🏦 Institutions Prep for Onchain Future

Mon 9th Jun 2025

At Binance Blockchain Week in Dubai, Ondo President Ian De Bode emphasized how **tokenization is reshaping finance**. The key message was clear: **major institutions are preparing for an onchain future**.

This follows recent regulatory support, with:

- **Paul Atkins (SEC Chairman)** calling tokenization inevitable for keeping the US competitive

- **BlackRock's leadership** highlighting tokenization's potential for enormous growth

- **Major financial institutions** converging at the upcoming Ondo Summit in February 2026

The institutional momentum is building as traditional finance recognizes blockchain's role in modernizing capital markets. From tokenized Treasuries to stocks and ETFs, the infrastructure for bringing trillions onchain is taking shape.

**The shift from experimentation to implementation is accelerating across the financial sector.**

Silver Outperforms Google Stock in 2025 as Precious Metals Shine

Thu 4th Dec 2025

**Silver has outperformed Google stock ($GOOGL) in 2025**, highlighting the continued strength of precious metals in investment portfolios.

This performance reinforces why **precious metals deserve a place in traditional investment strategies**. Investors can now access these assets alongside stocks through blockchain technology.

**Key highlights:**

- Silver beats major tech stock performance

- Precious metals proving portfolio value

- Traditional assets now available onchain

[Ondo Global Markets](https://summit.ondo.finance/2026) offers access to over 100 tokenized stocks and ETFs, including gold and silver ETFs, bringing traditional assets to the blockchain.

**Learn more at the upcoming summit** - view speakers and RSVP at the link above.

Onchain Stocks Set for Mainstream Adoption in 2026

Thu 4th Dec 2025

**2025 marked the emergence of onchain stocks** as a significant trend in the tokenization space.

**The next phase begins in 2026**, when these blockchain-based equity instruments are expected to gain widespread mainstream adoption.

Key developments:

- Onchain stocks gained traction throughout 2025

- Infrastructure and regulatory frameworks matured

- **2026 positioned as the breakthrough year** for mass market acceptance

This progression follows the broader tokenization trend that has seen various traditional assets move onto blockchain platforms, offering improved accessibility and programmability.

Nasdaq Embraces Tokenization as Next Evolution in Securities Trading

Mon 1st Dec 2025

**Nasdaq is positioning itself at the forefront of securities tokenization**, with Head of Digital Assets Matt Savarese describing it as the natural next step after the transition from paper to electronic trading.

The exchange is actively working to **support tokenized stocks and ETFs**, building on their earlier SEC filing to allow trading of tokenized securities on their platform.

**Key developments:**

- Nasdaq views tokenization as an evolutionary step in market infrastructure

- The exchange is developing capabilities for tokenized traditional securities

- This follows their September regulatory filing with the SEC

**Market implications:**

- Could increase trading efficiency and market accessibility

- Represents institutional validation of blockchain-based securities

- May face regulatory hurdles as the framework develops

Nasdaq's embrace of tokenization signals **growing institutional confidence** in blockchain technology for traditional financial markets, potentially paving the way for broader adoption across major exchanges.

Major Onchain Stock Purchases Hit $1.2M This Week Led by Google

Thu 27th Nov 2025

**Large institutional money is flowing into tokenized stocks this week**, with over $1.2 million in major purchases recorded onchain.

**Top purchases include:**

- $500,000 in Google (GOOGLon)

- $273,506 in QQQ ETF

- $200,705 in Meta

- $150,000 each in Alibaba and NVIDIA

The **Google purchase executed as a single transaction** on BNB Chain, demonstrating how tokenized stocks can handle large orders efficiently.

**Ondo's tokenized stocks inherit traditional exchange liquidity**, allowing these substantial onchain orders to execute with the same efficiency as conventional stock trades.

This activity signals **growing institutional adoption** of tokenized traditional assets in DeFi.

NY Fed Endorses Open Blockchain Rails for Global Financial Access

Thu 27th Nov 2025

The **Federal Reserve Bank of New York** published a significant analysis highlighting the structural advantages of open blockchain infrastructure for the financial system.

**Key advantages identified:**

- Blockchains already process trillions in value

- Permissionless rails enable **global access** to financial services

- Composability creates new financial workflows

- Monetary instruments can achieve **borderless reach**

The analysis emphasizes how open blockchain rails can expand access to U.S. markets and improve payment infrastructure through permissionless systems.

This represents a notable shift in Federal Reserve messaging toward recognizing blockchain technology's potential in traditional finance.

[Read the full NY Fed analysis](https://libertystreeteconomics.newyorkfed.org/2025/11/the-future-of-payment-infrastructure-could-be-permissionless/)

Ondo Tokenized Stocks Hit 200K+ DEX Trades as Activity Doubles

Thu 13th Nov 2025

**Ondo's tokenized stocks and ETFs have surpassed 200,000 total DEX trades**, marking a significant milestone in the tokenization space.

**Trading activity has doubled in recent weeks**, signaling accelerating adoption of tokenized financial products.

This growth builds on previous momentum:

- Tokenized stocks grew **60% in market cap** over 30 days in September

- Growth coincided with Ondo Global Markets launch

- Demonstrates **democratization of US capital markets** through blockchain technology

The surge suggests traditional finance participants are increasingly embracing on-chain alternatives for stock and ETF exposure.

