At Binance Blockchain Week in Dubai, Ondo President Ian De Bode emphasized how tokenization is reshaping finance. The key message was clear: major institutions are preparing for an onchain future.

This follows recent regulatory support, with:

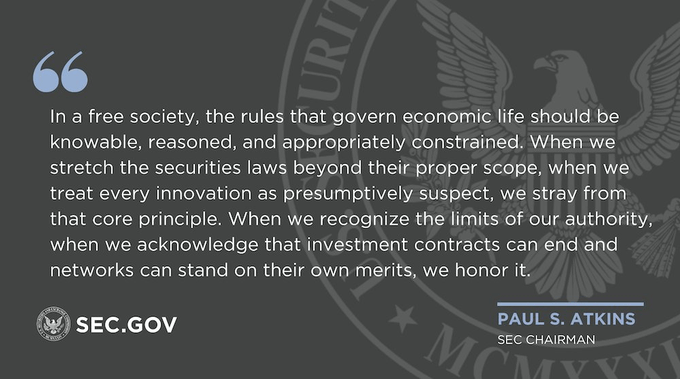

- Paul Atkins (SEC Chairman) calling tokenization inevitable for keeping the US competitive

- BlackRock's leadership highlighting tokenization's potential for enormous growth

- Major financial institutions converging at the upcoming Ondo Summit in February 2026

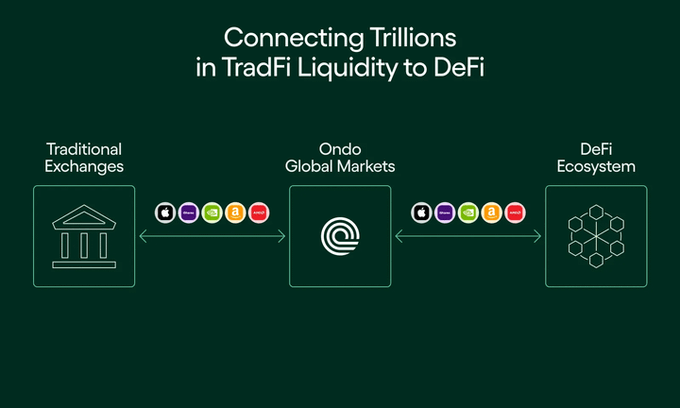

The institutional momentum is building as traditional finance recognizes blockchain's role in modernizing capital markets. From tokenized Treasuries to stocks and ETFs, the infrastructure for bringing trillions onchain is taking shape.

The shift from experimentation to implementation is accelerating across the financial sector.

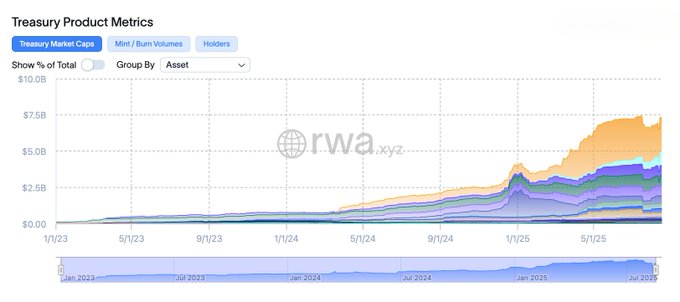

At the @PanteraCapital Blockchain Summit 2025, Ondo Finance CEO @nathanlallman addressed how institutions are approaching tokenization: “All of the large asset managers either have or are soon to launch tokenized treasury funds.” Tokenized U.S. Treasuries recently crossed $8.4B

From tokenized stocks to stablecoins and treasuries, the past week has seen a flurry of headlines that reflect the rapid institutional embrace of crypto and tokenized finance. Here are the key recent developments you need to know. 👇

The U.S. is choosing to lead the world in financial innovation. Through the tokenization of U.S. stocks and Treasuries, Ondo is building the infrastructure that will strengthen and modernize capital markets.

We will make sure the next chapter of financial innovation is written right here in America. Watch highlights from my speech launching Project Crypto at @A1Policy.

The future of finance is tokenized. “This will become bigger and bigger in the coming years. Starting with stocks, the asset class with the most potential.” Robinhood CEO @vladtenev on how tokenization will reshape finance.

Tokenization, simplified. Ondo Finance's Ian De Bode walks through how traditional assets become blockchain-native tokens on @TheStreet's Roundtable Network (@rtb_io). The straightforward breakdown everyone needs.

90+ million wallets just got access to tokenized stocks & ETFs. Blockchain․com (@blockchain) now supports Ondo Global Markets, bringing 100+ tokenized stocks & ETFs to users worldwide. Traditional markets, modern access.

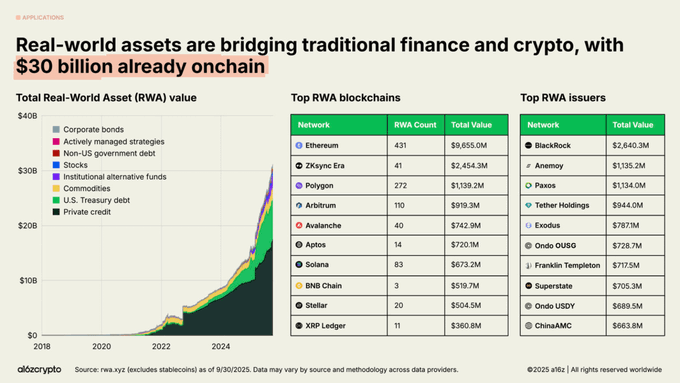

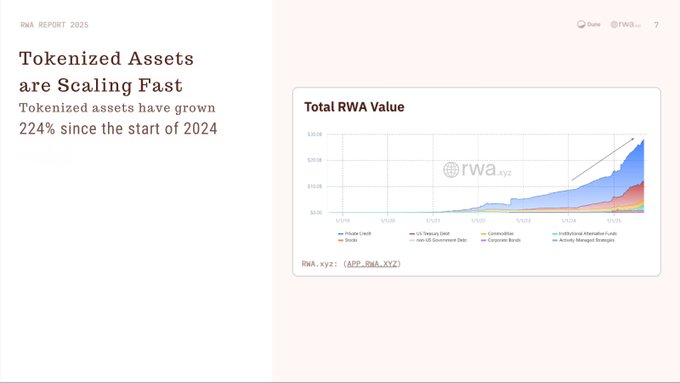

The adoption of digital assets continues to accelerate. This week saw major breakthroughs across global banks, fintechs, and market infrastructure players, from tokenized real-world assets surpassing $30B in market size to Revolut securing a MiCA license to offer crypto services

Yesterday, Circle—issuer of USDC—went public. It’s a milestone not just for one company, but for the stablecoin category writ large. It affirms what many in crypto already believe: that blockchain-based digital dollars are becoming core financial infrastructure. Stablecoins

The internet transformed media, commerce, and communication. Ondo Finance is doing the same for capital markets.

October marked another transformative month for Ondo. From expanding regulatory and operational capabilities to forming landmark partnerships and integrations, Ondo continues to build the infrastructure bringing global finance onchain. Highlights👇 1⃣Ondo Finance has completed

Today, SEC Chair Paul Atkins announced Project Crypto in a landmark speech, a bold initiative to modernize U.S. securities regulation for the blockchain era. His vision charts a clear path forward, one that embraces tokenized securities, stablecoins, and crypto-native

The SEC is recognizing the potential of tokenization. SEC Commissioner @HesterPeirce recently signaled on Bloomberg that the SEC is willing to work with firms on U.S. equity tokenization. Ondo is encouraged by the SEC's proactive approach and excited to lead the charge in

Shares of 100+ of the world's largest stocks and ETFs are tokenized on the Ondo Global Markets platform: ✅ BlackRock ✅ Microsoft ✅ Alphabet ✅ Amazon ✅ NVIDIA ✅ Shopify ✅ PayPal ✅ Netflix ✅ Apple ✅ Tesla ✅ Uber ✅ Meta ✅ AMD ✅ Nike ✅ Visa ✅ IBM & many more.

Institutions are going all in on tokenization. “A lot of institutions are looking at companies like Ondo to help bridge the TradFi-to-DeFi divide.” Ondo Finance President @iandebode on enabling the biggest players in finance to move onchain.

What’s onchain today is only the beginning. Value tokenized to date: Stablecoins → $280B+ Tokenized U.S. Treasuries → $7.5B+ Tokenized stocks & ETFs → $500M+ $288 billion tokenized. Trillions to go.

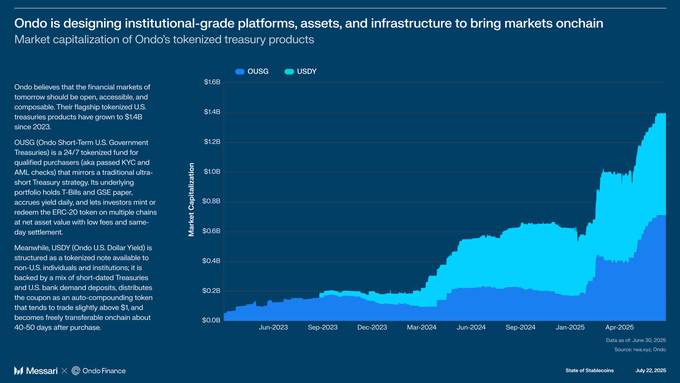

The onchain era has arrived. Since the start of 2023, Ondo's tokenized products have attracted $1.8B in AUM across nearly 30K holders. Tokenizing capital markets represents a multi-trillion-dollar opportunity and Ondo is building the infrastructure to capture it.

Ondo Finance CEO Nathan Allman joins @CNBC to discuss the growing adoption of tokenized ETFs. “I think that a lot of the demand is coming from crypto investors that haven't yet dipped their toes into investing in traditional assets and so ETFs are an easy way to do that.” -

The future of capital markets has no borders. “Anyone with a stablecoin is going to essentially be able to buy any U.S. stock or ETF that they want... we really want to break open the barriers that currently still exist for a global user base.” - Ondo Finance's @iandebode on

Ondo x @chainlink event at DC Fintech Week. Convening policymakers and industry leaders in Washington, D.C. to discuss tokenization policy, infrastructure, and institutional adoption. Together, shaping the conversation on how capital markets come onchain.

