Florence Finance Announces Project Wind-Down After Failed Merger

Florence Finance Announces Project Wind-Down After Failed Merger

🏛️ Four Years of RWA Lending Ends

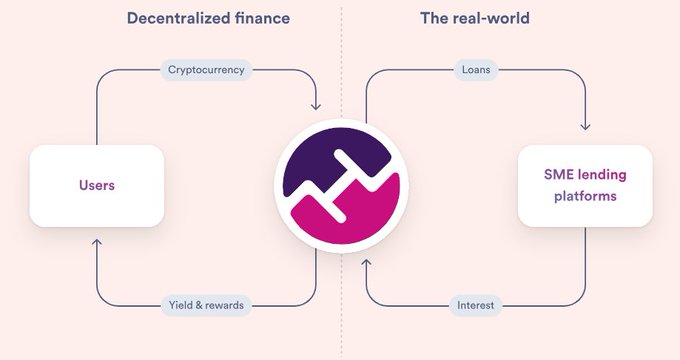

Florence Finance, a Real World Asset (RWA) lending protocol focused on SME funding, has announced its closure following a failed merger attempt. The project's intended partner was delisted from Binance, eliminating key strategic benefits. With limited vault participation and dwindling treasury funds, the team has opted for an orderly wind-down through March 2025.

Key achievements include:

- €10M+ in real-world loans funded

- €550,000 interest distributed

- 60,000 NFTs issued

- 10,000+ vault investors

Third-party investors will be able to claim principal and accrued interest, with DEX pools remaining active for one more month.

Since 2021, Florence Finance has achieved 0 bad debt losses for third-party investors. Zero. Nada. Your investments are safeguarded while supporting real-world businesses. $FFM

TradFi is failing the backbone of the economy! 90% of businesses are SMEs, yet they can’t get the credit they need. Why? Because banks would rather fund the rich & powerful. When the system shuts out those who keep it running, we need to ask: Who is the system really built for?

Small businesses make up 90% of all companies globally but face a $10 trillion funding gap. We bridge this gap by bringing Real-World Assets (#RWA) on-chain, funding SME loans with your stablecoins. Real yields. Real impact. Real growth.

€10.6M+ in SME loans. 100% real. No TradFi needed. Banks left SMEs behind. We didn’t. $FFM

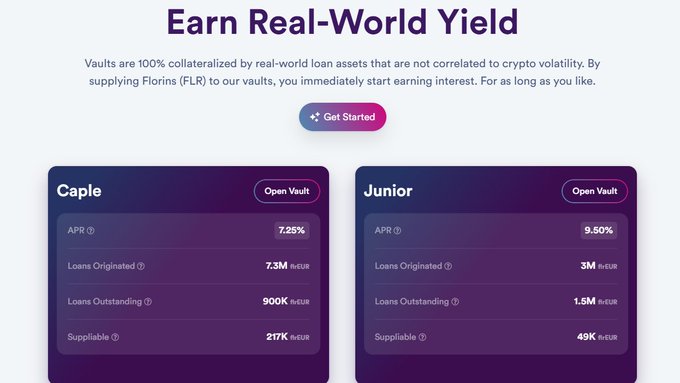

Florence Finance is leading the RWA revolution by turning stablecoins into real-world impact. With our vaults, you’re not just investing - you’re fueling SMEs, closing a $10T+ funding gap, and earning real yields (7-9.5% APY). Real returns. Real change. Real DeFi. $FFM

The future of crypto isn’t just speculation - it’s real-world impact. RWAs (RealWorldAssets) like SME loans bring stability, transparency, and actual utility to DeFi. $FFM

Most DeFi projects revolve around USD, but at Florence Finance, we focus on EUR. This choice reflects our commitment to funding real-world SME loans across Europe, delivering yields directly tied to the region’s economic growth. $FFM

Ever wonder why SMEs struggle to get funding while banks print endless money for corporations and hedge funds? Banks are too big, too slow, and too risk-averse to care about small businesses. Instead, they focus on squeezing profits from everyday people. Florence Finance

