Renzo

Renzo is the restaking hub of Eigenlayer built to streamline and expand access to the most intelligent Liquid Restaking strategies. Powered by institutional-grade node operators, Renzo abstracts away the complexities of securing Actively Validated Services (AVS) while delivering a powerful interface for risk management and rewards tracking on Eigenlayer. With Renzo’s ezETH—the most integrated Liquid Restaking Token (LRT)—users can access broad exposure to the EigenLayer (and Ethereum) ecosystems with more opportunities to generate rewards. Learn more: https://www.renzoprotocol.com/

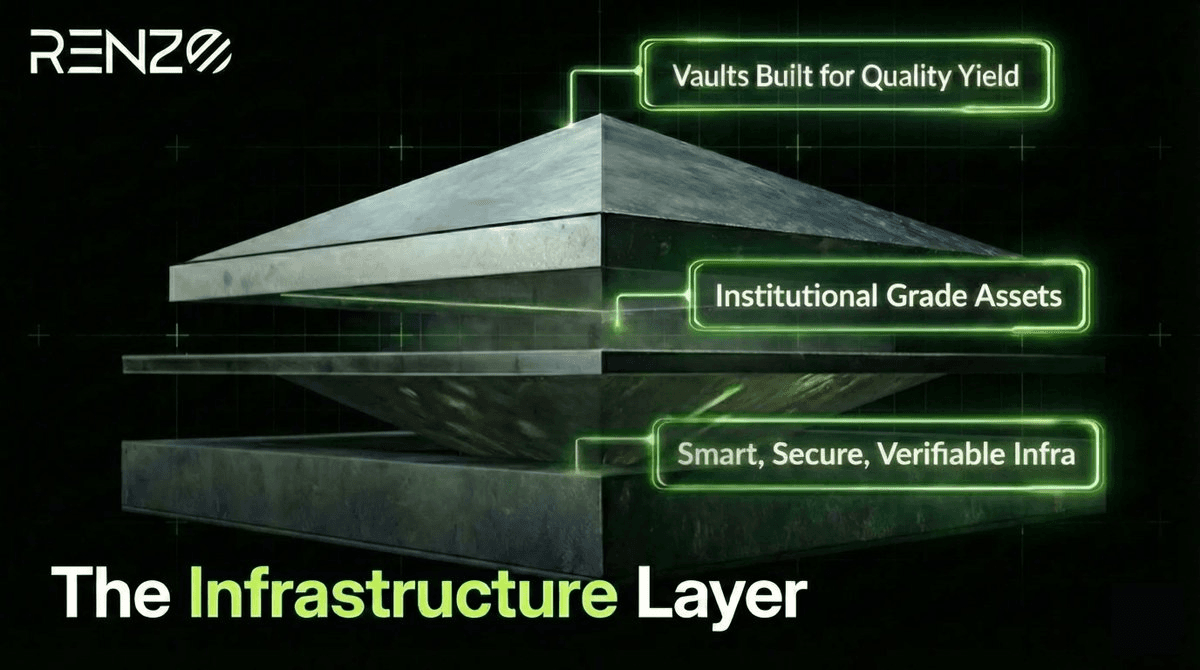

🏗️ Infrastructure Gap Blocks Regulated Assets from DeFi Vaults

Fri 6th Feb 2026

DeFi vaults are experiencing significant growth in 2026, expanding from $6B to over $15B. However, a critical infrastructure challenge remains.

**The Core Issue**

Vaults operate at the application layer, working with existing DeFi yield. The fundamental bottleneck isn't vault technology—it's the lack of infrastructure to bring regulated assets into DeFi in the first place.

**Key Points**

- Vaults can only work with assets already in DeFi

- Infrastructure must exist before applications can scale

- The question remains: who is building the necessary infrastructure layer?

This infrastructure gap represents the primary obstacle to broader institutional adoption and vault expansion.

