Native

Native is an infrastructure layer that turns exchange into a feature, empowering any project to set up and deploy their own DEX, integrated directly into their app. The infrastructure connects projects to deep, efficient liquidity through a series of proprietary integrations with both on and off-chain liquidity sources. It also enables projects teams to earn all their own fee revenue instead of giving it away to exchanges.

Native consists of modular smart contracts and a code-free toolkit to interact with project teams. It also includes integrations with all major aggregators and DEXs, as well as proprietary integrations with professional liquidity providers and market makers. These proprietary liquidity sources account for over 30% of daily crypto trading volume.

Between the liquidity and the underlying tech, Native gives teams a significant advantage over legacy standalone DEXs, and it’s completely free to use.

Shopify empowered millions of entrepreneurs to create their own eCommerce sites, cutting out middle-men, reducing costs, and boosting revenue. Native does the same for crypto entrepreneurs. The tech is completely modular, so teams can create whatever type of exchange they want, using whatever liquidity sources, pricing models, and trading pairs they want.

Liquidity comes from one of three sources:

- The project itself

- The community (public pools)

- Outside liquidity sources (AMMs, Aggregators, Market makers, or professional liquidity providers)

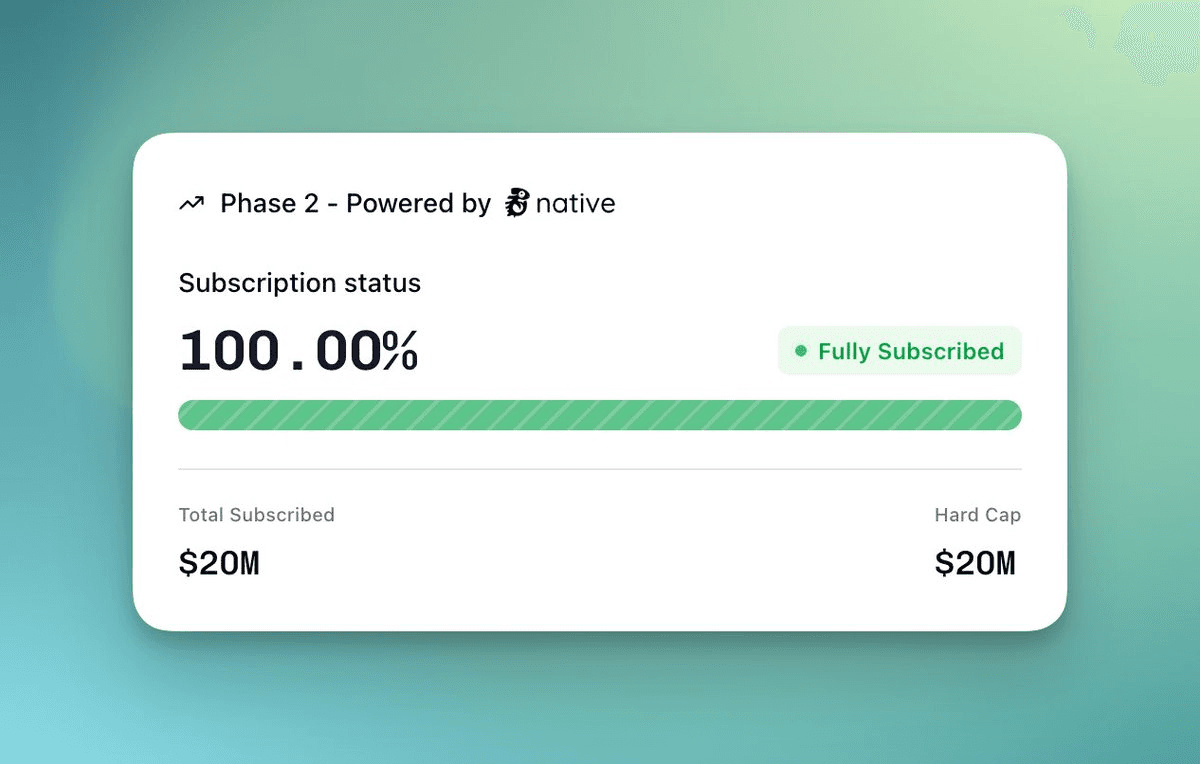

BuidlPad x Native Earn Phase 2 Reaches $20M Cap

Native DEX Infrastructure Hits $200M Daily Volume Milestone

Native V2 Achieves $30M-$60M Daily DEX Volume with CEX-Level Trading Depth

Native V2 Integrates Sahara Labs AI with Zero-Slippage Trading on BNB Chain

Native Powers Large $SKATE Token Swap with On-Chain Liquidity

DODO Integrates Native as Liquidity Source on Multiple Chains

Native Protocol Launches Infrastructure for Custom DEX Deployment

Native DEX Launches MEV-Free Trading for MyShell Token

Native and StakeStone Partnership Enhances LST Liquidity Infrastructure