

Key insight: *RWAs behave like systems, not tokens* - requiring stronger assumptions around liquidity, compliance, and market pricing mechanisms.

The analysis challenges common assumptions that trust, liquidity, and compliance will naturally emerge in RWA markets. Instead, it emphasizes that real assets demand more rigorous frameworks from the start.

Read the full analysis: [Market Regime article on Medium](https://medium.com/@roobee_invest/market-regime-02c63a2631c3)

Supply Shortages Drive Commodity Prices to Multi-Year Highs

Fri 30th Jan 2026

**Key commodity markets are experiencing significant price surges amid widespread supply constraints:**

- Indium and tin have jumped approximately 33% this month

- Natural gas reached a 3-year peak

- Copper hit a record high of ~$13,400

- Aluminium trading near 4-year highs

- Lithium climbed to 2-year highs

**This follows recent precious metals rallies**, with gold breaking above $4,850 per ounce (up 9.6% year-to-date, 73% year-over-year) and silver surpassing $95.

The broad-based commodity rally reflects tightening supply across critical industrial materials, suggesting potential inflationary pressures and increased demand for real-world assets as traditional markets face volatility.

Precious Metals Rally: Gold, Silver, Platinum Hit Multi-Decade Highs

Fri 30th Jan 2026

**Historic precious metals surge across the board**

The precious metals market is experiencing extraordinary gains:

- **Gold**: On track for its largest monthly gain since 1999, up 21% and trading above $5,300/oz

- **Silver**: Potentially seeing its strongest monthly rally on record

- **Platinum**: Heading for best month since 1974

- **Palladium**: Best performance since 2008

Investors are crowding into these traditional safe-haven assets amid market uncertainty.

**Key question for crypto markets**: If this metals rally fades, will Bitcoin emerge as the preferred alternative safe haven?

Roobee Publishes Core Thesis on DCA and RWA Strategy

Fri 30th Jan 2026

Roobee has published a comprehensive article on Medium outlining its core investment thesis and strategic direction.

The piece addresses:

- What Roobee is and what it isn't as a platform

- The importance of Dollar Cost Averaging (DCA) in current market conditions

- Why Real World Assets (RWA) matter for the platform's future

- Current market context and positioning

The article provides clarity on Roobee's approach to combining traditional investment strategies with blockchain technology, focusing on accessible financial products.

[Read the full thesis on Medium](https://medium.com/@roobee_invest/roobees-core-thesis-175596426fd1)

🏦 RWA Tokenization Surpasses $10B TVL as Major Players Build Infrastructure

Mon 15th Dec 2025

**Real World Asset (RWA) tokenization continues its rapid expansion**, with total value locked surpassing $10 billion and climbing.

**Traditional assets moving on-chain include:**

- Treasury securities

- Credit instruments

- Exchange-traded funds (ETFs)

**Major infrastructure players are scaling operations:**

- Canton Network building institutional-grade pipes

- Kraken expanding tokenization services

- Backed providing asset backing solutions

**Institutional adoption accelerating** as traditional finance discovers yield farming opportunities in the tokenized asset space.

The momentum suggests RWA tokenization is becoming a dominant narrative in crypto, bridging traditional finance with blockchain technology.

Roobee.finance Expands Multi-Chain Support to 15 Networks

Mon 4th Aug 2025

Roobee.finance has expanded its blockchain support to include 15 major networks, including BASE, Optimism, Arbitrum, and BNB Chain. Users can now:

- Switch between networks with one click on the platform

- Access DCA and Marketplace features across multiple chains

- Use native bridges for each supported blockchain

- Leverage universal bridges for cross-chain transfers

The platform aims to simplify cross-chain interactions for users' daily investment strategies. All features are accessible at [Roobee.finance](https://roobee.finance), with bridge functionality available at [app.roobee.finance/bridges](https://app.roobee.finance/bridges).