⚜️ Weekly Roundup at #FlorenceFinance ⚜️ ♦️ Q3 interest paid out: returning over €55K directly to our holders 💸 ♦️ Completed our quarterly #burn with more than 700K $FFM 🔥, supporting long-term value ♦️ Progress on the Avellinia loan: second installment successfully called up

Wondering what Florence Finance has been up to? From exciting milestones to a major new partnership and bold plans ahead, it’s all in our latest Community Update on Medium. Read it here: medium.com/florencefinanc… #DeFi #RWA #RWI $FFM

Small and medium-sized businesses represent 90% of global enterprises but are left struggling to access credit. The $10 trillion SME funding gap isn't just numbers - it's missed opportunities for growth and innovation. $FFM

It’s time to start the Real World Impact (RWI) movement! 🌍💼 With $FFM, we’re not just funding assets. We’re driving real growth, supporting real businesses, and making a real difference. This is decentralized finance for real people. #RWI #RWA #FFM #RealWorldImpact

Tired of the old ways of banking? Let’s redefine finance together. Banks hold the keys to credit, often sidelining the small businesses that power our communities. At Florence Finance, we say it is time for a change. We are turning stablecoins into real-world impact funding

We funded €1.0M in loans for the Dutch healthcare sector, helping SMEs grow while generating stable DeFi yields. No speculation, no empty promises - just real businesses getting funded, real investors earning returns. This is what DeFi was meant for. Ready to put your money to

The future of finance is here: Real World Assets (RWA) + DeFi. Florence Finance bridges crypto and the real economy by funding small businesses globally while delivering real yields. This isn’t just a trend - it’s a movement to decentralize credit creation, empower SMEs, and

The launch of Ozean is going to be a game-changer for real-world yield. Florence Finance + @ClearpoolFin = shaping the future of finance. 🚀 #RWA #DeFi $CPOOL $FFM

Clearpool has been pioneering this movement, even before #RWAs were even a term. Clearpool has tokenized $640M+ of financial assets since launching in 2022. The upcoming launch of Ozean - the blockchain for RWA yield, is set to elevate the ecosystem to the next level. $CPOOL

With Florence Finance, lending goes on-chain - and that means composability: Your assets integrate seamlessly with other DeFi platforms. Here’s how it works: 1️⃣ Deposit stablecoins into a Florence vault. 2️⃣ Earn real-world yield on your deposit. 3️⃣ Use your vault token as

We’ve already generated over $541k in interest income - and we’re just getting started! Florence Finance is putting your stablecoins to work, creating real-world impact while delivering steady returns. 🌍💸 This is DeFi for real people. $FFM

90% of businesses globally are SMEs. Many are denied loans due to outdated banking rules. Florence Finance funds real-world businesses using stablecoins, filling this massive gap. Let’s build the financial future SMEs deserve! $FFM

Crypto hype can only take DeFi so far. Without Real World Assets (RWA), it’s just speculation chasing volatile returns. RWAs like SME loans bring stability, transparency, and real-world impact - turning DeFi into a tool for meaningful growth. Florence Finance is leading this

We’re not just about DeFi; we’re making Real World Impact (RWI)! We use stablecoins in our vaults to fund real businesses, businesses that bring innovation and drive the economy forward. This is DeFi with purpose. $FFM

Ever tried getting a loan from a bank, only to be told you need more collateral, more guarantees, and still not get enough? SMEs deal with this every day. Banks want zero risk while making money off you. At Florence Finance, we fund the businesses they ignore - partnering with

We couldn’t agree more with BlackRock - tokenization is the future! At Florence Finance, we’re already tokenizing #SME lending on-chain, proving that #RWA and #DeFi are the perfect match. It’s only a matter of time before this becomes the new normal for finance. $FFM

🚨JUST IN: BlackRock wants to tokenize every financial asset The #RWA market is about to explode! 🚀