A step toward regulatory clarity. The Senate Agriculture Committee just released its portion of the market structure bill, bringing the U.S. closer to clear rules for digital assets. Key takeaways: → Defines which agencies oversee which assets → Requires CFTC and SEC

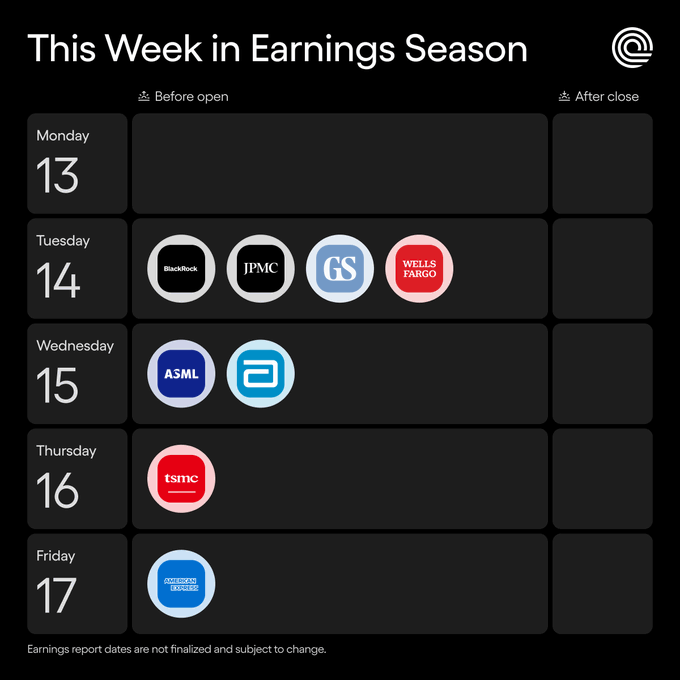

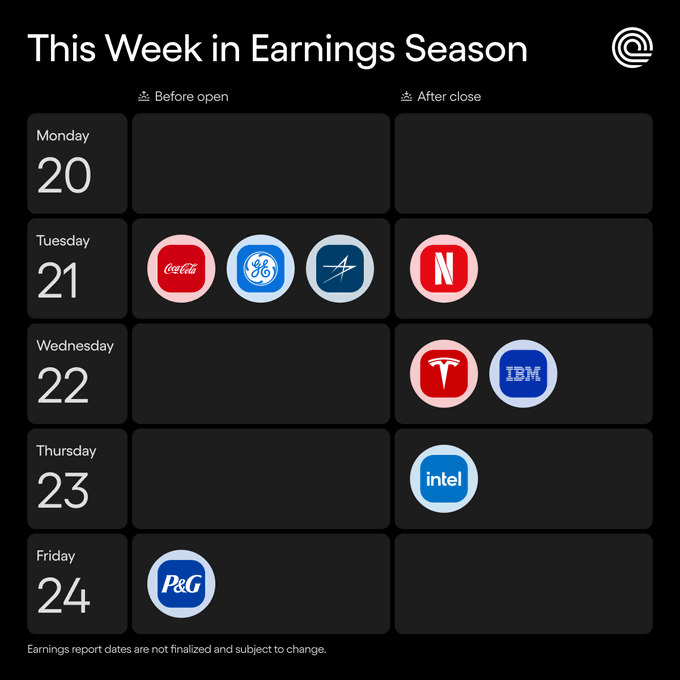

All eyes are on Wall Street’s biggest names this week. Q3 earnings season is here ↓ Tuesday, before open: → Blackrock, Inc. ($BLK) → JPMorgan Chase ($JPM) → Goldman Sachs ($GS) → Wells Fargo ($WFC) Wednesday, before open: → ASML Holding NV ($ASML) → Abbott ($ABT)

Another defining week for tokenization adoption, with significant developments from regulators, banks, and tech companies. The SEC pushed for unified trading frameworks, Google Cloud unveiled institutional blockchain plans, and banks embedded USDC into payment systems. The

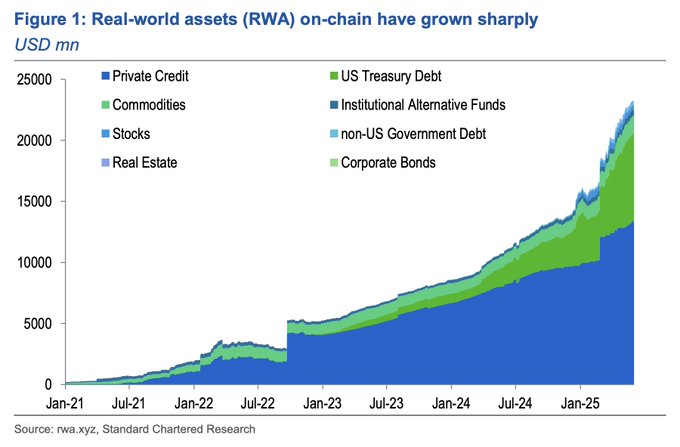

“Gradually, then suddenly.” A newly released report by analysts at @StanChart highlights a fundamental truth: Tokenized assets need “to be cheaper, quicker to settle, and/or create access for more investors than [their] offchain equivalent; or need to solve an onchain need,

Compliant pathways to European markets. “Making Ondo assets available to even more investors throughout the world in a liquid, regulated environment.” Claudio Tognella, BX Digital on partnering with Ondo Finance to bring tokenized stocks and ETFs to regulated European markets.

Liquidity of traditional markets. Coming onchain. Ondo tokenized stocks and ETFs are uniquely designed to tap into the liquidity of traditional equity markets, bringing unrivaled market depth onchain. Markets without compromise.

Billions globally were excluded from the world's largest capital markets. Ondo Global Markets is changing that. Explore the new website: ondo.finance/global-markets

1/ We’re excited to share that OKX Wallet (@wallet) is joining the Ondo Global Markets Alliance and that OKX users will be able to access Ondo’s tokenized stocks, ETFs, and more when we launch later this summer.

Early tokenized stock models reveal deep structural issues: limited liquidity, wide spreads, and persistent price dislocations. Ondo’s tokenized stocks and ETFs take a different approach, inheriting liquidity from public markets rather than trying to recreate it. In our latest

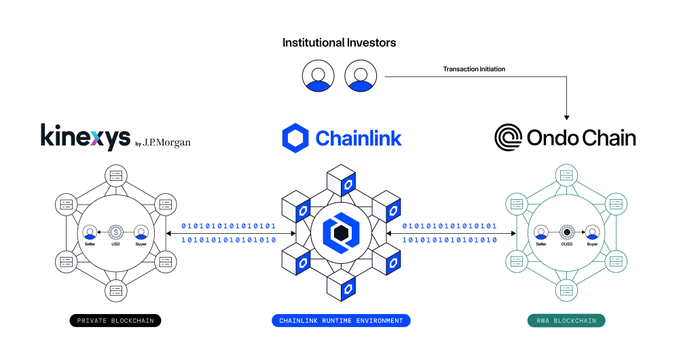

Hear from Nelli Zaltsman, Head of Platform Settlement Solutions at Kinexys by @JPMorgan, on our recent collaboration, and the future of tokenization. 👇 “The test transaction between Ondo Finance, J.P. Morgan and Chainlink was very exciting for our organization. I think it

"Providers like Chainlink play an important role because interoperability is not necessarily something a single institution can achieve by itself." @Nzaltsman of Kinexys by @jpmorgan joins Chainlink’s Future Is On series to discuss the institutional adoption of blockchain

Tokenized RWAs are becoming one of crypto’s biggest markets. “The total market for tokenized RWAs sits at $30 billion, up nearly 4x in the last two years” highlighted by @a16zcrypto's State of Crypto 2025 report. To date, Ondo has tokenized over $1.8 billion in RWAs.

Nearly $70 trillion sits in U.S. equities. Tokenization opens it to the world.

Everything will be tokenized. “All stocks, ETFs, Treasuries, and most financial instruments will be tokenized and run on public blockchain rails.” Ondo Finance President @iandebode on the onchain shift that will change markets forever.

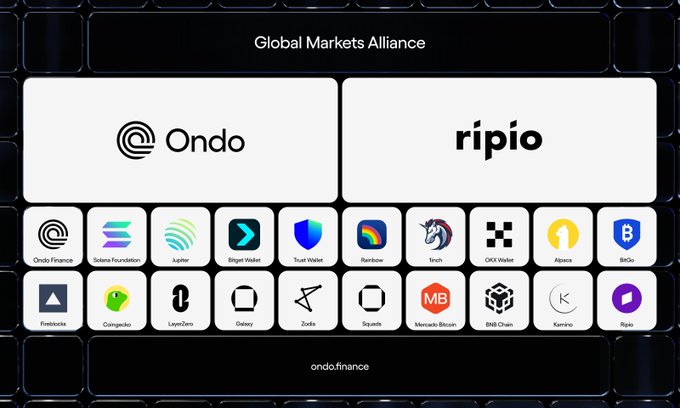

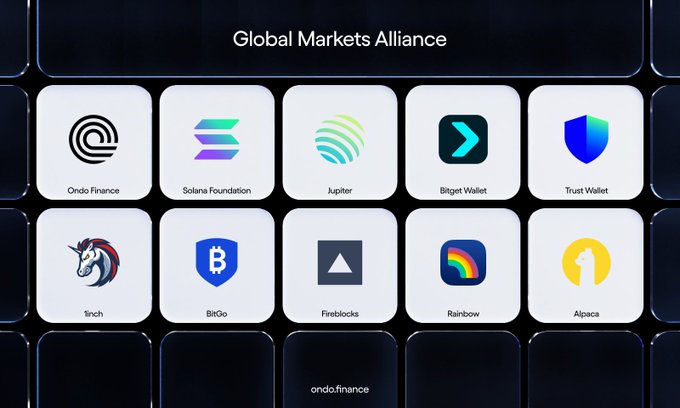

U.S. Capital Markets are going global. Ondo Global Markets launched with support from many of the world's leading applications and platforms, including: Bitget Wallet (@BitgetWallet) Trust Wallet (@TrustWallet) OKX Wallet (@wallet) Gate (@Gate) Chainlink (@chainlink) Bitget

