Metronome Synth

Metronome Synth is a leading synthetic protocol that enables users to post multi-collateral assets from their existing crypto holdings and create a multitude of synthetic assets in one complete platform. Synth will enable the creation of crypto synthetic assets, and the ability to swap synthetic assets with zero-slippage.

🔍 Metronome Revenue Surge Analysis

Thu 12th Feb 2026

**Jeff the Dunker** analyzed Metronome's recent revenue spike on Open Orbit Fridays hosted by Odyssey.

The discussion covered:

- Key factors behind the protocol's increased revenue

- Market dynamics driving growth

- Performance metrics and trends

Metronome is a synthetic asset protocol allowing users to create and swap synthetic assets with zero slippage using multi-collateral positions.

[Watch the full analysis](https://twitter.com/OdysseyFi)

Metronome Deploys $2M Treasury Revenue to Expand msUSD and msETH Liquidity Pools

Thu 12th Feb 2026

Metronome treasury has allocated over $2 million from recent revenue to establish new liquidity pools for msUSD and msETH on [Aerodrome](https://aerodrome.finance) and [Curve Finance](https://curve.fi).

**Key Details:**

- The deployment aims to improve liquidity connectivity for Metronome's synthetic assets

- Funds come from treasury revenue, not external capital

- Pools are now live on two major DeFi platforms

This move follows Metronome's ongoing strategy to strengthen infrastructure for its synthetic asset ecosystem. The protocol previously worked with Midas RWA on liquid yield tokens (mBASIS and mEDGE), which track DeFi strategy performance.

The new pools provide additional trading venues for users holding msUSD and msETH synthetic assets.

Metronome Deprecating Legacy FRAX Collateral Due to Chainlink Price Feed Sunset

Thu 22nd Jan 2026

Metronome is removing support for Legacy FRAX as collateral following Chainlink's decision to sunset FRAX price feeds.

**Key Actions Required:**

- Users must withdraw their FRAX positions to avoid liquidation

- Loan-to-value (LTV) ratios will be gradually reduced over the coming weeks

- This change affects Legacy FRAX only

**Background:**

This follows a similar pattern from May 2024 when Frax Finance deprecated the OHM-FRAX Fraxlend pair after Chainlink announced plans to deprecate the OHMv2/ETH price feed. In that case, the market was paused and users were urged to withdraw funds and pay down debt positions.

The deprecation is a technical necessity - without reliable price feeds from Chainlink, the protocol cannot safely maintain FRAX as collateral.

Full details and support available on [Metronome's Discord](https://discord.com/invite/metronome).

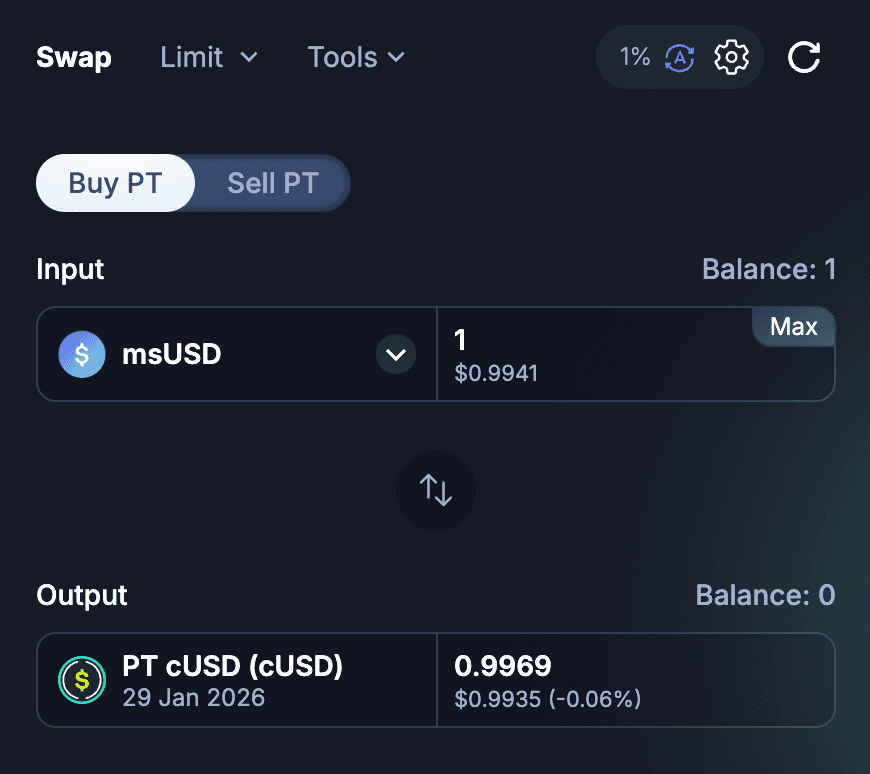

msUSD and msETH Now Available for Trading on Pendle Finance

Thu 22nd Jan 2026

**Metronome Synth assets expand trading options**

msUSD and msETH have been whitelisted and are now live on Pendle Finance's Mainnet, enabling users to swap these synthetic assets on the platform.