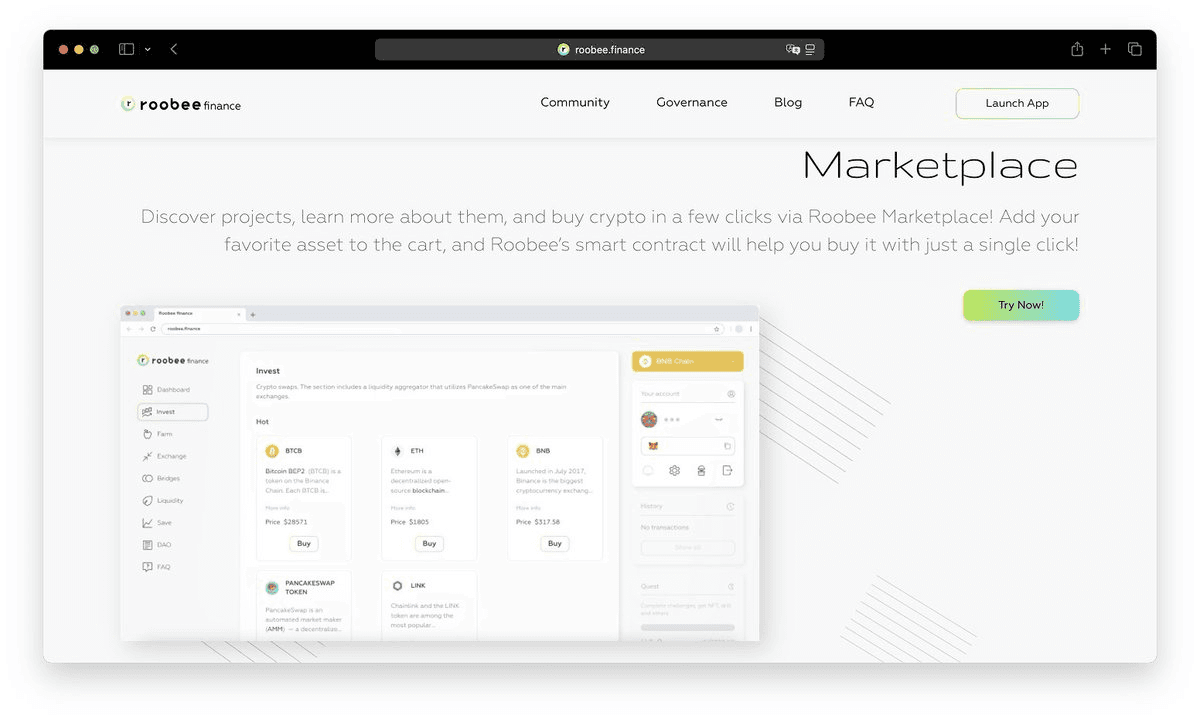

Roobee Launches One-Stop Crypto Marketplace

Thu 3rd Jul 2025

Roobee has launched a new marketplace that simplifies cryptocurrency purchases by functioning like a traditional e-commerce platform. Key features include:

- Single-transaction purchases for multiple tokens

- Built-in project descriptions for each token

- Favorites system for tracking preferred assets

- Category filters (DeFi, NFT, Memes, Gaming, etc.)

- Available across multiple blockchain networks

The platform aims to reduce gas fees and streamline portfolio building by eliminating the need to use multiple DEXs. Users can browse, research, and purchase various crypto assets in one place.

[Try Roobee Marketplace](https://app.roobee.finance/invest)

