Enzyme Acquires Myso Finance and Expands to Solana in Major 2024 Growth

Enzyme Acquires Myso Finance and Expands to Solana in Major 2024 Growth

🚀 Enzyme's Secret Weapon Revealed

Enzyme Protocol marked significant expansion in 2024 with key developments:

- Acquired Myso Finance, the leading on-chain covered calls protocol

- Invested in Trade Neutral to expand services to Solana ecosystem

- Extended protocol to Arbitrum and integrated GMX

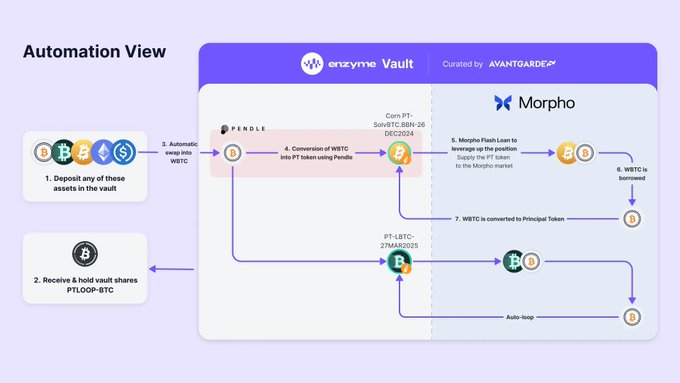

- Launched first Advanced Automated Loops with Stader Labs

- Reached $220M in Assets Under Technology with 1,400+ creations

2025 roadmap focuses on:

- Completing Solana integration

- Expanding to additional networks

- Launching V5 protocol update

- Strengthening global infrastructure position

The protocol has maintained steady growth since its 2017 launch as Melon Protocol, navigating market cycles while expanding capabilities.

Last week, we shared a major milestone for Enzyme: our investment in @TradeNeutral to bring our services to @solana Why is this important for Enzyme, Decentralized Finance, and Solana? Let’s break down the details⬇️

Network compatibility is essential for the widespread adoption of on-chain asset management services. Enzyme is already available on @ethereum, @0xPolygon, and has recently integrated @arbitrum. But that’s not all! Stay tuned for an exciting announcement this Wednesday🚀

Yesterday, we announced that Enzyme, the leading on-chain asset management infrastructure, is extending its services to @solana through a strategic partnership with @TradeNeutral. What’s next, and why does it matter? Let’s dive in 🧵

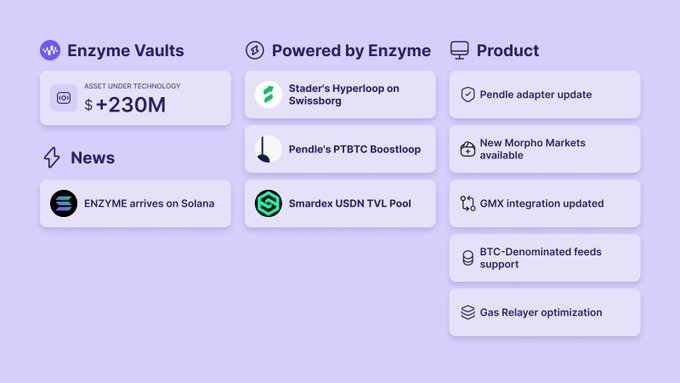

ENZYME - NOV 24 RECAP As December sets the stage for an exciting 2025, November proved to be an exhilarating month for Enzyme. @solana expansion, @pendle_fi PTBTC Vault, @staderlabs' Hyperloop on @Swissborg ... — Let’s take a moment to look back and reflect on these milestones.

ICYMI: today’s big news — Enzyme arrives on @Solana, unlocking new DeFi opportunities! Excited to be working together with our friends at @TradeNeutral to make this happen!