**Key details:**

- Both msUSD and msETH are now accessible for trading

- Integration is live on Ethereum Mainnet

- Expands liquidity options for Metronome Synth users

This follows previous integrations of Metronome assets, including mUSD's whitelisting on KyberSwap in September 2025.

Metronome Releases October Performance Report

Mon 17th Nov 2025

Metronome has published its **October performance report**, providing detailed insights into the synthetic protocol's monthly metrics and highlights.

The report covers key performance indicators and protocol developments from October, continuing the platform's regular monthly transparency updates.

- Monthly performance data and analytics

- Protocol highlights and key metrics

- Detailed breakdown of October activities

This follows previous monthly reports that track the multi-collateral synthetic asset platform's progress and user engagement.

[Read the full October report](https://mirror.xyz/0xBec0eE60106bc452e8182391169b5D7872d875Eb/Rvg3noHb0z9Z9N-6kUBX7p53zVgNpWGOwqlguZ9lF1k)

Metronome Reaches $63.5M TVL, Claims #2 Spot in Synthetics

Thu 9th Oct 2025

**Metronome hits major milestone** with aggregated TVL reaching ~$63.5M, positioning it as the #2 largest synthetics protocol by total value locked.

**Key details:**

- DeFiLlama currently lists Metronome at #3

- The discrepancy stems from excluded 3rd party collateral on Morpho

- Including all collateral would place Metronome at #2 among synthetic protocols

**Platform access:** Users can explore the protocol at [app.metronome.io/eth](https://app.metronome.io/eth)

This represents significant growth from the nearly $17M TVL reported in Q1'24, demonstrating strong adoption in the synthetics space.

Metronome Releases September Monthly Protocol Performance Report

Thu 9th Oct 2025

Metronome has published its **September monthly report**, providing insights into protocol performance and key developments.

The report continues the synthetic protocol's new series of **monthly updates** that began in August, offering transparency into operational metrics and highlights.

- Protocol performance data for September

- Key developments and milestones

- Ongoing updates from the multi-collateral synthetic asset platform

Read the full September report: [Metronome Monthly Report](https://mirror.xyz/0xBec0eE60106bc452e8182391169b5D7872d875Eb/9EDdD6-9INhkORXe58YqyCIlTRUWnSlcPh1y1gQgsQc)

*Stay informed on Metronome's progress in synthetic asset creation and zero-slippage swapping capabilities.*

Metronome Synth Joins Lithos on Plasma Network with New msUSD/USDT0 Pool

Mon 6th Oct 2025

**Metronome Synth has partnered with Lithos on the Plasma network**, launching a new msUSD/USDT0 liquidity pool.

**Key Features:**

- Part of the Genesis Program

- Users can earn **points, fees, and rewards**

- Pool is now live and operational

**Additional Plasma Activity:**

The network is seeing increased DeFi activity with Pendle USDe Principal Tokens also going live, offering enhanced rewards for participants.

**What This Means:**

The integration expands synthetic asset opportunities on Plasma while providing multiple earning mechanisms for liquidity providers.

oBUNNI Incentives Launch Announcement

Thu 3rd Jul 2025

The long-awaited oBUNNI incentives program has officially launched. This marks a significant milestone in the protocol's development and reward structure.

- Program is now live and accepting participants

- Users can start earning rewards through the incentives system

- Full details of the incentive structure are available

*Note: This represents a key expansion of the protocol's tokenomics and user rewards framework.*

Metronome DAO Executes 125K MET Buyback, Launches Rewards Program

Tue 8th Apr 2025

Metronome DAO has completed a 125,000 MET token buyback as part of its revenue share initiative. The tokens will be distributed to esMET lockers through a streaming rewards system.

Key details:

- Lock ratio: 1 MET = 15 esMET (lock periods 1 week to 2 years)

- Current max APR: 833% for longest locks

- Rewards stream continuously for 30 days

- Monthly buyback refreshes

Users can lock MET at [app.metronome.io/eth/lock-met](https://app.metronome.io/eth/lock-met). Manual claims available via Etherscan until frontend integration is complete.