Ondo Finance Appoints Former McKinsey Digital Assets Head as President

Mon 10th Nov 2025

**Ondo Finance** has appointed **Ian De Bode**, former Head of Digital Assets at McKinsey, as President.

De Bode will lead Ondo's expansion into institutional tokenization markets, focusing on:

- Accelerating global market reach

- Advancing institutional adoption of tokenized assets

- Building on Ondo's existing Treasury tokenization platform

The appointment signals Ondo's push to capture growing institutional demand for digital asset exposure through traditional financial products.

🏦 Tokenized Markets Must Beat Traditional Standards to Scale

Thu 6th Nov 2025

**Tokenized markets need to exceed traditional finance standards** to reach trillion-dollar scale, according to Ondo's Nathan Allman speaking at Nasdaq's TradeTalks.

**Key requirements for success:**

- Liquidity must match or surpass traditional markets

- Infrastructure needs institutional-grade reliability

- User experience should be seamless

This follows **Nasdaq's recent SEC filing** to enable tokenized securities trading - a major step toward bringing traditional assets onchain at scale.

**The vision:** Blockchain rails that provided global USD access will now offer worldwide access to US capital markets, potentially benefiting investors, issuers, and the broader economy.

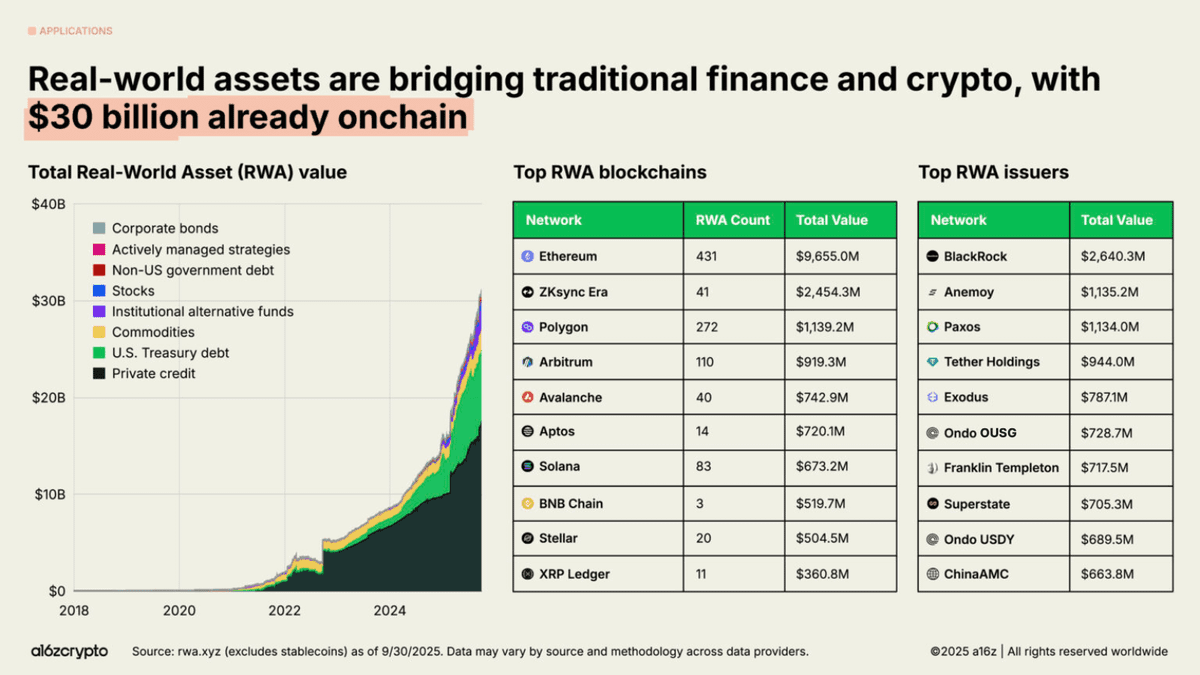

Tokenized RWAs Hit $30B Market Cap, Growing 4x in Two Years

Mon 20th Oct 2025

**Tokenized real-world assets (RWAs) have reached a $30 billion market**, representing nearly 4x growth over the past two years according to a16z's State of Crypto 2025 report.

**Key market segments driving growth:**

- Private credit dominates with $15.5B in active loans

- Tokenized Treasuries account for $7.4B, up 500% year-over-year

- Gold tokenization shows $2.1B in proven adoption

**Ondo Finance has tokenized over $1.8 billion** in RWAs, establishing itself as a major player in the space.

While the total RWA market appears large at $300B, **92% consists of stablecoins**. Non-stablecoin RWAs represent just $25B - still only 0.01% of global financial assets despite 2x annual growth.

**The sector faces real challenges:**

- Most projects rely on trust assumptions they claim to eliminate

- Regulatory frameworks remain unclear for public tokenized securities

- Data and oracle infrastructure gaps persist

However, **genuine adoption is concentrated** in three proven categories: private credit offering 9.7% yields, programmable Treasury yields serving as DeFi collateral, and 24/7 tradeable gold.

RWAs are evolving into crypto's yield layer through reliable infrastructure rather than speculative tokenization of everything.