Trava Lending Market Update: USDC Lending Conditions on Base Chain

Trava Lending Market Update: USDC Lending Conditions on Base Chain

🔥 USDC Markets Living Dangerously

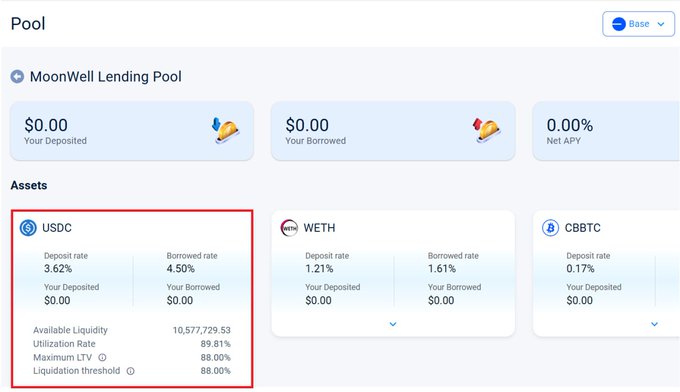

Current USDC Lending Metrics on Moonwell (Base Chain):

- Deposit APY: 3.62%

- Borrow APY: 4.50%

- Utilization Rate: 89.81%

- Max LTV & Liquidation Threshold: 88%

Market Analysis: High utilization rates are creating narrow lending spreads. With no safety buffer for borrowers, liquidation risks are significant. This continues a trend from previous months, where Base chain lending rates have remained competitive but risky.

Historical Context: Earlier rates in April showed lower but more stable metrics:

- Ionic Protocol: 3.04% deposit / 8.28% borrow

- Moonwell: 2.97% deposit / 4.38% borrow

- ZeroLend: 2.15% deposit / 3.74% borrow

🚨 Trava Lending on @MoonwellDeFi $USDC on @base is 🔥 • Deposit APY: 3.62% • Borrow APY: 4.50% • Utilization: 89.81% • Max LTV: 88% • Liquidation Threshold: 88% ➡️ High demand = tight lending spreads ⚠️ No buffer for borrowers, risk is real. Yield’s hot. Risk’s hotter.

Trava Freight Launches One-Click DeFi Transaction Bundling

Trava Finance introduces Freight, a new DeFi automation tool that bundles multiple transactions into a single click. The feature streamlines operations like withdrawing and depositing across different protocols, reducing both time and gas fees. Key features of Trava Station: - Freight: Custom transaction sequences - Tramlines: One-click shortcuts - Junction: Automated execution - Portfolio: Asset tracking - Analytics and Recommendations The platform aims to simplify DeFi operations through its unified dashboard at [Trava Station](https://app.trava.finance/station).

Why Overcollateralization Matters in DeFi

DeFi lending traditionally requires borrowers to deposit more collateral than they borrow for security. This overcollateralization can be challenging for borrowers to manage. New solutions are emerging to address this: - **Credit Delegation**: Aave enables trusted users to borrow without collateral when backed by another user - **On-Chain Credit Scoring**: AI models like Aimstrong assess borrower risk to enable lower collateral requirements - **Flash Loans**: Uncollateralized loans that must be repaid within the same transaction These innovations suggest DeFi lending is evolving toward more flexible collateral requirements while maintaining security.

Trava NFT Heuristic Farming Closure

Trava Finance has announced the closure of its NFT Heuristic Farming feature. This decision aims to redirect resources towards developing an AI-driven DeFi Station. Key points: - Heuristic Farming is now closed - No more rewards will be earned - User assets remain secure and withdrawable - Access via https://nft-app.trava.finance/heuristic-farming This closure follows recent deprecation of several farming pools, including VS-ETH, SWORD-ETH, and others, as part of Trava's efforts to streamline and focus on high-quality farming tokens.