Roobee Launches One-Stop Crypto Marketplace

Roobee Launches One-Stop Crypto Marketplace

🛒 Your DEX Cart Awaits

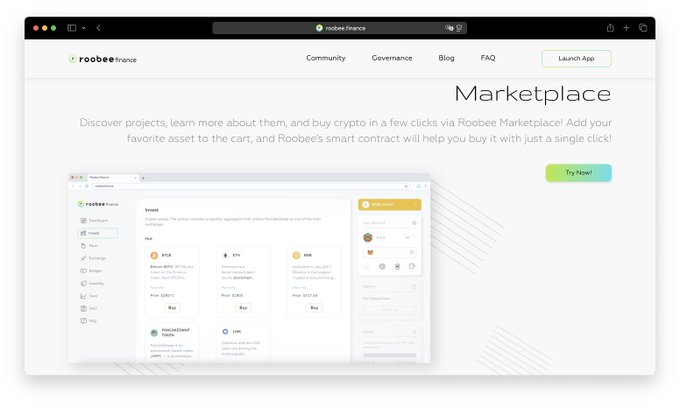

Roobee has launched a new marketplace that simplifies cryptocurrency purchases by functioning like a traditional e-commerce platform. Key features include:

- Single-transaction purchases for multiple tokens

- Built-in project descriptions for each token

- Favorites system for tracking preferred assets

- Category filters (DeFi, NFT, Memes, Gaming, etc.)

- Available across multiple blockchain networks

The platform aims to reduce gas fees and streamline portfolio building by eliminating the need to use multiple DEXs. Users can browse, research, and purchase various crypto assets in one place.

💥 Roobee Marketplace is here — and it’s like shopping for crypto in an online store. Let’s break down how it works and why it’s a game changer 🧵👇

💥 What is Roobee: the decentralized part! 🧵 A thread about how Roobee brings DeFi closer to everyone 👇

Roobee Explores Market Regime Shifts and Real-World Asset Investment Strategies

Roobee.finance published an analysis examining how different market phases require distinct investment approaches. The piece focuses on: - **Real-World Assets (RWAs)** and their unique behavioral patterns compared to traditional tokens - **Dollar-Cost Averaging (DCA)** as a strategy across market cycles - The importance of structural thinking over conviction-based trading Key insight: *RWAs behave like systems, not tokens* - requiring stronger assumptions around liquidity, compliance, and market pricing mechanisms. The analysis challenges common assumptions that trust, liquidity, and compliance will naturally emerge in RWA markets. Instead, it emphasizes that real assets demand more rigorous frameworks from the start. Read the full analysis: [Market Regime article on Medium](https://medium.com/@roobee_invest/market-regime-02c63a2631c3)

Supply Shortages Drive Commodity Prices to Multi-Year Highs

**Key commodity markets are experiencing significant price surges amid widespread supply constraints:** - Indium and tin have jumped approximately 33% this month - Natural gas reached a 3-year peak - Copper hit a record high of ~$13,400 - Aluminium trading near 4-year highs - Lithium climbed to 2-year highs **This follows recent precious metals rallies**, with gold breaking above $4,850 per ounce (up 9.6% year-to-date, 73% year-over-year) and silver surpassing $95. The broad-based commodity rally reflects tightening supply across critical industrial materials, suggesting potential inflationary pressures and increased demand for real-world assets as traditional markets face volatility.

Precious Metals Rally: Gold, Silver, Platinum Hit Multi-Decade Highs

**Historic precious metals surge across the board** The precious metals market is experiencing extraordinary gains: - **Gold**: On track for its largest monthly gain since 1999, up 21% and trading above $5,300/oz - **Silver**: Potentially seeing its strongest monthly rally on record - **Platinum**: Heading for best month since 1974 - **Palladium**: Best performance since 2008 Investors are crowding into these traditional safe-haven assets amid market uncertainty. **Key question for crypto markets**: If this metals rally fades, will Bitcoin emerge as the preferred alternative safe haven?

Roobee Publishes Core Thesis on DCA and RWA Strategy

Roobee has published a comprehensive article on Medium outlining its core investment thesis and strategic direction. The piece addresses: - What Roobee is and what it isn't as a platform - The importance of Dollar Cost Averaging (DCA) in current market conditions - Why Real World Assets (RWA) matter for the platform's future - Current market context and positioning The article provides clarity on Roobee's approach to combining traditional investment strategies with blockchain technology, focusing on accessible financial products. [Read the full thesis on Medium](https://medium.com/@roobee_invest/roobees-core-thesis-175596426fd1)

🏦 RWA Tokenization Surpasses $10B TVL as Major Players Build Infrastructure

**Real World Asset (RWA) tokenization continues its rapid expansion**, with total value locked surpassing $10 billion and climbing. **Traditional assets moving on-chain include:** - Treasury securities - Credit instruments - Exchange-traded funds (ETFs) **Major infrastructure players are scaling operations:** - Canton Network building institutional-grade pipes - Kraken expanding tokenization services - Backed providing asset backing solutions **Institutional adoption accelerating** as traditional finance discovers yield farming opportunities in the tokenized asset space. The momentum suggests RWA tokenization is becoming a dominant narrative in crypto, bridging traditional finance with blockchain technology.