Renzo

Renzo is the restaking hub of Eigenlayer built to streamline and expand access to the most intelligent Liquid Restaking strategies. Powered by institutional-grade node operators, Renzo abstracts away the complexities of securing Actively Validated Services (AVS) while delivering a powerful interface for risk management and rewards tracking on Eigenlayer. With Renzo’s ezETH—the most integrated Liquid Restaking Token (LRT)—users can access broad exposure to the EigenLayer (and Ethereum) ecosystems with more opportunities to generate rewards. Learn more: https://www.renzoprotocol.com/

Renzo Protocol Burns 90% of REZ Tokens Monthly, Next Burn January 5

Mon 15th Dec 2025

**Renzo Protocol** implements a systematic token burn mechanism for $REZ:

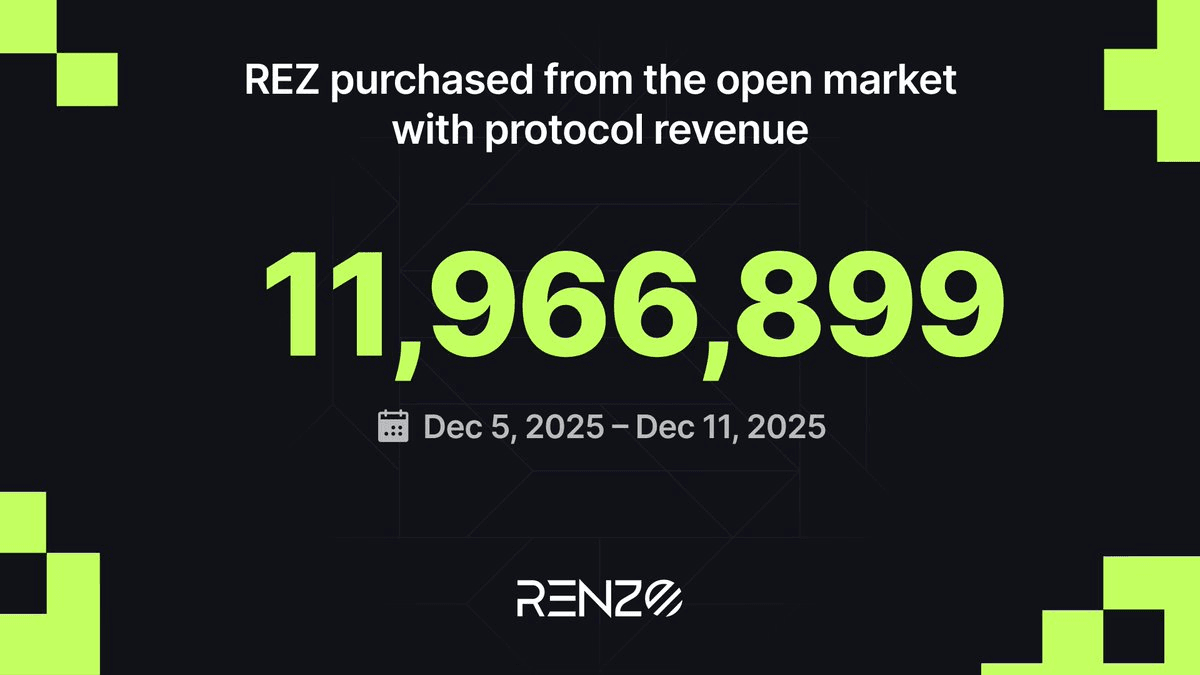

- **Weekly updates**: Every Thursday, the protocol reports how much $REZ was purchased using protocol revenue

- **Monthly burns**: On the 5th of each month, 90% of accumulated $REZ gets burned

- **Staker rewards**: Remaining 10% goes to ezREZ stakers

**Recent activity**: Protocol bought **11,966,899 $REZ** from open market during Dec 5-11.

**Next milestone**: Burn #3 scheduled for **January 5, 2025**.

This deflationary mechanism aims to reduce token supply while rewarding long-term stakers.

REZ Token Shows Strong Community Confidence with 907M Tokens Staked

Mon 15th Dec 2025

**REZ staking metrics reveal strong holder confidence** in the Renzo protocol's future potential.

**Key staking statistics:**

- 907,273,017 REZ tokens currently staked

- Represents 9.22% of total token supply

- Accounts for 17.82% of circulating supply

**Market impact:**

- Staked tokens are removed from active trading

- Demonstrates community belief in REZ's long-term value

- Reduces available supply pressure

The substantial staking participation indicates holders are choosing to lock up their tokens rather than trade them, suggesting **optimism about Renzo's roadmap** and earning potential.

This staking behavior typically signals a **healthy token economy** where users are committed to the protocol's success rather than seeking quick profits.

