CrossCurve

Abstract

CrossCurve is a cross-chain trading and yield protocol built on Curve, creating a unified cross-chain liquidity market by aggregating existing Curve pools.

The Problem

Fragmented liquidity is costly and inefficient across multiple blockchains. Transferring large amounts is inefficient, slow, inconvenient, and unsafe due to bridge hacks. Liquidity moves between blockchains for higher yields, leading to competition for liquidity incentives.

Our Solution

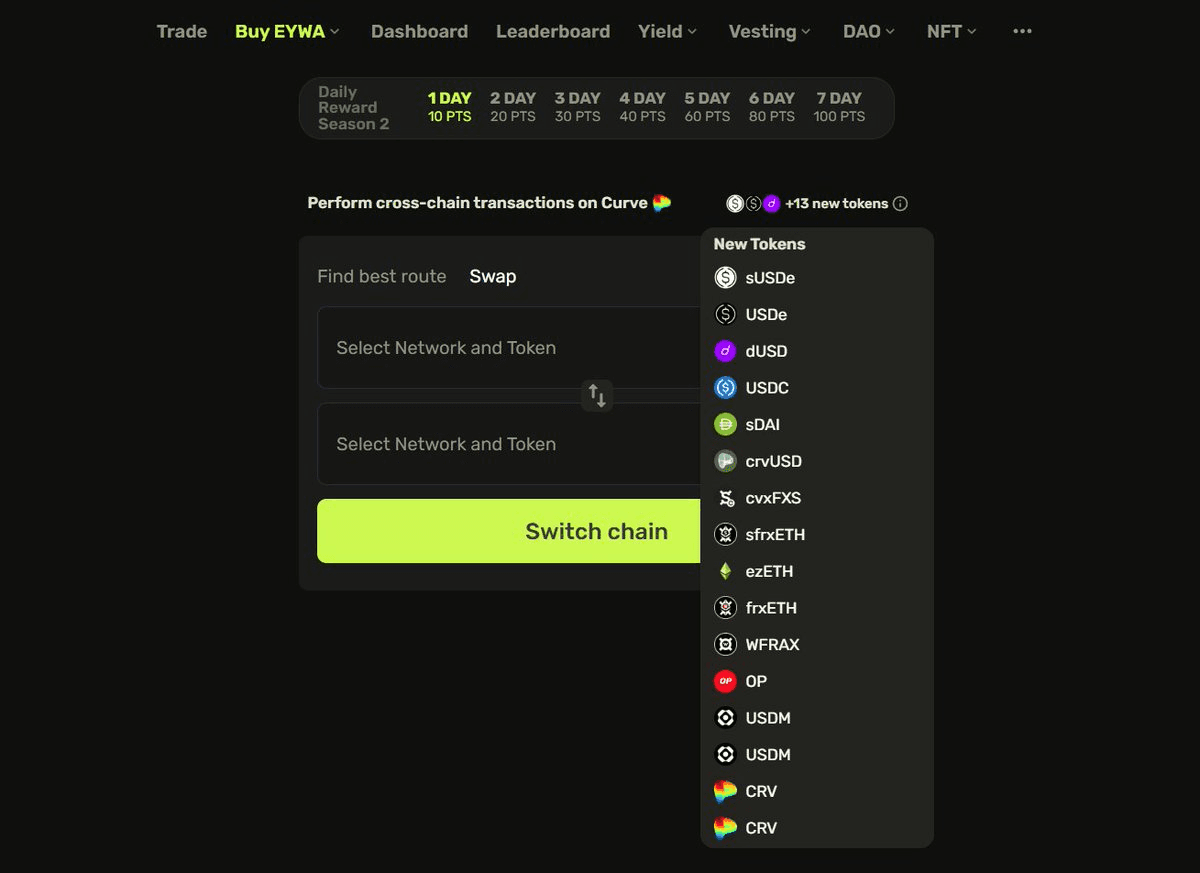

In partnership with Curve, CrossCurve addresses liquidity fragmentation and movement between blockchains. Leveraging Curve's liquidity pools, we offer low slippage rates for exchanging assets and Curve LP tokens.

Safe, Cost-Efficient Transfers: Provide a convenient method for transferring large liquidity volumes between chains.

Scalability and Efficiency: Enable projects to scale quickly and enhance capital utilization efficiency, reducing costs.

