DIA DAO | Open-Source Oracles for Web3

Welcome!

🤔 What is the DIA DAO? Open, decentralised work: a framework to enable the DIA community to support the growth and development of DIA while earning rewards along the way.

👌 What are the benefits of joining DIA DAO? Contributors earn ETH and “XP”. Additionally, DIA tokens are an extra layer of reward to enable participation in governance and other on-site utilities.

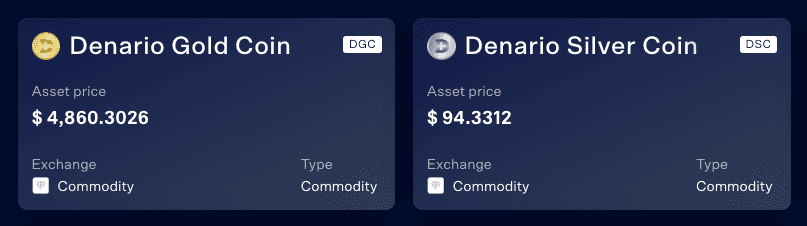

🪙 Swiss-Backed Digital Gold and Silver Tokens Launch with Full Physical Redemption Rights

Thu 22nd Jan 2026

**Denario Swiss has launched $DSC and $DGC**, tokenized precious metals representing one ounce each of 999.9-purity silver and gold.

**Key features:**

- Physical assets stored in insured Swiss duty-free warehouses

- Full commodity backing with no coverage limits (unlike CHF 100,000-capped bank deposits)

- Physical redemption rights available to holders at any time

- Digital co-ownership model for precious metal investments

**DIA partnership:**

DIA provides high-fidelity price feeds for $DSC on Polygon, reporting real-time silver market values across EUR, USD, and CHF. This enables secure transactions and DeFi integrations.

The collaboration bridges traditional commodities with decentralized finance, allowing users to access precious metals through decentralized applications.

[View price feeds](https://www.diadata.org/app/rwa/)

Wormhole: Defense-in-Depth Beats Risk Scores

Thu 22nd Jan 2026

**Security through redundancy, not ratings**

Wormhole's @nsuri_ challenges the industry's obsession with risk scoring frameworks. His argument: **layered defense mechanisms provide stronger security** than any single rating system.

**The core thesis:**

- Multiple overlapping security layers catch failures that scoring systems miss

- Defense-in-depth creates redundancy when individual protections fail

- Rating frameworks offer false precision in an inherently complex threat landscape

This perspective contrasts with the fragmented approach to shared security, where each network operates with distinct risks and slashing rules—a complexity that undermines composability in DeFi.

The debate highlights a fundamental question: Should protocols chase perfect scores or build overlapping safeguards?

🏗️ DIA's RWA Oracle Infrastructure Goes Multi-Chain

Thu 15th Jan 2026

**Multi-chain expansion complete**

DIA's xReal oracle suite deployed across five major blockchains: Avalanche, Plume, Base, XRPL, and Polygon. The infrastructure now supports real-world asset protocols with verifiable pricing data.

**Active integrations**

- KlimaDAO and Azos Finance using DIA oracles for collateral pricing

- Coverage includes equities, bonds, commodities, and FX rates

- Trustless verification layer for on-chain RWA protocols

The deployment follows the broader trend of tokenized RWAs reaching $28B on-chain, with DIA positioning its oracle infrastructure as purpose-built for this asset class.

🛡️ DeFi Security Gap

Thu 4th Dec 2025

**DeFi infrastructure maturity questioned** after B+ rated Balancer pool exploitation

**Key discussion points from Infra Gardens Buenos Aires:**

- Defense-in-depth security mechanisms

- Bridged asset risk management

- Insurance adoption challenges

- Stack security responsibility gaps

**Expert panel featured:**

- @dillonhanson12 (DIA)

- @PhilippZentner (LiFi Protocol)

- @MerlinEgalite (Morpho Labs)

- @nsuri_ (Wormhole)

- @jgorzny (Zircuit L2)

Despite infrastructure improvements, **security vulnerabilities persist** in rated protocols, highlighting ongoing institutional hesitation around DeFi adoption.

Ethereum's Fusaka Upgrade Goes Live

Thu 4th Dec 2025

**Ethereum's Fusaka upgrade is now active**, marking another milestone in the network's evolution.

The upgrade focuses on three key principles:

- **Open** development and accessibility

- **Unbiased** network operations

- **Secure scaling** solutions

This latest implementation continues Ethereum's roadmap of incremental improvements to enhance network performance and security. The Fusaka upgrade represents ongoing efforts to optimize the blockchain's infrastructure while maintaining decentralization.

The upgrade's emphasis on secure scaling addresses one of Ethereum's primary challenges - processing more transactions without compromising security or decentralization.

🚀 Ethereum's Fusaka Upgrade Goes Live Tomorrow

Thu 4th Dec 2025

**Ethereum's Fusaka upgrade launches tomorrow**, bringing the biggest infrastructure improvement for Layer 2 scaling yet.

**Key Changes:**

- **PeerDAS technology** - Validators only need to store 1/8th of blob data instead of everything

- **Blob capacity expansion** - More space for L2 transaction data at lower costs

- **Gas limit increase** - From 45M to 60M, with potential for 150M

- **Hardware requirements stay manageable** through data sampling

**Impact for Users:**

- **Lower L2 fees** as rollups like Arbitrum, Optimism, and Base can batch more transactions

- **Better UX** with preconfirmations and hardware wallet support

- **Passkey integration** for Ethereum accounts

**For L2s and L3s:**

The data bottleneck that has constrained rollup economics gets significantly relieved. Cheaper data posting costs translate directly into reduced user fees.