1/ Ondo Finance has completed its purchase of Oasis Pro, including its SEC-registered digital assets broker-dealer, alternative trading system (ATS), and transfer agent (TA) licenses. This provides the Ondo Finance group with the most comprehensive set of SEC registrations for

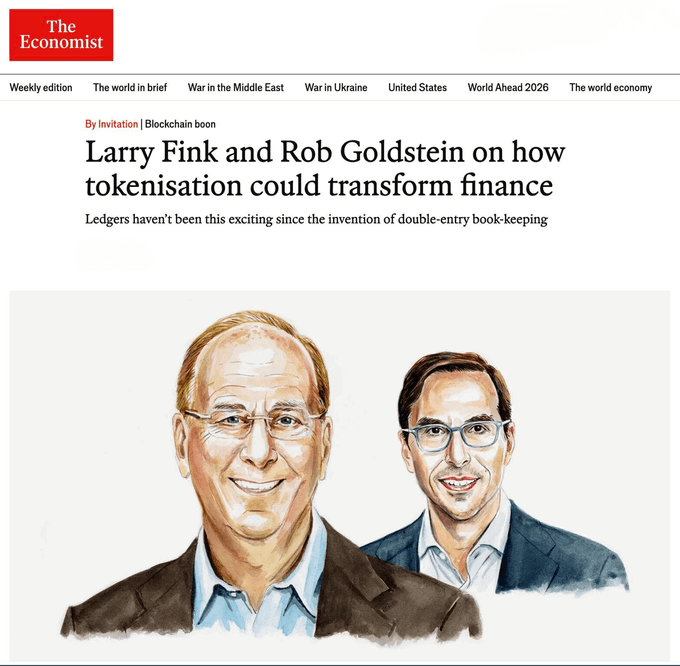

The world’s largest asset manager sees tokenization as the next frontier. “We're just at the beginning of the tokenization of all assets, from real estate to equity to bonds, across the board.” — Larry Fink, CEO of BlackRock, on CNBC It’s a vision of more open, efficient, and

Excited to welcome @MercadoBitcoin to the Global Markets Alliance. With a long-standing presence in LATAM’s digital asset markets, Mercado Bitcoin helps strengthen the Alliance’s global footprint and supports its mission to align infrastructure and standards for tokenized

Some launch on Solana. Some launch on Ethereum. This summer, Ondo tokenized stocks, funds, and more will launch on both. Because global means everywhere.

Institutions agree: Tokenization is the future of finance. We asked Mastercard, Standard Chartered, Bain & Company, Seturion (Boerse Stuttgart Group), Stellar, OKX, Fireblocks, Zodia and 21X whether tokenization is a fad or the future. @BainandCompany’s Ricardo Correia: “We're

We are excited to announce that Ondo Finance has acquired @strangelovelabs to accelerate our full-stack RWA platform development. This acquisition significantly expands Ondo’s engineering and product capabilities to develop infrastructure for bringing RWAs onchain, at scale.

Onchain capital markets represent a trillion-dollar opportunity. “5 years from now, when people open their first investment account, it will be on blockchain rails, and they'll be able to hold equities, crypto... and transact 24/7.” @iandebode & @nathanlallman on @BanklessHQ.

Regulators are calling tokenization inevitable. “We need to be embracing it to keep the United States at the forefront.” Paul Atkins, Chairman of the SEC, continues to emphasize that the future of finance is onchain.

Tokenization is making U.S. Treasury yield globally accessible. "Stablecoins give users in emerging markets access to U.S. dollars. Ondo's USDY takes that one step further; it gives them access to U.S. dollar savings." - Ondo Finance's @iandebode

Stablecoin Payments, The Trillion Dollar Opportunity Read how Stablecoins could drive $1T in payments. Written with @Bitso and expert insights from @Circle @Ripple @Sphere_Labs @OndoFinance @FDLabsHQ @BVNKFinance @ConduitPay @gnosispay @MANSA_FI keyrock.com/stablecoin-pay…

Mark Janoff, General Counsel at Ondo Finance, will join SEC Commissioner @HesterPeirce at @CoinDesk's Policy & Regulation event for a 1:1 conversation on the regulatory landscape shaping crypto's future. We look forward to joining the public officials and leaders across legal,

SEC Chairman Paul Atkins announces “we are mobilizing at the SEC all our divisions and offices to make President Trump's vision for making America the crypto capital of the world a reality.” Ondo is looking forward to contributing to the President's vision with our tokenized

Other tokenized stock and ETF models have struggled with one critical problem: liquidity. “Ondo Global Markets is the first platform where the assets are both permissionless and you can buy them in size at the right price.” Ondo Finance's @iandebode on @BanklessHQ.

Finance is entering its onchain era. Around the world, institutions, regulators, and markets are aligning like never before. We’re witnessing a generational shift that will reshape finance for decades to come.

A new chapter in compliant infrastructure for tokenized assets. Last week, we announced our agreement to acquire Oasis Pro, including its SEC-registered broker-dealer, ATS, and transfer agent. This lays the groundwork for Ondo to develop a regulated tokenized securities

BlackRock's Larry Fink continues to emphasize one message: the future is tokenized. “Tokenization is probably the most important component in the evolution of the world’s financial plumbing.” The next era of finance is being built onchain.

Stocks just landed in @BinanceWallet. Ondo’s 100+ tokenized stocks & ETFs — the most liquid in the market — are now available to Binance Wallet’s millions of users on @BNBCHAIN.

Discover on-chain Stocks — all in Binance Wallet! 1️⃣ Open Binance App and go to Wallet 2️⃣ Tap [Markets] 3️⃣ Select [Stock] to explore it all on-chain On-chain stocks with fees as low as 0% — explore now!👇

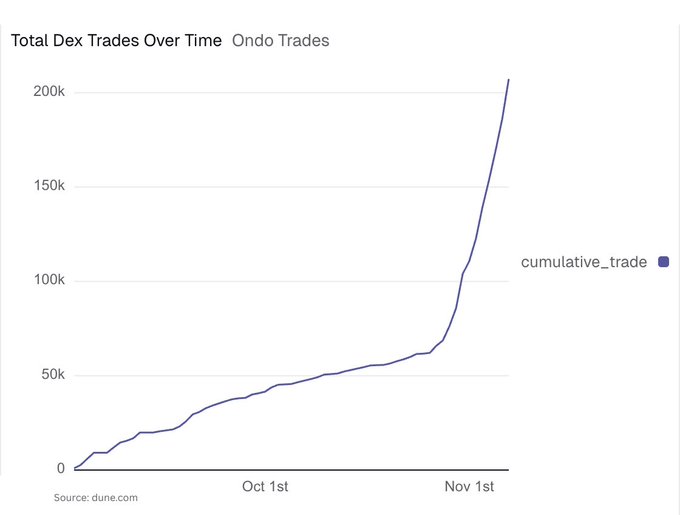

Hockey stick growth for tokenized stocks. Ondo tokenized stocks & ETFs have reached 200k+ total DEX trades, with trading activity doubling in recent weeks. The shift from traditional to tokenized markets is accelerating.

To scale to trillions, tokenized markets must exceed traditional standards. “Delivering liquidity that’s as good as traditional markets is a top priority.” Ondo's @nathanlallman on Nasdaq's @TradeTalks at SmartCon.