Sick of DeFi projects with no real impact? We’re flipping the game. Florence Finance turns your stablecoins into fuel for real-world businesses - funding SME loans and delivering stable yields. No hype. Just results. It’s time to bridge DeFi and the real world. Who’s in? 🚀🔥

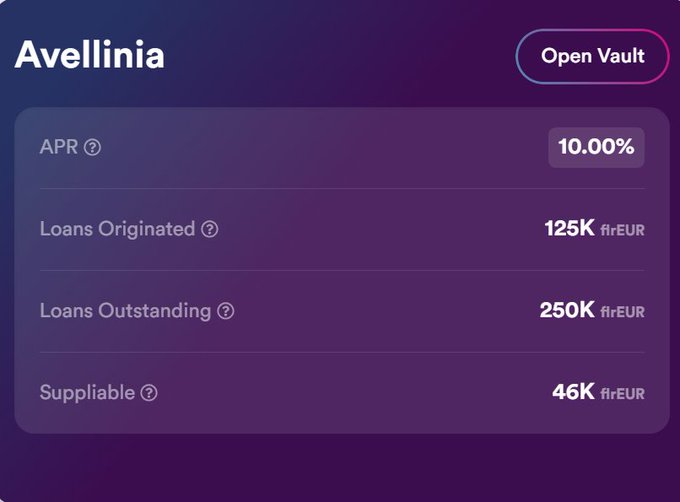

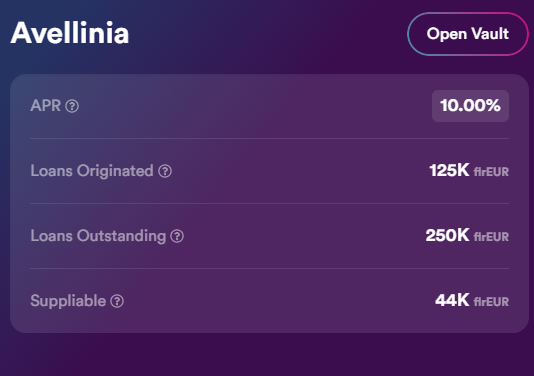

🚀Exciting update!🚀 We’ve successfully completed the on-chain funding for the second stage of the Avellinia Capital loan, bringing our vault to a solid $250K! This vault empowers SMEs and fintech leaders who are often overlooked by traditional finance. @AvCap2 #RWA #DeFi #RWI

Meet Avellinia Capital: Florence Finance’s Trusted Lending Partner! Avellinia Capital is a leader in alternative asset-based lending, focusing on SMEs and fintech innovators who are often ignored by traditional banks. Through their financing solutions, Avellinia bridges this

Crypto may be volatile, but real-world finance isn't. Florence Finance connects DeFi with SME lending, giving you steady returns in a trillion-dollar market. 📈 Real businesses, real impact, real yields. $FFM

Why is Florence Finance focused on a EUR-pegged stablecoin instead of USD? Here’s the reasoning: 1. Tapping into the European Market: The EU represents a massive economic zone where #SME funding gaps persist. A EUR stablecoin bridges this gap directly. 2. Addressing Local

We have underwritten an impressive $10.7 million in SME loans, empowering small and medium-sized enterprises that serve as the backbone of the global economy. These businesses, often overlooked by traditional finance, now have the resources to grow and innovate. This is our

DeFi needs real-world adoption to survive. Speculation won’t drive mass adoption - Florence Finance is proving how RWA-backed lending is the future. We’re bringing stability, transparency & growth to DeFi. $FFM

We see that TradFi needs to change, but why? 90% of businesses globally are #SMEs, yet they struggle to access the credit they need. Banks favor bigger, safer players, leaving these businesses underfunded and underserved. When the system fails those who drive the economy, it’s

The Avellinia Vault is Florence Finance’s highest APY performer at 10%! Powered by AvCap Investments Luxembourg, this vault secures SME loans with 100% asset backing and robust protections. Let your stablecoins achieve their full potential. $FFM

