ListaDAO

Lista DAO functions as a open-source liquidity protocol for earning yields on collateralized Crypto assets (BNB/ETH/Stablecoins) and borrowing of our decentralized stablecoin, lisUSD, also known as a "Destablecoin".

It uses and expands the proven MakerDAO model for a decentralized, unbiased, collateral-backed destablecoin.

The protocol consists of a dual token model (lisUSD and LISTA) and a set of mechanisms that support instant conversions, asset collateralization, borrowing, yield farming, etc. We are native to the BNB Chain ecosystem and have plans to expand to multiple chains in the near future.

The protocol is built by DeFi and smart contract experts with the aim to position the world-class revolutionary lisUSD Destablecoin as the most widely used one, by leveraging Proof-of-Stake (PoS) rewards and yield-bearing assets.

Lista DAO Adds 10M Liquidity to U Vault, Expands PT Markets Across Multiple Vaults

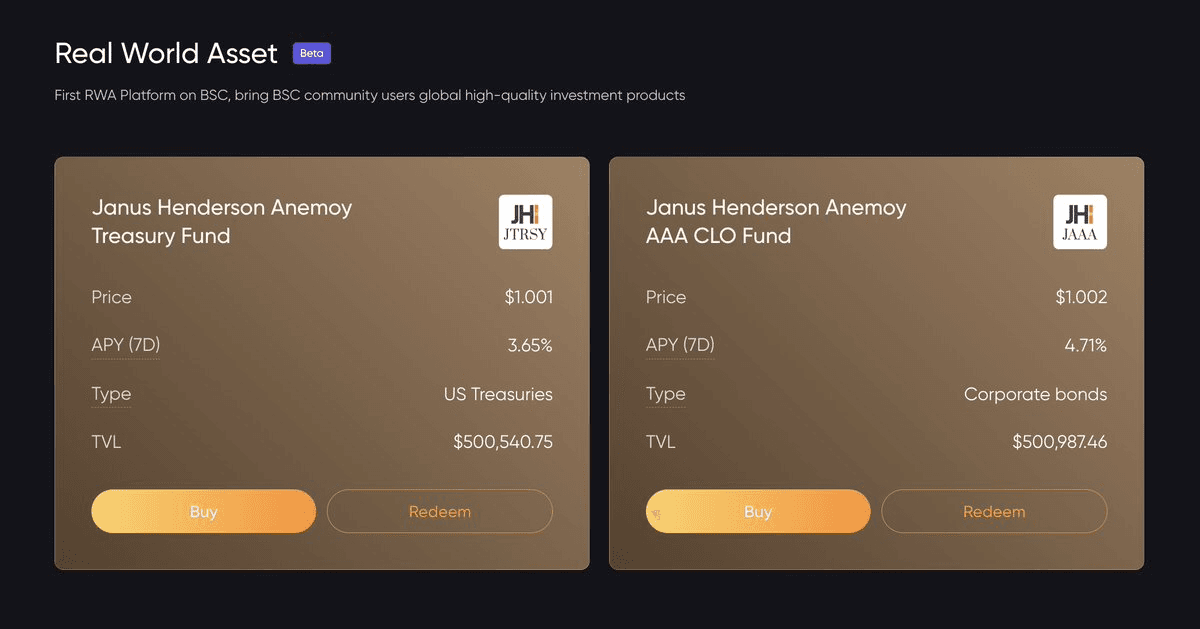

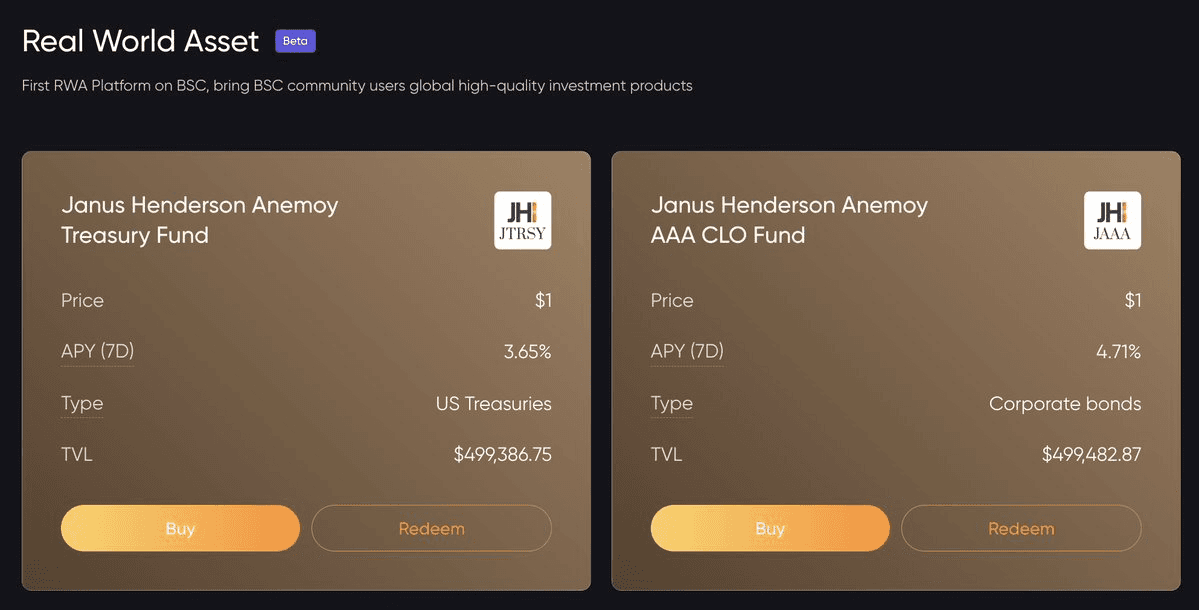

Lista DAO Launches Onchain U.S. Treasury and Corporate Bond Access on BNB Chain

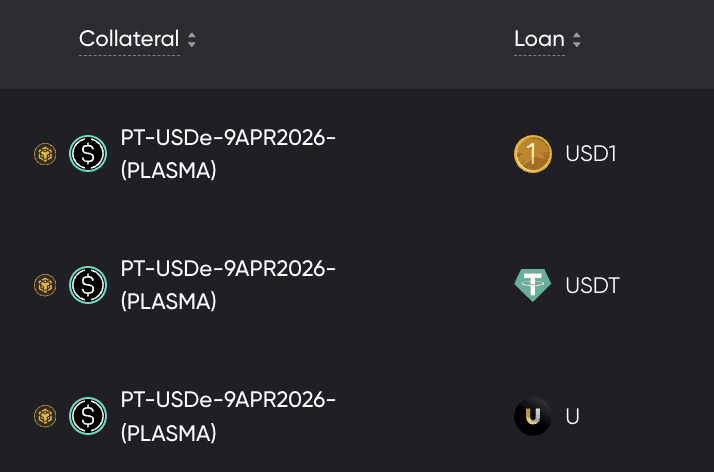

Lista Lending Adds PT-sUSDe Markets with Multi-Stablecoin Borrowing Options

Lista DAO Unveils 2026 H1 Roadmap with Ethereum Expansion and RWA Integration

Lista DAO Launches RWA Yields on BNB Chain

Lista DAO Distributes 262K LISTA Tokens in 72nd Weekly Rewards

Lista DAO Explains Smart Lending Protocol Mechanics

Lista DAO Launches Fixed Rate & Term Loans with Predictable Borrowing Costs

Lista DAO Launches Smart Swap DEX with Multi-Layer Yield Features