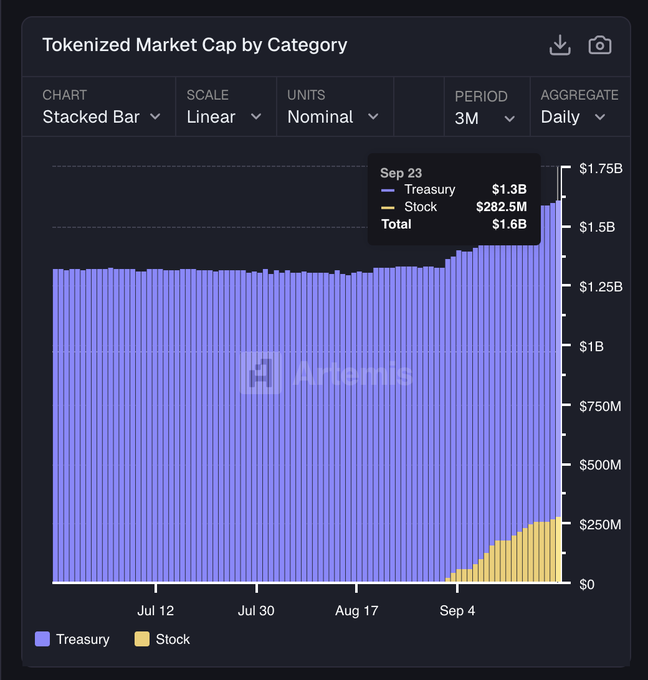

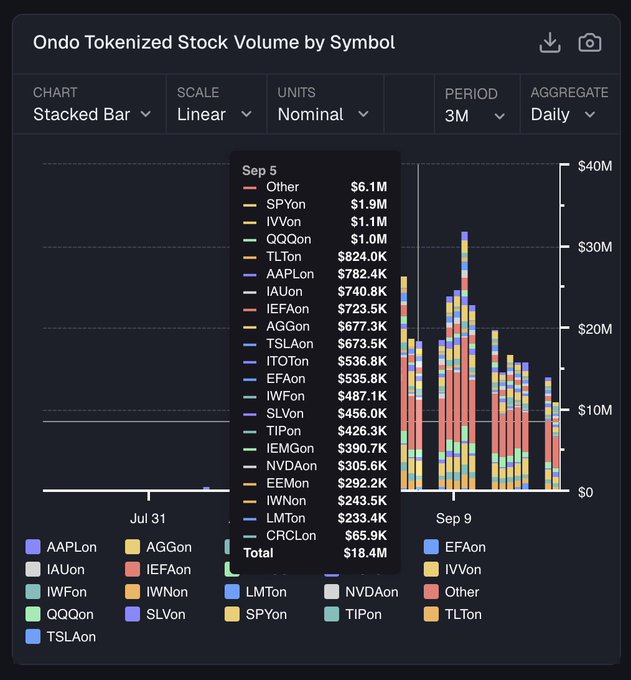

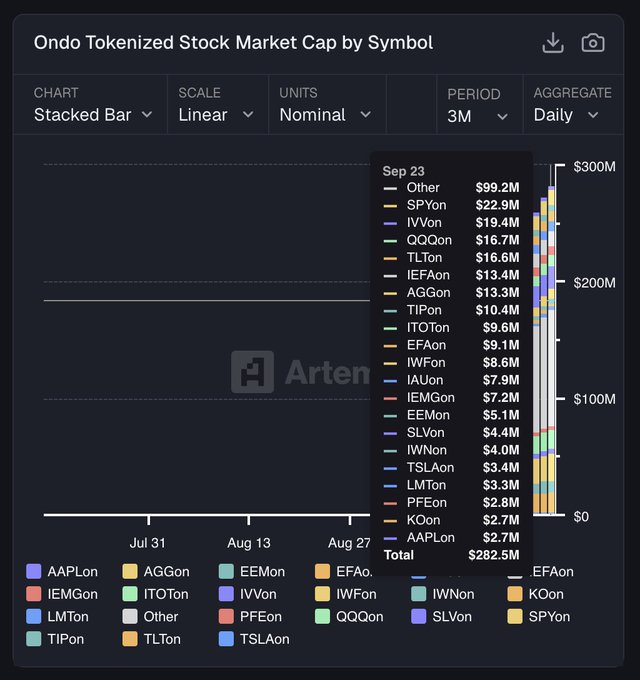

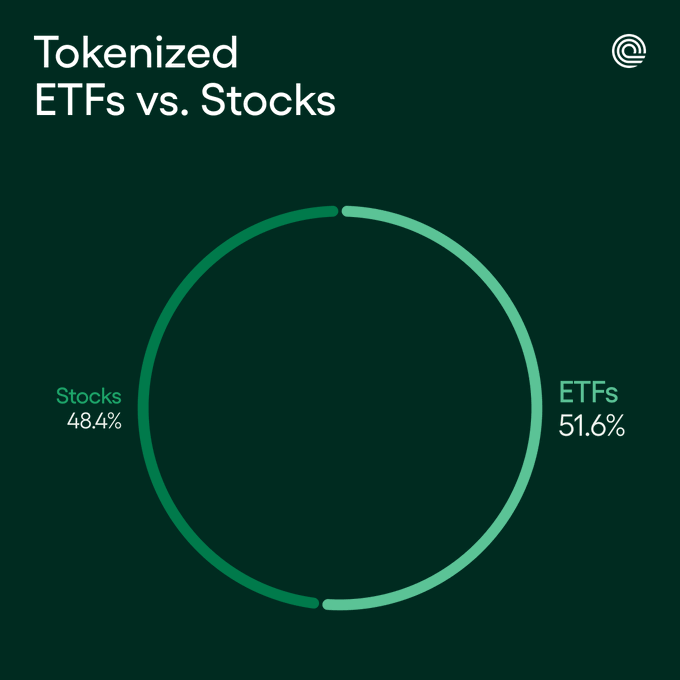

Ondo Global Markets is driving adoption of tokenized stocks and ETFs. Data from @artemis highlights: → Consistent TVL growth → Millions in daily volume → Tokenized ETF adoption outpacing tokenized stocks Ondo Finance is setting the standard for onchain capital markets.

Excited to announce our new Ondo Deep Dive including coverage for the newly launched Ondo GM Tokenized Stocks! You can now track deeper cuts of data including tokenized market cap by product and chain, tokenized stock volumes, etc. Highlights: 1️⃣ Ondo GM tokenized stocks

Ondo and Chainlink Unite to Bring Global Finance Onchain Starting today, Ondo and @chainlink are joining together in a landmark strategic partnership to bring financial institutions onchain, building the infrastructure to tokenize trillions. Together, we will work with leading

The Global Markets Alliance expands its footprint in Latin America. Welcome, @RipioApp With over a decade of experience driving crypto adoption in Latam, Ripio brings regional leadership to the global effort to standardize tokenized markets.

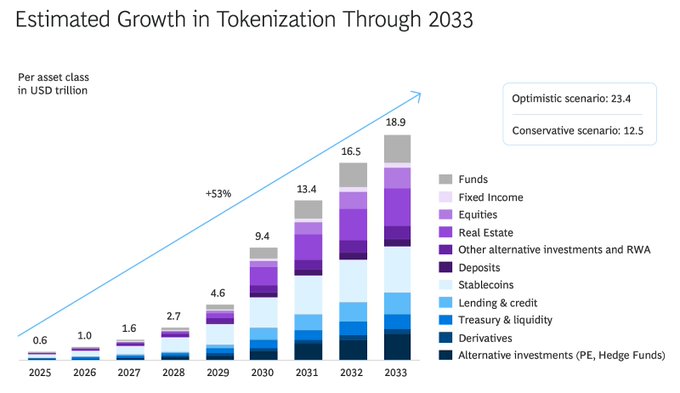

Standard Chartered projects $2T in tokenized assets within three years. In a recent report, the bank notes the biggest areas of growth are expected across money markets, U.S. equities, and private assets. That is: → 56x growth for RWAs overall → 86x growth for tokenized U.S.

Capital markets are coming onchain, and they’re not turning back.

Tokenization is a trillion-dollar opportunity. But thin onchain liquidity has slowed the adoption of tokenized stocks & ETFs. Ondo Global Markets overcomes this limitation by bringing Wall Street liquidity onchain. ❎ PROBLEM: Liquidity pools do not scale Other tokenized

Tokenization is bringing Wall Street to the world. “Everyone with a crypto wallet, including a blockchain․com wallet, can have access to U.S. stocks and ETFs.” Ondo's @iandebode on the @blockchain podcast discussing the integration bringing tokenized equities to 90M+ wallets.

Tokenization is impossible to ignore. The Ondo Summit is bringing together the institutions that influence trillions.

The biggest names in finance are coming. Ondo Summit’s first round of speakers is live: @BlackRock, @Fidelity, @PanteraCapital, @WisdomTreeFunds, and more. → Jonathan Steinberg, CEO, WisdomTree → Nathan Allman, Founder & CEO, Ondo → Dan Morehead, Founder & CEO, Pantera

Digital asset adoption is accelerating. This past week delivered key developments spanning Fed supervisors signaling blockchain adoption to BNY and Goldman entering the stablecoin reserve business - the shift is clear: traditional finance is embracing tokenization. Here's what

The future of markets is global, open, and onchain. Ondo tokenized stocks and ETFs on Ethereum, now available in the @baseapp.

200+ tokenized stocks now in the @baseapp

Another defining week for digital asset adoption. SEC Chairman Paul Atkins declared "crypto's time has come," BlackRock announced plans to tokenize ETFs, and Nasdaq filed to enable tokenized securities trading. The trend is clear: tokenization is transitioning from innovation

The golden age of finance begins. The SEC’s Project Crypto makes tokenization part of America's economic blueprint 🇺🇸

.@SECPaulSAtkins gave remarks at @A1Policy today on Project Crypto, an SEC Commission-wide initiative to modernize the securities rules and regulations to enable America’s financial markets to move on-chain. sec.gov/newsroom/speec…

A turning point for crypto in the U.S. “We’re on track to forge forward with crypto and embrace this new area of innovation.” Paul Atkins, Chair of the SEC, on how the agency is working to move digital asset policy forward.

Ondo is bringing global markets onchain. Flipping the switch to a more open, modern financial system.

Wall Street 2.0 is being built on Ethereum. “5 years from now there's not gonna be a stock, option, mutual fund, or ETF that's not in effect tokenized.” Former CEO of TD Ameritrade, Joe Moglia on CNBC.

“Tokenizing treasuries, stocks, and other assets is now the second hottest sector in crypto as the regulatory environment eases.” — @axios This growing wave of tokenization is what inspired Catalyst: a $250 million initiative supported by @PanteraCapital to back projects

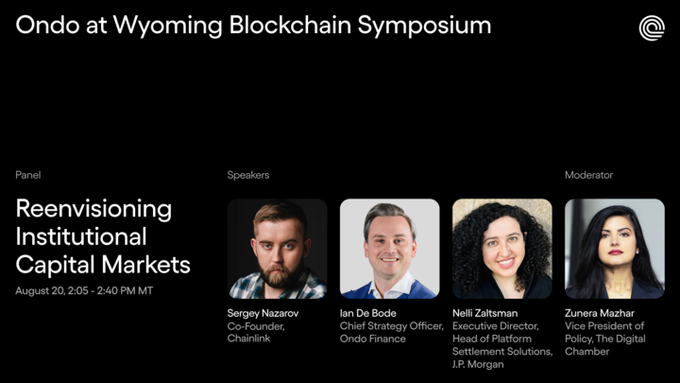

The Industry leaders reshaping capital markets converge. Tomorrow at the Wyoming Blockchain Symposium, Ondo Finance's @iandebode joins 'Reenvisioning Institutional Capital Markets.' Panelists include Sergey Nazarov (@chainlink), Nelli Zaltsman (@jpmorgan), and Zunera Mazhar

Blockchain․com (@blockchain) joins the growing ecosystem supporting Ondo Global Markets on BNB Chain. Users around the world now access 100+ tokenized U.S. stocks and ETFs in their wallet, on one of crypto’s most active ecosystems. U.S. Markets, Global Access.