Crypto is evolving beyond speculation, and Real World Assets (RWA) are leading the way. Florence Finance is bringing real yield on-chain by funding SME loans with stablecoins. This isn’t just DeFi - it’s decentralized finance with real-world impact. $FFM

🚀 $FFM Burn Update! 🔥 The second buy-back-and-burn is here! Florence Finance has just burned 715,000 FFM forever! Here's the breakdown: 289,000 FFM bought from real-world interest 💰 426,000 FFM added from trading fees 📊 This marks our ongoing commitment to burn all

"Too small." "Too uncertain." These are the words millions of SMEs hear when they seek funding to grow. From family-owned manufacturers to local tech startups, these businesses drive innovation and create jobs, but banks turn them away. At Florence Finance, we’re changing

Mastercard has tokenized 30% of its transactions in 2024 and is eyeing stablecoins as a major disruptor to TradFi. 💳🔗 DeFi & Real World Assets (#RWA) are no longer a niche - big players are embracing tokenization. The future is on-chain!🚀 $FFM

🚨 Breaking: Mastercard has tokenized 30% of its transactions in 2024 and acknowledges stablecoins’ potential to disrupt traditional finance. The #RWA revolution is unstoppable! 🚀

🚀 Exciting News! 🚀 We’re thrilled to announce that the Avellinia Vault is now listed on the @polytrade_app Marketplace! This vault represents a prime opportunity for you to invest in real-world assets and support #SME growth. 🔗Check it out here: market.polytrade.app/asset-detail/c…

🚫 Did you know? SMEs represent 90% of businesses globally, yet they face a staggering $10T funding gap. ⚜️ Florence Finance bridges this gap, turning your stablecoins into funding for real-world businesses. Together, we empower growth where it’s needed most. This is DeFi for

DeFi isn’t just about speculation. It can be about real impact. Florence Finance connects crypto liquidity with real-world lending, giving small businesses the capital they need while delivering solid returns for stablecoin holders. Finance should serve people, not institutions.

At Florence Finance, we burn tokens to reduce supply and enhance long-term value for holders. Here's how it works: A portion of protocol revenue is used to buy back $FFM. These tokens are permanently burned, reducing circulating supply. The result? A deflationary token model

We’re not just talking about assets, we’re talking about impact. With $FFM, it’s not just about Real World Assets (#RWA), it’s about Real World Impact (#RWI). We’re funding real businesses, creating real growth, and making a real difference. #FFM #RealWorldImpact

Weekly Roundup ⚜️ ♦️ Aerodrome liquidity increased, $FFM whitelisting requested ♦️ Visited Avellinia offices & recorded live podcast with Matthias to be released soon ♦️ Recorded AMA podcast with fellow founder @RealRickSchmitz We keep building 🤝 #FlorenceFinance #Update #AMA

#RWA is gaining traction and #FlorenceFinance is leading the way. We combine the power of DeFi with real world assets, turning stablecoins into real-world loans that fund businesses and drive economic growth. This is decentralized finance for real people. #RWA #DeFi

I have just published the Final Community Update for the project that I have spent the last four years of my life on (together with a loyal team). It has been one hell of a journey with many learnings and I whish to thank all those that contributed. medium.com/florencefinanc…

🔥Our Buyback & Burn🔥 When Florence Finance generates yield from Euro-denominated private credit, a portion of that revenue is allocated to buy back $FFM tokens on the open market. These tokens are then permanently burned, effectively reducing total supply.

