Ozean Expands RWA Distribution Through BounceBit Integration

Ozean Expands RWA Distribution Through BounceBit Integration

🌊 RWA Yield Gets Bouncy

BounceBit, a CeDeFi infrastructure provider with $500M+ TVL, will integrate PortUSD into their RWA Vaults. Port is Ozean's first RWA Exchange-Traded Pool that combines illiquid real-world assets with liquid yield instruments like U.S. T-bills.

Key points:

- Investors receive PortUSD tokens representing portfolio shares

- Integration enables direct RWA yield access for BounceBit users

- Provides institutional-grade DeFi experience

- Fully EVM-compatible environment

This partnership expands Ozean's reach in bringing regulated RWA yield opportunities to DeFi users.

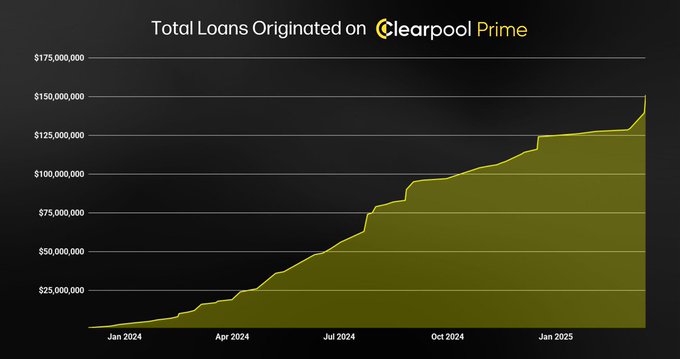

🌊 Ozean Weekly Waves 🏄♂️ Surfing the highlights of the week from our ecosystem! 1️⃣ @BastionTrading Secures $10M USDC Loan on Clearpool Prime 💰 This brings total loans originated on Clearpool Prime to over $150 million, reinforcing its leadership in the $1.6 trillion tokenized

Tweet not found

The embedded tweet could not be found…

🌊 Ozean Weekly Waves 🏄♂️ Surfing the highlights of the week from our ecosystem! 1️⃣ Ozean x @redstone_defi: Secure Oracles for RWA Yield ♦️ Ozean integrates RedStone’s modular oracle system to power low-latency, accurate pricing across 1,250+ assets—boosting transparency and

🌊 Ozean Weekly Waves 🏄♂️ Surfing the highlights of the week from our ecosystem! 1️⃣ Major Payment Institution License Secured by @Hex_Trust Hex Trust, building Ozean alongside Clearpool, secured a Major Payment Institution (MPI) License from the Monetary Authority of Singapore

🌀 @centrifuge to launch on Ozean to bring high-quality RWAs to Port The launch starts with JTRSY, a regulated U.S. Treasury fund by @anemoycapital and Janus Henderson, giving users compliant access to stable, yield-generating assets with daily liquidity. 🤝 The partnership

🚀 Clearpool has been invited to join the first ever RWA accelerator hosted by @PlugandPlayTC Accelerator in collaboration with @XDCFoundation. 🧑💻 This exclusive three-month program will be hosted at Plug and Play’s Silicon Valley headquarters, uniting top innovators to drive

(1/3) We are excited to announce the selected startups for the XDC RWA Accelerator program, a collaboration between Plug and Play and @XDCFoundation! Full details available here: prn.to/4igwQsq #Web3Innovation #PNPTC #XDCNetwork #Fintech #Blockchain

The USDX T-Pool TVL on Clearpool continues to increase and has surpassed $26M! 🚀 USDX is Ozean’s native stablecoin issued by @Hex_Trust. The T-Pool represents to 94.65% of the total USDX minted supply on Flare.

