Unusual Whales

The Unusual Whales NFT Project. There are currently 6,969 Whales in this project, each one being unique in it's own way. No two are alike with some being rarer than others.

However, this is not just another generative art project, but a pass to access NFT tools to help you navigating the NFT space. It also gives you access to the equity, options, crypto, and derivative tools.

Holding an NFT in your wallet will allow you to access the tools exclusively.

As a reminder, NFT prices are highly volatile, and often represent illiquid markets. These are not investment vehicles but rather access to equity, options, and crypto tooling. Enter/purchase at your own risk and please be responsible. You can lose all or some of your initial crypto bid.

It is not recommended to buy these NFTs.

Workers' Share of Economic Pie Hits Historic Low Since 1947

Florida Leads Nation in Foreclosures for 2025

Ray Dalio Warns Trump Policies Could Trigger Capital Wars

Commerce Secretary Lutnick Faces Calls to Resign Over Epstein Business Ties

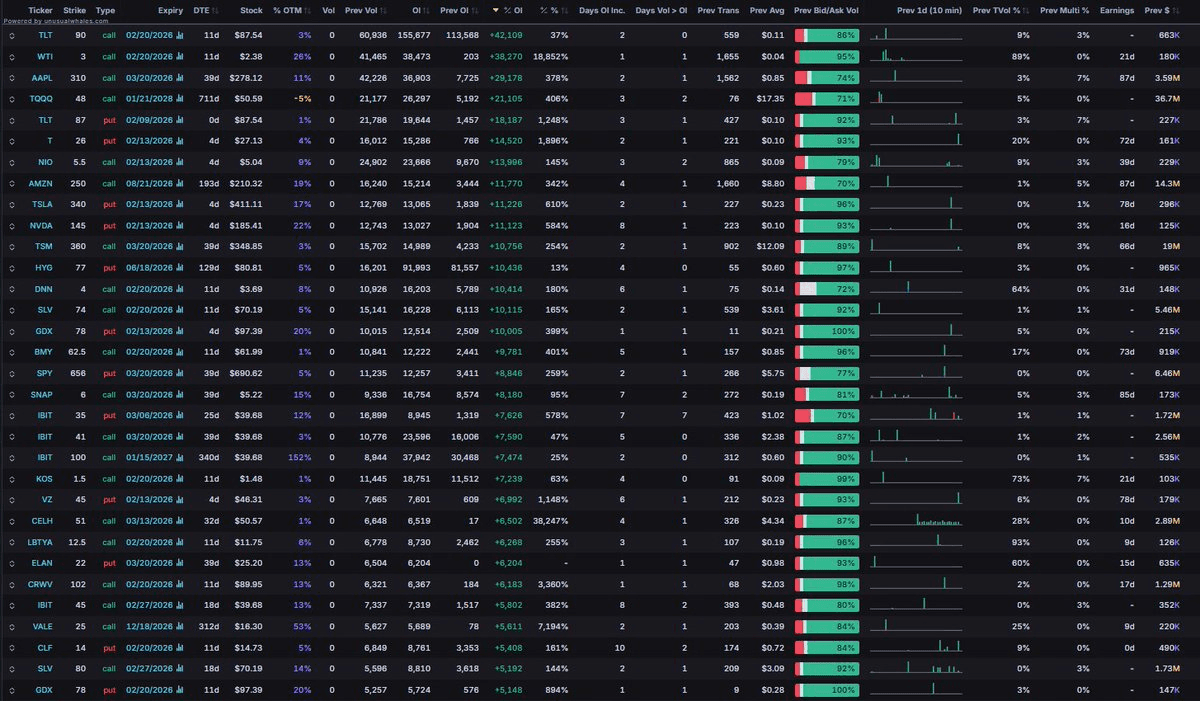

Unusual Whales Releases Daily Open Interest Data Early for Subscribers