Morpho

Morpho is a Lending protocol.

It is a lending pool optimizer and can be seen as a peer-to-peer layer on top of lending pools like Compound or Aave. Rates are seamlessly improved for suppliers and borrowers while preserving the same liquidity and risk parameters.

In short:

- Morpho AaveV2 Optimizer is an upgraded version of Aave V2.

- Morpho AaveV3-ETH Optimizer is an upgraded version of Aave V3 ETH e-mode.

- Morpho CompoundV2 Optimizer is an upgraded version of Compound V2.

As such, Morpho enhances your rates while preserving the same user experience, the same liquidity, and the same risk parameters as the underlying protocols

Morpho Builds Global Onchain Liquidity Network Connecting Banks and Fintechs

Thu 13th Nov 2025

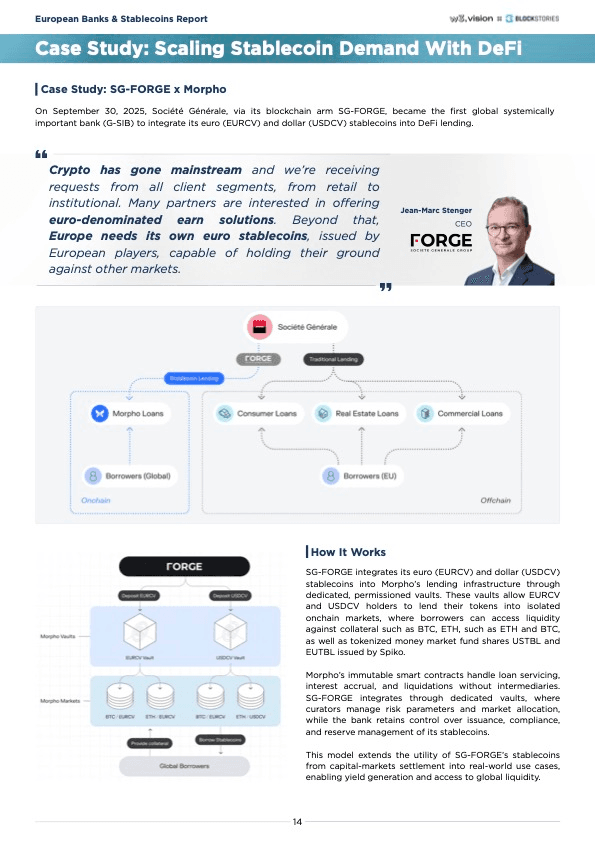

**Morpho is developing a global onchain liquidity network** that bridges traditional finance with DeFi by connecting banks, fintechs, and capital markets.

The Block Stories European Banks & Stablecoin Report showcases how **Morpho drives stablecoin adoption** among regulated financial institutions.

**Key highlights:**

- Regulated banks like Société Générale Forge are adopting stablecoins through Morpho's infrastructure

- The network enables seamless liquidity flow between traditional and decentralized finance

- Growing institutional adoption demonstrates real-world utility for onchain financial services

This development represents a significant step toward **mainstream institutional DeFi adoption**, as traditional banks increasingly explore blockchain-based financial infrastructure.

[Read the full report](https://www.blockstories.io/)

🔄 Morpho Launches V2 Vaults

Thu 13th Nov 2025

**Morpho has officially launched Vaults V2**, marking a significant upgrade to their lending protocol infrastructure.

**Key Features:**

- Fully onchain, verifiable, and noncustodial

- Designed specifically for enterprise and institutional asset management

- Built for the future of onchain asset management

**Curated Partners:**

The V2 vaults are curated by leading firms including:

- Keyrock

- ClearstarLabs

- Gauntlet

- SteakhouseFi

- Re7Labs

- Hyperithm

- kpk_io

**What This Means:**

Vaults V2 represents Morpho's evolution toward serving institutional clients who need robust, transparent, and secure onchain asset management solutions.

[Explore Vaults V2](https://app.morpho.org/ethereum/earn?vaultV2Filter=true)

🔍 Credora Risk Ratings Return to Morpho Protocol

Mon 10th Nov 2025

**Credora risk ratings are making a comeback on Morpho**, the lending protocol optimizer.

**Key developments:**

- Curators can now **opt in to independent risk assessments** from Credora via RedStone

- Risk ratings help **surface vault risks** and provide transparency

- Users gain **additional insights** for informed lending decisions

This marks a return of the risk rating system that was previously discussed in Morpho's governance forum earlier this year.

**Why it matters:** Enhanced risk visibility could improve user confidence in Morpho's lending vaults, potentially driving more adoption of the protocol's peer-to-peer lending optimization services.

Curators interested in implementing these ratings can explore the opt-in process through Morpho's platform.

Vaults Become New Standard for Asset Curation with 50%+ Market Share

Thu 25th Sep 2025

**Keyrock Trading's latest Onchain Asset Management Report** reveals that vaults have emerged as the dominant standard for asset curation in DeFi.

