BendDAO

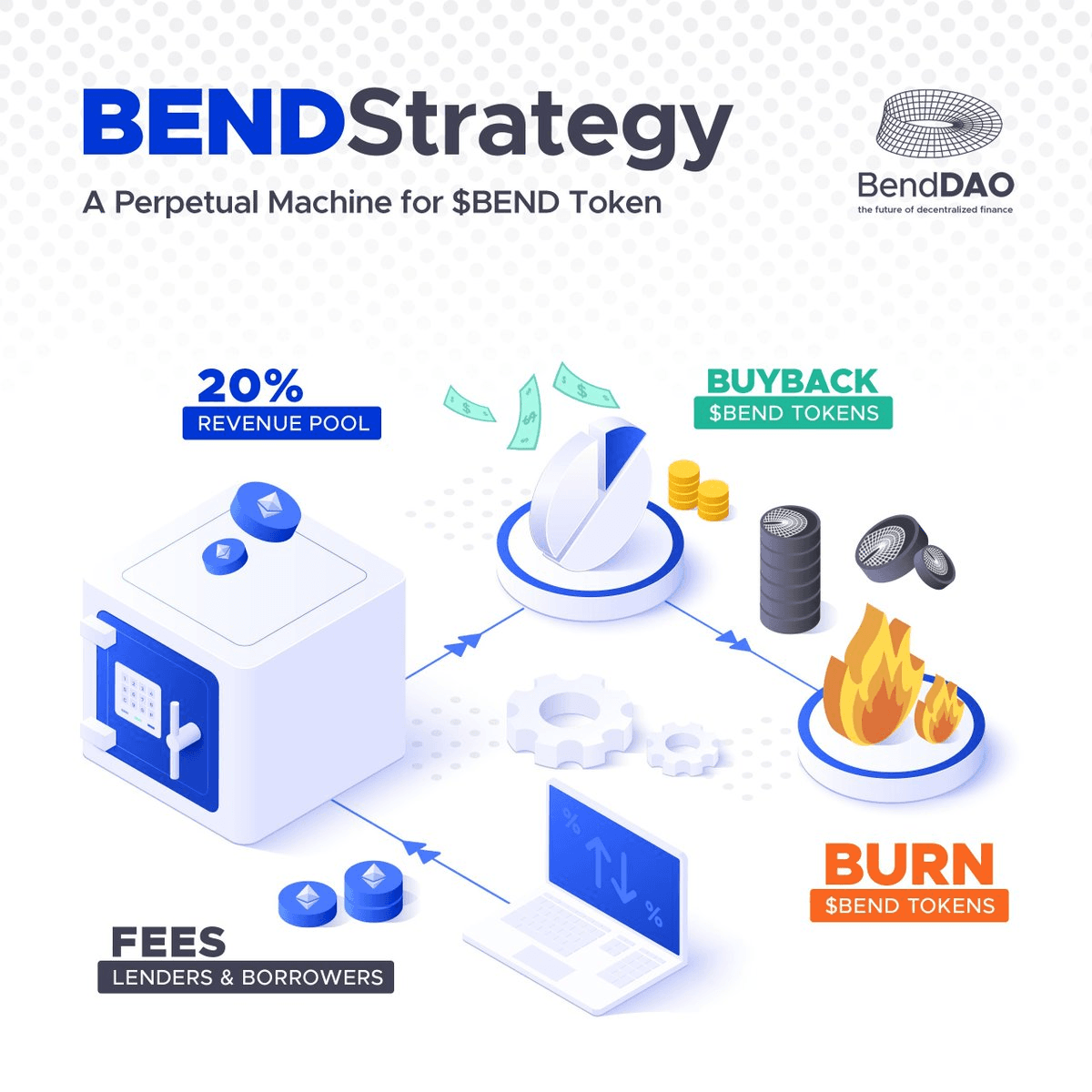

Bend is a decentralized peer-to-pool based NFT liquidity protocol.

Depositors provide ETH liquidity to the lending pool to earn interest, while borrowers are able to borrow ETH through the lending pool using NFTs as collateral instantly.

