SperaxDAO

Sperax USD (USDs) is the primary protocol under the SperaxDAO. USDs is a stablecoin that generates auto-yield natively. Currently, USDs is live on Arbitrum, the largest Layer-2 Ecosystem of Ethereum. It has achieved $20M TVL in the first 2 months since launch. Eventually, Sperax will build a system of interoperability so that USDs will be natively deployed to all major blockchain platforms.

The highlights of this protocol:

- Auto-yield - Users holding USDs in their wallets automatically earn organic yield. The end user requires no staking. Users do not need to spend gas calling the smart contract to claim their yield.

- Layer 2 native — Cheaper transaction fees on Arbitrum make this protocol retail investor-friendly

- Fully Backed Model - USDs is 100% backed by a diversified basket of whitelisted crypto assets (stablecoins)

Demeter protocol enables DAOs to launch and manage decentralized exchange (DEX) liquidity pools and farms on platforms like Uniswap V2, Uniswap V3, Camelot V2, Camelot V3, and Balancer V2. The protocol simplifies the process of incentivizing liquidity for the DAOs' native tokens without requiring coding expertise. Demeter automates the creation, management, and reward distribution for liquidity pools, providing support in engineering, marketing, and financial incentives

Sperax is backed by Polychain Capital, Jump Trading, Amber Group, Outlier Ventures and, Steve Aoki.

Sperax Partners with Google Cloud for AI-Powered DeFi Development

🌐 Sperax Secures .sperax TLD on Handshake for Permanent Web3 Identity

Sperax Partners with Lista DAO for $SPA Vault Launch on BNB Chain

Sperax Gains Forbes Coverage with SPA Price Tracking

SperaxOS: AI-Powered Financial Operating System Launches on BNB Chain

Sperax USD (USDs) Launches Auto-Yield Stablecoin Protocol on Arbitrum

USDs Maintains Yield Generation During Market Volatility

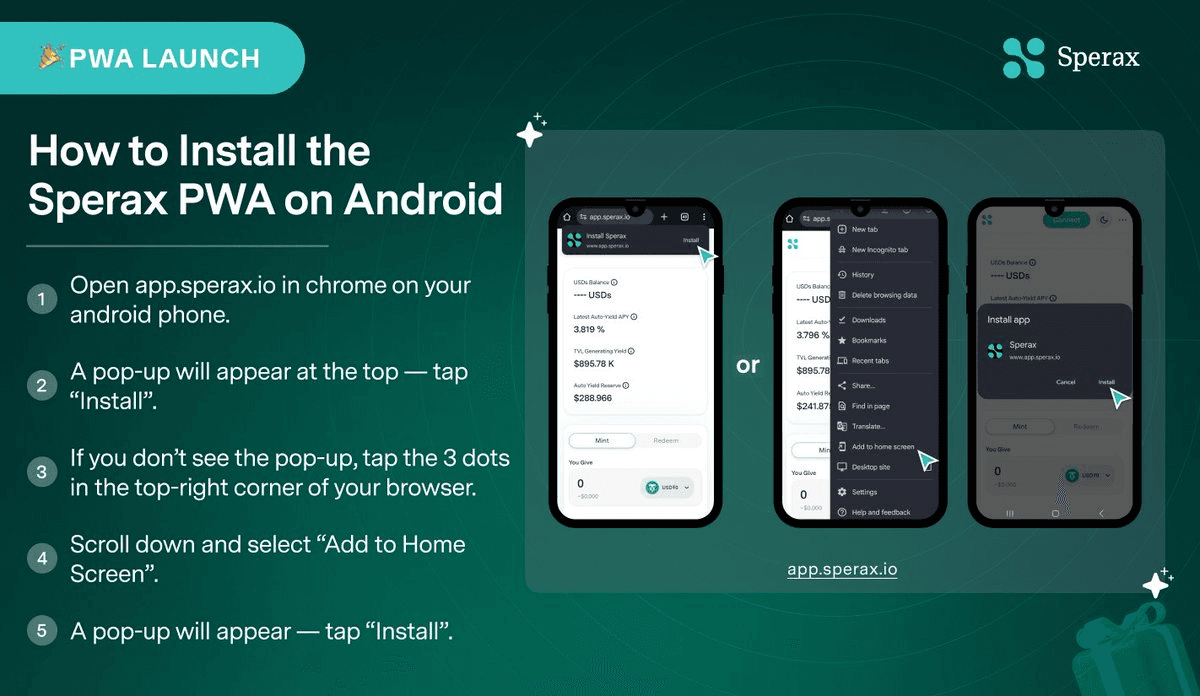

Sperax Progressive Web App Now Available on Android and iOS

USDs/USDT and SPA/USDT Trading Pairs Launch on Biconomy