Two Paths to Tokenized Funds: Ad-hoc vs Native

Two Paths to Tokenized Funds: Ad-hoc vs Native

🤔 Old Funds vs New Money

Two distinct approaches are emerging in the tokenized funds space:

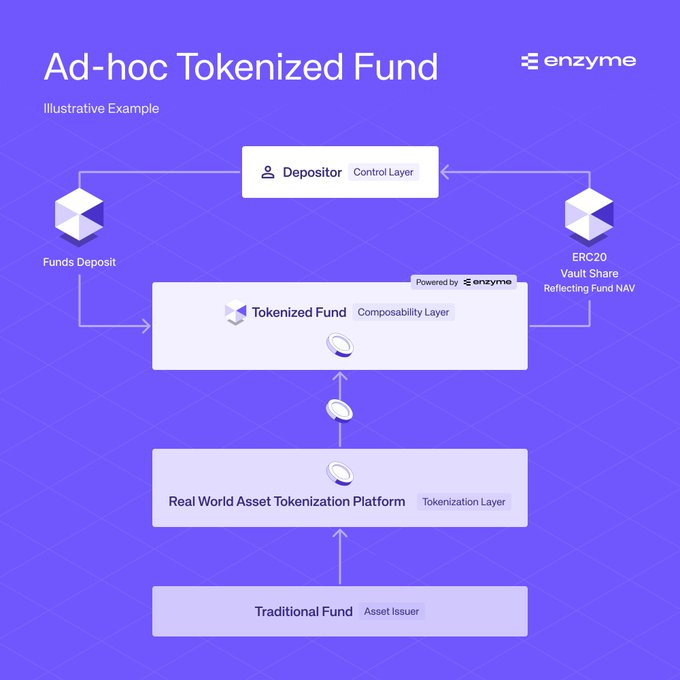

- Ad-hoc tokenization: Wrapping existing off-chain funds into on-chain wrappers via RWA platforms

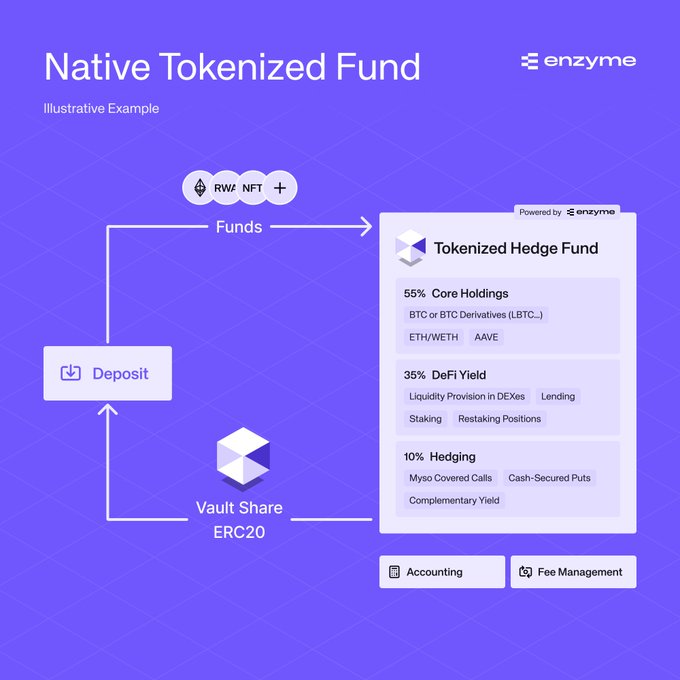

- Native tokenization: Building fully on-chain funds from inception with programmable features

Market projections are significant:

