Maverick Protocol Achieves Top DEX Rankings with Superior Capital Efficiency

Maverick Protocol Achieves Top DEX Rankings with Superior Capital Efficiency

🚀 DEX Wars: The Efficiency King

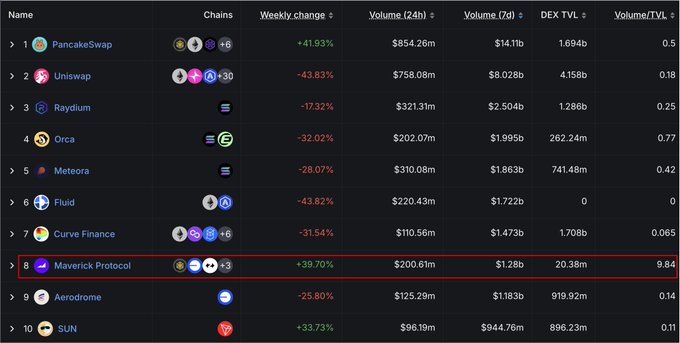

Maverick Protocol has established itself as a leading DEX, ranking in the top 8 across all chains by 7-day trading volume according to DeFiLlama. The protocol demonstrates exceptional capital efficiency metrics among the top 10 DEXs.

Key achievements:

- Maintained top 3-10 position in monthly trading volume since early 2023

- Delivers better pricing and market depth

- Provides enhanced returns for liquidity providers

The protocol's success on Arbitrum includes:

- Launch of gas-efficient Maverick v2 AMM

- Integration with 1inch and DIA oracle

- Achievement of top 5 status by volume

A good AMM/DEX provides better pricing & market depth with given liquidity—driving more on-chain volume. Maverick ranks top 8 across all chains by 7D volume while leading capital efficiency (volume/TVL) among the top 10 DEXs, accoridng to @DefiLlama. What does that mean? A🧵

Maverick v2 Hits $2.8B Trading Volume on Base with 10x Capital Efficiency

Maverick Protocol's v2 AMM has processed over **$2.8 billion in trading volume** on Base, demonstrating significant capital efficiency gains for liquidity providers. **Key Highlights:** - LPs earning fees in stablecoins, ETH, and other assets - Achieving **10x capital efficiency** compared to traditional venues - Requires fraction of TVL that other platforms need for similar volume - Part of Maverick's broader $40B+ total onchain trading volume milestone **What This Means:** Maverick's Dynamic Distribution AMM automatically concentrates liquidity as prices move, eliminating manual position adjustments and high gas fees. This automation enables LPs to earn more fees with less capital deployed. Projects building on Base can now [launch customized liquidity pools](https://app.mav.xyz/pool/new) on Maverick to access this capital-efficient infrastructure for both stablecoins/LSTs and long-tail tokens.

Maverick Community Breaks Down LP Economics in Comprehensive Guide

**Understanding LP Earnings Made Simple** Maverick Protocol community member @mavwarriors published a detailed 35-minute guide explaining the economics of liquidity provision on DEXs. The comprehensive resource covers: - How LP earnings actually work - Fee distribution mechanisms - Capital efficiency factors - Risk-reward calculations This educational content addresses common confusion around LP profitability and provides practical insights for both new and experienced liquidity providers. **Why This Matters** Many DeFi users provide liquidity without fully understanding their potential returns or associated risks. This guide fills that knowledge gap with clear explanations of the underlying economics. Read the full breakdown: [The Economics of Liquidity Provision](https://www.mav.xyz/blog/the-economics-of-liquidity-provision)

Coinbase Embedded Wallets Launch on Maverick Protocol for Simplified DeFi Access

**Coinbase Developer Embedded Wallets are now live on Maverick Protocol**, making DeFi participation significantly more accessible. **Key features include:** - Instant wallet creation with email login - Direct debit card deposits - One-click swapping and liquidity provision - Streamlined onboarding process Users can now access Maverick's advanced AMM features without the typical complexity of wallet setup and crypto onboarding. The integration eliminates traditional barriers like seed phrases and complex wallet management. **This builds on previous integrations** with Coinbase Smart Wallet, which already offered simplified gas experiences and easy onboarding for Maverick's liquidity strategies. The embedded wallet solution targets mainstream users who want DeFi exposure without technical hurdles. Access the platform at [app.mav.xyz](https://app.mav.xyz/).

Maverick Protocol Powers Base Network Since Launch Day

**Maverick Protocol has been operational on Base network since its initial launch**, offering liquidity providers flexible positioning options. **Key Features:** - Static and automated moving positions available - Strong fee generation for liquidity providers on Base - Capital-efficient AMM technology The protocol has demonstrated significant traction with **$60B+ in decentralized trading volume** across 6 chains, enabling lower slippage swaps through its innovative AMM design. **For Liquidity Providers:** Maverick's Dynamic Distribution AMM automates liquidity concentration as prices move, maximizing capital efficiency while reducing gas fees from manual position adjustments. [Start providing liquidity](https://app.mav.xyz/add-liquidity?chain=1)

Maverick v2 Celebrates First Year with Top 5 DEX Rankings Across Multiple Chains

Maverick v2 has achieved significant milestones in its first year, securing Top 5 DEX positions by 7-day volume across Ethereum, Arbitrum, Base, zkSync, and Scroll. Key achievements: - $32 Billion cumulative volume - Peak daily volume of $300M - Lowest gas costs in concentrated liquidity AMMs The protocol's success stems from its unique features: - Custom liquidity distribution - Directional trading modes - Boosted Positions with targeted incentives [Learn more about Maverick's liquidity technology](https://docs.mav.xyz)