Renzo's ezETH/wETH Market Goes Live on Curvance with Monad Integration

Mon 15th Dec 2025

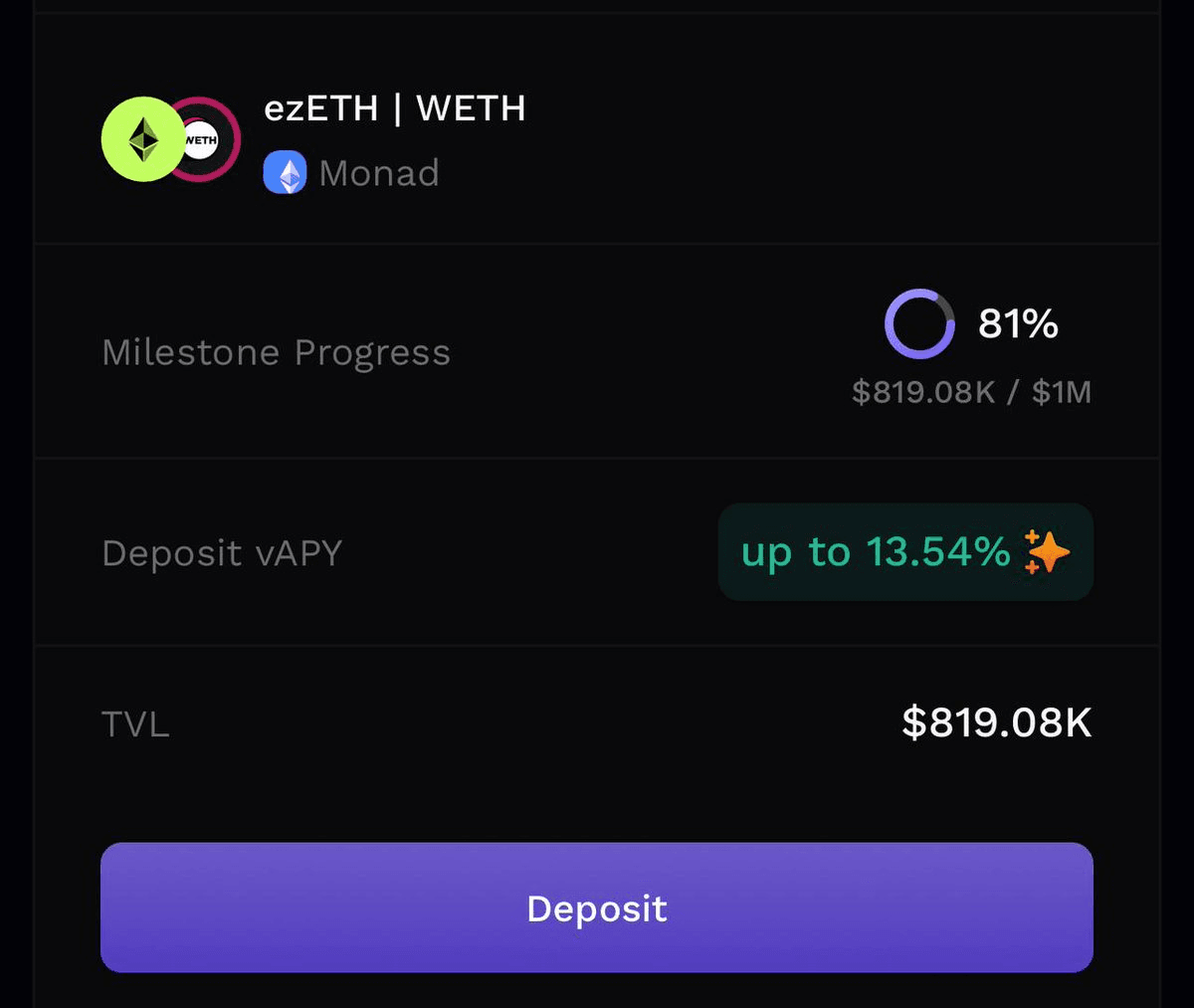

**Renzo's ezETH/wETH trading pair** has launched on Curvance protocol, now running on the Monad blockchain.

**Key developments:**

- First 24 hours of trading activity completed successfully

- gMonad.ETH restaking officially available on Monad

- Multiple reward incentives active for participants

**Available rewards include:**

- $REZ tokens

- $MON tokens

- Curvance Bytes

**Participation options:**

- Supply ezETH or WETH

- Borrow WETH

- Loop positions for enhanced yields

This integration expands Renzo's liquid restaking ecosystem beyond Ethereum, bringing ezETH to Monad's infrastructure.

🔥 Monad Madness Begins

Mon 15th Dec 2025

**gMonad.ETH restaking** is now live on Monad with fresh incentives for ezETH on Curvance.

**Earn multiple rewards:**

- $REZ tokens

- $MON tokens

- Curvance Bytes

**How to participate:**

- Supply $ezETH

- Supply $WETH

- Borrow WETH

- Loop your position

This integration makes **ezETH a core collateral asset** on Curvance's 1-Click Borrowing Markets, offering simple leverage profiles and automated looping.