- Citi forecasts $45T in tokenized securities by 2030

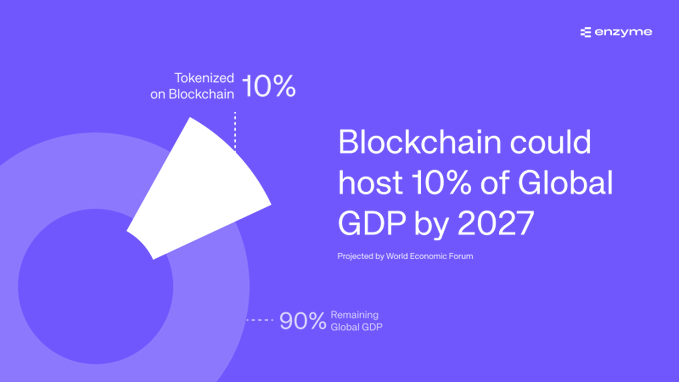

- WEF estimates 10% of global GDP tokenized by 2027

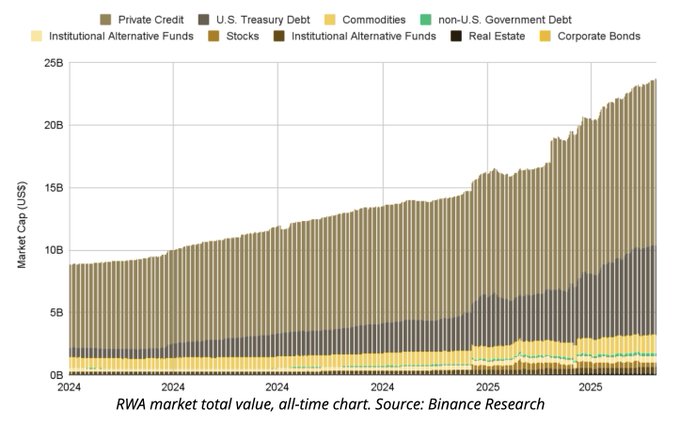

The RWA tokenization market has grown 260% in H1 2025, reaching $23B. This growth is driven by increased regulatory clarity and institutional adoption.

According to a recent report from @binance, the RWA tokenization market has experienced a remarkable 260% growth in the first half of 2025, reaching a valuation of $23 billion. 📈 This surge is largely attributed to increasing regulatory clarity in the industry, which has

How are real-world assets tokenized? Here’s a quick breakdown, from legal structuring to onchain deployment👇 1/🧵

Right now, everyone talks about tokenized funds, but there are two very different ways to build them. The first, and most common today, is ad-hoc tokenization: wrapping existing offchain funds into an onchain wrapper via RWA platforms. The second is building natively tokenized

Tokenized Securities Market Projected to Reach $45T by 2030

Major financial institutions are forecasting significant growth in tokenized assets: - Citi projects tokenized securities market could reach $45T by 2030 - WEF estimates 10% of global GDP could be blockchain-tokenized by 2027 - McKinsey reports shift from pilot to at-scale deployment Key trends expected in next cycle: - Shift to natively tokenized funds - Increased institutional adoption - Integration with DeFi infrastructure - Clearer regulatory framework Traditional finance faces challenges from outdated systems, while tokenized vehicles offer programmability and global accessibility. Enzyme Protocol is positioning to support this transition with native tokenization capabilities. [Learn more about tokenized funds](http://enzyme.finance/use-cases/tokenized-funds)

Chainlink Powers Hong Kong CBDC and Stablecoin Pilot

Chainlink has achieved a significant milestone by providing infrastructure for Hong Kong's Central Bank Digital Currency (CBDC) and stablecoin pilot program. This development represents a crucial bridge between traditional banking systems and blockchain technology, specifically in asset tokenization. The partnership builds on Chainlink's recent collaborations with major financial institutions: - Integration with DTCC - Partnership with SWIFT - Support for global financial infrastructure These initiatives demonstrate practical applications of blockchain technology in mainstream finance.

Tokenized Real-World Assets Hit Major Milestone

Real-world assets (RWAs) tokenized on blockchain have reached a significant milestone, surpassing $10B in Total Value Locked (TVL). This marks a crucial shift in how traditional assets are being brought on-chain. Key developments: - Over $18B in assets now tokenized (excluding stablecoins) - Infrastructure development becoming priority for operational use - Integration possibilities include RWA funds, ETPs, and indices Enzyme Protocol enables users to leverage these tokenized assets within investment strategies, marking a practical step toward mainstream RWA adoption. Learn more about tokenized asset infrastructure: [Chainlink's Guide](https://blog.chain.link/definitive-guide-to-tokenized-assets/)

Enzyme Acquires Myso Finance and Expands to Solana in Major 2024 Growth

Enzyme Protocol marked significant expansion in 2024 with key developments: - Acquired Myso Finance, the leading on-chain covered calls protocol - Invested in Trade Neutral to expand services to Solana ecosystem - Extended protocol to Arbitrum and integrated GMX - Launched first Advanced Automated Loops with Stader Labs - Reached $220M in Assets Under Technology with 1,400+ creations 2025 roadmap focuses on: - Completing Solana integration - Expanding to additional networks - Launching V5 protocol update - Strengthening global infrastructure position The protocol has maintained steady growth since its 2017 launch as Melon Protocol, navigating market cycles while expanding capabilities.