Maverick Protocol

Maverick Protocol offers a new infrastructure for decentralized finance, built to facilitate the most liquid markets for traders, liquidity providers, DAO treasuries, and developers, powered by a revolutionary AMM. Maverick AMM helps its users maximize capital efficiency by automating the concentration of liquidity as price moves. Higher capital efficiency leads to more liquid markets, which means better prices for traders and more fees for liquidity providers. This built-in feature also helps LPs to eliminate the high gas fees that come from adjusting positions around price themselves. Liquidity providers can also now choose to follow the price of an asset in a single direction, effectively making a bet on the price trajectory of a specific token. These directional bets are similar to single-sided liquidity strategies, in that the liquidity provider will be mostly or entirely exposed to a single asset in a given pool. Together, these technological innovations represent a paradigm shift in the way smart contracts manage liquidity. Maverick is the first Dynamic Distribution AMM, capable of automating liquidity strategies that before now have required daily maintenance or the use of metaprotocols.

Maverick Protocol Targets Tokenized Stock Trading with Precision Liquidity AMM

Maverick v2 Hits $2.8B Trading Volume on Base with 10x Capital Efficiency

Maverick Community Breaks Down LP Economics in Comprehensive Guide

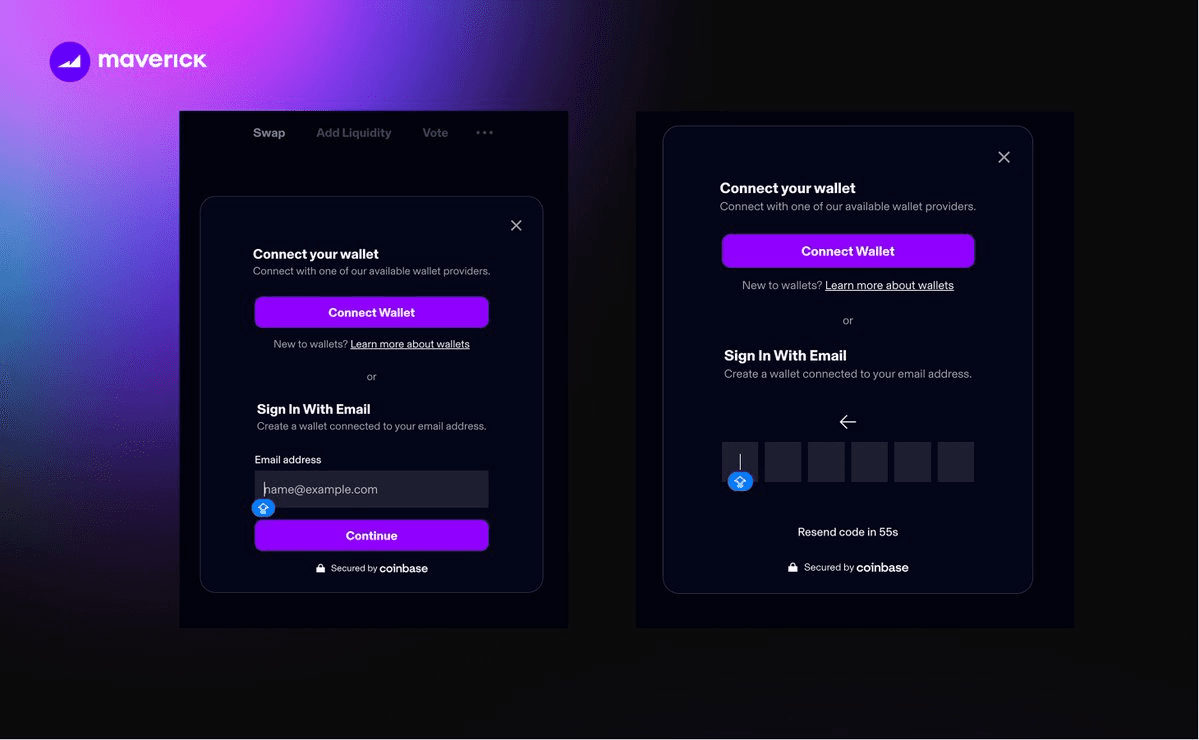

Coinbase Embedded Wallets Launch on Maverick Protocol for Simplified DeFi Access

Maverick Protocol Powers Base Network Since Launch Day

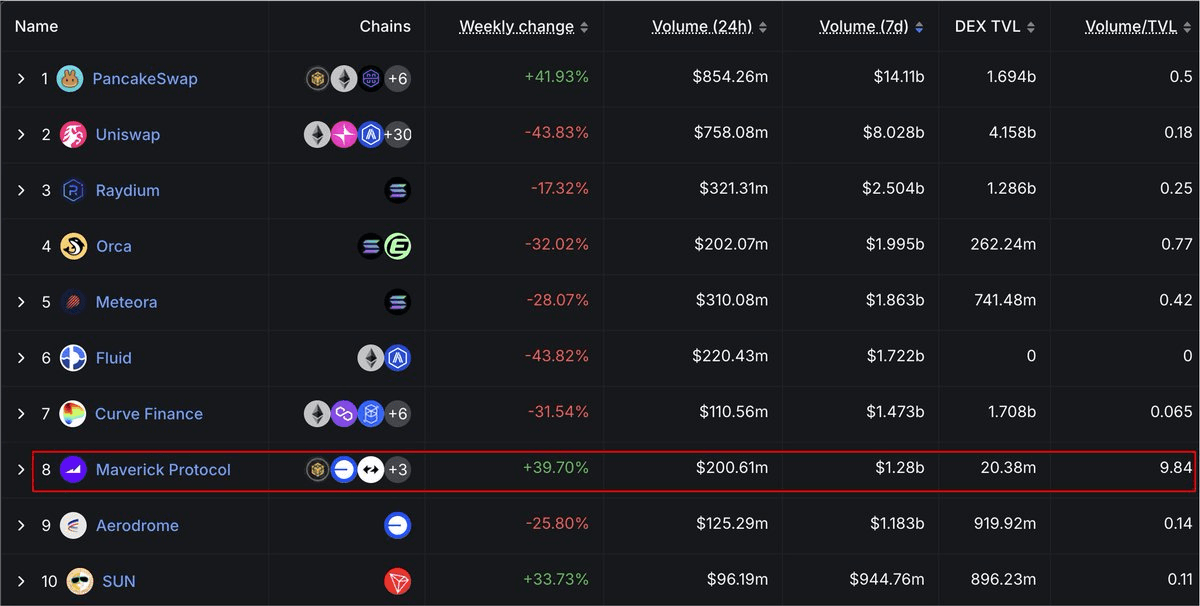

Maverick v2 Celebrates First Year with Top 5 DEX Rankings Across Multiple Chains

Maverick Protocol Introduces Modular Liquidity Infrastructure for DeFi

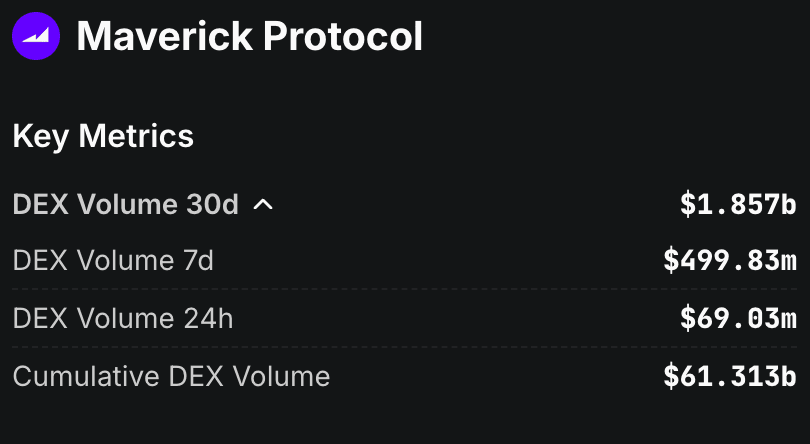

Maverick Protocol Achieves Top DEX Rankings with Superior Capital Efficiency

Maverick v2 Achieves Record Capital Efficiency on Arbitrum

Epoch 9 Voting Now Live for Maverick Protocol