Bend protocol enables NFT assets to be pooled and converted into representing ERC721 boundNFTs to realize NFT loans.

BendDAO Burns 50M BEND Tokens in Week 18 Treasury Reduction

Fri 6th Feb 2026

BendDAO has completed its **Week 18 token burn**, removing 50 million $BEND tokens from the treasury.

**Key Details:**

- 50M $BEND tokens permanently burned

- Part of ongoing weekly burn program

- Transaction verified on [Etherscan](https://etherscan.io/token/0x0d02755a5700414b26ff040e1de35d337df56218?a=0x472fcc65fab565f75b1e0e861864a86fe5bced7b)

This continues the protocol's regular token burn schedule, with previous burns including Week 13's 50M token removal. The burns reduce the circulating supply of BEND tokens over time.

BEND DAO Continues Daily Token Buybacks on Day 25

Thu 13th Nov 2025

**BEND DAO maintains its daily token buyback program**, now on day 25 of consistent operations.

- Daily automated buybacks continue through DAO-controlled bot

- Buybacks executed at randomized times with price impact controls

- Part of broader token reduction strategy alongside weekly burns

**Recent burn activity:**

- Week 13: 50M $BEND tokens burned from treasury

- Week 12: Another 50M $BEND removed from circulation

- Total of 500M+ tokens permanently removed

The protocol combines daily buybacks with weekly large-scale burns to reduce token supply. All transactions are publicly verifiable on [Etherscan](https://etherscan.io/token/0xdac17f958d2ee523a2206206994597c13d831ec7?a=0x0e15871efd047fc0f0b26543d2bee02718e3afa3).

🔥 Week 11: Another 50M BEND Tokens Burned

Thu 13th Nov 2025

**Week 11 burn completed** - Bend protocol has permanently removed another 50M $BEND tokens from circulation through treasury burning.

- **Total burned**: Over 550M tokens eliminated forever

- **Weekly schedule**: Protocol continues systematic 50M token burns

- **Deflationary mechanism**: Reduces total supply to potentially increase scarcity

The burn was executed via smart contract transaction, with tokens sent to a burn address where they cannot be recovered.

[View transaction](https://etherscan.io/tx/0x957844327a97159fb0c9346d1242a06b56e48540cdb4d9804cf188c7b707cb49)

BendDAO Completes Week 6 Token Burn Removing 300M BEND Total

Mon 4th Aug 2025

**BendDAO completed its sixth weekly token burn**, permanently removing another 50M $BEND tokens from circulation.

**Key Details:**

- 50M $BEND burned from treasury in Week 6

- **300M total tokens removed** from circulation across all burns

- Transaction verified on [Etherscan](https://etherscan.io/tx/0xe985c40f62f9cab044b393f06ee2662f5c07331d915143c394ec0b2824caf56b)

**Burn Program Progress:**

The weekly burns are part of BendDAO's approved governance proposal to burn 50% of treasury tokens over 5 months. Each week consistently removes 50M tokens, reducing total supply permanently.

This systematic approach aims to decrease token supply while the protocol continues operating its NFT lending services.

BEND Token Plan Hits Week 1 Milestone

Mon 8th Sep 2025

**BEND Protocol** completes first week of token burn program as planned.

**Key Updates:**

- Week 1 token burn successfully executed ✅

- Lender rewards program now active and operational

- Buyback and burn mechanism scheduled to begin in Month 3

The NFT lending protocol continues executing its tokenomics restructuring plan on schedule. Lenders can now earn rewards while the protocol prepares for expanded buyback operations.

*Next phase launches in two months with enhanced token mechanics.*

BEND Token Burn Week 1 Complete

Mon 1st Sep 2025

**BEND Protocol completed its first weekly token burn**, permanently removing 50 million $BEND tokens from circulation.

The burn transaction has been **confirmed on Ethereum**, reducing the total supply as part of the protocol's deflationary strategy.

