Morpho Builds Global Onchain Liquidity Network Connecting Banks and Fintechs

Morpho Builds Global Onchain Liquidity Network Connecting Banks and Fintechs

🏦 Banks Going Onchain

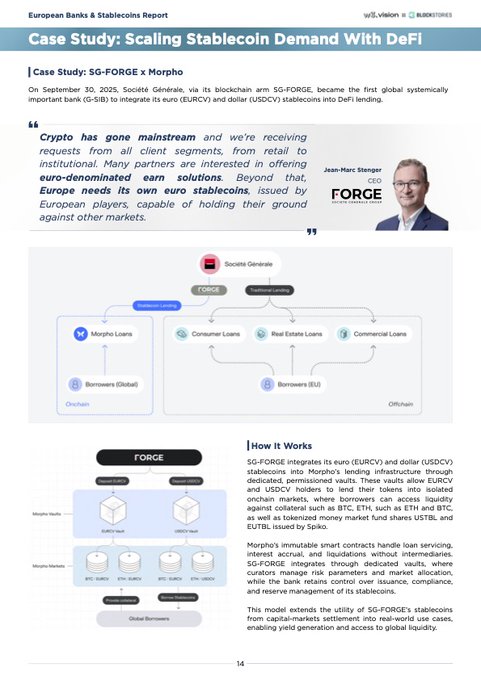

Morpho is developing a global onchain liquidity network that bridges traditional finance with DeFi by connecting banks, fintechs, and capital markets.

The Block Stories European Banks & Stablecoin Report showcases how Morpho drives stablecoin adoption among regulated financial institutions.

Key highlights:

- Regulated banks like Société Générale Forge are adopting stablecoins through Morpho's infrastructure

- The network enables seamless liquidity flow between traditional and decentralized finance

- Growing institutional adoption demonstrates real-world utility for onchain financial services

This development represents a significant step toward mainstream institutional DeFi adoption, as traditional banks increasingly explore blockchain-based financial infrastructure.

Morpho is building a global onchain liquidity network that connects banks, fintechs, and capital markets. @block_stories European Banks & Stablecoin Report highlights how Morpho drives the adoption of stablecoins from regulated banks such as @SocieteGenerale Forge.

🔄 Morpho Launches V2 Vaults

**Morpho has officially launched Vaults V2**, marking a significant upgrade to their lending protocol infrastructure. **Key Features:** - Fully onchain, verifiable, and noncustodial - Designed specifically for enterprise and institutional asset management - Built for the future of onchain asset management **Curated Partners:** The V2 vaults are curated by leading firms including: - Keyrock - ClearstarLabs - Gauntlet - SteakhouseFi - Re7Labs - Hyperithm - kpk_io **What This Means:** Vaults V2 represents Morpho's evolution toward serving institutional clients who need robust, transparent, and secure onchain asset management solutions. [Explore Vaults V2](https://app.morpho.org/ethereum/earn?vaultV2Filter=true)

🔍 Credora Risk Ratings Return to Morpho Protocol

**Credora risk ratings are making a comeback on Morpho**, the lending protocol optimizer. **Key developments:** - Curators can now **opt in to independent risk assessments** from Credora via RedStone - Risk ratings help **surface vault risks** and provide transparency - Users gain **additional insights** for informed lending decisions This marks a return of the risk rating system that was previously discussed in Morpho's governance forum earlier this year. **Why it matters:** Enhanced risk visibility could improve user confidence in Morpho's lending vaults, potentially driving more adoption of the protocol's peer-to-peer lending optimization services. Curators interested in implementing these ratings can explore the opt-in process through Morpho's platform.

Vaults Become New Standard for Asset Curation with 50%+ Market Share

**Keyrock Trading's latest Onchain Asset Management Report** reveals that vaults have emerged as the dominant standard for asset curation in DeFi. **Key findings:** - Curated vaults on Morpho now represent **over 50% of all deposits** secured by ERC-4626 vaults - This marks a significant shift toward **professional asset management** in decentralized finance - Vaults are becoming the preferred method for **optimizing yield strategies** The report highlights how institutional-grade curation is gaining traction, with platforms like Morpho leading the charge in vault adoption. **Recent developments** include Spark officially entering the asset curation space with their new vault offerings, leveraging the Spark Liquidity Layer to optimize allocations. This trend suggests that **automated, curated investment strategies** are becoming mainstream in DeFi, moving beyond simple lending and borrowing.

Morpho Reaches $6B TVL Milestone

Morpho's lending protocol optimization platform has maintained over $6 billion in Total Value Locked (TVL) and $9 billion in total deposits since August 1st, 2025. This represents significant growth from $2.5 billion TVL reported in mid-July 2025. The protocol, which enhances rates on major lending platforms while maintaining their risk parameters, has shown consistent growth in adoption across its optimizers for AaveV2, AaveV3-ETH, and CompoundV2. - TVL growth: $2.5B → $6B+ in ~2 weeks - Total deposits: $9B+ - Sustained levels since August 1st This rapid expansion demonstrates increasing user confidence in Morpho's lending pool optimization technology.