Decentralized finance has revolutionized access to financial tools, but for DeFi to truly revolutionize financial power, it must connect to the real world... And that’s exactly what we’re doing. By bridging DeFi with real-world businesses, we’re transforming crypto liquidity

At Florence Finance, we believe that true innovation in the economy lies in bringing more financial instruments on-chain. Decentralized finance (DeFi) empowers transparency, efficiency, and accessibility. Imagine a world where real-world loans and investments are open for

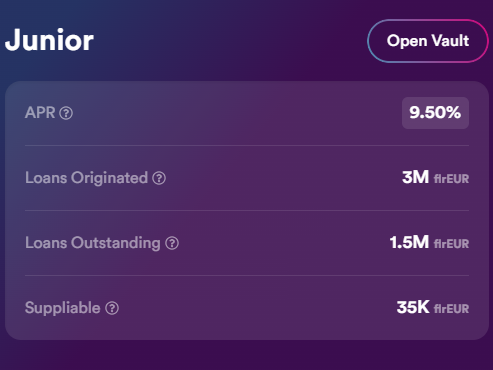

Florence Finance Q4 Interest Update: 💸 €34.1K in interest credited to the Junior Vault 💸 €11.5K in interest credited to the Caple Vault Real-world impact. Real-world yields $FFM

#RWA is heating up, and we're ready for it! We’re already funding real-world businesses, delivering real yields and shaping the future of decentralized finance. #RWI #DeFi $FFM

🚨NEW: #RWA tokens are on the verge of breaking their all-time high market cap of $58.50B and rallying to new heights! Which RWA project will lead the charge this bull run?

Traditional finance has failed small businesses for too long. Florence Finance is bridging the gap, funding SMEs that drive the real economy while giving DeFi users access to stable, real-world yields. It’s finance that works for everyone, not just the banks. $FFM

🏦 Banks are slow. DeFi is fast. Traditional finance keeps tightening credit, but tokenization is opening new doors for lending. With Florence Finance, your stablecoins fuel real-world loans - faster, more transparent, and built for the future. 🚀 Are you still waiting for

Our partnership with @ClearpoolFin makes it possible to tap into Europe’s €400 billion private credit market through their #RWA chain, Ozean! 🚀 Together, we’re bringing Euro-denominated private credit on-chain, creating new, compliant pathways for #SME's and #DeFi users to

Looking for a secure way to earn 9.5% APY? Our Junior Vault underwrites $1.5M in short-term SME loans fully backed by performing assets. Only $35K remains before this vault is full. Don’t miss your chance to earn big while supporting real-world businesses! $FFM

Major financial players like BlackRock, JPMorgan, and Goldman Sachs are rapidly entering the Real World Asset (RWA) space, recognizing its potential to bring real yield on-chain. The next major shift in DeFi isn’t speculation - it’s real finance, real returns, and real impact.

Who should TradFi work for? For people - not just institutions. At Florence Finance, we bridge crypto liquidity with real-world businesses, ensuring: ✅ Capital flows to those who need it most ✅ Individuals earn real, transparent yields It’s finance for the people, not just

🌍 #FlorenceFinance is making real-world impact (#RWI)! By turning stablecoins into loans for small and medium-sized businesses, we're helping to close the $10 trillion #SME funding gap. Every investment you make with Florence helps real businesses grow while you earn steady

At Florence Finance, we focus on EUR because we believe in the strength of European markets and the untapped potential of its businesses. Across Europe, small and medium-sized enterprises (SMEs) face a staggering €2 trillion credit gap, often overlooked by traditional finance.

💥 #DeFi isn’t just about speculation, it’s about #impact. Florence Finance connects your stablecoins to real-world businesses, driving real growth and delivering stable returns. This is DeFi with purpose. 💼🌱 #FlorenceFinance #RWA #RealWorldImpact #RWI

Last week, we kept our word and burned 715,000 $FFM from quarterly fees and real-world interest buybacks! 🔥 Are you guys excited for the next burn? #FFM #FlorenceFinance #DeFi #Burn

🚀 $FFM Burn Update! 🔥 The second buy-back-and-burn is here! Florence Finance has just burned 715,000 FFM forever! Here's the breakdown: 289,000 FFM bought from real-world interest 💰 426,000 FFM added from trading fees 📊 This marks our ongoing commitment to burn all

Done with market volatility? Ready to put your funds in a stable, productive place? Florence Finance has you covered: ✅ Earn consistent yields with real-world #SME loans ✅ Flexible withdrawals – no lock-ups ✅ Support real businesses while securing your returns Say goodbye to

