UniswapX: Aggregating Liquidity for Better Swaps

UniswapX: Aggregating Liquidity for Better Swaps

🔥 Uniswap's Ace Up Its Sleeve

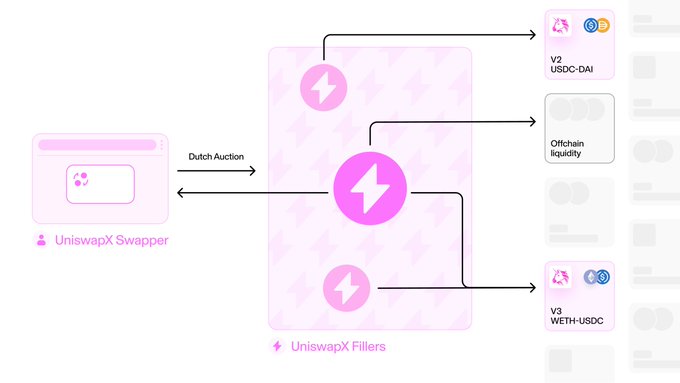

UniswapX, a new feature from Uniswap, aims to provide users with the best prices for their trades by aggregating liquidity from various sources, both on-chain and off-chain. The system utilizes a network of 'fillers' who compete to offer the most favorable rates by sourcing liquidity beyond just the Uniswap automated market maker (AMM). While AMMs remain important, UniswapX complements them by accessing liquidity that may not exist on AMMs, ultimately delivering deeper liquidity and better swap execution for users.

UniswapX uses fillers to make zero gas swaps possible But how do they actually work? 👇

DeFi markets have evolved since Uniswap v1 While AMMs are still important, intents-based systems play a complementary role in giving swappers the best prices That’s why we built UniswapX 👇

UniswapX uses fillers to source liquidity onchain and offchain ⭐️ Your swap goes through UniswapX only if it gives you the best price compared to v2 and v3 Deeper liquidity. Better swaps. 💫

Most swaps that go through aggregators settle on Uniswap But what about the swaps that don’t? The reality is that some liquidity doesn’t exist on AMMs – our goal to make sure Uniswap users can easily access that liquidity

UniswapX aggregates all liquidity into one place ⭐️ With UniswapX, a network of fillers compete to give swappers the best price for their trade Fillers can source liquidity onchain or offchain, which means UniswapX delivers deep liquidity in addition to the Uniswap AMM

Flow.bid Launches Nine-Minute Token Auctions Using CCA Protocol

Flow.bid is implementing the CCA (Credible Commitment Auction) protocol to create nine-minute token auctions. The system enables automated agents to: - Register new tokens - Discover market prices - Deploy liquidity directly to Uniswap v4 CCA operates as a **permissionless, open-source protocol** designed to help projects distribute tokens and establish credible market pricing. The protocol has been integrated into the Uniswap Web App, allowing users to discover auctions, place bids, and claim tokens through a familiar interface. The approach mirrors Uniswap's impact on decentralized trading by providing configurable infrastructure for token distribution and liquidity bootstrapping.

Uniswap Developer Platform Enters Public Beta with API Keys and Agent Skills

Uniswap has opened its Developer Platform to public beta access. Developers can now generate API keys to integrate swap and liquidity provider functionality into applications. **Key features available:** - API key generation for any builder - Direct swap integration for apps - Suite of Agent Skills for protocol interactions - Seven new Skills providing structured access to core Uniswap actions The platform aims to simplify building on Uniswap, with the beta launch timed for ETHDenver attendees.

Bankr's AI-Powered Uniswap v4 Hook Surpasses $100M in Two Weeks

Bankr has launched an AI-integrated hook on Uniswap v4 that combines artificial intelligence with decentralized trading. The protocol crossed $100M in volume within its first two weeks of operation. **Key metrics:** - Live for less than 14 days - Over $100M in protocol volume - Built on Uniswap v4's hook architecture This development comes as Uniswap v4 continues its growth trajectory, having processed over $315B in swap volume and attracted 23,305 hooks since its launch one year ago. The protocol currently holds more than $682M in total value locked. Bankr's hook represents a practical application of AI in decentralized finance infrastructure, leveraging v4's customizable pool functionality.

Uniswap AI Now Available on GitHub

Uniswap has released an AI tool on GitHub, making it publicly accessible to developers and the community. **Key Details:** - Repository available at [github.com/Uniswap/uniswap-ai](https://github.com/Uniswap/uniswap-ai) - Community can provide feedback or submit requests through [GitHub issues](https://github.com/Uniswap/uniswap-ai/issues) - Open-source release enables developers to explore and potentially contribute to the project The release represents Uniswap's move toward integrating AI capabilities into its decentralized exchange infrastructure.

Uniswap Opens Developer Platform Beta with API Keys for Instant Integration

Uniswap has launched its Developer Platform in beta, allowing any builder to generate API keys and integrate swap and liquidity provider functionality directly into their applications. **Key Features:** - Instant API key generation for developers - Quick integration of swap functionality - Built-in LP (liquidity provider) capabilities - Launch timed for ETHDenver hackathon participants The platform aims to simplify the process of adding decentralized trading features to applications, reducing integration time from potentially days to minutes.