Clearpool

Clearpool is the first decentralized marketplace for unsecured digital asset liquidity, where institutional borrowers can create single-borrower liquidity pools and compete for uncollateralized liquidity directly from a decentralized network of lenders. Liquidity providers on Clearpool earn attractive yields, with pool interest rates enhanced by additional rewards paid in CPOOL — the protocol’s utility and governance token. Clearpool LP tokens, called cpTokens, are the building blocks for a system of tokenized credit and on-chain risk management.

Clearpool is building the architecture to facilitate flows between traditional capital markets and the burgeoning DeFi ecosystem. Clearpool is backed by leading investors from both traditional venture capital and blockchain, including Sequoia Capital India, Arrington Capital, Sino Global Capital, Hex Trust, Huobi Ventures, GBV Capital, HashKey, and Wintermute.

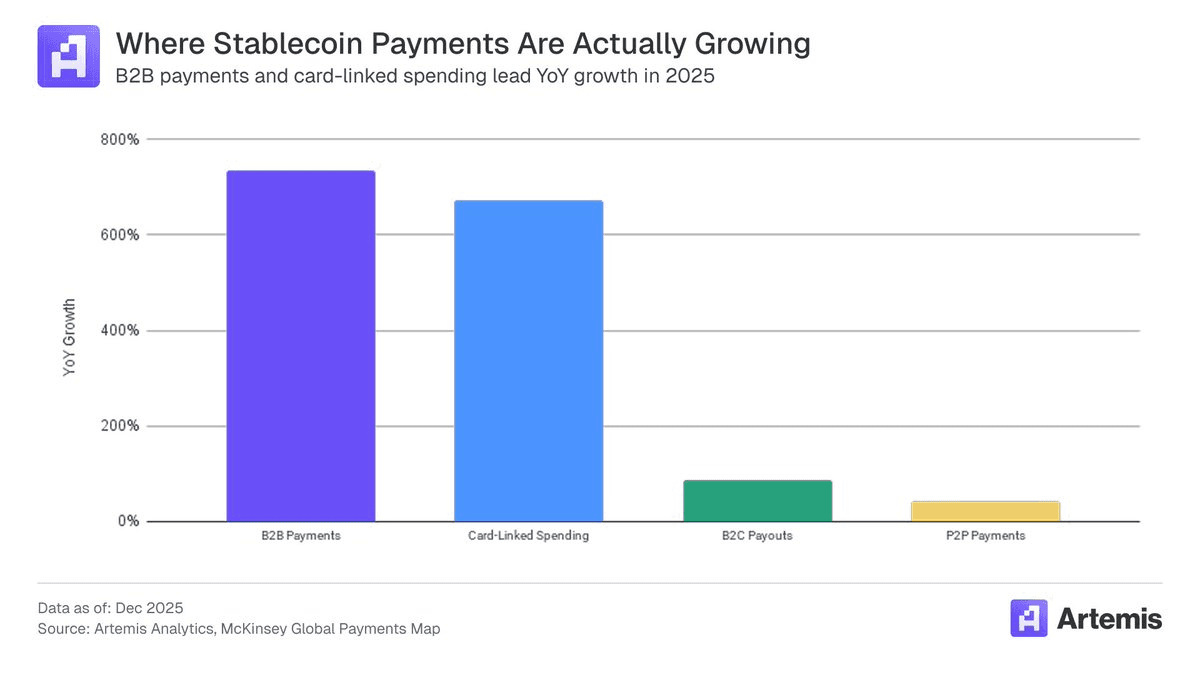

🏦 CFTC Signals Stablecoin Issuers May Qualify as National Trust Banks

White House Discusses Stablecoin Reward Regulations with Crypto Firms and Banks

Hong Kong to Issue First Stablecoin Licenses in March 2026

Coinbase Stock Drops Despite Metal Futures Expansion

🎯 Clearpool Hits $900M Milestone

Clearpool Hits $50M USDX Milestone with $45M Deployed

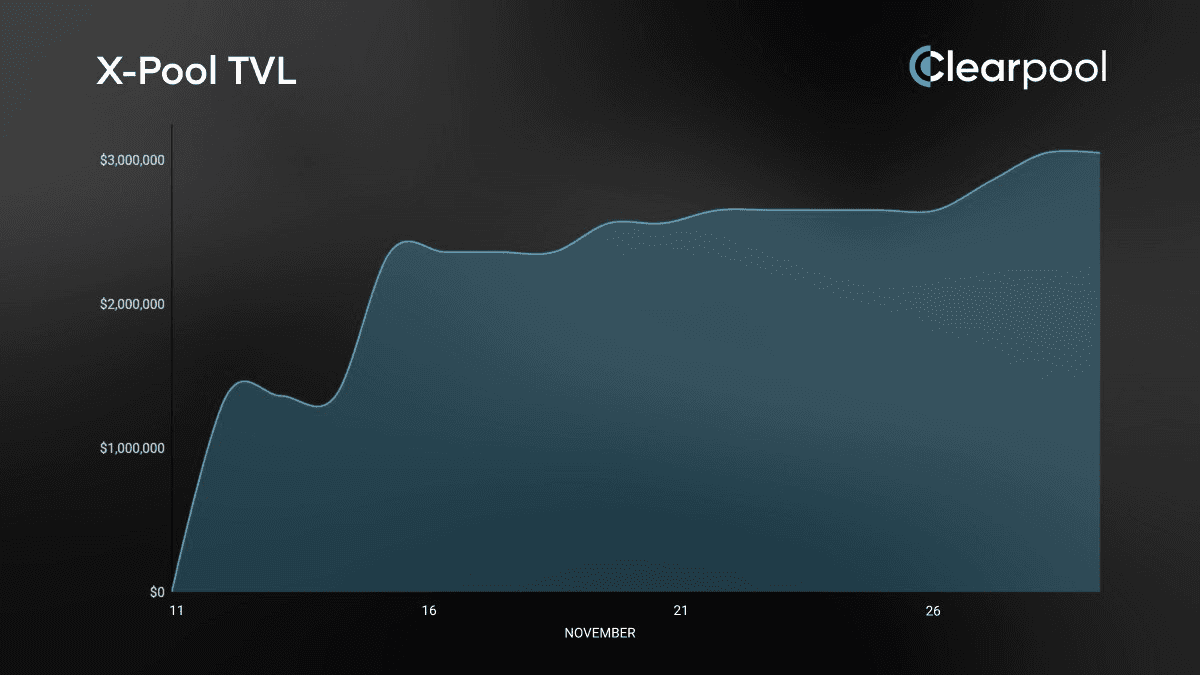

🎯 X-Pool Milestone

Clearpool Resumes $CPOOL Buybacks and Expands to Major Korean Exchanges

🇭🇰 Hong Kong Approves First Spot Solana ETF