Banks make it harder than ever for SMEs to get funding. Florence Finance decentralizes lending so businesses can thrive. The best part? You can be part of the solution. $FFM

Crypto has been a playground for speculation - but that’s changing. Real businesses need funding, and DeFi can provide it. That’s where Real World Assets (RWA) come in. We turn stablecoins into real-world SME loans, offering real yield, not imaginary APYs. With 9.5-10% stable

DeFi summer was fun. But let’s be honest - most of it was just Ponzi yield, farm-and-dump tokens, and hype with no real backing. Real World Assets (RWA) are the next big thing because they bring actual, sustainable returns on-chain. Florence Finance is leading the charge by

Did you know? We dedicate a portion of the platform's revenue from real-world loans to buybacks and burns of $FFM tokens! 🔥 This deflationary strategy not only strengthens the token’s value but also rewards our amazing holders. Together, we’re building a sustainable DeFi

In TradFi, banks and financial institutions decide who gets credit, often leaving SMEs, the backbone of the economy, without support. Florence Finance takes control away from the old system, using stablecoins to fund real-world businesses. Our decentralized vaults offer: ✅

Maximize your stablecoins with Florence Finance vaults! Earn real-world yields while funding small businesses (#SME's): no lock-up, full flexibility and transparent returns. 🌍 Ready to make an impact? app.florence.finance/vaults #DeFi #RealWorldImpact $FFM

Why Choose Florence Finance Over TradFi? Let’s talk about empowerment and impact. In TradFi, banks decide who’s “creditworthy,” often sidelining the smaller enterprises that drive local economies. Florence Finance disrupts this by using stablecoins to fund real-world businesses,

Most people earn little to no interest on their TradFi bank accounts, even as their money funds the economy. At Florence Finance, we offer 7-10% APY - a real-world, stable income - while funding the same economy at much higher rates. This isn’t just better returns; it’s a

Who should finance empower? Everyone - not just the privileged few. At Florence Finance, we’re building a better future: ✅ Your stablecoins fund real-world SME loans ✅ You earn transparent, real yields This is finance done right.

Crypto used to be all about speculation and on-chain hype. Now with Real World Assets (#RWA), it is proven that crypto can do so much more. We can use it to make financial instruments accessible to the whole world, not just for banks and the big players. With Florence Finance,

Why SMEs? They’re the backbone of the global economy, making up 90% of businesses and employing nearly half the world’s workforce. Yet, these small and medium-sized enterprises often face huge barriers accessing credit - over $10 trillion globally in unmet funding needs. $FFM

Yesterday we shared the incredible 10% APY offered by the Avellinia Vault. Today, it’s time to hear the story behind it. In this video, our own @DukeFlorence69 sits down with Matthias Dux from Avellinia Capital to discuss their groundbreaking partnership and how it’s reshaping

Curious about how $FFM is transforming #SME lending on-chain? Matthias Dux from Avellinia Capital joins our own @DukeFlorence69 , to dive into their powerful partnership and what it means for real-world finance. Watch the full conversation and see how we're bringing real-world

Traditional banks concentrate power and risks, relying on fractional-reserve banking that can create instability. Florence Finance decentralizes credit creation, providing transparency, fair funding, and real-world returns - reducing systemic risks and fostering a more stable

Tired of the same old financial system? Florence Finance is here to change the game. With $FFM, we’re decentralizing credit creation, empowering SMEs, and breaking free from the grip of traditional banks. It’s more than DeFi – it’s a movement for transparency, efficiency, and

Meet Avellinia Capital: Florence Finance’s Trusted Lending Partner! Avellinia Capital is a leader in alternative asset-based lending, focusing on SMEs and fintech innovators who are often ignored by traditional banks. Through their financing solutions, Avellinia bridges this

The future of crypto isn’t just speculation - it’s real-world impact. RWAs (RealWorldAssets) like SME loans bring stability, transparency, and actual utility to DeFi. $FFM

What if your stablecoins could do more than just sit idle? Florence Finance transforms your stablecoins into a force for real-world change. By connecting crypto liquidity with real-world lending, we fund businesses that drive growth while delivering steady, tangible returns.