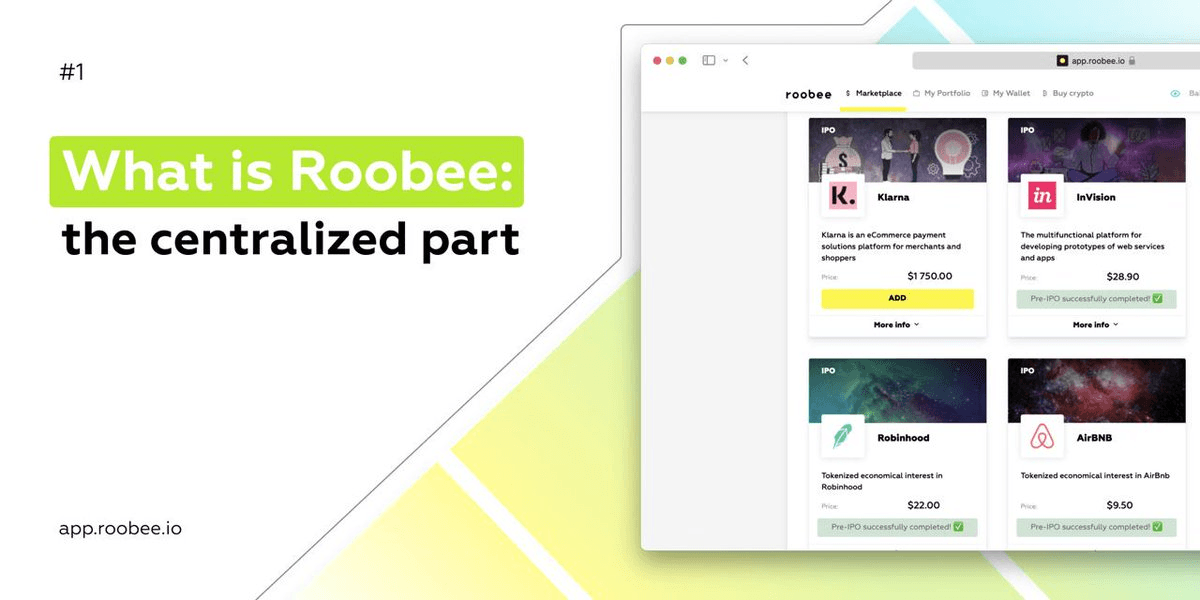

Roobee Platform Deep Dive: The Centralized Component

Thu 19th Jun 2025

Roobee is launching a comprehensive exploration of their platform that bridges TradFi and DeFi. The first installment focuses on their **centralized platform**, which serves as an entry point for most users.

Key features:

- Investment tools including ETF, Pre-IPO, and bonds

- Security and user control mechanisms

- Accessible to both novice and experienced investors

- Emphasis on transparency and ease of use

The platform aims to democratize traditional investing by lowering barriers to entry and allowing small-amount investments.

[Read the full article](https://coinmarketcap.com/community/articles/640eef9b8ad5f32ca85e1e6c6/)

*Part Two will cover Roobee's decentralized infrastructure.*

Roobee DCA Module Now Live on Four Major Blockchains

Thu 24th Apr 2025

Roobee's Dollar-Cost Averaging (DCA) module has expanded its blockchain presence after 1.5 years of operation. The service is now available on:

- Arbitrum

- Optimism

- BNB Chain

- Blast

Key features:

- Automated crypto purchases (daily, weekly, or monthly)

- Fully decentralized operation

- One-minute setup process

- Direct-to-wallet transfers

- User maintains full fund control

The platform plans to add more assets and networks in future updates. Users can access the DCA module at [Roobee Finance](https://app.roobee.finance/dca).

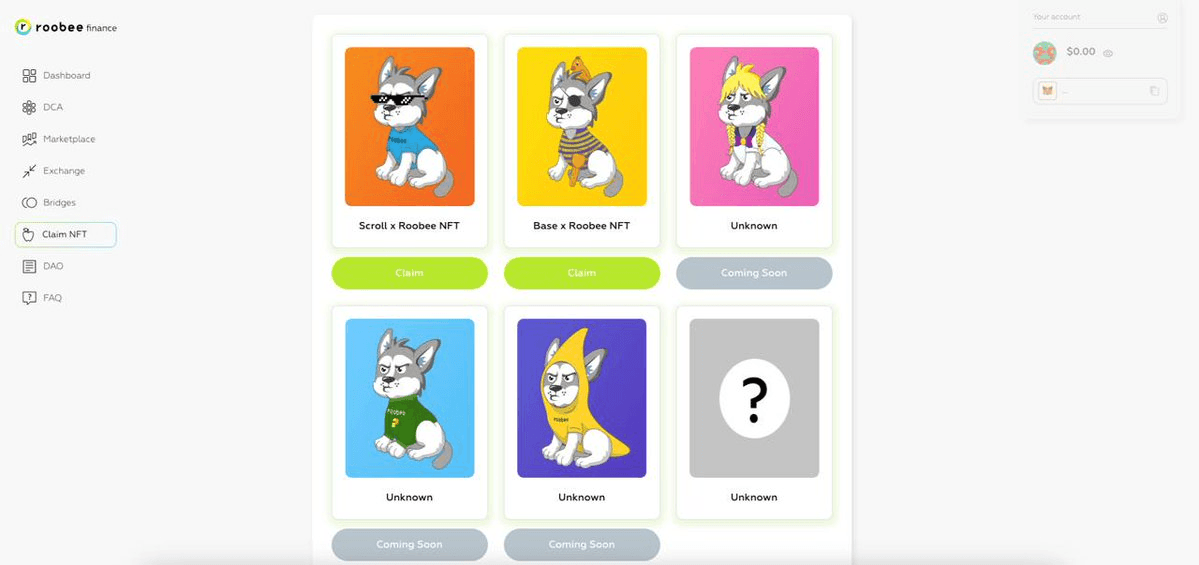

Roobee Launches Free NFT for BASE Network Users

Thu 13th Feb 2025

Roobee.finance is offering a complimentary NFT to celebrate its BASE network support. Key details:

- Available to all BASE network users

- No minimum balance or transaction requirements

- Minting available at [app.roobee.finance/nft](http://app.roobee.finance/nft)

The platform plans to release additional NFTs for other supported networks in the future. This initiative recognizes and rewards BASE network participation with a unique digital collectible.

Want to claim yours? Visit the minting page to get started.