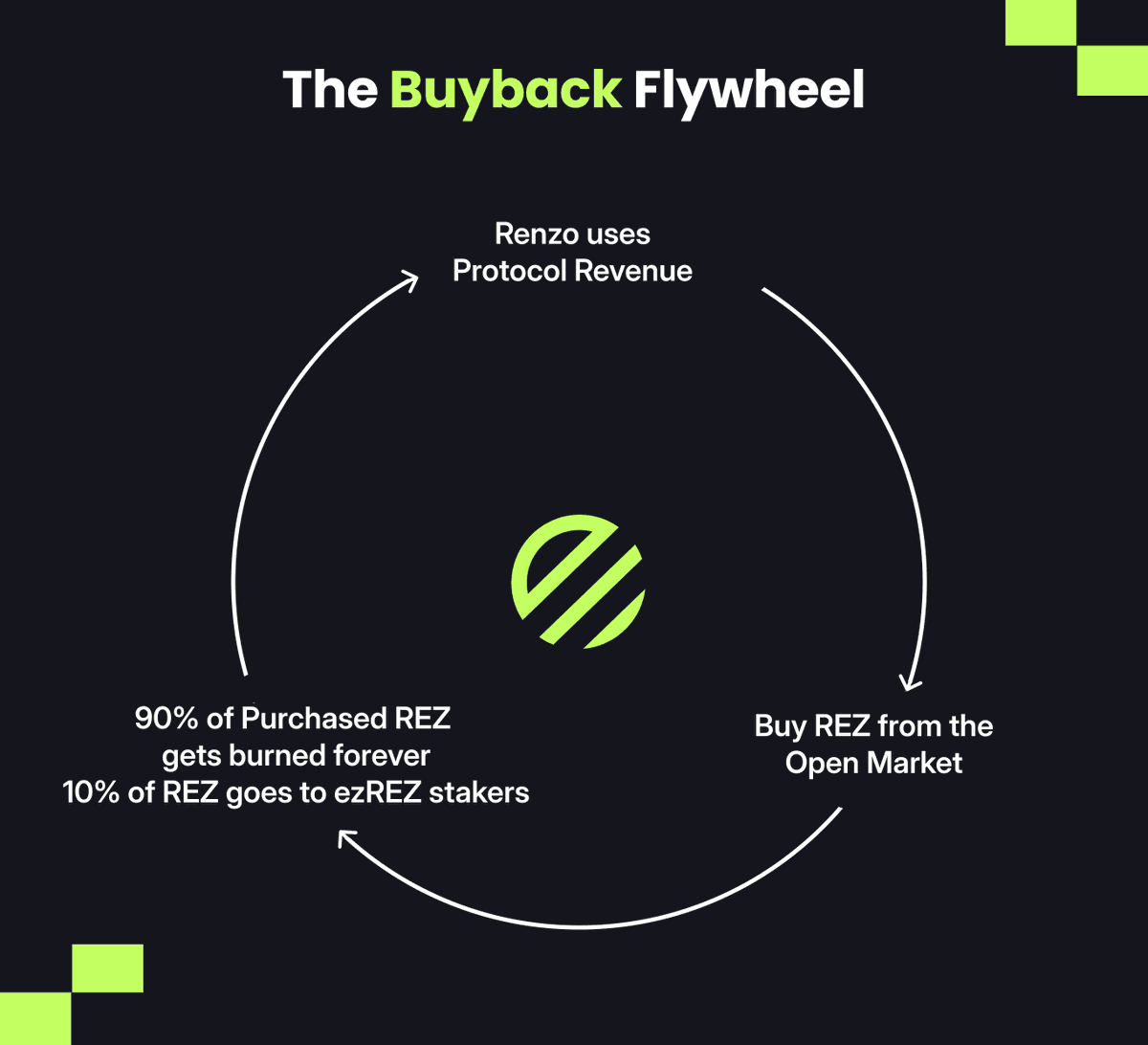

🔥 Renzo Launches Real-Time Buyback Dashboard

Fri 6th Feb 2026

Renzo Protocol has introduced a **Buyback and Burn Flywheel** program for its REZ token, with real-time tracking available through a [Dune Analytics dashboard](https://dune.com/renzo_team/renzo-protocol#rez-buyback-program).

**Key Details:**

- The program aims to reduce REZ token supply through systematic buybacks and burns

- Token holders can monitor the program's progress in real-time

- Renzo emphasizes alignment between protocol success and token holder outcomes

The initiative represents Renzo's commitment to its community and REZ holders, creating a transparent mechanism where protocol growth directly benefits token holders through supply reduction.

