Gearbox

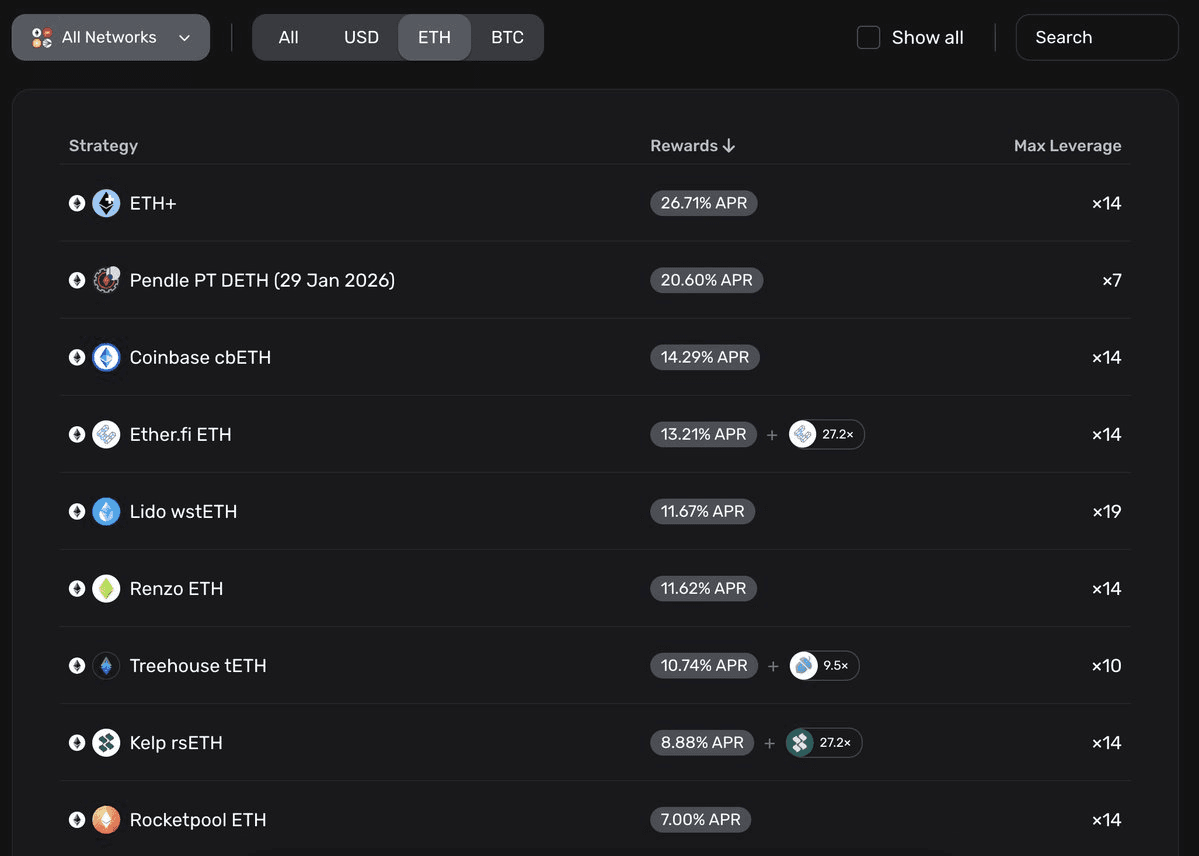

Gearbox is a generalized leverage protocol. It has two sides to it: passive lenders who earn low-risk APY by lending single-assets; and active farmers, firms, or even other protocols who borrow those assets to trade or farm with even x10 leverage.

Gearbox Protocol allows anyone to take DeFi-native leverage and then use it across various (DeFi & more) protocols. This enables you to compose your position as you want. You take leverage with Gearbox and then use it on other protocols you already love: Uniswap, Curve, Convex, Lido, etc. For example, you can leverage trade on Uniswap, leverage farm on Yearn, make delta-neutral strategies, hedge your exposure, get Leverage-as-a-Service for your structured product, and more...

Balancer Pools Launch on Gearbox with 10x Leverage for Liquid Staking

Thu 22nd Jan 2026

Gearbox has integrated Balancer pools, enabling users to provide liquidity with up to 10x leverage on StakeWise and Rocket Pool positions.

**Key Features:**

- Leverage liquidity provision up to 10x on select liquid staking pools

- Integration with StakeWise and Rocket Pool through Balancer

- Built on Gearbox's Permissionless infrastructure

- Curated by kpk for risk management

**How It Works:**

Users can now deposit collateral and borrow up to 10 times their position size to provide liquidity in Balancer pools containing liquid staking tokens. This allows for amplified exposure to LP rewards while maintaining the protocol's correlated debt model for reduced liquidation risk.

The deployment follows Gearbox's recent expansion to Lisk L2, where the protocol offers similar leverage capabilities with institutional-grade security and no platform fees.

Gearbox continues to expand its permissionless lending infrastructure across multiple chains and DeFi protocols.

Gearbox Introduces Credit Accounts for Real-World Asset Lending in DeFi

Thu 22nd Jan 2026

Gearbox Protocol has launched Credit Accounts (CAs), smart wallets designed to bring traditional finance lending mechanics to DeFi and Real-World Assets (RWAs).

**Key Features:**

- Users access actual credit lines rather than token looping mechanisms

- Borrowers can obtain up to 40% credit leverage

- Credit Accounts enforce logic and constraints required for RWA lending

- Capital can be deployed across permitted integrations while maintaining security

**How It Works:**

Unlike standard lending pools, Credit Accounts function as smart wallets that mirror real-world lending practices. This infrastructure enables borrowers to acquire assets with borrowed capital in a way that aligns with traditional finance credit lines.

The system is specifically built to handle the unique requirements of Real-World Assets, which demand more sophisticated lending structures than typical DeFi token operations.

Learn more about [Gearbox Protocol](https://gearbox.fi)

🚀 Gearbox Accelerates Market Listings 4X in Q4

Mon 1st Dec 2025

Gearbox Protocol has dramatically accelerated its market expansion in the final quarter of 2024.

**Key Metrics:**

- 50+ new markets listed in just 3 months

- 4X faster speed to market compared to previous pace

- Previously took all of 2024 to list 42 markets

This rapid expansion is part of Gearbox's preparation for **Gearbox Permissionless** - positioning the protocol for what they call "DeFi's inflection point."

The acceleration demonstrates the protocol's growing momentum as it builds toward a more permissionless future for leveraged DeFi trading.