StakeWise Boosted osETH-ETH Pool Update

StakeWise Boosted osETH-ETH Pool Update

🏊 Pool Yields Just Got Juicy

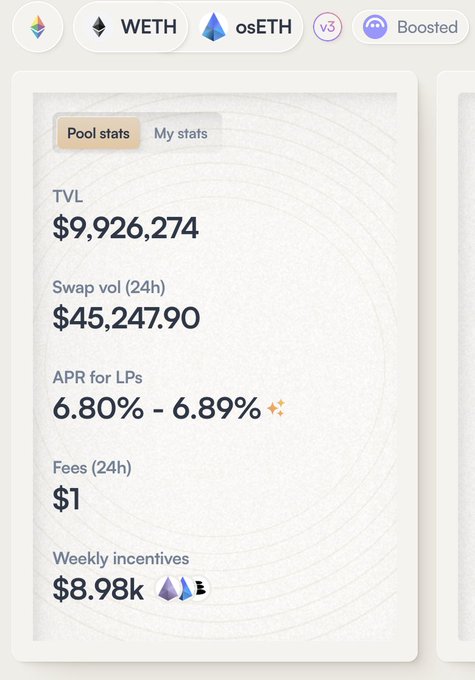

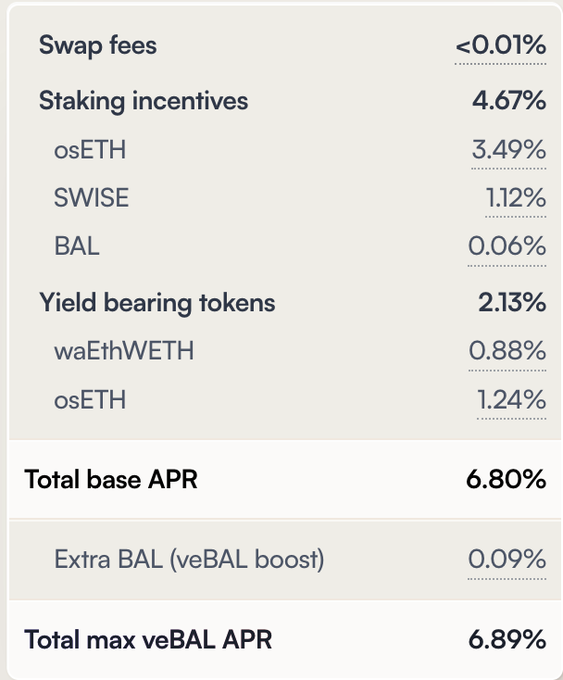

The new Boosted osETH-ETH pool on Balancer is delivering strong returns, with 80% of yields now in ETH following reduced SWISE emissions. Key features:

- Automated deployment of spare ETH capacity to Aave for lending yields

- Incentive mix: 75% osETH, 25% SWISE (BAL rewards coming soon)

- Enhanced capital efficiency compared to legacy pool

The pool transition began April 28th with new incentives structure. LPs can now migrate from the legacy pool to access these improved yields.

A reminder for all osETH-ETH LPs on Balancer 🚨 On Monday, April 28th (next week), StakeWise DAO will be reallocating incentives to the new Boosted osETH-ETH pool 🚀 The new pool will bring more capital efficiency as the spare ETH capacity of the pool will be automatically

The incentives are LIVE in the new Boosted osETH-ETH pool on Balancer! Migrate from the legacy pool to the new, Boosted pool, and enjoy an ETH-denominated APY for your liquidity 💧 Links to the pool & guide inside 👇

Liquidity providers in our Boosted osETH-ETH pool are making good $$$ - see below 👀 The best part? 80% of this yield is pure ETH, since $SWISE emissions were cut last month. Link to the pool inside 👇

🔥 New osETH Strategy Launches

A new osETH strategy has been launched through a collaboration between Gearbox Protocol, KPK, and Beefy Finance. **Key Features:** - Up to 34% APY - Instant deposits and withdrawals with no delays or penalties - Low risk profile tied to pegged assets The strategy is now live and accessible at [kpk.gearbox.finance](https://kpk.gearbox.finance/strategies/open/1/0x1a711a5bc48b5c1352c1882fa65dc14b5b9e829d). A detailed guide and risk explanation will be released in the coming days.

