Florence Finance

At Florence Finance we kill two birds with one stone:

1. We provide a crypto-agnostic (uncorrelated) real-world yield to an ecosystem that today is still overly dependent on trading fees, spreads & inflationary incentive schemes ("ponzinomics").

2. Address the societally significant SME funding gap that exists to varying degrees in developing and developed markets all over the globe.

Florence Finance works with existing SME lenders to gain access to diverse SME credit exposure by providing an alternative source of funding to Lenders with a proven track record of success in sourcing and managing specific types of SME credit.

Florence Finance seeks to be the most efficient and transparent wholesale funder (re-distributor) of such diversified SME credit exposure by creating a platform to enable real-world loans to be used as collateral in tried and tested DeFi primitives (loan vaults) to facilitate the efficient funding thereof, without the use of leverage or fractional reserves.

This RWA tokenization creates a plethora of RWA-backed yield-bearing digital assets (tokens/instruments) that are freely transferable and fully composable with other DeFi protocols. We believe this will be a major driver in the next wave of crypto adoption.

Florence Finance Platform Shutdown Notice

Florence Finance Announces Project Wind-Down After Failed Merger

Florence Finance Reports 10.7M+ SME Loans Underwritten Amid Global Credit Crisis

Florence Finance Q4 2024 Interest Distribution Report

Florence Finance Junior Vault Nears Capacity with 9.5% APY Offering

SMEs: The Unmet $10T Funding Challenge

Florence Finance Partners with Clearpool to Launch Ozean RWA Chain

Florence Finance Expands to Ethereum Mainnet

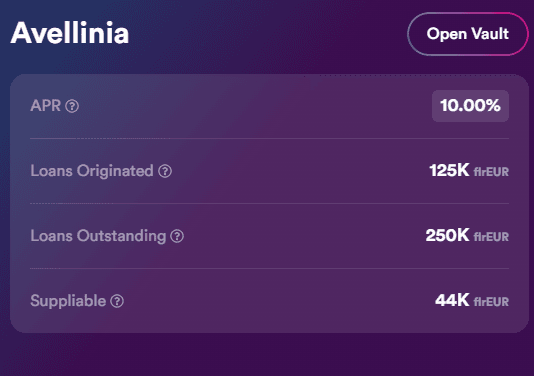

Florence Finance Partners with Avellinia Capital for Asset-Based Lending