**Key findings:**

- Curated vaults on Morpho now represent **over 50% of all deposits** secured by ERC-4626 vaults

- This marks a significant shift toward **professional asset management** in decentralized finance

- Vaults are becoming the preferred method for **optimizing yield strategies**

The report highlights how institutional-grade curation is gaining traction, with platforms like Morpho leading the charge in vault adoption.

**Recent developments** include Spark officially entering the asset curation space with their new vault offerings, leveraging the Spark Liquidity Layer to optimize allocations.

This trend suggests that **automated, curated investment strategies** are becoming mainstream in DeFi, moving beyond simple lending and borrowing.

Morpho Reaches $6B TVL Milestone

Mon 4th Aug 2025

Morpho's lending protocol optimization platform has maintained over $6 billion in Total Value Locked (TVL) and $9 billion in total deposits since August 1st, 2025. This represents significant growth from $2.5 billion TVL reported in mid-July 2025.

The protocol, which enhances rates on major lending platforms while maintaining their risk parameters, has shown consistent growth in adoption across its optimizers for AaveV2, AaveV3-ETH, and CompoundV2.

- TVL growth: $2.5B → $6B+ in ~2 weeks

- Total deposits: $9B+

- Sustained levels since August 1st

This rapid expansion demonstrates increasing user confidence in Morpho's lending pool optimization technology.

Morpho Launches on World App with $5M Rewards Campaign

Mon 28th Apr 2025

**Morpho** has integrated with the World app, enabling 25M+ users to access crypto-backed loans and onchain yield directly through the platform.

Key features:

- Easy deposit, borrowing, and asset management via Morpho Mini App

- Advanced features accessible through okutrade frontend

- Mobile-first experience from joinlegend

- Built-in bridging functionality

- Initial vaults: USDC, WETH, ezETH, WBTC, and WLD

A $5M rewards campaign launches today for lending and borrowing activities, marking Morpho's largest launch campaign to date. This follows Morpho's recent integration as Trust Wallet's default earn engine.

Maple Finance Integrates with Morpho for Enhanced SyrupUSDC Borrowing

Thu 27th Mar 2025

Maple Finance has integrated with Morpho Labs to enable borrowing against SyrupUSDC. The new feature is now live with USDC borrowing available through Gauntlet and MEV Capital vaults.

Key features:

- Supply SyrupUSDC as collateral (~11-12% yield)

- Borrow USDC at ~56% rate

- Mint new SyrupUSDC

- Potential for ~5% additional yield per cycle

Users can access the borrowing feature at [Morpho's platform](https://app.morpho.org/ethereum/market/0x729badf297ee9f2f6b3f717b96fd355fc6ec00422284ce1968e76647b258cf44/syrupusdc-usdc).

Morpho Launches Explore Feature and Expands to Multiple Chains

Thu 13th Feb 2025

Morpho has launched its Explore feature on the Morpho App, providing enhanced protocol metrics and vault information in one centralized location.

The protocol continues its multichain expansion with new deployments on:

- Unicorn Chain

- Mode Network

- Hemi

- Corn

- Sonic Labs

These infrastructure-only deployments include core smart contracts but require DAO approval for frontend support and MORPHO rewards.

Recent developments:

- Became largest lending protocol on Base

- Awarded 198,000 MORPHO to 11 teams in pilot grant program

- Released refreshed app with improved backend architecture

- Implemented Pre-Liquidations for enhanced loan management

[Try Explore now](https://app.morpho.org/ethereum/explore)

Morpho Becomes Leading Lending Protocol on Base Network

Mon 3rd Mar 2025

Morpho has achieved a significant milestone by becoming the largest lending protocol on Base network, measured by active loans. The protocol, which optimizes lending pools through a peer-to-peer layer, operates on top of established platforms like Compound and Aave.

Morpho's key features:

- Seamless rate improvements for users

- Maintains same liquidity and risk parameters as underlying protocols

- Operates optimized versions of AaveV2, AaveV3-ETH, and CompoundV2

The protocol's growth on Base demonstrates increasing adoption of optimized DeFi lending solutions.

Morpho Expands to Multiple Chains with Infrastructure Deployments

Thu 30th Jan 2025

**Morpho has expanded to seven new chains** including Polygon POS, World Chain, Ink, Arbitrum, Scroll, Fraxtal, and OP Mainnet.

Key points:

- Infrastructure-only deployments without initial Morpho App support or MORPHO rewards

- Can transition to core deployments with DAO approval

- Independent builders encouraged to develop on these chains

- Includes full suite of smart contracts including Vaults 1.1 and Oracles

Security features:

- Audited by SpearbitDAO and OpenZeppelin

- Formal verification by CertoraInc

- $2.5M bug bounty program

*Future deployments will focus on chains with confirmed curator and builder interest.*