Meridian Weekly Buyback Report - January 15, 2025

Meridian Weekly Buyback Report - January 15, 2025

🔄 MST Supply Keeps Shrinking

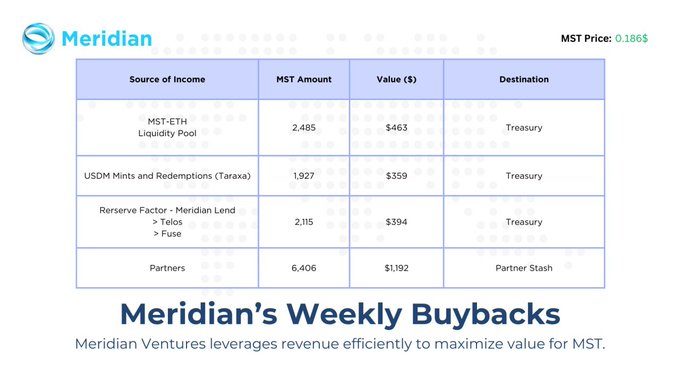

Meridian completed its latest weekly buyback, purchasing 3,028 MST (0.03% of max supply) from Base and Telos liquidity pools. This follows last week's buyback of 3,312 MST plus 4,005 MST acquired by partners.

The protocol recently launched a Buybacks Dashboard to track performance metrics including:

- Purchase amounts

- Revenue allocation

- Transaction verification

Notable recent developments:

- Integration of Fuse network lending fees

- First 2025 buyback totaled 6,527 MST (~$1,212)

- Partner acquisition of 6,406 MST (~$1,192)

All transactions are verifiable through the new dashboard.

🌐GM! Meridian Lend has reached a significant milestone surpassing $1 million in market value TVL on the @HelloTelos ecosystem This achievement highlights the growing adoption of Meridian & the strength of the #Telos community Congrats everyone & see you for the next million🫡

Attention, numbers enthusiasts—we’ve got you covered! We’re excited to unveil our Buybacks Dashboard, designed to track $MST buyback performance, including the amounts purchased, revenue allocation, and more. Dashboard > flipsidecrypto.xyz/pepperatzi/mer… Stay tuned for the upcoming

Another buyback is complete, with 3,028 MST (0.03% of the max supply) purchased from the market on @base and @HelloTelos LPs! It's exciting to see the circulating supply decrease as more MST is added to the protocol's treasury. Check out our new buybacks dashboard to verify

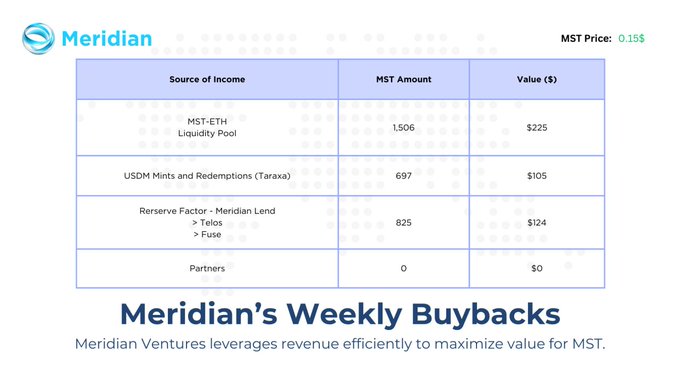

Meridian has completed another weekly buyback, purchasing 5,380 MSTs (942$) from the market! As we wrap up a successful 2024, we're setting the stage for an even brighter 2025. Merry Christmas to everyone celebrating! Transactions: basescan.org/tx/0x4a57e9c08…

