Mezo Earn's 200 BTC capacity is filling up, with over 100 BTC already locked and earning 4% APY in native Bitcoin.

The platform enables Bitcoin holders to earn yield without wrapping or moving their BTC off the Bitcoin network. Users need to:

- Lock their BTC

- Vote weekly

- Claim rewards

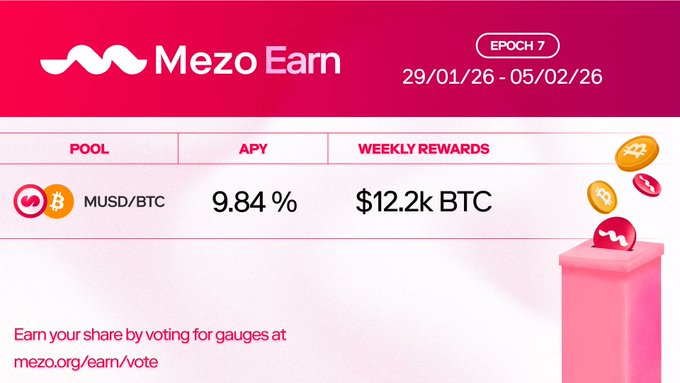

Community members received over $12,000 in BTC last week for participating. The program represents a shift from passive holding to what Mezo calls "productive HODLing" - earning native BTC yield while maintaining custody.

Mezo inverts the model. When you lock $MEZO, you aren't just holding a token. You’re gaining a say in how the desk allocates fees and incentives. You aren't just using a bank; you are building the infrastructure of the new Bitcoin economy. 🟠

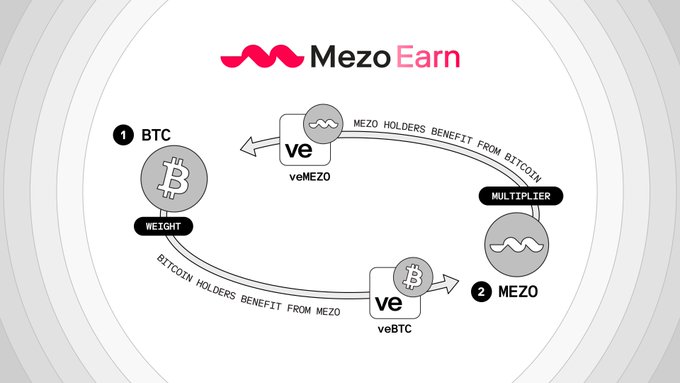

Lock BTC for veBTC to secure the base yield and earn protocol fees. Want to supercharge earnings? Lock MEZO for veMEZO to unlock up to a 5x boost. Your total voting power is the sum of both. The more MEZO locked, the more BTC earned.

Hal Finney envisioned a Bitcoin bank long before anyone else. Aside from Bitcoin-backed loans, that tool stack needs BTC yield on BTC savings. Today that's possible with Mezo Earn. Secure your share of the 4% APY before the 200 BTC cap is full. Don't forget to vote every week!

Get your BTC ready! We're raising the cap tomorrow. How high? We'll see! How to earn: 🔒 Lock BTC 🗳️ Vote every week 🤝 Claim Locks always expire every Thursday @ 00:00 UTC. Votes don't carry over. No votes forfeit your share of fees and incentives for that week.

We haven't forgotten about raising the cap 😏 Get ready to lock your BTC to earn more BTC. Yes, it's as good as it sounds. $MEZO is dropping soon, so you can pair and 5x boost your rewards.

Why keep your BTC on Ethereum? 🌉 Mezo is the native home your assets deserve. Migrate tBTC, cbBTC, or WBTC now. We've allocated 2.5% of $MEZO supply to this mission. Early depositors get a 32% incentive APR (~34% total). Learn more and deposit 🔽 comehome.mezo.org

Clock's ticking! ⏳ 24 HOURS LEFT to deposit tBTC, cbBTC, WBTC, or USDT before the vaults lock. Secure your share of the 2.5% $MEZO supply and lock in your boosted 32% incentive APR (~34% total) while you still can. Deposit here 🔽 comehome.mezo.org

🎉 CAPS ARE FULL! Bring Bitcoin Home vaults have officially closed. Thank you to those who brought their BTC home to native Bitcoin infrastructure. If you missed it, don't worry, there's more! Mezo Earn caps have just been raised to 200 BTC 🤩 Go lock some BTC!

Over 240 BTC are coming home! tBTC and WBTC vaults are now full 🎉 With so much momentum over the weekend, we are extending the vaults for another 8 HOURS until 00:00 UTC! Get your BTC off Ethereum and bring it over to Mezo.

Clock's ticking! ⏳ 24 HOURS LEFT to deposit tBTC, cbBTC, WBTC, or USDT before the vaults lock. Secure your share of the 2.5% $MEZO supply and lock in your boosted 32% incentive APR (~34% total) while you still can. Deposit here 🔽 comehome.mezo.org

Institutional-scale borrowing against BTC today is inefficient. Small holders won't risk their keys. Large funds are stuck in rigid custody rules. Both end up holding an appreciating asset with zero liquidity. Mezo is building the decentralized lending desk Bitcoin deserves. 🏦

Mezo lets your BTC stay BTC and earn. Through "Bring Bitcoin Home," we’re distributing 2.5% of the MEZO supply to those who help bootstrap this future. Current early depositor incentive: 32% APR (~34% total). Bring your BTC home by January 26th 👇

HODLing is a strategy, but productive HODLing is a flex. Mezo Earn lets you stack 4% APY in native BTC while you wait for the moon. The 200 BTC cap is filling up and over 100 BTC is auto-maxed locked. Don’t just sit on your stack, put it to work. comehome.mezo.org

Still holding wrapped assets on ETH? Bring them home 🟠🏠 Deposit tBTC, cbBTC, WBTC, or USDT to @MezoNetwork. We’ve allocated 2.5% of total $MEZO supply to this.