🌊 Building the Future of RWA Yield with Ozean 🌊 RWAs like private credit, real estate, and treasuries are starting to flow into DeFi — but barriers like illiquidity, compliance, and poor UX still hold the space back. That’s why we’re launching Ozean — a purpose-built Layer 2

✨ Clearpool was featured by @Altcoinbuzzio as one of the hidden gem of RWA projects 🗣 “Clearpool is leading the way in on-chain credit with undercollateralized lending, the Ozean mainnet launch just around the corner, Hex Trust secured MPI license from Singapore’s MAS, and

🌊 Ozean & @maplefinance Partner to Expand Institutional Access to DeFi Yields – Adding SyrupUSDC to Port 🚢 🥞 SyrupUSDC is Maple’s yield-bearing stablecoin and will be integrated into Ozean’s Pre-Deposit Campaign and Port — Ozean’s first Exchange-Traded Product (ETP). By

📃 Clearpool's Q1 2025 report is out! Key Takeaways: 🔵 Clearpool surpassed $750M in total loans originated 🔵 $CPOOL milestones: @Bybit_Official Perpetual Futures contract and listing on @binance Alpha 🔵 Ozean ecosystem expanding: Partnerships with @maplefinance, @LidoFinance,

🌊 Ozean Weekly Waves 🏄♂️ Surfing the highlights of the week from our ecosystem! 1️⃣ Clearpool's Q1 2025 Report is Out 📃 Clearpool surpassed $750M in total loans originated, achieved key CPOOL milestones with @Bybit_Official Perpetual Futures and Binance Alpha, and expanded the

🚀 Ozean & @Stake_Stone Partner to Expand Real-World Assets and Liquidity Token Opportunities StakeStone powers an omnichain liquidity network with $725M+ TVL and 150K+ stakers, backed by Binance Labs and Polychain Capital. The partnership starts by bringing $STONE—a

🌊 Learn more about Port, Ozean's RWA Exchange-Traded Pool! Port is an on-chain vault infrastructure designed to solve the biggest challenges in RWAs. ✨ Key Features: 🔷 Decentralized Governance: $CPOOL token holders vote on asset composition and weighting, ensuring

🚨 Major Payment Institution License Secured 🚨 @Hex_Trust building Ozean alongside Clearpool, has secured a Major Payment Institution (MPI) License from the Monetary Authority of Singapore (MAS). As part of Ozean’s core infrastructure via Hex Trust, this enables: •

Clearpool has officially surpassed $750M in Total Loans Originated! 🚀 The momentum keeps building as we lead the charge in RWA lending—most recently with @BastionTrading securing a $10M USDC loan on Clearpool Prime. And we’re just getting started. More loans and institutions

📢 Euronext-listed global trading firm @FlowTraders has successfully secured a $10 million USDC loan on Clearpool Prime! 📈 This brings the total loans originated on Clearpool Prime to over $160 million as the institutional demand for tokenized private credit surges. $CPOOL

🌊 Ozean Partners with Leading Oracle Provider @redstone_defi to Strengthen RWA Integration in DeFi ♦️ RedStone’s secure, modular oracle infrastructure will power reliable, low-latency price feeds for RWAs on Ozean—supporting institutional-grade DeFi with accurate and

🌊 Ozean Weekly Waves 🏄♂️ Surfing the highlights of the week from our ecosystem! 1️⃣ Ozean CEO Takes the Stage in Hong Kong 🇭🇰 @JKronbichler shared Ozean’s vision at the Web3 Festival, spotlighting how Ozean solves RWA adoption barriers like accessibility and liquidity—while

📈 Clearpool Prime keeps gaining momentum, surpassing $151M+ in Total Loans Originated! 📍 This milestone was driven by recent loans secured by @FlowTraders and @BastionTrading last week—highlighting the rising institutional demand for tokenized private credit. 🏦 Clearpool

🇭🇰 @JKronbichler shared his vision at the @festival_web3 panel, "RWA’s Trillion Dollar Opportunity: Risks and Rewards," highlighting the transformative potential of #RWAs in DeFi.. Jakob emphasized how Ozean addresses key challenges in RWA adoption, such as accessibility and