Value Proposition

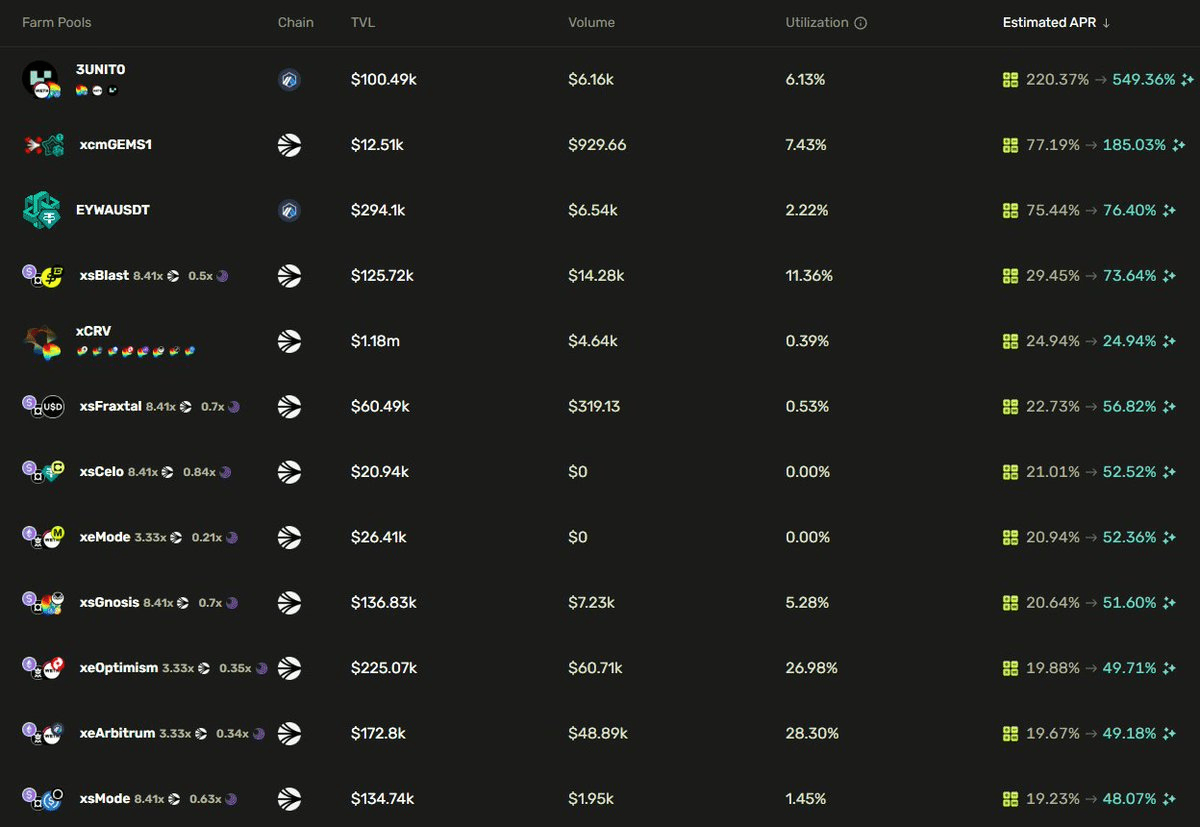

Capital Efficiency & Low Slippages: CrossCurve's architecture ensures low slippage rates (2-5 bps) during cross-chain exchanges, requiring less liquidity than competitors.

Cut Costs & Scale Quickly: Attract new users from various blockchains, scale token utility across networks, and reduce cross-chain liquidity costs using a single pool.

Cross-Chain Listings: Access the largest liquidity pool, create cross-chain pools, and trade on all chains against any asset. Enjoy yields from CrossCurve, Curve, and Convex.

Security First: The Eywa Consensus Bridge secures CrossCurve by aggregating advanced bridge protocols (LayerZero, Axelar, Wormhole, Chainlink CCIP). Clients can select customizable security options. Reliable Curve code and audited additional code ensure safety.

EYWA Evolution: CrossCurve MetaLayer Transformation Announced

CrossCurve Expands Token Support and Network Presence

CrossCurve Pool Voting Period Ending Soon - Top vAPR Pools Revealed

EYWA CLP Security Audit Completed by MixBytes

xBTC Pool Coming to CrossCurve

CrossCurve: Revolutionizing Cross-Chain Liquidity

CrossCurve Adds Taiko Support for ETH/WETH Swaps