We are delighted to share that Enzyme, the leading on-chain asset management infrastructure, has invested in @TradeNeutral and extends its services to @solana! This partnership marks a pivotal moment for Decentralized Finance and the Solana ecosystem. Learn more ⬇️

We are delighted to share that Enzyme, the leading on-chain asset management infrastructure, has invested in @TradeNeutral and extends its services to @solana! This partnership marks a pivotal moment for Decentralized Finance and the Solana ecosystem. Learn more ⬇️

2025 : A NEW CHAPTER 🚀 As we wrap up 2024 and prepare for what promises to be the most pivotal year in Enzyme’s journey, we reflect on the exhilarating path we’ve traveled. In 2025, Enzyme steps into a new chapter, building on past successes to aim higher ⬇️ This milestone

Enzyme Partners with 1Token to Solve Multi-Venue Asset Valuation

Asset managers running strategies across centralized exchanges, DeFi protocols, and multiple wallets face a critical challenge: accurate reporting. Inconsistent data sources make it difficult to provide reliable valuations to investors. **The Solution** Enzyme has partnered with [1Token](https://enzyme.finance/blog-posts/enzyme-and-1token-partnership?utm_source=x&utm_medium=organic&utm_content=post) to address this problem: - Reconciles data from both CeFi and DeFi sources - Provides unified valuation across multiple venues - Helps managers maintain investor confidence through transparent reporting This follows Enzyme's recent integration with Octav, showing a pattern of building infrastructure for cross-chain and multi-venue asset management. **Why It Matters** As crypto strategies become more complex, spanning different chains and platforms, accurate position tracking becomes essential for institutional adoption and investor trust.

On-Chain Spot Markets Gain Institutional Traction with Improved Execution

On-chain spot markets are narrowing the price gap with traditional venues while maintaining self-custody and instant settlement advantages. **Key developments:** - Capital efficiency improving through faster block times and enhanced execution infrastructure - Trading volume expanding as tooling matures - Institutional participants now actively monitoring the space **Market context:** This follows 3x year-over-year growth in USDC's share of spot trading volume through September 2025. Stablecoins are increasingly powering settlement and providing 24/7 market liquidity beyond traditional banking hours. The shift represents a tangible evolution from theoretical concepts to operational reality in capital markets infrastructure.

🔧 Onyx Timing Strategy

**Enzyme Onyx** addresses different protocol needs across three key stages: - **Pre-TGE**: Early participation incentives to build community - **Post-TGE**: Strengthen Total Value Locked (TVL) after token launch - **Mature stage**: Manage liquidity across multiple assets including stablecoins and liquid staking tokens The platform provides structured, on-chain strategies that protocols can adopt when timing is right for their development phase. Each stage requires different tooling approaches, but most protocols eventually need comprehensive on-chain financial infrastructure. [Explore Onyx](https://enzyme.finance/products/onyx?utm_source=x&utm_medium=organic&utm_content=post)

Chainlink CRE Automates Multi-Chain Asset Reporting for Fund Managers

**Multi-chain complexity solved**: As investment products expand across different blockchains, reporting becomes increasingly complex for asset managers. **Automated data sourcing**: Chainlink's CRE (Crypto Reporting Engine) automatically pulls and verifies NAV and performance data from: - On-chain sources - Centralized finance platforms - Traditional financial systems **Pain point addressed**: The solution eliminates manual reporting work that previously required tracking assets across multiple chains and platforms. **Verification built-in**: All data is automatically verified, reducing errors and ensuring accuracy for compliance and investor reporting.

Enzyme.Myso Introduces Institutional-Grade Options for On-Chain Yield Generation

Enzyme.Myso is advancing DeFi with institutional-grade on-chain options trading. The platform offers: - Native on-chain options strategies - Fully auditable transaction flows - Infrastructure designed for DAOs and institutions **Real-world implementation**: Compound DAO recently integrated covered calls into their treasury strategy using Enzyme.Myso, targeting approximately 15% APY while maintaining controlled risk exposure. This development signals a shift in how DAOs can optimize idle capital through sophisticated options strategies. *Learn more at* [Enzyme Finance](http://enzyme.finance/products/myso)