At Florence Finance, we’ve built a solution to tackle the $10 trillion SME funding gap. By transforming stablecoins into real-world loans, we empower SMEs to grow and deliver real yields to our community. Together, we’re bridging the gap. $FFM

Small and medium-sized businesses represent 90% of global enterprises but are left struggling to access credit. The $10 trillion SME funding gap isn't just numbers - it's missed opportunities for growth and innovation. $FFM

There’s a reason RWAs (Real World Assets) are set to be a massive narrative this bull run. Bringing real-world assets on-chain is the next step for finance, and Florence Finance has been part of the RWA revolution for over 3 years by bringing SME loans on-chain. 🌍 Real

🚨Breaking: #RWA ranked as the 3rd most profitable narrative of 2024 - @coingecko Trillions are coming in 2025

The tokenization of Real World Assets (#RWA's) is set to revolutionize finance, with projections estimating the market could reach $30 trillion by 2034. At Florence Finance, we're at the forefront of this evolution, seamlessly integrating RWAs with DeFi to offer stable,

The future of finance is here, and it’s decentralized. By removing middlemen and leveraging blockchain technology, decentralized loans offer transparency, trust, and global accessibility. Fair and open systems where every transaction is secure and traceable. This isn’t just an

A USD stablecoin might be common, but EU businesses borrowing in EUR don’t want FX risk. 📉 By using EUR stablecoins, Florence Finance makes lending efficient, stable, and relevant for real-world borrowers. This isn’t just another DeFi product - it’s a solution for real

Florence Finance is tackling a critical need: the funding gap faced by European SMEs. Traditional bank lending often leaves these vital businesses underserved, but Florence Finance is changing that by bringing Euro-denominated private credit on-chain. Our platform partners with

Florence Finance is doing what other DeFi projects haven’t - bringing crypto liquidity to the real world. We take your stablecoins and fund SME loans, putting real-world yield on-chain. It’s decentralized finance meeting real-world impact, creating a system where your

DeFi with a purpose is the future of finance because it goes beyond speculation. It's about creating real-world impact (#RWI). #FlorenceFinance connects your stablecoins to small businesses in need of funding, directly contributing to economic growth while earning steady,

90% of SMEs struggle for credit. Do you even understand how massive that market is? We are here, already making moves - 10.7M+ loans underwritten, and we’re just getting started. $FFM

SMEs create 90% of global jobs - but banks won’t fund them. Florence Finance steps in where banks step out, using crypto liquidity to empower real businesses and deliver real yields. 💼 Your investment, their growth. $FFM

We’re not just about #RWA; we’re about impact! 💪 Florence Finance is leading the way in the Real World Impact (#RWI) movement, turning $FFM into a force for real growth and real change. This is #DeFi with purpose.

It’s time to start the Real World Impact (RWI) movement! 🌍💼 With $FFM, we’re not just funding assets. We’re driving real growth, supporting real businesses, and making a real difference. This is decentralized finance for real people. #RWI #RWA #FFM #RealWorldImpact

At Florence Finance, we believe Real World Assets (RWA) are the future of finance. They connect crypto innovation with real-world impact, funding businesses that drive global growth while delivering stable, meaningful yields. RWAs bring purpose to DeFi, moving it beyond

At Florence Finance, we burn tokens to reduce supply and enhance long-term value for holders. Here's how it works: A portion of protocol revenue is used to buy back $FFM. These tokens are permanently burned, reducing circulating supply. The result? A deflationary token model

🌟 What is Ozean? 🌟 Created by @ClearpoolFin, Ozean is the #RWA chain designed to seamlessly integrate real-world assets on-chain. With its compliance-first infrastructure, Ozean simplifies private credit funding, making it transparent and efficient. Florence Finance is