Users gain access to enhanced yield opportunities across the entire **Monad ecosystem** through capital-efficient lending markets.

Renzo Reserve Launches First Strategy with Superstate USCC Vault

Mon 15th Dec 2025

**Renzo Reserve debuts** with Superstate's USCC vault as its inaugural strategy, marking a significant step in institutional DeFi integration.

**Key Features:**

- Open access to **$600M AUM** crypto carry fund for all users

- **Delta-neutral basis trading** on CME with BTC/ETH/SOL/XRP

- **Institutional-grade** transparency and rules-based management

- Optional **leveraged borrowing** via Aave Horizon

**Yield Generation:**

- Basis trading spreads between spot and futures

- Staking rewards and Treasury yields

- Strategic Treasury parking during weak basis periods

This launch establishes the **quality benchmark** for future Reserve strategies, combining institutional standards with DeFi accessibility.

Renzo Enables ezETH Bridging to Ink Network Through Unified Interface

Mon 24th Nov 2025

**Renzo Protocol** has integrated **Ink Network** bridging capabilities directly into its user interface, allowing users to seamlessly bridge ezETH tokens to the Ink blockchain.

**Key Features:**

- Direct bridging through [Renzo's platform](https://app.renzoprotocol.com/bridge?toChainId=57073)

- Unified interface for multiple blockchain routes

- Instant ezETH transfers to Ink Network

The integration represents Renzo's continued expansion of cross-chain functionality for its liquid restaking token. **More DeFi integrations** are planned for the near future.

*Start bridging ezETH to Ink Network through Renzo's streamlined interface.*

Renzo Launches $REZ Buyback Program Targeting 10% of Total Supply

Mon 20th Oct 2025

**Renzo Protocol** has initiated a major **$REZ buyback and burn program** targeting 10% of total token supply over 6 months.

**Key Details:**

- 9% of purchased tokens will be **burned**, 1% allocated to $ezREZ stakers

- **75-100% of protocol revenue** will fund the program

- Initial 1% purchase (2.3% of circulating supply) already executed

- Automated market buys designed to minimize slippage

**Why Now?**

With 42.6% of $REZ in circulation, Renzo considers itself substantially decentralized. The protocol is generating real revenue with new products in pipeline, creating opportunity to return value to token holders.

**Implementation:**

Buybacks will be automated through [smart contract](https://etherscan.io/address/0x8d8Cf66582e5866c99fDb548E424b13d26B28599). Burns go directly to dead address. Monthly reports will track progress via Dune Dashboard.

The proposal is live on [governance forum](https://gov.renzoprotocol.com/t/rez-buyback-burn-program/251) for community discussion before Snapshot voting.

Renzo Protocol Joins SparkLend, Enables ezETH Borrowing

Thu 27th Mar 2025

SparkLend has expanded its borrowing options by onboarding Renzo Protocol, allowing users to borrow against ezETH tokens. This integration is part of a broader expansion that includes four new assets:

- rsETH from KelpDAO

- ezETH from Renzo Protocol

- tBTC from The T Network

- LBTC from Lombard Finance

Users can now access these enhanced borrowing capabilities on [Spark's platform](https://app.spark.fi/borrow).

Renzo's ezETH Launches on Fluid with Enhanced Features

Thu 27th Mar 2025

Renzo's ezETH has launched on Fluid, offering new DeFi capabilities:

- Two new pools available:

* ezETH / wstETH

* ezETH-ETH / wstETH

**Key Features:**

- Up to 96% LTV for wstETH borrowing

- Smart Collateral and Smart Debt functionality

- 4x points earning on all ezETH deposits

- Intuitive interface for swapping, lending, and borrowing

Users can supply ezETH or ezETH-ETH as collateral, enabling dual-sided rewards through Smart Collateral and Smart Debt systems.

[Visit Fluid's documentation](https://fluid.guides.instadapp.io/vault-protocol/vaults-on-fluid) for detailed information.

Renzo Protocol Expands to Base L2 with REZ/USDC Pool Launch

Thu 20th Mar 2025

Renzo Protocol has expanded to Base, one of the fastest-growing L2 networks powered by Coinbase. The integration features:

- First REZ DeFi integration on Base through REZ/USDC pool on Aerodrome Finance

- Bridge functionality powered by Hyperlane

- Additional rewards for LP providers

Users can access the new features through:

- [Aerodrome Finance](https://aerodrome.finance/pools) for liquidity provision

- [Renzo Bridge Dapp](https://app.renzoprotocol.com/bridge) for token bridging

Support available via [Discord](https://discord.gg/renzoprotocol)