The era of "passive holding" is evolving into the era of "Bitcoin Banking." Stop waiting for Wall Street to build a cage for your BTC. Build the desk you own. Dive into the full architecture of the Mezo Lending Desk here 🔽 mezo.org/blog/building-…

📢 NEW CAP NOW OPEN! Start the year by working smarter, not harder. We've reopened the Mezo Earn cap for the next 100 BTC until we reach 200 BTC locked and earning passively. Remember to complete all three steps: Lock > Vote > Claim Epochs close every Thursday at 00:00 UTC.

⏰ 48 HOURS REMAINING! The countdown is officially on! You have just two days left to complete your airdrop registration if you qualify. Once the clock hits zero, the list is locked 🔒 Final deadline: Jan 21 @ 23:59 UTC Get it done 👇 bankfree.mezo.org

3 DAYS LEFT! ⏳ The window to register for the MEZO airdrop is closing fast. If you've been banking on yourself with Mezo, it's time to get rewarded! 🗓 Deadline: Jan 21, 23:59 UTC

We’ve been told to "HODL" because the alternative was trusting centralized lenders who gambled with our keys. But what if you could bank on Bitcoin without the bank? Here is how we're building the decentralized lending desk Bitcoin deserves 🧵👇

📢 Registration is now closed! The clock has struck midnight UTC, and the window for the MEZO airdrop is officially shut. Thank you to the thousands who joined us! 🙌 What’s next? We're now verifying entries. 📢 Stay tuned for distribution updates!

If you participated in the @nansen_ai points program, you're eligible for the $MEZO airdrop. Registration closes Jan 21 @ 23:59 UTC. Register here 👇 bankfree.mezo.org

🧭 @nansen_ai explorers here’s how to claim your Mezo bonus mats dropping in January ⚡️ Create your Mezo ID + bridge tBTC. Your Nansen tier sets your reward. Full breakdown in the next tweet 👇

104 BTC is already locked and earning BTC yield on Mezo Earn! We’re over halfway to our 200 BTC cap. Lock your Bitcoin now to secure at least 4% APY and start earning native yield. Join the first 200 BTC deposits: mezo.org/earn/lock

Community members just received over $12,000 in BTC for locking their BTC on Mezo Earn over the last week. The market's down, but that's the perfect moment to sit back and stack your BTC effortlessly. Just 🔒 lock 🗳️ vote 🤝 claim in under one minute every week.

Bitcoin Lending Gets Simpler: 1% Rates vs Traditional 5-8%

A new Bitcoin lending service is launching with three key features: - **One-click borrowing** for retail users with no bridge requirements - **Custody-compatible infrastructure** allowing institutions to access credit while keeping BTC in qualified custody - **Prime rates at 1%** compared to 5-8% charged by traditional brokers This follows Coinbase's earlier rollout of Bitcoin-backed loans to US users (excluding NY), which saw $100M USDC borrowed in under 100 days at rates starting from 5%.

Mezo Introduces Ownership Model for Bitcoin Lending

Mezo is launching a new approach to crypto lending that differs from traditional models. **Key Changes:** - Traditional lending desks operate on the "Cantillon Model" - offering privileged access to cheap money - Mezo's "Ownership Model" transforms depositors into stakeholders - Users who lock $MEZO tokens gain voting rights on fee allocation and incentive distribution **What This Means:** The platform aims to align incentives between lenders and borrowers from the start, rather than maintaining the traditional separation between service providers and users. Mezo positions this as infrastructure development for Bitcoin's financial ecosystem.

Counterparty Crisis Exposes Rehypothecation Risks in Crypto Lending

The crypto industry is grappling with a **counterparty crisis** as traditional finance prime brokers and centralized finance platforms engage in rehypothecation practices. **What's happening:** - Platforms are taking customer Bitcoin and lending it out to fund their own trading positions - Customers bear the risk while platforms profit from these activities - This practice mirrors issues that led to previous CEFI platform failures **The core problem:** Rehypothecation creates a chain of dependencies where your assets are used as collateral multiple times over. When markets turn volatile or platforms make bad bets, customers' funds become vulnerable. **Why it matters:** Bitcoin was designed to remove intermediaries and give users direct control over their assets. Current practices by centralized platforms contradict this fundamental principle, reintroducing the same counterparty risks that blockchain technology aimed to eliminate. The situation highlights the ongoing tension between decentralized ideals and centralized business models in crypto.

Fixed Rate Drops to Historic 1% Low

A new **1% fixed rate** offering has emerged, significantly undercutting traditional banking options and previous rates. **Key Details:** - Fixed rate now at 1%, down from 3.2% earlier - Available across any maturity period - Positioned as alternative to conventional bank branches This represents a dramatic shift in the fixed-rate lending landscape, with rates dropping by over two-thirds in recent months. The offering appears designed to challenge traditional financial institutions by providing more competitive terms than typically available at physical bank locations. The consistent messaging around branch comparison suggests a direct play for customers frustrated with legacy banking rates.