USDs/USDT and SPA/USDT Trading Pairs Launch on Biconomy

USDs/USDT and SPA/USDT Trading Pairs Launch on Biconomy

🚀 New pairs, who dis?

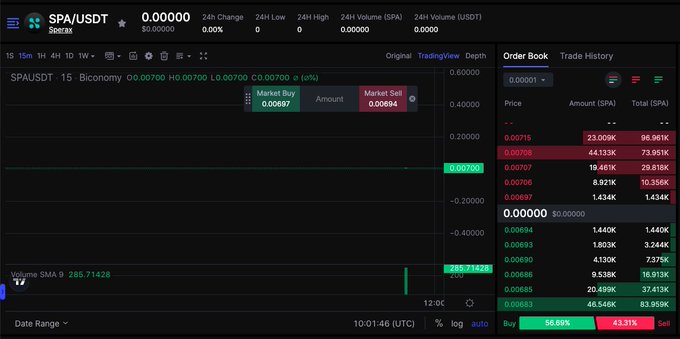

Biconomy Exchange has introduced new trading pairs for Sperax USD (USDs) and SPA tokens against USDT. This development expands trading options for these assets on the platform.

Key points:

- USDs/USDT pair now available

- SPA/USDT pair also added

- Trading accessible via Biconomy's exchange

This listing follows a trend of exchanges expanding USDT trading pairs, as seen with recent additions on other platforms.

Traders interested in these new pairs can visit Biconomy's exchange to start trading.

Great news, fam!🎉🥳 USDs/USDT and SPA/USDT trading pairs are now LIVE on @BiconomyCom biconomy.com/exchange/USDS_… biconomy.com/exchange/SPA_U… #listing #usdt $USDs $spa

Sperax Partners with Google Cloud for AI-Powered DeFi Development

Sperax has partnered with Google Cloud to accelerate development of AI-integrated DeFi tools through its SperaxOS platform. **Key Details:** - Sperax received $200,000 in Google Cloud and Firebase credits under the Scale tier program - Google Cloud's infrastructure will enable faster AI responses and real-time data processing across multiple blockchains - The partnership provides low-latency global access to SperaxOS for users worldwide - Sperax now uses the same infrastructure that powers Coinbase, BNB Chain, and Solana The collaboration aims to enhance user experiences in DeFi by leveraging Google Cloud's computing power for processing blockchain data and delivering AI-driven insights. The partnership was featured in [Business Insider](https://www.businessinsider.com). This infrastructure upgrade supports Sperax's broader ecosystem, which includes USDs stablecoin and the Demeter protocol for DEX liquidity management.

🌐 Sperax Secures .sperax TLD on Handshake for Permanent Web3 Identity

**Sperax has secured the complete .sperax top-level domain (TLD)** and key .os domains on Handshake Network via Namebase. **Key features of .sperax domains:** - Permanent Web3 identity with no renewals required - Censorship-resistant and seizure-proof - Private by default - Support for always-on dApps and AI agents **Domain structure includes:** - yourname.sperax for personal identity - app.sperax for decentralized applications - agent.sperax for AI agents The move eliminates traditional domain middlemen and provides users with truly owned digital identities. **Claims and SperaxOS updates are coming soon.**

Sperax Partners with Lista DAO for $SPA Vault Launch on BNB Chain

**Sperax has partnered with Lista DAO** to launch the $SPA Vault in Lista's Lending Alpha Zone on BNB Chain. The **Lending Alpha Zone** enables strategic borrowing for whitelisted users with flexible collateral options, supporting the Binance Alpha ecosystem. Key features include: - **Automated capital deployment** through SperaxOS agents - **Real-time risk management** logic - **Optimized yield flows** for users As capital flows into $SPA, this partnership establishes the foundation for more advanced onchain lending strategies within the BNB Chain ecosystem.

Sperax Gains Forbes Coverage with SPA Price Tracking

**Sperax** has secured coverage on **Forbes** with $SPA token news and price tracking through **Forbes Crypto**. This milestone brings mainstream financial media attention to Sperax's ecosystem, which includes: - **USDs stablecoin** - Auto-yield generating token on Arbitrum - **$20M TVL** achieved within first two months of launch - **Demeter protocol** - Enables DAOs to manage DEX liquidity pools The Forbes listing provides increased visibility for SPA token pricing and project developments. Sperax continues expanding its **Layer-2 native** stablecoin infrastructure with backing from major investors including Polychain Capital and Jump Trading. This coverage represents growing institutional recognition of Sperax's **fully-backed stablecoin model** and automated yield generation technology.

SperaxOS: AI-Powered Financial Operating System Launches on BNB Chain

SperaxOS is launching a financial operating system on BNB Chain that uses AI-powered smart agents to automate DeFi operations. The platform enables: - Automated capital management for staking, swapping, and bridging - No-code tools for traders to customize strategies - Developer tools to build and monetize intelligent agents - Integration with $SPA token for governance and agent activation Key features include real-time reaction to market events, automated payments, and yield strategies. The system aims to simplify DeFi operations for both individual users and DAOs. Platform expansion planned for Q3-Q4 2025 includes: - Mainnet launch on Arbitrum and BNB Chain - Agent marketplace beta - AI-powered strategy optimization - USDs payment agent integration