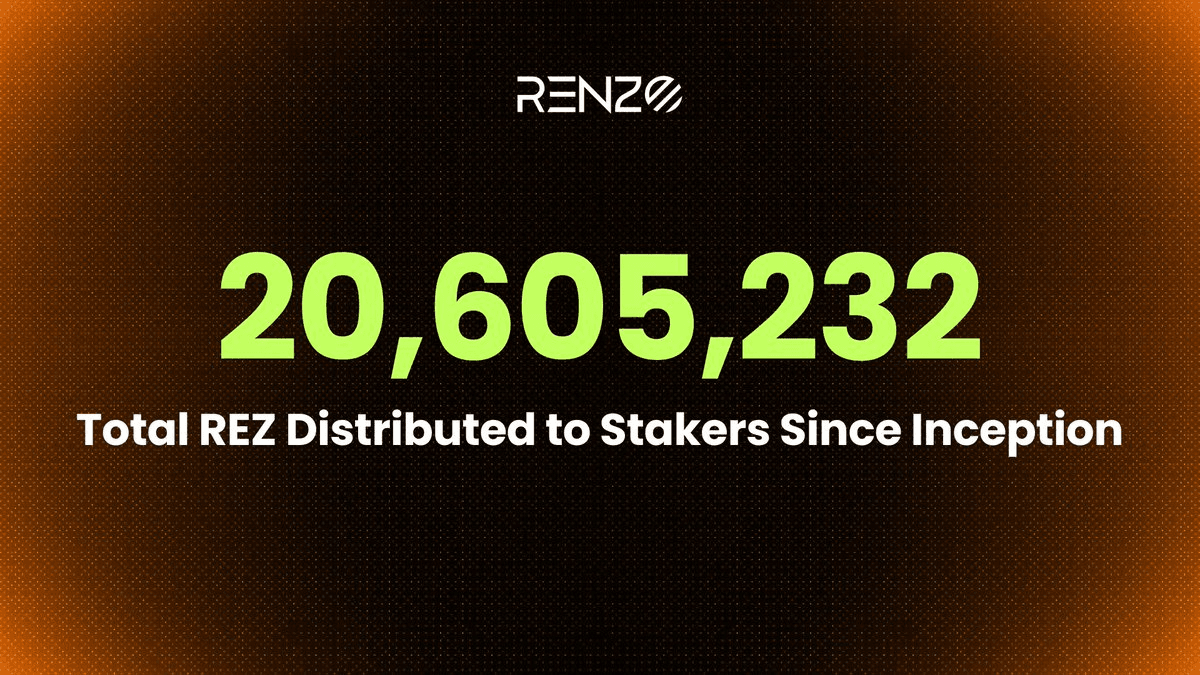

Renzo Distributes Over 20M REZ to Stakers

Fri 6th Feb 2026

Renzo has distributed a cumulative total of **20,605,232.6 REZ** to REZ stakers since the program's inception.

**Key Protocol Metrics:**

- Purchased 206,052,326 REZ from the open market using protocol revenues

- Burned 185,447,093 REZ, reducing total supply by 1.85%

- Additional token burns planned for the future

The distribution represents ongoing rewards for participants in Renzo's staking program, funded through the protocol's revenue-generating activities. The token buyback and burn mechanism aims to manage REZ supply while rewarding long-term holders.

Renzo Completes Fourth Token Buyback and Burn

Fri 6th Feb 2026

Renzo Protocol has executed its fourth buyback and burn event as part of its ongoing token economics program.

**Key Details:**

- REZ tokens were purchased from the open market

- Tokens have been permanently burned, reducing total supply

- Additional REZ distributed to stakers as rewards

This marks the fourth iteration of the program, following previous burns in January. The initiative aims to manage token supply while rewarding long-term holders who stake their REZ tokens.

Specific amounts and cumulative totals are available in the full thread announcement.

The Infrastructure Gap Between Regulated Assets and DeFi Capital

Fri 6th Feb 2026

The tokenized economy faces a critical infrastructure challenge: **asset issuers need distribution and liquidity**, while **allocators want access to high-quality assets**, but there's no bridge between them.