**Key details:**

- 50M $BEND tokens burned from treasury

- Tokens permanently removed from circulation

- Part of 5-month plan to burn 50% of treasury holdings

The burn mechanism aims to **reduce token supply** over time, potentially benefiting existing holders through scarcity.

Transaction details available on [Etherscan](https://etherscan.io/tx/0xfaf5bee0dbb3ab68ce4165d681c6eacdd07a3e1cdb0d717d856e6de658819e17).

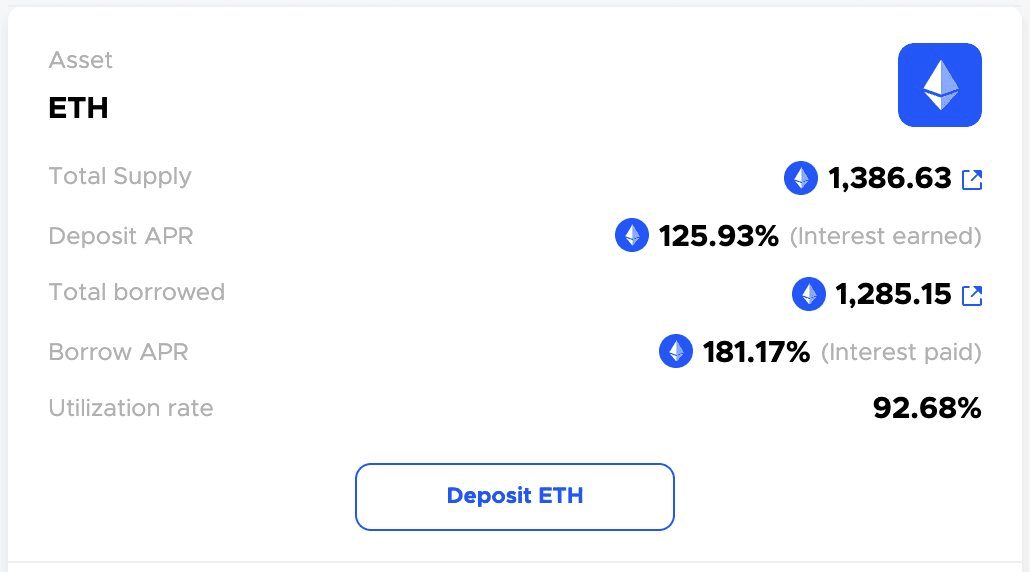

BendDAO ETH Lending Pool Update

Mon 3rd Feb 2025

The ETH lending pool utilization on BendDAO has shown significant improvement, dropping from 92.68% to 68.61% over the past week. This decrease indicates recovering liquidity in the protocol.

- Current utilization rate: 68.61%

- Previous rate: 92.68%

- Interest rates remain elevated

*Recommendation for borrowers*: Consider repaying outstanding loans while the pool shows improved liquidity conditions.

The steady recovery suggests growing stability in the lending protocol's operations.

BendDAO Pools Hit Capacity with High Interest Rates

Mon 27th Jan 2025

BendDAO lending pools have reached maximum capacity, pushing interest rates to significant levels - 164% for ETH and 92% for USDT.

The protocol faces a $465k mark-to-market loss due to Azuki price fluctuations, though this remains well below the DAO treasury's $1.5M valuation.

- Current rates:

- ETH: 164%

- USDT: 92%

*Key Development*: DAO Treasury plans to begin bidding on affected assets in the near term.

**Market Impact**: Despite losses, protocol maintains strong treasury position with 3x coverage of current mark-to-market deficit.

BendDAO Launches ApeCoin Staking with Auto-Compounding Features

Mon 11th Nov 2024

BendDAO has introduced a new staking service for BAYC, MAYC, and BAKC NFT holders to earn ApeCoin rewards. Key features include:

- Single NFT staking support

- Auto-compounding yield mechanism

- No liquidation risk for pure staking

- Second largest ApeCoin staking pool after ApeStake.io

- Dual yield opportunities with BendDAO V2

Platform is now live at BendDAO's website, offering a streamlined way to generate passive income from Ape NFT holdings.

Visit v1.benddao.xyz/ape-staking to start earning rewards.