This upgrade represents the infrastructure foundation that makes Ethereum's rollup-centric roadmap viable at scale.

🔒 Privacy Gap Exposed

Thu 4th Dec 2025

**Privacy tech is ready - but adoption isn't.**

A panel at Infra Gardens Buenos Aires tackled the disconnect between available privacy infrastructure and real-world usage. Despite **MPC, TEEs, and ZKPs** being production-ready, privacy remains a feature rather than the default.

**Key discussion points:**

- Why mature privacy tech isn't widely adopted

- Barriers preventing privacy from becoming standard

- What's needed to bridge the technology-adoption gap

**Expert speakers included:**

- Luciana Faria (Alchemy)

- Alexandre Carvalheira (Fhenix)

- Eli Cohen (Centrifuge)

- Bogdan Habic (Tenderly)

- Patrick McClurg (Randamu)

The conversation highlighted that while the **infrastructure exists**, systemic changes are needed to make privacy the cornerstone of Web3 projects rather than an optional add-on.

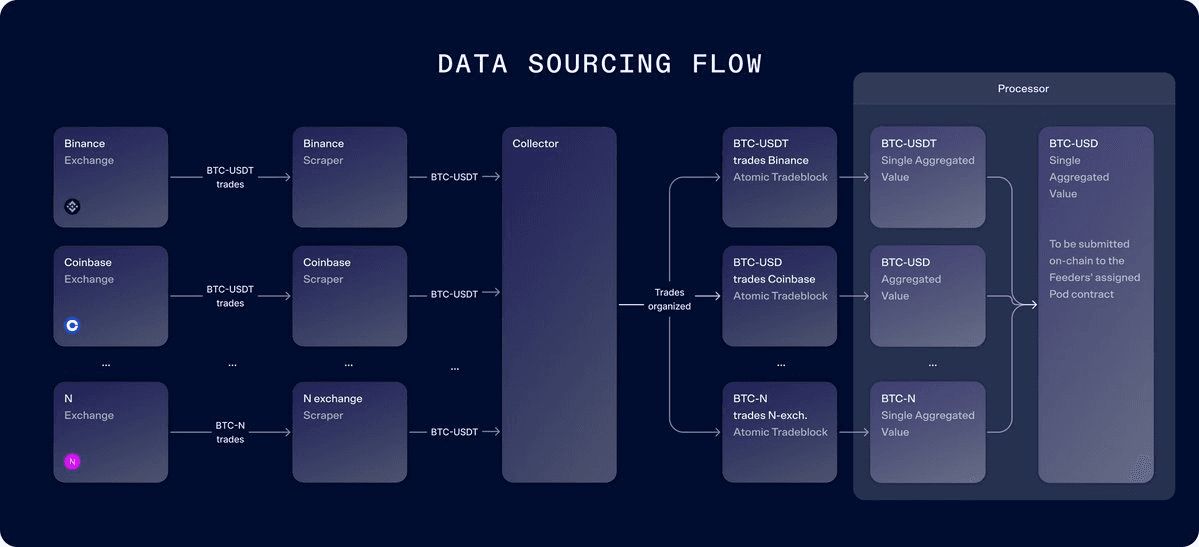

DIA Launches Fully Customizable Oracle Infrastructure

Thu 27th Nov 2025

**DIA introduces fully customizable oracles** that let protocols build exactly what they need instead of using generic feeds.

**Key customization options:**

- Choose specific data sources from 100+ exchanges

- Define update frequency based on protocol needs

- Select pricing methodology that fits use case

- Set deviation thresholds for price movements

**Why this matters:**

Most oracle solutions offer one-size-fits-all approaches. DIA's system allows protocols to configure oracles precisely for their requirements - whether they need only DEX data, specific CEX sources, or traditional market feeds.

**Technical foundation:**

Built on Lasernet, DIA's custom L2 rollup that brings oracle computation onchain. Every data point remains verifiable with complete transparency from collection to smart contract delivery.

This represents a shift from standardized oracle feeds to **protocol-specific data infrastructure** tailored for individual use cases.

🔍 RWA Panel: $36B Success or Just Digital Velvet Rope?

Mon 24th Nov 2025

**Tokenized RWAs reached $36B in 2025**, but industry leaders debate whether we're truly democratizing finance or simply moving traditional barriers on-chain.

Key discussion points from Infra Gardens Buenos Aires:

- **Treasury dominance vs. real demand** - Are we seeing genuine adoption or just yield-chasing?

- **Cross-chain compliance hurdles** - Regulatory frameworks struggle across different blockchains

- **Infrastructure gaps** - What's missing to reach the projected $360B milestone?

The panel featured experts from CoinDesk, Protocol Labs, Sei Network, Paxos, and Goldsky discussing the real challenges behind the growth numbers.

**Recent momentum includes:**

- Aave Horizon crossing $590M in institutional demand

- European regulatory approvals for tokenized funds

- Major banks launching tokenized deposit programs

While the numbers look impressive, the core question remains: **Is tokenization creating new access or just digitizing existing exclusivity?**

Arbitrum Keeps 97% of Transaction Fees for Community Treasury

Mon 1st Dec 2025

**Arbitrum retains 97% of transaction fees** after paying Ethereum for security services.

Unlike Layer 1 blockchains that distribute revenue to validators, Arbitrum's fee structure works differently:

- Only 3% goes to Ethereum for security

- **97% flows into community-controlled treasury**

- Funds growth initiatives without inflating token supply

This revenue model gives Arbitrum significant financial resources for development and ecosystem expansion while maintaining decentralized governance over treasury allocation.