EthicHub

EthicHub is a ReFi (Regenerative Finance) protocol helping unbanked farmers access capital at low-interest rates. Since its inception in 2018, EthicHub has intermediated more than $2M in loans and is helping over 1250 families in 21 communities.

EthicHub’s cornerstone and biggest asset are the crowd collateral it created with its community. EthicHub’s community who buy the $Ethix token and stake it on behalf of unbanked farmers, enable farmers to attract more investors to invest capital in their projects; whilst giving those same farmers security in the case of loan default and be able to pay back those capital investors.

Over the last four years, EthicHub has financed more than 340 projects and kept a default rate below 1%, a 0,7% default rate. The global average loan default for this population is about 4-5%. EthicHub operates in Mexico, Honduras, and Brazil and continuously seeks to expand its scope to new markets and continents.

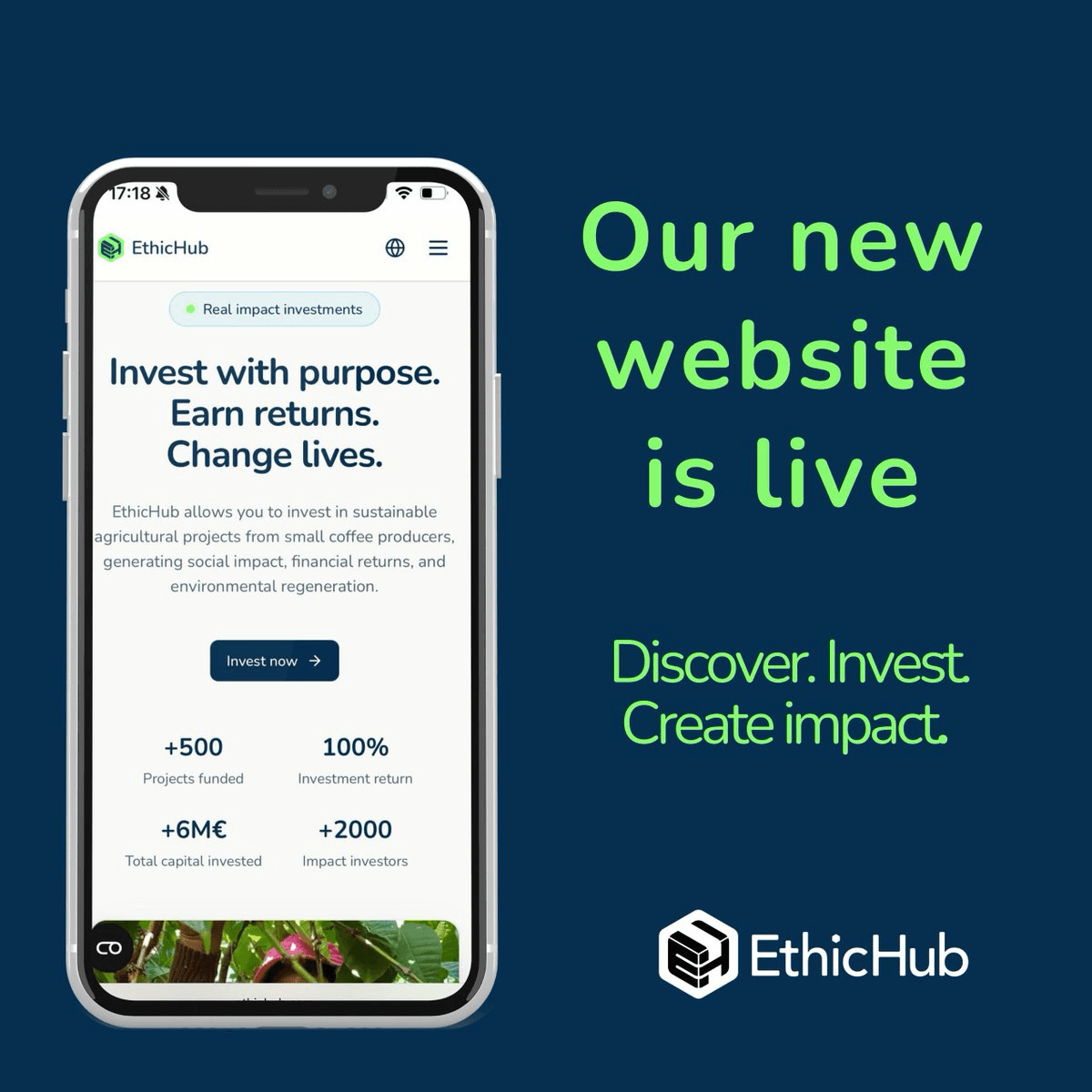