🚨 Banks are failing SMEs. ⚜️90% of businesses globally are SMEs, but they struggle to access credit. ⚜️€2 TRILLION in SME funding demand is unmet in the EU alone. ⚜️Banks are slow, restrictive, and focused on big corporations, leaving small businesses behind. The system isn’t

Florence Finance has already paid out $539,000 in interest to our community. 💸 That’s $539K of real-world yields, directly into the hands of our supporters. 🌍 $FFM

10% APY in #DeFi might not sound groundbreaking, but for real-world interest, it’s a massive shift. While billions of euros sit idle in bank accounts earning near-zero returns, Florence Finance is flipping the script. We are opening doors to yields once only reserved for

"People don’t buy what you do, they buy why you do it." At Florence Finance, our "why" is simple: to innovate, empower, and revolutionize banking. We’re building a marketplace for everyone - permissionless, transparent, and inclusive. Fixing real-world problems. Closing the

Tired of #DeFi projects with no real-world impact? #FlorenceFinance is changing the game. We’re using stablecoins to fund Real World Assets (#RWA) and drive actual business growth. 🌍 This is decentralized finance for real people. 💸 $FFM #RealWorldImpact #RWI

Sick of banks calling all the shots? Florence Finance flips the script. ⚜️Your stablecoins = SME loans. ⚜️ Real-world yields = your reward. Let’s decentralize finance and empower small businesses together. It’s time to rewrite the rules! $FFM

Small and medium-sized enterprises (#SMEs) are the backbone of our global economy, accounting for about 90% of businesses and more than 50% of employment worldwide. Yet, many struggle in accessing the financing they need to grow and thrive. The International Finance Corporation

🌍 Florence Finance is doing what other DeFi projects haven’t - bringing crypto liquidity into the real economy. We take your stablecoins and fund SME loans, turning digital assets into real-world impact. It’s decentralized finance powering real growth. $FFM

Florence Finance Platform Shutdown Notice

**Final Day Notice**: Florence Finance's website and front-end interface will cease operations after March 31, 2025. - Users must redeem their Vault tokens and flrEUR from Treasury for EURA - Legacy support will continue but without the familiar website interface - Critical deadline for easy fund withdrawal is approaching *Important*: Take immediate action to secure your assets through the current user-friendly interface while it remains available.

Florence Finance Reports 10.7M+ SME Loans Underwritten Amid Global Credit Crisis

Small and medium-sized enterprises (SMEs), representing 90% of global businesses, face significant challenges accessing traditional credit channels. Key developments: - 10.7M+ loans have been successfully underwritten through alternative financing - A $10 trillion funding gap continues to affect SME growth globally - Traditional banks show preference for larger, established clients The credit access problem particularly impacts developing markets, where SMEs serve as crucial economic drivers. This persistent gap between SME credit needs and available financing highlights the potential for alternative lending solutions. *Data indicates the market opportunity remains substantial despite recent progress.*

Florence Finance Q4 2024 Interest Distribution Report

Florence Finance has completed its Q4 2024 interest distribution: - Junior Vault: 34.1K credited - Caple Vault: 11.5K credited This distribution continues Florence's track record of generating real-world yields from SME lending, with total interest income now exceeding $541k. The platform connects stablecoin holders with SME credit opportunities, providing uncorrelated returns from traditional lending markets. *Key Highlight*: Consistent quarterly distributions demonstrate the platform's stability in delivering returns from real-world assets.

Florence Finance Junior Vault Nears Capacity with 9.5% APY Offering

Florence Finance's Junior Vault, offering 9.5% APY, is approaching full capacity with only $35,000 remaining of its $1.5M allocation. The vault specializes in: - Short-term SME loan underwriting - Full backing by performing assets - Secure yield generation The vault operates alongside the Avellinia Vault (10% APY), managed by AvCap Investments Luxembourg, which provides similar SME loan security features. *Investment opportunity closing soon for this stable, real-world asset backed yield generation vehicle.*