⚠️ New osETH Strategy Launches with 34% APY and Important Depeg Warnings

A new leveraged staking strategy for osETH has launched through a collaboration between Gearbox Protocol, kpk, and Beefy Finance. **Key Features:** - Up to 34% APY by earning the spread between Balancer's boosted osETH-ETH pool (~7% APY) and ETH/wstETH borrowing costs (~3% APY) - Supports up to 10x leverage loops - Flexible withdrawals with no delays or penalties if APY drops below base osETH staking rate **Critical Risk Warning:** Collateral pricing is based on Balancer LP exchange rates. **Depegs exceeding 2% will directly impact your health rate on Gearbox.** **Recommended Safety Measures:** - Maximum 6x leverage (not the full 10x available) - This provides an 8% depeg buffer for protection The strategy targets users seeking higher yields on pegged assets while maintaining relatively low risk, though proper leverage management is essential.

🎯 StakeWise DAO Acquires $10M osETH Liquidity at Zero Cost

StakeWise DAO has secured a significant win with three major developments: - **infoFi suspended** - removing a previous operational concern - **Withdrawal queue reduced** to under 24 hours, improving user experience - **$10M in osETH liquidity** now owned by the DAO at zero cost The liquidity acquisition represents a strategic treasury gain for the protocol without requiring capital expenditure. Combined with the improved withdrawal times, these changes strengthen StakeWise's operational efficiency and financial position. The DAO continues its governance activities, with previous votes including a proposal to migrate ~15,000 ETH from node operators to StakeWise Vaults.

Ethereum's PeerDAS Upgrade Delivers 8x Throughput Boost in 3 Weeks

**Ethereum's PeerDAS upgrade launches in approximately 3 weeks**, delivering the network's biggest scalability improvement since Layer-2 rollups. **How PeerDAS Works:** - Splits transaction data into **128 pieces** instead of sending full data to every node - Each validator only stores and verifies **8 out of 128 pieces** (1/16th of original data) - Uses **erasure coding** - data can be fully reconstructed from just 50% of pieces - Reduces storage requirements from 768kb to **96kb per validator** **Key Benefits:** - **8x network throughput increase** without hardware upgrades - Maintains **decentralization** by keeping home stakers viable - Applies specifically to **Layer-2 blob data**, amplifying L2 transaction capacity - Preserves full data availability and security guarantees **Technical Innovation:** Nodes are organized into 128 gossip networks, each responsible for one data piece. Every validator participates in at least 8 groups, ensuring redundancy while dramatically reducing individual resource requirements. This upgrade addresses Ethereum's core challenge: scaling transaction volume while keeping validation accessible to independent operators, not just large institutions with expensive hardware.

StakeWise DAO Recovers $20.7M from Balancer V2 Exploiter

**StakeWise DAO successfully recovered majority of stolen funds** from the Balancer V2 exploit through emergency multisig operations. **Recovery Details:** - Recovered ~5,041 osETH (~$19M) - representing 73.5% of stolen tokens - Recovered 13,495 osGNO (~$1.7M) - 100% of stolen osGNO - Total recovery: **$20.7M in stolen assets** **What Happened:** - Attacker had converted remaining osETH portion to ETH before recovery - Emergency multisig executed series of transactions within hours of exploit - Full osGNO recovery achieved on Gnosis Chain **Next Steps:** - Recovered funds will be **returned to affected users** - Distribution based on pro-rata pre-exploit balances - Full post-mortem and detailed operation account coming soon Collaboration with Balancer, Gnosis Chain teams, and security experts enabled the swift recovery operation.