EthicHub Launches Redesigned Website for $50 Minimum Impact Investments

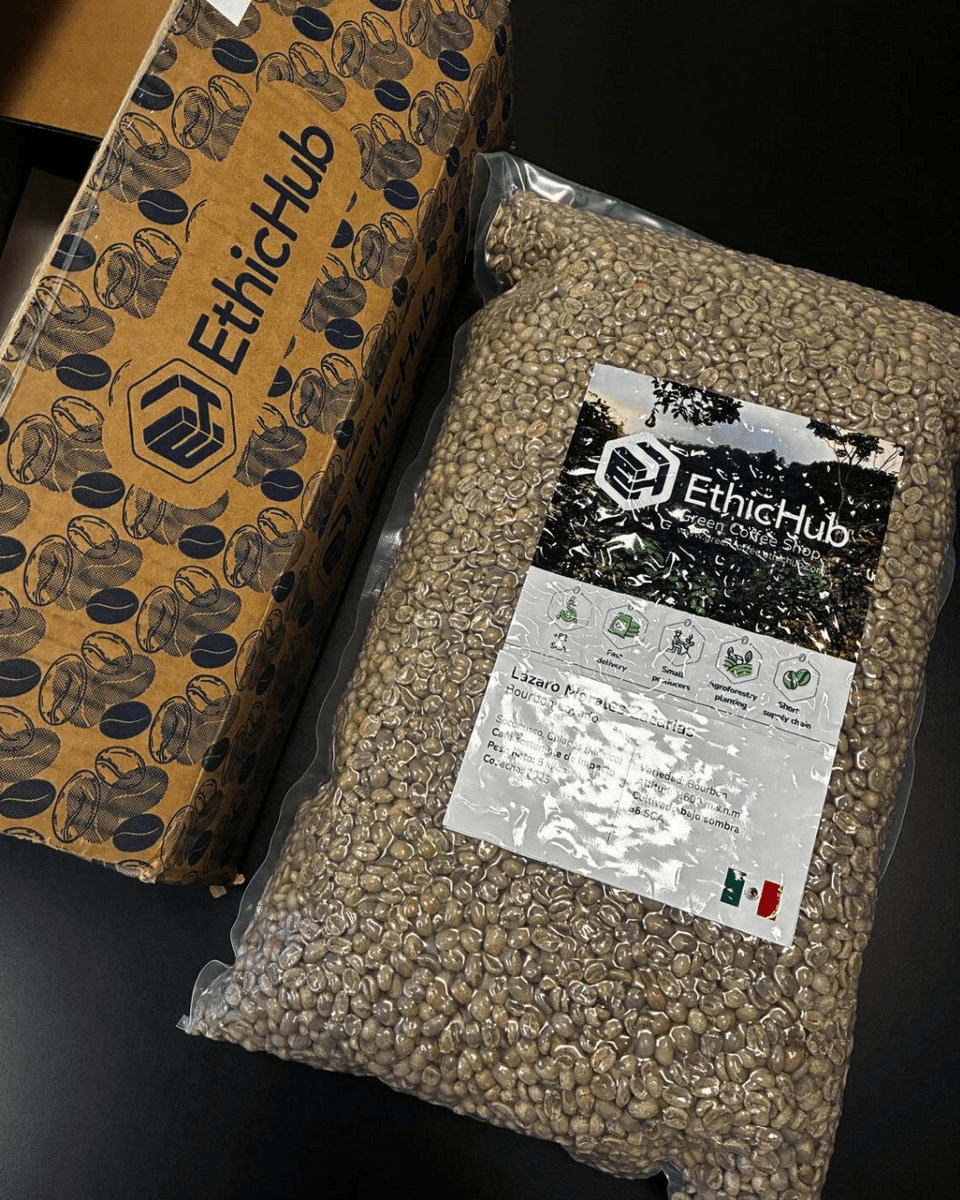

☕ EthicHub Launches Direct-to-Consumer Green Coffee Marketplace

EthicHub Co-founder Presents Farmer Empowerment at Copenhagen Blockchain Forum

EthicHub Co-Founders Speak at South Summit 2025 Madrid

Blockchain Agriculture Partnership Announcement

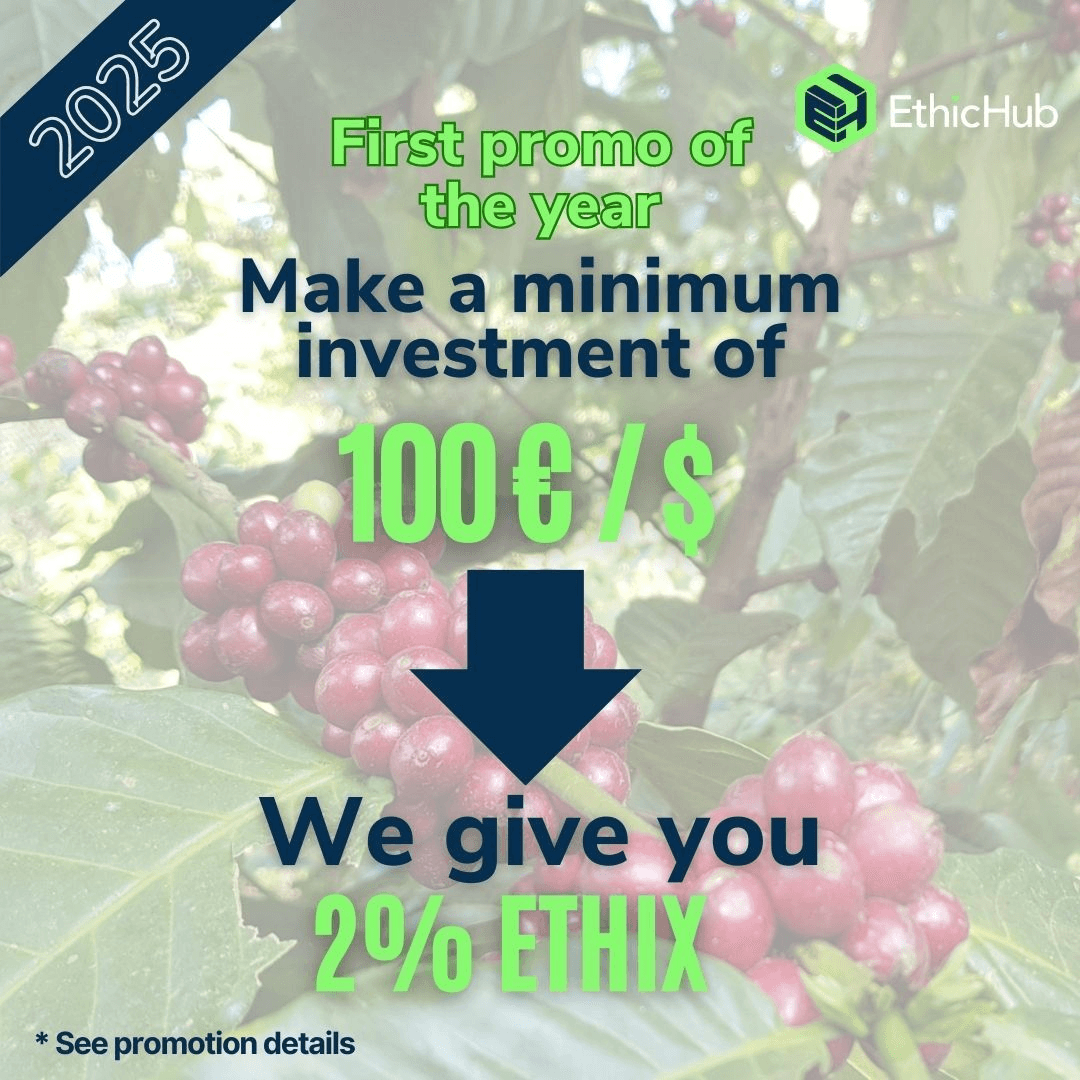

EthicHub Launches Special Investment Promotion with ETHIX Rewards