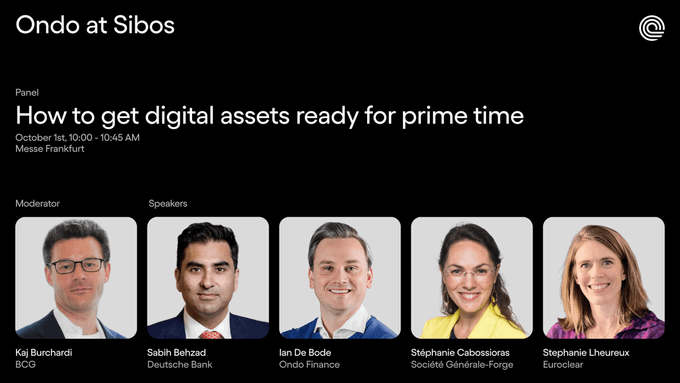

Today at @Sibos, Ondo’s @iandebode joins leaders from BCG, Deutsche Bank, Société Générale-Forge, and Euroclear to discuss digital assets. Tokenization is moving into the mainstream, and Ondo is helping lead the dialogue. Taking place 10:00–10:45 AM (GMT+2) at Messe Frankfurt.

USDY is now available on @IcrypexGlobal—a prominent digital asset platform. ICRYPEX’s users can now gain exposure to daily yield collateralized by US Treasuries, furthering Ondo Finance’s mission to make institutional-grade financial products and services available to everyone.

Ondo Finance and BX Digital partner to launch regulated trading of Ondo tokenized stocks and ETFs in Europe. BX Digital, part of the Boerse Stuttgart Group, Europe's sixth-largest exchange group with €90 billion in annual trading volume, will enable the admission and trading of

Ondo has all the infrastructure required to bring Wall Street onchain.

A new chapter for capital markets begins this summer. Get ready. Ondo Stocks are coming.

A better approach to bringing stocks onchain. "There is instant connectivity into these traditional liquidity venues to make sure that people can always mint and burn these assets at the same price as is available in traditional markets." Ondo Finance's @iandebode on the

Landmark Moment: U.S. Stablecoin Bill, the GENIUS Act, Passes the U.S. Senate. In a historic milestone for digital assets, the U.S. Senate has passed the GENIUS Act, the first comprehensive stablecoin legislation, with strong bipartisan support. Stablecoins are the first killer

As detailed in @MessariCrypto’s latest report, the tokenization of financial assets is no longer theoretical. Ondo’s tokenized US Treasuries products alone have surpassed $1.4 billion since launching in 2023. This growth is confirmation of a structural shift. As the report

Another milestone week for digital asset adoption. This week brought significant progress from regulators, banks, and exchanges alike, making one thing clear: traditional finance is embracing onchain infrastructure. Here's what you need to know 👇 1️⃣ SEC approves new rules

Ten years. Zero downtime. Hundreds of billions secured. Ethereum has redefined financial infrastructure. From trustless settlement to composable applications, it’s driven financial innovation at a historic pace, enabling DeFi, stablecoins, and now tokenized real-world assets.

The Global Markets Alliance welcomes @Top_nod TopNod is a self custodial wallet designed to make digital asset management simple, secure, and accessible to millions. They now support Ondo tokenized stocks and ETFs on Ethereum, helping bring traditional assets onchain for users

Onchain finance deserves the highest level of investor protection. The same comprehensive approach that established Ondo as the most trusted platform for tokenized U.S. Treasuries extends these protections to tokenized stocks: 1. Bankruptcy-remote structures to isolate assets

Tokenization is moving into the heart of traditional finance. This week regulators, banks, and market leaders launched new initiatives, from the CFTC’s tokenized collateral program to a euro-denominated stablecoin backed by nine European banks. This week's highlights. 👇 1️⃣

Stablecoins made the US dollar globally accessible, instantly tradable and fully composable. Ondo Global Markets will unlock the same upgrades for US securities. US Treasuries and equities represent $28T and $62T in market value, respectively. Learn more about Ondo Global

Earnings season is heating up. For the first time, the companies that define global markets are tokenized and accessible to millions onchain. Ondo brings Wall Street to the world.

Ondo Catalyst, a $250M strategic investing initiative, is attracting visionary founders and teams advancing the future of capital markets. Are you building tokenized financial products, DeFi protocols, or financial infrastructure? Apply today: forms.gle/akQfJaSamHrwDq…

1/ We’re excited to announce the launch of the quarter-billion dollar Ondo Catalyst initiative, one of the largest dedicated commitments to support the tokenization of real-world assets with support from @PanteraCapital.

The traditional stock market holds $60+ trillion in value yet most can't access it. Through Ondo Global Markets, shares of 100+ of the world's largest companies and ETFs are tokenized, making global access to these markets possible. Ondo is how Wall Street comes onchain.

U.S. regulators mobilize behind President Trump's vision to make America the “crypto capital of the world” Following SEC Chairman Paul Atkins' “Project Crypto” initiative to modernize U.S. securities rules, the Commodity Futures Trading Commission is launching “Crypto Sprint” to

Breaking down barriers to U.S. financial products. In @dynamic_xyz's 2025 Stablecoin Playbook, Ondo serves as a case study for how tokenized U.S. Treasuries and soon tokenized U.S. stocks through Ondo Global Markets are bringing better financial products to emerging markets.

Fintech teams have started building with stablecoins and they’re not slowing down. Your competitors are scoping integrations. CEOs are asking for a stablecoin strategy. We spoke with 20+ operators in market and distilled their insights into one guide for building global money

Blockchain is reinventing how asset managers operate. Today at FT's Future of Asset Management North America, Ondo Finance CEO @nathanlallman takes the stage for “Eliminating Risk and Enhancing Efficiency – How Blockchain is Streamlining Asset Management Operations.” Alongside

Wall Street’s biggest names, tokenized. The companies that define the S&P 500 and represent trillions in value are now open to the world. → Tesla → Meta → Apple → NVIDIA → Amazon → Alphabet → Microsoft The age of open, global onchain markets is here.

Here’s what leaders from Ondo Finance, Trust Wallet, Bitget Wallet, Jupiter, Fireblocks, and BitGo had to say about yesterday’s Global Markets Alliance announcement. 👇 “Access to US capital markets has historically been gated and inefficient and standardization is essential to

1/ Today we're announcing the Global Markets Alliance, a historic alliance of leading wallets, exchanges, and custodians to bring capital markets onchain and set standards for the interoperability of onchain stocks. This alliance includes: • @SolanaFndn • @BitgetWallet •

High-quality tokenized assets are a step toward upgrading the financial system—deeper transformation is enabled at the infrastructure level. Ondo Finance Vice Chairman @PatrickMcHenry joined @APompliano's latest podcast to discuss the latest in legislation and tokenization. “A

We’re excited to announce that Ondo Finance has appointed Ian De Bode (@iandebode), former Head of Digital Assets at McKinsey, as President. Under Ian’s leadership, Ondo will usher in the institutional era of tokenization, accelerating our reach and impact across global markets.

Excited to share that @bitgetglobal is joining the Global Markets Alliance and that Bitget users will be able to access Ondo’s 100+ tokenized stocks, ETFs, and more this summer. Capital markets are coming onchain.

The foundation of U.S. capital markets: $28 trillion in U.S. Treasuries. $69 trillion in U.S. stocks. $13 trillion in U.S. ETFs. Ondo is how trillions come onchain.

The event that put tokenization on the map returns. On February 3, 2026, the world’s leading executives, investors, and policymakers reconvene in New York for the Ondo Summit to define the next era of capital markets. Apply to attend: summit.ondo.finance/2026

Gold just had its best year since 1979. Precious metals ETFs are among the 100+ tokenized stocks and ETFs available on Ondo Global Markets. Onchain access to the worlds largest assets.

The tokenized U.S. Treasuries market has grown 7,000%+ since 2023. That growth is driven by three key factors: 1) Rising demand for 24/7 access to USD-denominated assets. 2) Increased need for liquid, short-duration cash management solutions. 3) Growing recognition that

Over $90 trillion in value exists in US Treasuries and US stocks, with only a fraction accessible onchain. Ondo Finance was the first to bring US Treasuries onchain at scale. Now we’re doing the same for hundreds, soon thousands, of stocks.

The world’s largest asset manager recognizes the future of financial markets is onchain. “We’re not spending enough time talking about how quickly we’re going to tokenize every financial asset.” — Larry Fink, CEO of BlackRock A multi-trillion-dollar transformation is coming.

2025 will be the year of tokenized stocks.

The latest @artemis report covers the evolution of onchain stablecoin yields and institutional adoption, and highlights Ondo Finance's role in this transformation. “The trend for onchain finance is clear: global markets are moving onchain. And we are building the products, rails

The on-chain yield landscape is maturing, as institutions and users seek more sophisticated opportunities on-chain. We partnered with @vaultsfyi to dive into the world of on-chain yield — here’s what we found 🧵

Tokenization is reviving public markets. Delivering the transparency, efficiency, and inclusivity they were designed to provide.

Half a billion people worldwide have crypto wallets. Yet most can't access U.S. stocks and ETFs. Tokenization bridges the gap.

This summer, Ondo Global Markets will redefine capital markets. “Onchain US Treasuries, led by firms like Securitize and Ondo, now exceed several billion dollars.” -@Bloomberg “Major players like BlackRock and Citigroup are actively digitizing funds,” and now, “crypto’s big

The U.S. is rapidly adopting tokenization. This week delivered significant moves from SEC leadership, regulators, and major fintech companies all making headlines in the tokenization space. Here's what you need to know. 👇 1️⃣ SEC Chairman Paul Atkins mobilizes agency for

Asset managers, regulators, and banks made notable moves in tokenization this week. From new research by Franklin Templeton to BlackRock's CEO discussing his vision for tokenization to the UK FCA proposing new rules - institutional adoption continues. Here's what you need to

1 Week, $100m+ TVL Ondo Global Markets is now the largest platform for tokenized stocks and ETFs.

Featured in @Reuters: Ondo's approach to institutional-grade tokenization. “Done right, tokenization enhances investor protections, rather than eroding them.” - Ondo's @iandebode The Reuters article identifies problems with poorly designed tokenized stock and ETF models. Where

Tokenization is an innovation. “Tokenization... is the next step to have much more efficiency in the marketplace.” – SEC Chairman Paul Atkins As regulatory clarity improves, the path is clearing for tokenized assets to transform capital markets.