Most tokenized assets are permissioned, requiring compliance checks and eligibility requirements that prevent them from integrating with DeFi protocols. This creates what's known as the **Integration Gap**—quality regulated assets exist but remain isolated from DeFi capital markets.

The core problem:

- Supply side: Issuers lack distribution channels

- Demand side: Allocators can't access quality assets

- Missing piece: Infrastructure to connect regulated assets with DeFi

The question remains: who will build the rails to bridge this gap?

The Integration Gap: Quality Tokenized Assets Stuck Outside DeFi

Fri 6th Feb 2026

**The Challenge**

Tokenized assets are moving onchain, but most remain isolated from DeFi due to compliance requirements and eligibility checks. This "Integration Gap" prevents quality permissioned assets from accessing decentralized finance infrastructure.

**Key Barriers**

- Compliance checks and eligibility requirements create friction

- Permissioned assets can't easily plug into existing DeFi protocols

- Quality institutional assets exist but remain disconnected from DeFi liquidity

**What's Needed**

The industry needs solutions that bridge traditional finance compliance with DeFi's composability, allowing regulated assets to access decentralized markets while maintaining necessary oversight.

🔄 The Evolution from DeFi to RealFi

Fri 6th Feb 2026

**Key Lessons from TradFi and DeFi Integration:**

- **Infrastructure over yield sources** - Building robust systems matters more than chasing returns

- **Flexibility over single-stack lock-in** - Adaptable solutions win over rigid frameworks

- **Selective transparency over everything public** - Strategic disclosure beats total openness

These insights reveal opportunities beyond restaking.

**The Shift to RealFi:**

Web3 capital is moving from speculation toward real-world assets that generate tangible value:

- Clear ownership structures

- Physical asset backing

- Demand from traditional markets

- Predictable economic models

Instead of token-generated yields, RealFi connects Web3 to commodities, treasuries, and physical assets moving trillions off-chain. This represents Web3's maturation into lasting economic infrastructure.

🔐 Renzo Launches ezETH Alpha Loop Vault

Fri 6th Feb 2026

Renzo Protocol has launched the **ezETH Alpha Loop Vault** in partnership with Compound Finance, marking a new addition to Renzo Reserve.

The vault represents a strategic expansion of Renzo's liquid restaking offerings, building on their existing ezETH token infrastructure. This collaboration with Compound Finance introduces automated looping strategies for ezETH holders.

**Key Points:**

- Partnership between Renzo Protocol and Compound Finance

- New Alpha Loop Vault for ezETH token holders

- Part of Renzo Reserve's expanding product suite

- Detailed technical specifications available in the blog post

The vault aims to provide ezETH users with additional yield optimization strategies while maintaining exposure to Ethereum staking and EigenLayer restaking rewards.

Full technical details and implementation specifics are available in [Renzo's blog post](https://blog.renzoprotocol.com/2026/01/15/new-ezeth-loop-vault-on-compound/).

Renzo Protocol Launches Auto-Compounding ETH Yields with ezcompeth1

Fri 6th Feb 2026

Renzo Protocol has introduced automated ETH yield generation through their new ezcompeth1 product, currently supporting WETH deposits.

**Key Features:**

- Automated yield compounding on autopilot

- Available exclusively for WETH holders

- Accessible through Renzo's Reserve platform

This launch builds on Renzo's recent expansion to Swellchain, where users can already access auto-compounding restaking rewards with ezETH and pzETH tokens.

Renzo continues to simplify liquid restaking by abstracting the technical complexities of Eigenlayer while providing institutional-grade node operations and risk management tools.

[Access ezcompeth1](https://app.renzoprotocol.com/reserve/ezcompeth1)

Crypto Vaults Evolve: Team Ships Yield-Focused, Gas-Efficient Solution After Months of Development

Fri 6th Feb 2026

A development team has launched an updated approach to crypto vaults after identifying key pain points in the market.

**Key Features:**

- Yield-focused design with reward-bearing tokens

- Gas-efficient operations

- 100% automation

- Safety-by-design architecture

The innovation follows the team's pivot to tokenized vaults (V2) after earlier strategies didn't gain traction. These vaults have been tested over 500 days of live performance and are deployed across multiple layers via Superform.

The shift came after recognizing that users prioritized security and yield over other features, despite ongoing challenges with market liquidity concentration among large holders.