Uniswap Interface Update: New Fee Tiers for v3 LPs on Base

Uniswap Interface Update: New Fee Tiers for v3 LPs on Base

🔵 Uniswap's sneaky fee update

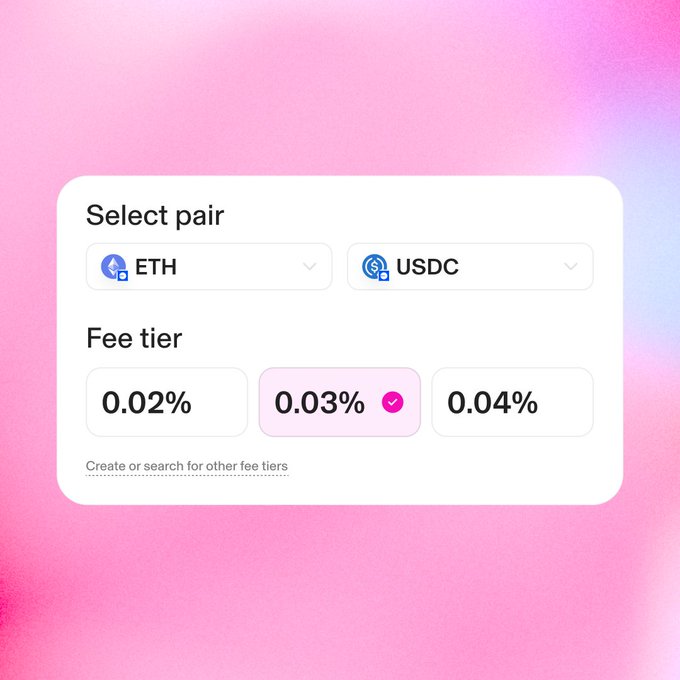

The Uniswap interface on Base now supports two, three, and four basis points (bps) fee tiers for v3 Liquidity Providers (LPs). This update brings two key benefits:

- Improved pricing for swappers: Lower LP fees result in better pricing for users executing swaps.

- More options for LPs: Liquidity providers now have a wider range of fee choices for their liquidity.

This enhancement aims to increase flexibility and efficiency in the Base ecosystem, potentially leading to improved liquidity and trading experiences for users.

Based update for the Base community 🔵 Two, three, and four bps fee tiers for v3 LPs are now supported on the Uniswap interface, that means: + Swappers can access better pricing with lower LP fees + LPs have more choice in fees they can use for liquidity

$RNBW Auction Concludes, Trading Now Live on Uniswap V4

The $RNBW token auction has officially ended, marking a new milestone for the project. **Key Updates:** - A liquidity pool has been established on Uniswap v4 - $RNBW tokens are now available for trading - Participants can claim their tokens through the [Uniswap Web App](http://app.uniswap.org) - Users who participated in the auction can withdraw any unused funds The auction followed a timeline that began with pre-bidding on February 2nd and concluded on February 5th with the creation of the Uniswap V4 liquidity pool. Trading commenced immediately following the pool's creation, and the airdrop distribution is now active for eligible participants.

Uniswap Clarifies Verification Standards for Token Listings

Uniswap has issued a reminder that **verified auctions do not constitute endorsements** of tokens or projects. The platform is directing users to review their [CCA Verified Listings criteria](https://support.uniswap.org/hc/en-us/articles/43107250032781-What-are-CCA-Verified-Listings) to understand what verification actually means. **Key points:** - Verification indicates a token meets certain technical standards - It does not imply Uniswap's recommendation or approval - Users should conduct their own research before trading This clarification comes as the platform continues to balance accessibility with user protection in decentralized trading.

Uniswap Token Auction Opens February 7-11 with Pre-Bidding Now Live

Uniswap's next token auction runs **February 7-11**, with pre-bidding already open on their web app. **Key Details:** - Users can submit bids anytime during the auction period - Pre-bidding increases chances of clearing in earlier blocks - Earlier block clearing typically results in lower average prices - Powered by Continuous Clearing Auctions (CCA) protocol The CCA system enables fully onchain, transparent token distributions. Recent auctions like Aztec's raised $60M from 17K+ participants, with 99% contributing under $100K. [Participate in auction](https://app.uniswap.org/explore/auctions)

Top AI Tokens by Trading Volume on Uniswap Apps

Uniswap has released data showing the most actively traded AI tokens by volume on its platform over the past 24 hours. The ranking reflects trading activity across Uniswap V2, V3, and V4 protocols. This data provides insight into which AI-focused tokens are currently attracting the most swapping activity from users. The volume metrics exclude major assets like ETH, WBTC, and stablecoins to highlight AI token-specific trading patterns. This follows similar reporting from earlier this month tracking top AI token swaps on the platform.

🌈 $RNBW Token Auction Now Live Through February 5th

The **$RNBW token auction** is officially underway for the Rainbow community. **Key Details:** - Auction period: Now through **February 5th** - Users can submit bids during this window - Follows the snapshot taken on January 26th at 4:20pm EST This auction represents the distribution phase after the airdrop eligibility snapshot. Community members who accumulated Rainbow Points prior to the snapshot deadline can now participate in bidding for $RNBW tokens. The auction concludes in two days, giving eligible participants a limited window to submit their bids.