Traditional finance is embracing tokenization. From Goldman and BNY tokenizing money market funds to Vietnam rolling out a national blockchain, the transformation is accelerating globally. Here's the biggest headlines from the past week. 👇

First it was dollars, then treasuries, now stocks and ETFs. “Tokenized treasuries went from a billion dollars 18 months ago to now $7 billion and we expect the same thing to start to occur for tokenized stocks and ETFs.” Ondo Finance's @iandebode at the @NYSE

.@PythNetwork is joining the Global Markets Alliance. With Ondo’s tokenized stocks, ETFs, and more set to launch soon, fast and reliable market data will play an important role. Pyth delivers real-time pricing across 100+ blockchains, contributing critical infrastructure for

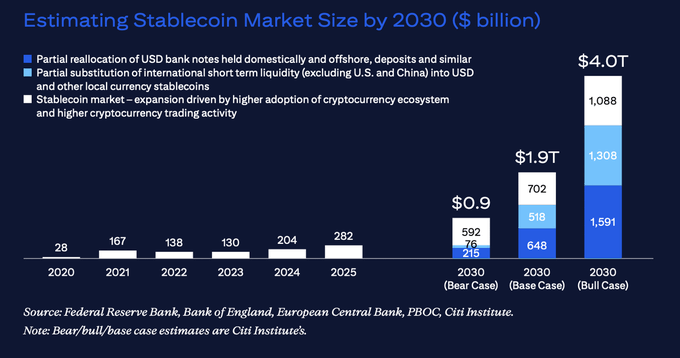

In Citi Institute's recent “Stablecoins 2030” report, they forecast a $4 trillion market cap by 2030 (bull case). That's 10x growth from today's market. The implication: trillions flowing onchain, creating massive tailwinds for tokenized Treasuries, equities, and other RWAs.

Ondo Finance CEO @nathanlallman discusses the GENIUS Act's impact on institutional participation with @TheStreet: “This legislation provides long-awaited clarity around the treatment of digital assets, laying the foundation for increased institutional participation.” Sustained

From tokenized stocks to stablecoins and US Treasuries, the past week has delivered a number of headlines that show how fast the institutional embrace of tokenized finance is racing ahead. Here are the key recent developments you need to know. 👇

Tokenization is already scaling. “You’re starting to see that inflection point and hockey stick moment. First in cash. Now in treasuries. And the big question is: what’s next? We believe that the assets that make most sense to tokenize is stuff that people really want and is

Gradually, then suddenly. Have we already reached the inflection point for tokenization? 📶 @OndoFinance’s Ian De Bode says yes and joined @MonicaLongSF on the XRPL mainstage at Apex 2025 to unpack what's next as markets move onchain.

Traditional finance is embracing tokenization. JPMorgan's latest report predicts stablecoins will be “integrated with the traditional financial system, as well as more tokenization of real world assets.” This convergence is well underway, and Ondo is building the infrastructure

What stablecoins did for the dollar, Ondo is doing for capital markets. Speaking with @thestreet, @nathanlallman explained, “the financial system wasn’t designed for the world we live in—it was stitched together over centuries.” Just as stablecoins brought accessibility and

NEW: What stablecoins did for the dollar, @OndoFinance is doing to capital markets. thestreet.com/crypto/innovat…

Policy is catching up to technology. Yesterday, Ondo's Head of Global Regulatory Affairs Peter Curley joined leaders from Chainlink, Coinbase, and the European Commission at DC Fintech Week. The panel explored how identity, compliance, and infrastructure are core to the future

“Blockchain technology inside the core of America’s equity market.” @Nasdaq recently filed with the SEC to enable tokenized securities trading - a significant step toward bringing traditional assets onchain at scale. Live on Nasdaq @TradeTalks earlier in the year, Ondo’s

The institutional era is here. From early experimentation to tokenizing the world's largest markets, Ondo's newly appointed President has spent over a decade driving adoption with major financial institutions. @iandebode on Ondo's mission to bring trillions onchain ↓

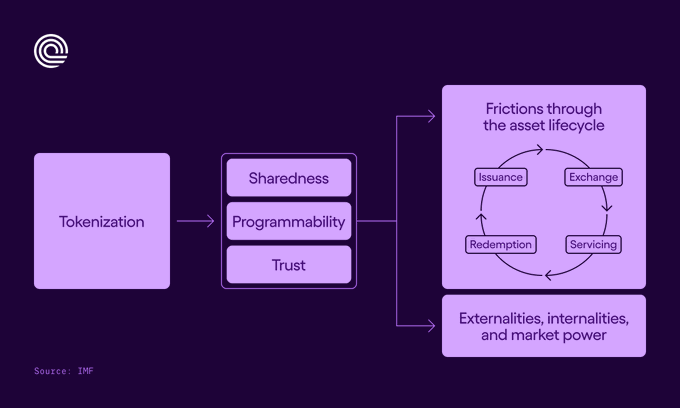

In its latest Finance & Development issue, the International Monetary Fund (@IMFNews) highlights tokenization as a model for efficient, competitive markets. “Tokenization allows data to be transferred among brokers with the click of a button. It makes it simpler for investors to

Another landmark week for digital asset adoption. From CFTC launching crypto initiatives to JPMorgan trading $5B in cross-ledger repos, the move toward onchain infrastructure is accelerating across every level of the financial system. Here are the biggest developments from the

With the SEC increasingly recognizing the importance of tokenization, Ondo is helping build the standards and infrastructure to support it. Follow the discussion as Mark Janoff, General Counsel at Ondo Finance, joins SEC Commissioner @HesterPeirce for a 1:1 at @CoinDesk's Policy

The SEC is recognizing the potential of tokenization. SEC Commissioner @HesterPeirce recently signaled on Bloomberg that the SEC is willing to work with firms on U.S. equity tokenization. Ondo is encouraged by the SEC's proactive approach and excited to lead the charge in

Tokenized U.S. Treasuries recently crossed $7B, with 72% issued on @Ethereum. This underscores Ethereum’s role as the foundation for onchain capital markets. Ondo has issued more than $1B of tokenized U.S. Treasuries on Ethereum, leading the chain’s RWA growth. U.S. Treasuries

What stablecoins did for dollars, Ondo is doing for U.S. stocks & ETFs. “These assets have been an incredible engine of global wealth creation, but with Ondo Global Markets we aim to make that accessible to a global audience” @iandebode on @CoinDesk's Market Outlook.

Verified daily. Open to all. Ondo Global Markets provides daily third-party reserve verifications, empowering users to verify that every tokenized stock and ETF is fully backed 1:1. Institutional-grade infrastructure. Accessible to everyone.

BNB Chain is on. @BNBCHAIN, one of the most widely used blockchain networks, will soon support Ondo's suite of tokenized assets, including over 100 US stocks, ETFs, and funds to start. As part of this collaboration, BNB Chain joins the Global Markets Alliance, a growing group

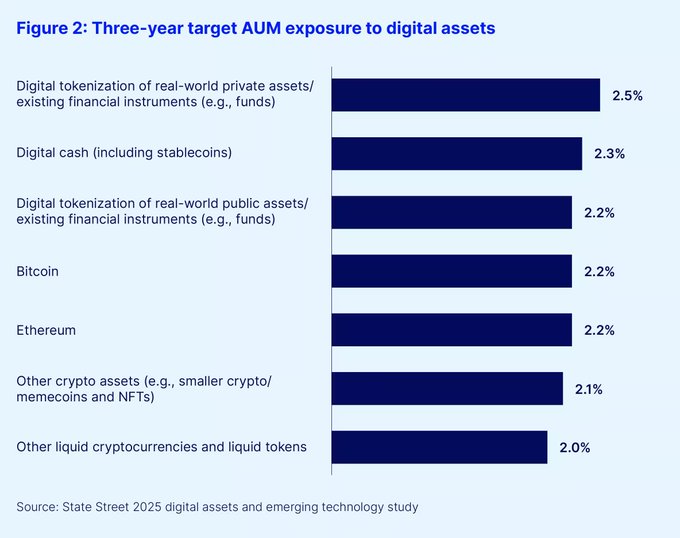

State Street, a $5T asset manager, on institutional crypto adoption: “Stablecoins and tokenized RWAs are the largest component of institutional digital asset allocations.” @StateStreet's study indicates institutional allocations are expected to reach 16% within three years.

Ondo Global Markets sets the standard for tokenized stocks and ETFs. → 24/7 peer-to-peer transferability → 24/5 instant mint & redemption → Access to traditional exchange liquidity → DeFi compatibility This is how Wall Street comes onchain.

1/ September marked Ondo's most significant month to date. From the launch of Ondo Global Markets to WisdomTree joining the Global Markets Alliance and USDY now live on Stellar, Ondo is executing on its vision to build an open economy accessible to all. More highlights👇

ICYMI: Ondo Finance, @Chainlink, and Kinexys by @JPMorgan teamed up to connect bank settlement infrastructure to Ondo Chain.

Chainlink is excited to be working with Kinexys by J.P. Morgan and Ondo on a groundbreaking way to utilize Kinexys Digital Payments to allow institutional clients to purchase Ondo’s tokenized treasuries. With $23B+ in tokenized RWAs on public chains, the need for secure

“Tokenization is the biggest innovation to come to capital markets in the past decade.” That’s how Robinhood CEO @vladtenev describes tokenization. He points to something powerful: the future won’t be either crypto or traditional, it will be both, working in tandem to redefine

“This surge should be expected to continue.” Today, @coingecko released a report on the real-world asset tokenization market. It notes that the “tokenized treasuries market cap climbed by $4.7B (+544.8%) since the start of 2024,” with Ondo Finance as one of the top contributors

Finance can't come onchain alone. Ondo brings together an ecosystem of 100+ financial institutions, chains, protocols, applications, infrastructure, and more. Where Wall Street meets Web3.

The SEC is working with industry on blockchain-based stock trading proposals, per new report from @theinformation. As the #1 platform for tokenized stocks and ETFs, Ondo is excited for the coming regulatory clarity to unlock a golden age for digital assets in the U.S.

