Super OETH: The Least Volatile Liquid Staking Token

Super OETH: The Least Volatile Liquid Staking Token

🛡️ Steady as she goes

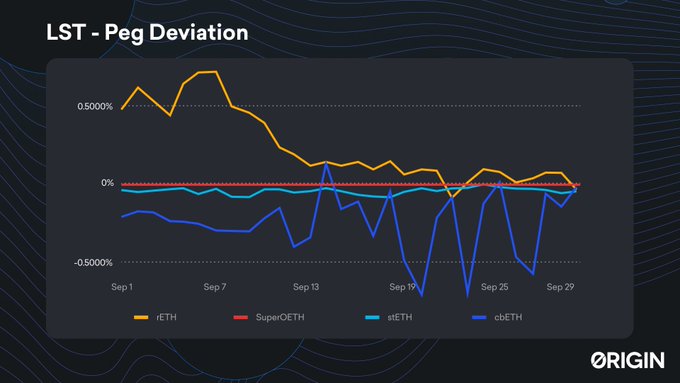

Super OETH has emerged as the most stable Liquid Staking Token (LST) in the market, maintaining a tight peg to ETH.

- A chart comparing peg stability across various tokens highlights Super OETH's performance.

- The token's price deviation from ETH is represented by a notably flat red line.

This stability offers users a reliable option for participating in Ethereum staking while minimizing volatility risks.

Key Takeaway: Super OETH's consistent peg to ETH sets it apart in the LST landscape, potentially attracting investors seeking stability in the volatile crypto market.

Super OETH: The least volatile LST, staying tightly pegged to ETH 🛡️ See that little flat red line? That's Super OETH's deviation from the price of ETH. 🔴 Check out the chart below comparing each token's peg stability:

Origin and Frax Launch frxUSD/OUSD Pool on Curve, Surpasses $1M TVL

Origin and Frax have launched a new liquidity pool pairing frxUSD and OUSD on Curve Finance, which crossed $1M in total value locked within its first week. **Key Details:** - LPs currently earn up to 19.7% APY through co-incentives from both protocols - Origin's Pool Booster routes additional incentives to maintain liquidity depth - The pool enables tight spreads and efficient execution for traders **Strategic Framework:** The launch establishes a repeatable model for bringing new stablecoin markets to Curve with sustained liquidity and aligned incentives. Origin is already working on similar deployments with other stablecoin issuers. [Explore the pool](https://www.curve.finance/dex/ethereum/pools/factory-stable-ng-584/deposit)

Origin Ether Deploys Upgrade with Merkle Proofs and Validator Protections

Origin Ether has deployed a protocol upgrade that introduces three technical improvements for ETH staking: - **Merkle proofs** enable onchain balance verification - **Consolidated, compounding validators** streamline operations - **Built-in protection** against validator front-running The upgrade simplifies the staking architecture while providing clearer accounting and stronger execution guarantees for participants. These changes aim to make the staking process more transparent and secure for ETH holders using the Origin protocol.

Origin Dollar Launches New USDC-Backed Yield Engine with Morpho Vault

**Origin Dollar (OUSD) has completed a major infrastructure upgrade**, transitioning to 100% USDC backing and launching a custom-built yield engine. **Key Changes:** - OUSD now exclusively backed by USDC instead of multiple collateral types - Yield generated through dedicated [Morpho Vault](https://www.originprotocol.com/blog/ousd-new-yield-engine?lang=en&category=all&page=1) built with Yearn Finance - Vault dynamically allocates liquidity across whitelisted lending markets **Initial Markets Include:** - WBTC and cbBTC - wstETH and OETH - Select stablecoins **What's Next:** Phase 2 will introduce multi-chain yield opportunities, expected to push APYs into the high single-digit range. The simplified architecture aims to improve capital efficiency, risk management, and redemption predictability while positioning OUSD to scale as new strategies and chains are supported.

**Pendle Launches First stETH Volatility Trading Market via ARM Integration**

**Pendle introduces liquid yield trading for stETH volatility** through ARM (Automated Risk Management) integration. **How ARM generates yield:** - Buys stETH at discount during volatility - Redeems back to ETH at 1:1 ratio via Lido - Captures spread as profit for depositors **Pendle splits ARM yield into tradeable tokens:** - **PT (Principal Tokens):** Steady ETH exposure + fixed yield - **YT (Yield Tokens):** Leveraged upside to ARM yields This creates the **first direct way to trade stETH volatility** on Pendle. Higher stETH price swings = more arbitrage opportunities = increased yields for ARM depositors. Traders can now: - Speculate on stETH volatility through YT - Lock in fixed yields from ARM via PT - Provide liquidity to earn trading fees The ARM vault combines Lido stETH arbitrage with lending yield on idle ETH via Morpho, creating a unique yield source tied to protocol-driven arbitrage. [Trade the market](https://app.pendle.finance/trade/markets/0x53f940db819400f226466f5ad330c177a4be6b3c/swap?view=pt&chain=ethereum)

💰 Reverse Lending

**Morpho's Borrow Booster markets** are offering negative interest rates on USDC loans across Base and Ethereum networks. **Key Features:** - Borrowers earn ~9.7% APY while taking USDC loans - Available on both Base (Super OETH market) and Ethereum (OETH market) - Auto-deleverage feature provides automatic risk management - Higher LTV loops generate more rewards **How It Works:** The markets use yield generated by OETH and Super OETH tokens to subsidize borrowing costs, effectively paying users to borrow rather than charging them. **Risk Management:** Auto-deleverage handles risk trims automatically, allowing users to maintain higher loan-to-value ratios while reducing liquidation pressure. Both markets are accessible through [Morpho's platform](https://app.morpho.org) with competitive LTV ratios - 86% on Ethereum and 77% on Base.