Meridian Finance

Meridian is a non-custodial, decentralised financial trading platform that offers interest-free stable coin lending, leverage trading and zero slippage swaps all in one place.

With Meridian users can trade whitelisted crypto assets with up to 50x leverage, obtain interest-free overcollateralised loans against ETH and earn interest, fees and rewards for supporting the protocol.

🛡️ LayerCover Insurance Protocol Update

Mon 17th Nov 2025

**Meridian provides update on LayerCover**, a parametric insurance marketplace for DeFi.

**Key Features:**

- Instant claims processing

- Single-sided liquidity provision

- Pay-as-you-go coverage model

**Market Context:**

Recent depeg events with $xUSD and $deUSD highlight urgent need for **stronger DeFi security infrastructure**.

**Current Progress:**

- Team establishing partnerships with industry leaders

- Pursuing strategic funding for liquidity scaling

- Building awareness in the market

**Stakeholder Benefits:**

Meridian stakeholders will be **included in early protocol phases** and rewarded for their support.

LayerCover aims to make DeFi more secure and trustworthy, helping onboard institutions and larger capital flows into crypto markets.

🔥 Meridian Accumulates More veSTELLA

Mon 22nd Sep 2025

Meridian contributors continue building their veSTELLA position, acquiring **51,642.10 STELLA** tokens from StellaSwap markets.

This accumulation strategy supports the **MST-DOT liquidity pool** that recently launched on StellaSwap with a starting price of $0.075 and 1% swap fees.

**Key details:**

- veSTELLA position will incentivize MST pool during high efficiency periods

- MST supply remains hard capped with deflationary mechanics

- Previous epoch saw 65,190.43 STELLA accumulated with 97% staked

The strategy leverages vote-escrow mechanics to expand MST liquidity while accelerating long-term supply deflation through carefully designed tokenomics.

🔄 StellaSwap Bribing Paused

Thu 9th Oct 2025

**StellaSwap bribing strategy update:**

- MST-DOT voting gauge bribing **temporarily suspended**

- Will resume only when bribing efficiency exceeds 1.0

- **Efficiency above 1** means pool receives more USD rewards than bribe costs

This approach ensures stakeholder value isn't diluted through inefficient spending. The team continues monitoring metrics to determine optimal restart timing.

*Strategic pause protects community resources while maintaining long-term sustainability.*

Meridian to Attend EthCC Conference

Mon 30th Jun 2025

Meridian has announced its participation in the upcoming EthCC (Ethereum Community Conference). The team will be actively networking and exploring potential partnerships during the event.

- Focus on building new connections

- Seeking partnership opportunities

- Open invitation to meet community members

This follows their previous successful appearance at ETH Milano, where team members engaged with the Ethereum community.

**Want to connect?** Reach out to schedule a meeting during the conference.

Meridian Joins Taraxa Ecosystem, Plans Integration with StorkOracle

Thu 13th Feb 2025

Meridian, a decentralized trading platform, has announced its participation in the Taraxa ecosystem. The platform aims to leverage StorkOracle's price feeds following their integration with Taraxa.

- Meridian will utilize Taraxa's scalable infrastructure

- Integration with StorkOracle's price feeds planned

- Focus on enhancing DeFi trading experience

The collaboration aims to strengthen Meridian's existing services while benefiting from Taraxa's technological capabilities.