Regulatory clarity is key to making the U.S. the crypto capital of the world. SEC Chairman Paul Atkins: “It is a new day at the SEC and CFTC... The age of harmonized, innovation-friendly oversight is here.” Welcome to the golden age of digital assets.

1/ An Open Letter: The Growing Role of Tokenized Securities Today, we’ve published an open letter to the World Federation of Exchanges (WFE). We believe tokenization is not only here to stay but is an essential step forward for global financial markets. However, recent

“Tokenized markets are here and they are the future.” CFTC Commissioner Caroline Pham (@CarolineDPham) described tokenization as a structural improvement to U.S. market infrastructure, not a speculative trend. Delivering remarks at FIA Boca, she emphasized: → The importance

Tokenization is taking hold. Since launch, Ondo tokenized stocks and ETFs have surpassed over $1 billion in volume. With TVL surpassing 315M+, the growth of Ondo Global Markets is a clear sign that RWAs are scaling faster than ever.

Institutions are actively embracing tokenization. “The amount of movement I'm seeing right now within TradFi is unlike anything I've seen in almost 10 years.” - Ondo Finance's @iandebode

This September, Mark Janoff, General Counsel at Ondo Finance, is set to join SEC Commissioner @HesterPeirce for a 1:1 conversation at @CoinDesk’s Policy & Regulation event in D.C. What questions should Mark ask Commissioner Peirce as tokenization meets regulatory clarity? 👇

As part of Project Crypto, SEC Chair Paul Atkins has outlined the SEC's "super-app" approach to unify trading of traditional securities, tokenized securities, and non-security crypto assets under a single license. This regulatory framework aims to enable broker-dealers and

Tonight Netflix, tomorrow Tesla. Earnings season is now onchain, with shares of over 100 of the most traded U.S. companies and ETFs tokenized on the Ondo Global Markets platform. Bringing Wall Street to millions worldwide.

“Tokenization digitizes entire markets.” Jane Fraser, CEO of Citi, a $2.64 trillion bank, on why tokenization is a better way to move value globally. The largest institutions in the world are preparing for an onchain future.

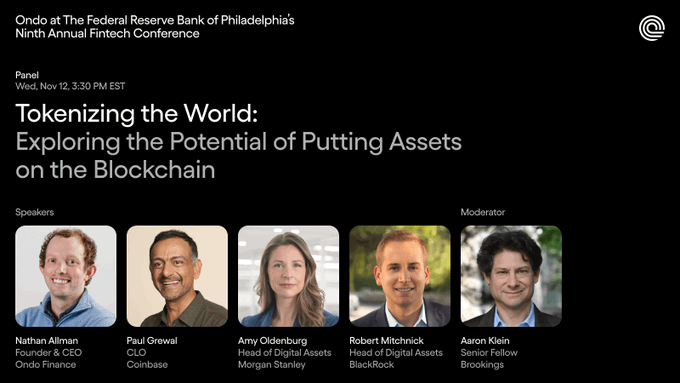

Institutions are going all-in on tokenization. This week saw breakthroughs from the SEC, CFTC, J.P. Morgan, and Coinbase as traditional finance moves onchain. Here's what you need to know 👇 1⃣ SEC Chair gives updates on Project Crypto at Philadelphia Fed's Annual Fintech

The perfect storm: ETF adoption, regulatory clarity, and years of pent-up demand converging. “At this point it's safe to say that crypto as an asset class is not going to go away.” Ondo Finance's @iandebode at the @NYSE

"Change is coming," says Michelle Bowman, Vice Chair for Supervision at the Federal Reserve. At the Wyoming Blockchain Symposium, she urged regulators to abandon their "overly cautious mindset" toward blockchain technology. Key takeaways: 1) Regulators must embrace

The institutions behind trillions are converging at the Ondo Summit. ✅ Citi ✅ Swift ✅ DTCC ✅ Invesco ✅ Fidelity ✅ Pantera ✅ Moody's ✅ Coinbase ✅ Bloomberg ✅ Broadridge ✅ J.P. Morgan ✅ S&P Global ✅ State Street ✅ WisdomTree ✅ Goldman Sachs ✅ Bank of America ✅

Ondo at DC Fintech Week. Tomorrow, Peter Curley, Ondo's Head of Global Regulatory Affairs, joins a panel on “Securing Financial Infrastructure” moderated by @EleanorTerrett. Panelists include: → Peter Kerstens, Advisor, (@EU_Commission) → Faryar Shirzad, Chief Policy

Ondo Receives EU Approval to Offer Tokenized Stocks and ETFs Across Europe. This approval expands the reach of Ondo’s tokenized stocks and ETFs to over 500 million investors across the EU and EEA. The Base Prospectus governing the issuance of tokenized stocks and ETFs was

The institutional era of tokenization is here. The NY Fed reaffirmed open blockchains and Europe’s largest asset manager took a MMF onchain, alongside other notable moves this week. Here’s what you need to know 👇 1⃣ New York Fed highlights advantages of open blockchains In a

All eyes are on tokenization. At Binance Blockchain Week in Dubai, Ondo President @iandebode highlighted how tokenization is reshaping finance. The takeaway was clear: major institutions are preparing for an onchain future.

Who said tokenized US Treasuries are only for DeFi-native users? Ondo Finance CEO @nathanlallman joined @NYSE Live to discuss our collaboration with @jpmorgan and @chainlink to integrate bank payment rails into Ondo Chain. Ondo's latest transaction with J.P. Morgan demonstrates

Tokenization, made in America. “Ondo's Oasis Pro Deal Opens the Floodgates to U.S. Investors in Tokenized Assets” - @CCNDotComNews The acquisition provides the Ondo Finance group with the most comprehensive set of SEC registrations for digital asset services in the U.S.

Stablecoins are just “the tip of the iceberg.” In a new interview with @Blockworks_, Ondo Finance CEO @nathanlallman outlines the thesis behind Ondo Global Markets, our platform for tokenized US equities, ETFs, and bonds. While stablecoins have achieved real product-market fit,

Regulatory clarity will unleash the full potential of tokenization. “We will not let fear of the future trap us in the past.” At the Federal Reserve Bank of Philadelphia, SEC Chairman @SECPaulSAtkins outlined the next phase of Project Crypto, laying the foundation for clear,

The tokenization masterclass Wall Street needed. Ondo Finance's Ian De Bode spoke with @thestreet explaining tokenization and how it will reshape finance. Ondo continues to lead the conversation on bringing capital markets onchain. Full interview.👇 thestreet.com/crypto/explain…

Ondo tokenized stocks and ETFs are changing how markets are accessed worldwide. Just weeks after launch, Ondo Global Markets is already the largest platform of its kind, with: - 250+ Million TVL - 400+ Million in Total Volume - 30+ Global Markets Alliance Partners

Tokenized ETFs have captured significant market attention. Ondo Global Markets demonstrates this preference, with tokenized ETFs representing over 50% of the platform's total value. Wall Street 2.0 breaks the mold.

“What stablecoins did for the dollar, Ondo is doing for securities.” Recent coverage from @Blockworks_ explores Ondo’s recent acquisitions of @strangelovelabs and Oasis Pro, and what this signals ahead of the launch of Ondo’s tokenized stocks, ETFs, and more. “The vast, vast

Stablecoins unlocked programmable dollars. Ondo Global Markets is unlocking programmable equities. To learn more about Ondo Global Markets, visit ondo.finance/global-markets

Tokenization is entering the mainstream. Today: Ondo’s @nathanlallman joins leaders from BlackRock, Morgan Stanley, and Coinbase at the Federal Reserve Bank of Philadelphia to explore tokenization’s role in finance. A timely discussion on the transformation of capital markets.

September was a defining month for Ondo. With tokenization going mainstream, regulatory clarity emerging, and institutional adoption accelerating, Q4 is set to be pivotal.

1/ September marked Ondo's most significant month to date. From the launch of Ondo Global Markets to WisdomTree joining the Global Markets Alliance and USDY now live on Stellar, Ondo is executing on its vision to build an open economy accessible to all. More highlights👇

The biggest players in finance get it. Mastercard, Standard Chartered, Bain & Company, Seturion, Stellar, and BX Digital all share one message: Tokenization = Access for everyone.

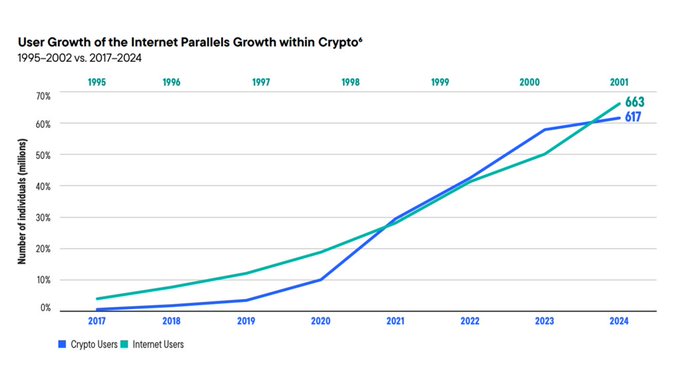

Franklin Templeton’s (@FTDA_US) latest research highlights why the time has come for digital assets: → Broader market access → Rising institutional participation → Increasingly favorable regulation The report draws parallels to the early internet era and points to

The new gold rush is onchain. BlackRock’s iShares Gold Trust is one of 100+ tokenized assets on Ondo Global Markets. Wall Street without the walls.

How soon until $5 trillion in tokenized assets? “The thing with these assets is they always follow a hockey stick curve... these numbers are actually more achievable than one would think.” Ondo's @iandebode discusses tokenization's exponential growth at @Sibos

Another big week for tokenization. Regulators signaled growing support, institutions increased their activity, and new approvals broadened access to onchain assets. Here’s what you need to know 👇 1⃣ Acting CFTC Chair: “Tokenized markets are here and they are the future.”