🏦 CFTC Signals Stablecoin Issuers May Qualify as National Trust Banks

**U.S. regulators are treating stablecoins more like traditional banking instruments.** The CFTC has indicated that stablecoin issuers may qualify as national trust banks, marking a shift toward formal financial regulation. **Key developments:** - Stablecoins moving from crypto assets to regulated financial instruments - Growing demand for compliant liquidity infrastructure - Clearpool positioning its on-chain credit platform for regulated environment **Why it matters:** As stablecoins gain regulatory clarity, institutional adoption requires infrastructure that operates within compliance frameworks. This regulatory evolution creates opportunities for platforms offering transparent, compliant lending solutions. [Read full article](https://cointelegraph.com/news/cftc-stablecoins-national-trust-banks)

White House Discusses Stablecoin Reward Regulations with Crypto Firms and Banks

The White House is engaging in discussions with cryptocurrency firms and traditional banks to establish regulatory frameworks for stablecoin rewards. These conversations aim to create clear definitions around stablecoin yield mechanisms. **Key Points:** - Regulatory clarity on stablecoin rewards is viewed as essential for increased institutional adoption of on-chain finance - Talks involve both crypto companies and traditional banking institutions - The discussions represent progress toward integrating digital assets into mainstream financial regulation The outcome of these talks could significantly impact how institutions participate in decentralized finance markets. Clear regulatory guidelines would provide the certainty needed for banks and other traditional financial players to engage with stablecoin-based products. [Read the full article](https://www.theblock.co/post/388106/inside-white-house-talks-crypto-banks-on-stablecoin-rewards-exactly-the-progress-needed)

Hong Kong to Issue First Stablecoin Licenses in March 2026

Hong Kong's Monetary Authority (HKMA) is set to issue its first stablecoin issuer licenses in **March 2026**, marking a significant step in Asia's digital finance regulation. **Key Details:** - 36 institutions have applied for licenses - Approvals will be limited and subject to strict scrutiny - Framework emphasizes risk controls, compliance, and cross-border treatment - Regulators are examining use cases, risk management, and reserve assets The move reflects growing demand for **institutional-grade liquidity** and regulated infrastructure as Asian financial hubs establish formal frameworks for digital money. Read the full article: [Reuters](https://www.reuters.com/world/asia-pacific/hkma-issue-first-stablecoin-licenses-march-2026-02-02/)

Coinbase Stock Drops Despite Metal Futures Expansion

Coinbase shares declined following the company's announcement to expand into metal futures trading. According to Clearpool's COO Steven, featured in Decrypt Media, the stock movement reflects broader market conditions rather than concerns about Coinbase's execution. **Key Points:** - Stock decline tied to wider market trends, not company-specific issues - Metal futures expansion represents strategic diversification beyond crypto - Move positions Coinbase as broader derivatives venue - Expansion less about hedging crypto volatility, more about platform growth The development comes as Coinbase continues building out its institutional trading infrastructure, adding traditional financial instruments alongside its core cryptocurrency offerings. [Read full article](https://decrypt.co/356128/coinbase-shares-tumble-expands-new-metal-futures)

🎯 Clearpool Hits $900M Milestone

**Clearpool has officially surpassed $900M in Total Loans Originated**, marking a significant milestone for the decentralized credit platform. The achievement reflects growing institutional demand for on-chain credit infrastructure. Clearpool thanked its lenders, borrowers, and ecosystem partners for making this milestone possible. **Key highlights:** - Total loans originated now exceed $900M - More borrower pools coming soon - Building open credit infrastructure for real-world yield - Institutional demand continues growing This milestone builds on Clearpool's recent innovations, including: - **RLOC Vaults** that deploy unused capital into money markets - **X-Pool** crossing $3M TVL with 8-15% APR targeting - **$45M USDX** actively deployed across T-Pool and X-Pool Clearpool continues expanding its ecosystem across institutional stablecoin finance, from Prime Lending to Treasury Pools and Credit Vaults 2.0.