🔥 New osETH Strategy Launches

Thu 22nd Jan 2026

A new osETH strategy has been launched through a collaboration between Gearbox Protocol, KPK, and Beefy Finance.

**Key Features:**

- Up to 34% APY

- Instant deposits and withdrawals with no delays or penalties

- Low risk profile tied to pegged assets

The strategy is now live and accessible at [kpk.gearbox.finance](https://kpk.gearbox.finance/strategies/open/1/0x1a711a5bc48b5c1352c1882fa65dc14b5b9e829d).

A detailed guide and risk explanation will be released in the coming days.

⚠️ New osETH Strategy Launches with 34% APY and Important Depeg Warnings

Thu 22nd Jan 2026

A new leveraged staking strategy for osETH has launched through a collaboration between Gearbox Protocol, kpk, and Beefy Finance.

**Key Features:**

- Up to 34% APY by earning the spread between Balancer's boosted osETH-ETH pool (~7% APY) and ETH/wstETH borrowing costs (~3% APY)

- Supports up to 10x leverage loops

- Flexible withdrawals with no delays or penalties if APY drops below base osETH staking rate

**Critical Risk Warning:**

Collateral pricing is based on Balancer LP exchange rates. **Depegs exceeding 2% will directly impact your health rate on Gearbox.**

**Recommended Safety Measures:**

- Maximum 6x leverage (not the full 10x available)

- This provides an 8% depeg buffer for protection

The strategy targets users seeking higher yields on pegged assets while maintaining relatively low risk, though proper leverage management is essential.

🎯 StakeWise DAO Acquires $10M osETH Liquidity at Zero Cost

Thu 22nd Jan 2026

StakeWise DAO has secured a significant win with three major developments:

- **infoFi suspended** - removing a previous operational concern

- **Withdrawal queue reduced** to under 24 hours, improving user experience

- **$10M in osETH liquidity** now owned by the DAO at zero cost

The liquidity acquisition represents a strategic treasury gain for the protocol without requiring capital expenditure. Combined with the improved withdrawal times, these changes strengthen StakeWise's operational efficiency and financial position.

The DAO continues its governance activities, with previous votes including a proposal to migrate ~15,000 ETH from node operators to StakeWise Vaults.

Ethereum's PeerDAS Upgrade Delivers 8x Throughput Boost in 3 Weeks

Thu 27th Nov 2025

**Ethereum's PeerDAS upgrade launches in approximately 3 weeks**, delivering the network's biggest scalability improvement since Layer-2 rollups.

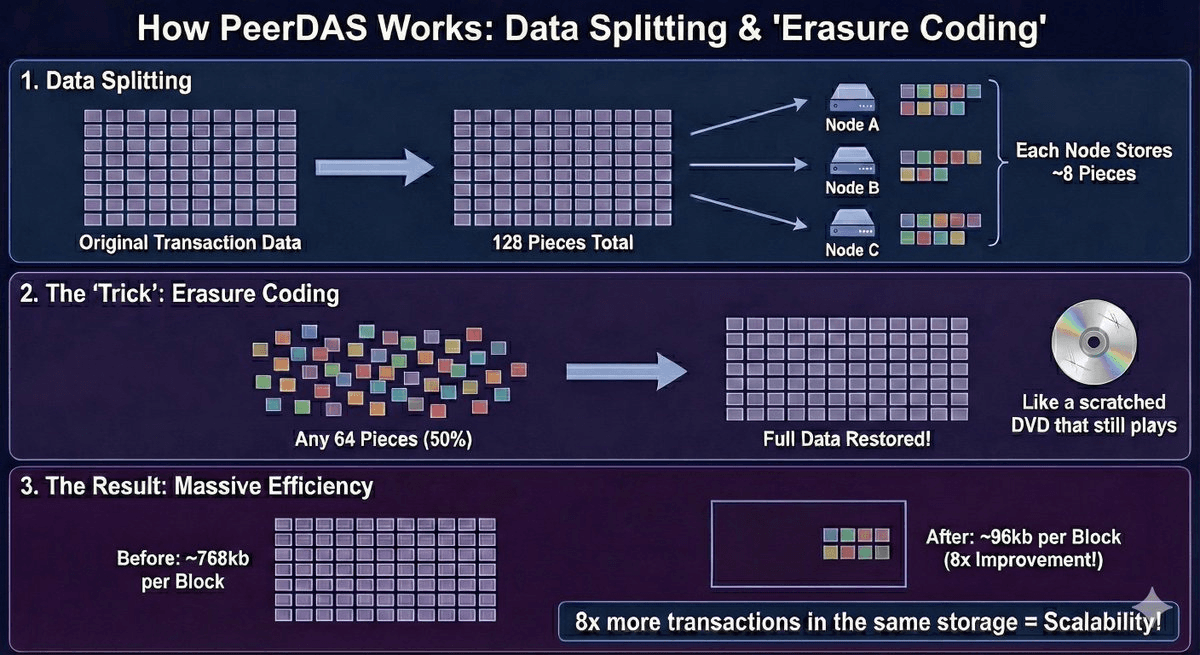

**How PeerDAS Works:**

- Splits transaction data into **128 pieces** instead of sending full data to every node

- Each validator only stores and verifies **8 out of 128 pieces** (1/16th of original data)

- Uses **erasure coding** - data can be fully reconstructed from just 50% of pieces

- Reduces storage requirements from 768kb to **96kb per validator**

**Key Benefits:**

- **8x network throughput increase** without hardware upgrades

- Maintains **decentralization** by keeping home stakers viable

- Applies specifically to **Layer-2 blob data**, amplifying L2 transaction capacity

- Preserves full data availability and security guarantees

**Technical Innovation:**

Nodes are organized into 128 gossip networks, each responsible for one data piece. Every validator participates in at least 8 groups, ensuring redundancy while dramatically reducing individual resource requirements.

