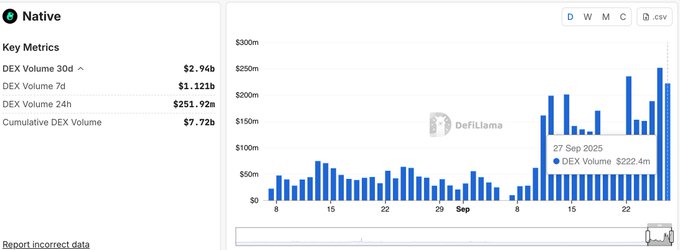

Native DEX Infrastructure Hits $200M Daily Volume Milestone

Native DEX Infrastructure Hits $200M Daily Volume Milestone

📈 $200M Volume Milestone

Native's DEX infrastructure reached $200 million in daily trading volume on September 27th, marking consistent performance after hitting the same milestone just two days later on September 29th.

This achievement follows Native's impressive August performance when it:

- Crossed $1.25 billion in 24-hour volume

- Ranked #3 in trading volume among all DEXs

- Outpaced nearly the entire perpetual DEX space

Native's infrastructure allows projects to deploy their own DEXs while keeping all fee revenue instead of paying it to traditional exchanges. The platform connects to deep liquidity through proprietary integrations with professional market makers and liquidity providers.

The modular system gives teams flexibility to customize their exchange setup, trading pairs, and pricing models while accessing liquidity from multiple sources including AMMs, aggregators, and professional providers.

Daily $200M DEX volume

BuidlPad x Native Earn Phase 2 Reaches $20M Cap

Native's BuidlPad Earn Phase 2 has reached full capacity at $20M in total value locked. **Key Details:** - Phase 2 is now completely filled - Participants who missed the rollover can maintain funds in Phase 1 vaults - Phase 1 vault holders receive **priority access to Phase 3** - Flexible staking continues with competitive APRs **Rewards Distribution:** - Phase 1 distributed $129,000 USD total to participants - Ongoing rewards of approximately $25,000 USD weekly for flexible staking liquidity providers Users can access flexible staking through Native's [credit pool](https://native.org/app/credit-pool/?chainId=1).

Native V2 Achieves $30M-$60M Daily DEX Volume with CEX-Level Trading Depth

**Native V2 has reached significant trading milestones** since its launch, processing $30M-$60M in daily DEX volume. Key achievements include: - **CEX-level depth and spreads** for WETH-USDT/USDC pairs on Ethereum - **$1M+ whale trades** settled in single transactions - **$3.5M WETH-Stables** processed in one transaction - **Top-2 liquidity source** position on OKX Wallet The platform demonstrates **institutional-grade trading capabilities** by matching centralized exchange performance in terms of liquidity depth and tight spreads. *Native's infrastructure enables projects to deploy their own DEX with deep liquidity access.*

Native V2 Integrates Sahara Labs AI with Zero-Slippage Trading on BNB Chain

Native V2 has announced integration with Sahara Labs AI, offering MEV-free trading with zero slippage on BNB Chain. Key features: - Zero slippage trading - MEV-free transactions - On-chain liquidity support Users can access the platform through multiple entry points: - OKX wallet - KyberNetwork - BreederDodo - Direct trading on [Native.org](http://native.org) This follows Native's February launch of MEV-free trading and impermanent loss-free liquidity provisioning, showing continued platform evolution.

Native Powers Large $SKATE Token Swap with On-Chain Liquidity

Native infrastructure successfully facilitated a significant $SKATE token swap, demonstrating its capability in handling large-scale on-chain transactions. Key highlights: - Successful execution of 10,000 USDT to $SKATE conversion - Transaction powered entirely by Native maker liquidity - MEV-free and fully on-chain execution - Efficient processing with minimal slippage This swap showcases Native's ability to provide deep liquidity and secure transaction processing for decentralized exchanges. The platform continues to support projects with professional-grade trading infrastructure.