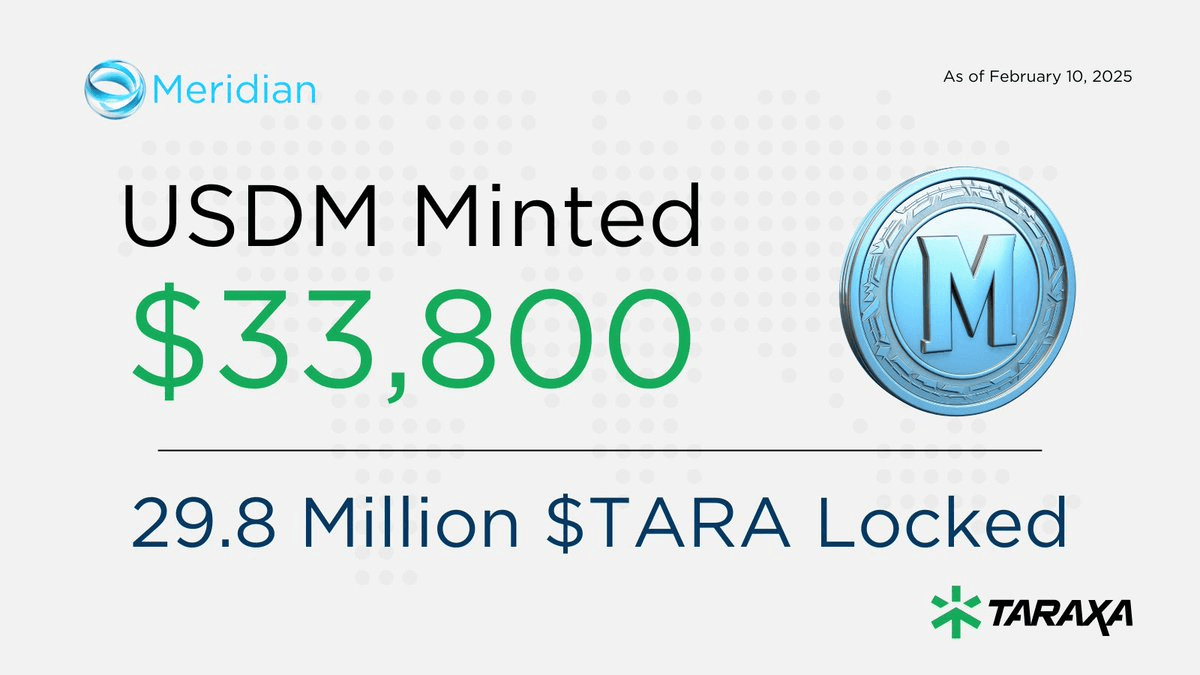

Meridian Mint Status Update on Taraxa Network

Mon 10th Feb 2025

Latest metrics from Meridian's operations on the Taraxa network show significant activity:

- **Locked TARA**: 29.8 Million tokens (↑7.8M from December)

- **USDM Minted**: $33,800 (↓$31,400 from December)

The TARA/USDM liquidity pool continues to demonstrate protocol adoption. View current pool statistics at [TaraSwap](https://www.taraswap.info/#/pools/0x66c4c7a91f9c42259c52a415ebba9866bbb4179a).

Meridian Finance Launches USDM on Artela Network

Thu 30th Jan 2025

**Meridian Finance** announces the launch of $USDM and Meridian Mint protocol on Artela Network, scheduled for January 29th. The launch follows ArtexSwap's successful mainnet deployment.

- Users will be able to **mint**, **redeem**, and **trade** $USDM on ArtexSwap

- Platform offers seamless integration with existing DeFi infrastructure

- Full details available in Meridian's Medium article

Visit ArtexSwap to participate in the launch and explore new DeFi opportunities.