This upgrade addresses Ethereum's core challenge: scaling transaction volume while keeping validation accessible to independent operators, not just large institutions with expensive hardware.

StakeWise DAO Recovers $20.7M from Balancer V2 Exploiter

Thu 6th Nov 2025

**StakeWise DAO successfully recovered majority of stolen funds** from the Balancer V2 exploit through emergency multisig operations.

**Recovery Details:**

- Recovered ~5,041 osETH (~$19M) - representing 73.5% of stolen tokens

- Recovered 13,495 osGNO (~$1.7M) - 100% of stolen osGNO

- Total recovery: **$20.7M in stolen assets**

**What Happened:**

- Attacker had converted remaining osETH portion to ETH before recovery

- Emergency multisig executed series of transactions within hours of exploit

- Full osGNO recovery achieved on Gnosis Chain

**Next Steps:**

- Recovered funds will be **returned to affected users**

- Distribution based on pro-rata pre-exploit balances

- Full post-mortem and detailed operation account coming soon

Collaboration with Balancer, Gnosis Chain teams, and security experts enabled the swift recovery operation.

StakeWise Recovers $20.7M from Balancer Exploit

Mon 3rd Nov 2025

**StakeWise successfully recovered majority of stolen funds** from the Balancer V2 exploit through emergency multisig action.

**Recovery Details:**

- Recovered ~5,041 osETH (~$19M) - representing 73.5% of stolen tokens

- Recovered 13,495 osGNO (~$1.7M) - 100% recovery

- Total recovery: **$20.7M**

**What Happened:**

- Attacker converted remaining osETH to ETH, preventing full recovery

- StakeWise smart contracts remained unaffected throughout

- Emergency response executed within hours

**Next Steps:**

- Funds will be **returned to affected users pro-rata**

- Distribution based on pre-exploit balances

- Full post-mortem report coming soon

The swift recovery demonstrates the effectiveness of emergency protocols in DeFi, though highlights the challenge of recovering assets once converted by attackers.

🚨 Balancer Security Alert: osETH-aETH LPs Must Withdraw Immediately

Mon 3rd Nov 2025

**Urgent security notice for osETH-aETH liquidity providers on Balancer V3 pools.**

**Immediate action required:**

- Remove all assets from Balancer pools immediately

- Withdraw funds to your personal wallet

- Revoke all contract approvals

While V3 pools like osETH-aETH appear unaffected by the current exploit, the protocol is taking precautionary measures to protect user funds.

**This is a temporary safety measure** - users should act quickly to secure their assets until the situation is resolved.

StakeWise Launches Vaults v4.0 with MetaVaults and Enhanced Staking Features

Mon 22nd Sep 2025

StakeWise has released **Vaults v4.0**, introducing significant improvements to their Ethereum staking platform.

**Key Features:**

- **0x02 validators** for faster withdrawals and higher rewards

- **MetaVaults** - distribute stake across up to 50 sub-Vaults in custom proportions

- Enhanced customization options for vault management

- Improved contract efficiency with rigorous security audits

The upgrade leverages Ethereum's fast lane EL withdrawals and increased validator maxEB to deliver **shorter withdrawal times** and **better staking rewards**.

MetaVaults enable sophisticated stake allocation across 100+ operators, offering flexible management for complex staking setups.

New customization features allow users to change vault admins, edit fees, and assign separate wallets for different roles - addressing commercial and operational needs.

All contracts have been audited by ABDK Consulting for security assurance.

[Read the full release article](https://stakewise.medium.com/vaults-v4-0-optional-upgrade-now-available-23a41a37afbd)

Record-Breaking Deposit Made to StakeWise Protocol

Thu 14th Aug 2025

A new milestone has been reached in the StakeWise protocol with the largest single deposit ever recorded. This follows significant activity in September 2023, when unusual withdrawals totaling $13.7M ($3.9M in USDT and $9.8M in ETH) were made to a previously inactive account.

- New record deposit marks growing confidence in liquid staking

- Previous notable activity: $13.7M withdrawal in September 2023

- Pattern suggests increasing institutional interest in protocol

*This development indicates evolving dynamics in the liquid staking sector.*

StakeWise DAO Monthly Budget Update and Migration Vote

Thu 14th Aug 2025

StakeWise DAO has confirmed a monthly operational budget of approximately 35 osETH ($170,000). This announcement comes alongside a significant governance vote for an Incentivized Migration Request involving ~15,000 ETH.

The migration proposal aims to:

- Compensate a major node operator for transferring 459 validators to StakeWise Vaults

- Provide vested SWISE tokens as additional incentive

- Facilitate protocol growth through validator consolidation

Community members holding SWISE tokens can participate in the vote at [StakeWise Governance](https://vote.stakewise.io/#/proposal/0x9bb996c0acc884225d8de827a443b71d8da317daa554dc5d8567f5b38ab8ae26)