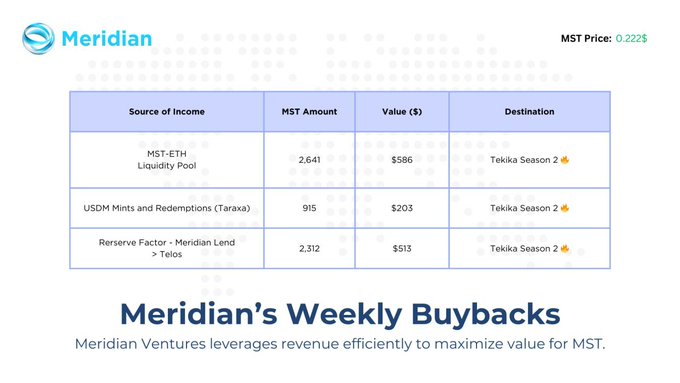

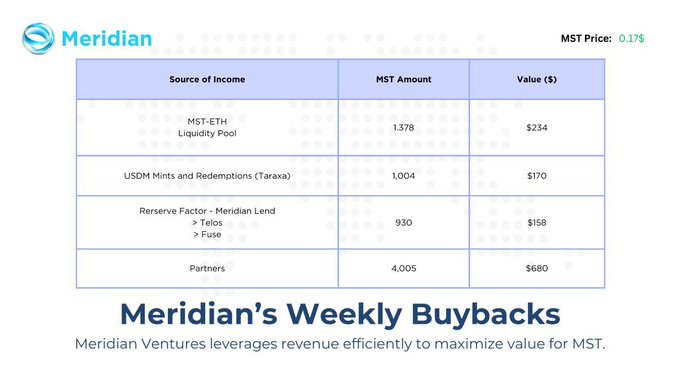

Meridian has completed its weekly MST buybacks, totaling 5,868 MSTs, equivalent to $1,302! A little spoiler: Meridian will participate in Tekika's second season, where these MSTs will be utilized to drive greater activity across Meridian products and within the community. Next

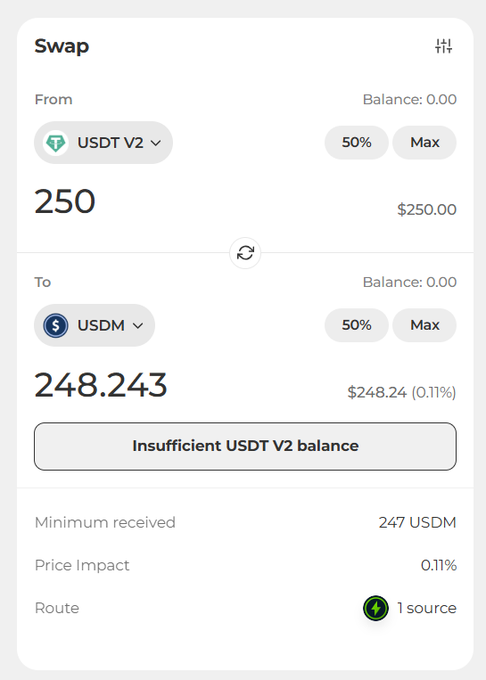

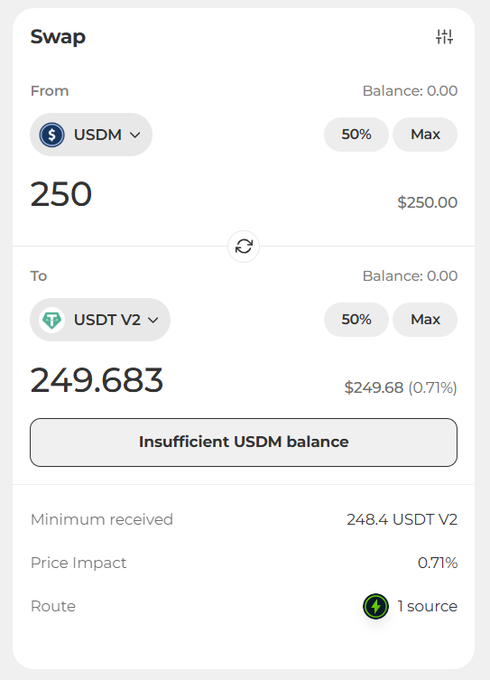

USDM liquidity continues to strengthen, reducing price impact and ensuring a smoother trading experience. This improvement provides an easier pathway for users to capitalize on the attractive yields available on Meridian Lend on the @Fuse_network.

To enhance the trading experience for $USDM on the @Fuse_network, we’ve launched the USDT-USDM liquidity pool on @voltfinance! Now, users can easily swap stablecoins and leverage Meridian’s USDM on Meridian Lend seamlessly. Currently, USDM offers a whopping 40% APR on Meridian

To enhance the trading experience for $USDM on the @Fuse_network, we’ve launched the USDT-USDM liquidity pool on @voltfinance! Now, users can easily swap stablecoins and leverage Meridian’s USDM on Meridian Lend seamlessly. Currently, USDM offers a whopping 40% APR on Meridian

No matter if the market is up or down, $MST buybacks continue weekly, with 3,312 MST bought from the market and 4,005 MST acquired by our partners this week. Check out all the transactions on our new buybacks dashboard! 🔗 Dashboard: flipsidecrypto.xyz/pepperatzi/mer…

The latest buyback update is here! A total of 6,338 MSTs have been repurchased from the market. These tokens will be allocated to support long-term MST stakers and other efficient initiatives. Transactions: basescan.org/tx/0x2708a7343… teloscan.io/tx/0x135a1fcaf… teloscan.io/tx/0xa3057366b…

Milestone after milestone! 🚀 Meridian Lend has hit the $150,000 TVL mark on the @Fuse_network! This represents an impressive $130,000 increase in just the last 4 days since the campaign launched. 📢 MST holders: Revenue generated from Fuse will start contributing to buybacks