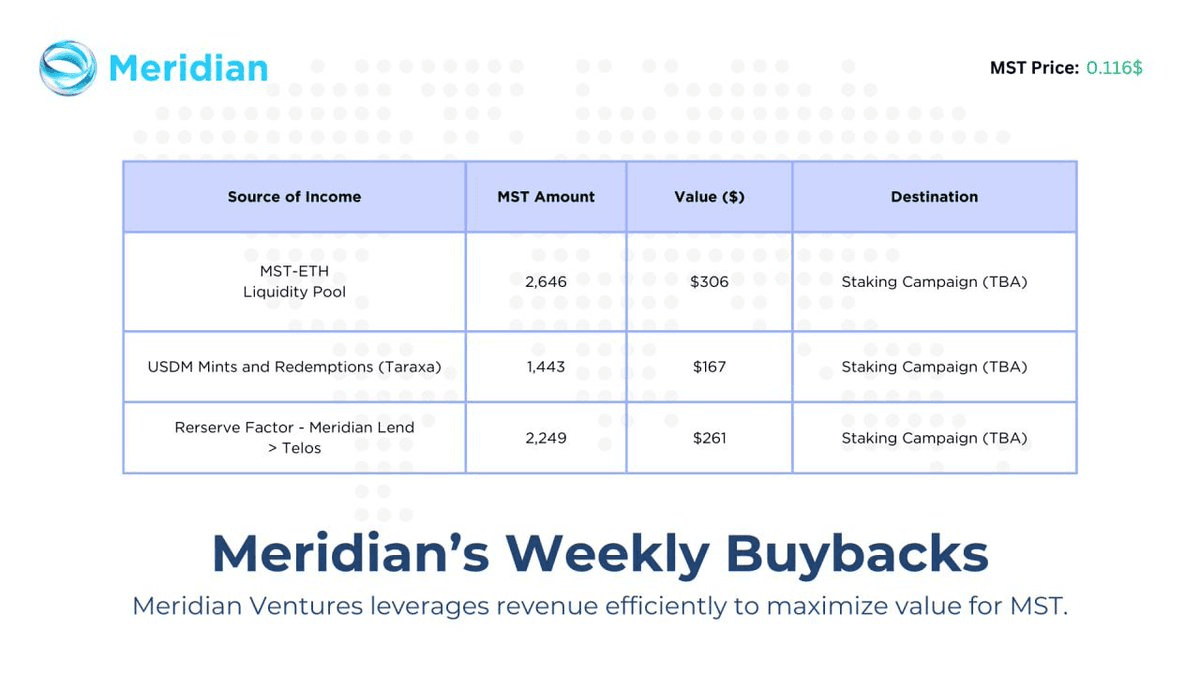

Meridian Weekly Buyback Report - January 15, 2025

Mon 16th Dec 2024

Meridian completed its latest weekly buyback, purchasing 3,028 MST (0.03% of max supply) from Base and Telos liquidity pools. This follows last week's buyback of 3,312 MST plus 4,005 MST acquired by partners.

The protocol recently launched a Buybacks Dashboard to track performance metrics including:

- Purchase amounts

- Revenue allocation

- Transaction verification

Notable recent developments:

- Integration of Fuse network lending fees

- First 2025 buyback totaled 6,527 MST (~$1,212)

- Partner acquisition of 6,406 MST (~$1,192)

**All transactions are verifiable** through the new dashboard.

Meridian Lend Achieves Multiple TVL Milestones Across Networks

Thu 12th Dec 2024

Meridian Lend has reached significant milestones across multiple networks:

- $150,000 TVL on Fuse Network, with $130,000 growth in 4 days

- $1 million TVL milestone on Telos ecosystem

Recent platform updates include:

- Integration of wstETH (Wrapped staked ETH) with 3.2% base APR

- New FUSE rewards program for lenders and borrowers

- Revenue from Fuse operations will fund MST buybacks

*Key markets receiving FUSE incentives:*

- USDM

- sFUSE

- wstETH (boosted rewards)

- USDT

Users can bridge assets via Fuse Console Bridge powered by LayerZero.

Meridian Weekly Buyback Report - December 11, 2024

Thu 21st Nov 2024

Meridian continues its systematic buyback program with significant progress:

- **Latest Buyback**: 6,338 MST tokens repurchased

- **Previous Week**: 4,400 MST (~$480) acquired

- **Total Since Nov 20**: 33,830 MST accumulated

The repurchased tokens will support:

- Long-term MST stakers

- Strategic protocol initiatives

- veAERO voter incentives

- Tekika Adventure Season 1 rewards

Revenue streams now include Taraxa project integration, with HelloTelos lending revenue to be incorporated in future buybacks.

*All transactions verified on Basescan and Teloscan*