The world’s largest financial institutions are going onchain. This week, Citi partnered with Coinbase to power institutional payments, J.P. Morgan tokenized a private-equity fund on Kinexys, and Standard Chartered projected $2T in tokenized assets by 2028. The lines between

Tokenization has reached an inflection point. Leaders from Ondo, Chainlink, JPMorgan, and Digital Chamber discussing institutional capital markets on one panel. Happening today at the Wyoming Blockchain Symposium with @iandebode, @SergeyNazarov, @NZaltsman, and @ZuneraMazhar.

The Industry leaders reshaping capital markets converge. Tomorrow at the Wyoming Blockchain Symposium, Ondo Finance's @iandebode joins 'Reenvisioning Institutional Capital Markets.' Panelists include Sergey Nazarov (@chainlink), Nelli Zaltsman (@jpmorgan), and Zunera Mazhar

Regulatory clarity is unleashing institutional adoption. “TradFi is racing towards having a digital assets strategy.... because crypto is starting to be at a scale where it's very, very hard to ignore.” Ondo Finance's @iandebode on the @ThinkCryptoPod

The S&P 500 keeps hitting new highs. For decades, global investors have been locked out of U.S. markets. With Ondo Global Markets now live on @BNBCHAIN, millions can access tokenized stocks & ETFs across one of the world’s most active ecosystems.

Wall Street is now on BNB Chain. @OndoFinance Global Markets has expanded to BNB Chain, bringing 100+ tokenized U.S. stocks and ETFs onchain. Supported by @pancakeswap and powered by one of the most active DeFi ecosystems in the world. Learn more 👇 bnbchain.org/en/blog/ondo-g…

Excited to welcome @MEXC_Official to the Global Markets Alliance. As one of the most active global exchanges, MEXC will help expand access to Ondo’s tokenized stocks, ETFs, and more, making these assets available to millions of users. Capital markets are coming onchain.

BlackRock is doubling down on tokenization. “Tokenization could advance at the pace of the internet... with enormous growth over the coming decades.” Larry Fink & Rob Goldstein share how the technology that started with Satoshi is now transforming traditional finance.

Ethereum runs 24/7/365, securing over $400B in assets. The bedrock of decentralized finance. A perfect starting point for Ondo's tokenized stocks & ETFs.

Earnings season is here, and this time, it’s onchain. Trillions in value move through U.S. markets as stocks swing and trading volumes rise. Now, tokenized shares representing those same U.S. markets are accessible worldwide through Ondo Global Markets. Companies reporting

Another big week for digital asset adoption. The SEC weighed tokenized stock trading, Swift announced blockchain infrastructure with major banks, and Robinhood's CEO predicted tokenization will reshape global finance. This week's updates. 👇 1️⃣ Robinhood CEO says "Tokenization

The institutional era has arrived. This week saw breakthroughs across banks, infrastructure providers, and digital asset leaders as the shift to onchain finance accelerates. Here's what you need to know 👇 1⃣ Standard Chartered CEO Bill Winters: “All transactions will settle

The stock market was local. Tokenization makes it global.

From closed systems to open protocols. Ondo Finance is accelerating one of the biggest upgrades in capital markets history.

A big win for tokenization. Soon millions across the EU will be able to access tokenized stocks and ETFs within a regulated framework.

Ondo Receives EU Approval to Offer Tokenized Stocks and ETFs Across Europe. This approval expands the reach of Ondo’s tokenized stocks and ETFs to over 500 million investors across the EU and EEA. The Base Prospectus governing the issuance of tokenized stocks and ETFs was

The world is ready for tokenization. “I do think this time is different, in part because you have a lot of stablecoin liquidity out there, onchain adoption is real. DeFi exists now, it didn't exist back then. So I think the time really is now to start moving all of this

“My goal is always to make the U.S. the most friendly jurisdiction to people who are trying to build things.” - SEC Commissioner @HesterPeirce In a conversation with Hester Peirce, Mark Janoff, General Counsel at Ondo Finance, explored how regulators can better support digital

Following up on its Crypto Sprint initiative, CFTC makes its first major move. The Commodity Futures Trading Commission will launch an initiative for trading spot crypto asset contracts that are listed on a CFTC-registered futures exchange (designated contract market or DCM).

A defining week for digital assets just concluded. The White House published its Digital Asset Report, the SEC launched Project Crypto, and major financial entities announced tokenization initiatives. The foundation for America's tokenized economy is being built. Here's what

Tokenized stocks & ETFs are gaining significant adoption. According to @RWA_xyz, tokenized stocks grew 60% in market cap over the past 30 days, coinciding with the launch of Ondo Global Markets. This growth demonstrates what becomes possible when U.S. capital markets are

What stablecoins did for dollars, Ondo is doing for U.S. stocks & ETFs. “We put traditional financial assets on crypto rails and make them available to a global audience.” Ondo's @iandebode on bringing the world's largest markets onchain.

The decade's top performing U.S. tech stocks. All tokenized through Ondo Global Markets.

Tomorrow, Washington turns its attention to tokenization. Ondo Finance General Counsel Mark Janoff will join SEC Commissioner @HesterPeirce for a one-on-one at the @CoinDesk Policy & Regulation Forum to discuss the evolving regulatory landscape for tokenization.

From upgrading financial plumbing to enabling faster payment, the past week has delivered a number of headlines that show the strong momentum of institutional embrace of crypto and digital assets. Here are the key recent developments you need to know.👇

“The race to mainstream onchain stock trading is clearly underway.” “Ondo Finance...a leader in tokenizing US treasuries, and Coinbase, the largest US crypto exchange, are staking early claims in what many regard as the next big trend of Web3 finance: onchain stock trading,”

Ondo at @Ethereum_NYC. Head of DeFi, @matt_blumberg, will speak at NextFin Summit on “Real World Assets and Retail Users”, exploring how tokenization and DeFi infrastructure are unlocking new opportunities for global participants.

“The public has spoken: tokenized markets are here, and they are the future,” says Caroline D. Pham, Acting Chair of the CFTC. The Commodity Futures Trading Commission announced an initiative to permit stablecoins and tokenized U.S. Treasuries to serve as collateral in

Ondo's @iandebode on @FintechTvGlobal at the NYSE “How do you truly get global access to assets that people really want, like U.S. capital markets? Tokenization actually helps quite a bit.” Financial access should be global, not geographical. Tokenization is how we get there.

A clear signal from the NY Fed. “Any monetary instrument issued on such blockchains can achieve borderless, global reach.” In a new analysis, the Federal Reserve Bank of New York highlights the structural advantages that open blockchain rails introduce to today’s financial

Finance is changing forever. “All transactions will settle on blockchains eventually and all money will be digital ... a complete rewiring of the financial system.” Bill Winters, CEO of Standard Chartered, a $900B global bank, on the inevitable shift to onchain finance.

Another strong week for digital asset adoption, with major moves from global banks and market infrastructure providers. GSIBs explored consortium stablecoins, BNY Mellon tested tokenized deposits for client payments, and custody providers announced new blockchain integrations.

A huge unlock for global access. Millions of @BinanceWallet users now have access to the largest selection of tokenized stocks & ETFs with: → Access to traditional exchange liquidity → 24/7 peer-to-peer transferability → 24/5 instant mint & redemption → Real market pricing

RWAs aren't slowing down. $34B tokenized. Trillions to go.

Finance is entering its onchain era. Tomorrow, Ondo Finance CEO @nathanlallman joins @Chainlink Labs' Fernando Vasquez at SmartCon to discuss how tokenization is reshaping global markets. A conversation on the systems redefining finance.

Silver Outperforms Google Stock in 2025 as Precious Metals Shine

**Silver has outperformed Google stock ($GOOGL) in 2025**, highlighting the continued strength of precious metals in investment portfolios. This performance reinforces why **precious metals deserve a place in traditional investment strategies**. Investors can now access these assets alongside stocks through blockchain technology. **Key highlights:** - Silver beats major tech stock performance - Precious metals proving portfolio value - Traditional assets now available onchain [Ondo Global Markets](https://summit.ondo.finance/2026) offers access to over 100 tokenized stocks and ETFs, including gold and silver ETFs, bringing traditional assets to the blockchain. **Learn more at the upcoming summit** - view speakers and RSVP at the link above.

Onchain Stocks Set for Mainstream Adoption in 2026

**2025 marked the emergence of onchain stocks** as a significant trend in the tokenization space. **The next phase begins in 2026**, when these blockchain-based equity instruments are expected to gain widespread mainstream adoption. Key developments: - Onchain stocks gained traction throughout 2025 - Infrastructure and regulatory frameworks matured - **2026 positioned as the breakthrough year** for mass market acceptance This progression follows the broader tokenization trend that has seen various traditional assets move onto blockchain platforms, offering improved accessibility and programmability.

Nasdaq Embraces Tokenization as Next Evolution in Securities Trading

**Nasdaq is positioning itself at the forefront of securities tokenization**, with Head of Digital Assets Matt Savarese describing it as the natural next step after the transition from paper to electronic trading. The exchange is actively working to **support tokenized stocks and ETFs**, building on their earlier SEC filing to allow trading of tokenized securities on their platform. **Key developments:** - Nasdaq views tokenization as an evolutionary step in market infrastructure - The exchange is developing capabilities for tokenized traditional securities - This follows their September regulatory filing with the SEC **Market implications:** - Could increase trading efficiency and market accessibility - Represents institutional validation of blockchain-based securities - May face regulatory hurdles as the framework develops Nasdaq's embrace of tokenization signals **growing institutional confidence** in blockchain technology for traditional financial markets, potentially paving the way for broader adoption across major exchanges.

Major Onchain Stock Purchases Hit $1.2M This Week Led by Google

**Large institutional money is flowing into tokenized stocks this week**, with over $1.2 million in major purchases recorded onchain. **Top purchases include:** - $500,000 in Google (GOOGLon) - $273,506 in QQQ ETF - $200,705 in Meta - $150,000 each in Alibaba and NVIDIA The **Google purchase executed as a single transaction** on BNB Chain, demonstrating how tokenized stocks can handle large orders efficiently. **Ondo's tokenized stocks inherit traditional exchange liquidity**, allowing these substantial onchain orders to execute with the same efficiency as conventional stock trades. This activity signals **growing institutional adoption** of tokenized traditional assets in DeFi.