Telos fam! Loyalty deserves to be rewarded. We’re launching a pilot program offering staking points for users who believe in Meridian’s long-term success. Meridian Staking Points are automatically earned for MST staked in 6-month or 1-year locked positions. This means that once

Fusians, get ready for the return of Meridian magic! 🪄 We're excited to announce that @LidoFinance's staked Ether ($wstETH) is now integrated with Meridian Lend on the Fuse Network. This integration is a key step in driving the adoption of liquid staked assets across the

Meridian is shutting down Meridian Mint on the Base network by December 31, 2024, to optimize MST token vesting across other ecosystems. Trove owners are encouraged to close their positions earlier, and we’ve provided guidance to most trove owners on alternative options for

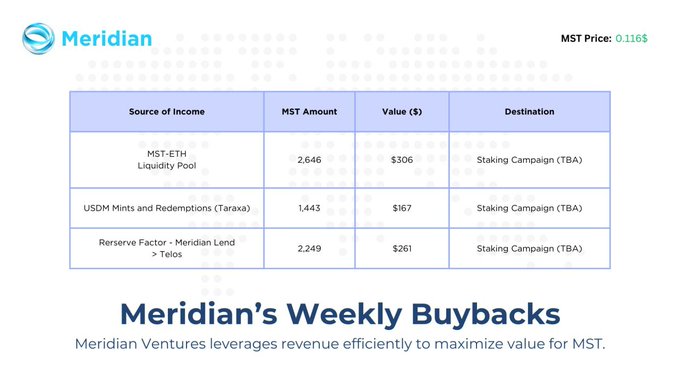

The first buyback of 2025 is here! This week, we integrated @Fuse_network lending fees into the equation, resulting in a total of 6,527 MST (~1,212$) bought back from the market! Additionally, a Meridian partner acquired 6,406 MST (~1,192$), further aligning with Meridian's

🛡️ LayerCover Insurance Protocol Update

**Meridian provides update on LayerCover**, a parametric insurance marketplace for DeFi. **Key Features:** - Instant claims processing - Single-sided liquidity provision - Pay-as-you-go coverage model **Market Context:** Recent depeg events with $xUSD and $deUSD highlight urgent need for **stronger DeFi security infrastructure**. **Current Progress:** - Team establishing partnerships with industry leaders - Pursuing strategic funding for liquidity scaling - Building awareness in the market **Stakeholder Benefits:** Meridian stakeholders will be **included in early protocol phases** and rewarded for their support. LayerCover aims to make DeFi more secure and trustworthy, helping onboard institutions and larger capital flows into crypto markets.

🔥 Meridian Accumulates More veSTELLA

Meridian contributors continue building their veSTELLA position, acquiring **51,642.10 STELLA** tokens from StellaSwap markets. This accumulation strategy supports the **MST-DOT liquidity pool** that recently launched on StellaSwap with a starting price of $0.075 and 1% swap fees. **Key details:** - veSTELLA position will incentivize MST pool during high efficiency periods - MST supply remains hard capped with deflationary mechanics - Previous epoch saw 65,190.43 STELLA accumulated with 97% staked The strategy leverages vote-escrow mechanics to expand MST liquidity while accelerating long-term supply deflation through carefully designed tokenomics.

🔄 StellaSwap Bribing Paused

**StellaSwap bribing strategy update:** - MST-DOT voting gauge bribing **temporarily suspended** - Will resume only when bribing efficiency exceeds 1.0 - **Efficiency above 1** means pool receives more USD rewards than bribe costs This approach ensures stakeholder value isn't diluted through inefficient spending. The team continues monitoring metrics to determine optimal restart timing. *Strategic pause protects community resources while maintaining long-term sustainability.*

Meridian to Attend EthCC Conference

Meridian has announced its participation in the upcoming EthCC (Ethereum Community Conference). The team will be actively networking and exploring potential partnerships during the event. - Focus on building new connections - Seeking partnership opportunities - Open invitation to meet community members This follows their previous successful appearance at ETH Milano, where team members engaged with the Ethereum community. **Want to connect?** Reach out to schedule a meeting during the conference.

Meridian Joins Taraxa Ecosystem, Plans Integration with StorkOracle

Meridian, a decentralized trading platform, has announced its participation in the Taraxa ecosystem. The platform aims to leverage StorkOracle's price feeds following their integration with Taraxa. - Meridian will utilize Taraxa's scalable infrastructure - Integration with StorkOracle's price feeds planned - Focus on enhancing DeFi trading experience The collaboration aims to strengthen Meridian's existing services while benefiting from Taraxa's technological capabilities.