Stablecoins Shift from Experiment to Core Financial Infrastructure at Davos

Stablecoins Shift from Experiment to Core Financial Infrastructure at Davos

🏦 Stablecoins surpass traditional transfers

Circle CEO Jeremy Allaire spoke at the World Economic Forum about stablecoins transitioning from experimental technology to essential financial infrastructure.

Key developments:

- Stablecoin transfer volumes now exceed traditional payment rails

- Focus has moved from testing to rebuilding core systems for payments, cross-border flows, and reserve currencies

- The shift reflects growing institutional confidence in regulated digital assets

The discussion comes as USDC processes nearly $10T in quarterly transaction volume and expands across 30 blockchains, with regulated stablecoins increasingly integrated into mainstream financial workflows.

The internet financial system isn’t built with a single product. It’s built with layers that reinforce each other. → Trusted digital assets power value. → Applications turn that value into real workflows. → @Arc unites programmable money and onchain innovation with real-world

Tweet not found

The embedded tweet could not be found…

Building the infrastructure behind internet-native financial systems requires trust, scale, and time. @jerallaire joined @DM_Rubenstein at @TheEconomicClub to discuss Circle’s work on stablecoin rails and the foundations of global money movement.

For users and institutions, the promise is simple: faster, cheaper, always-on finance. But regulated stablecoins are just the beginning. A new system is taking shape. → @Arc, a new blockchain network designed as the Economic OS for the internet → Regulated digital assets

Arc was designed in 2025 to become the Economic OS for the internet. → Designed for deterministic sub-second finality → @USDC as native gas with predictable, fiat-denominated fees → Built for institutions, developers, and AI-native financial workflows → Backed by a growing

Circle’s Chief Strategy Officer @ddisparte shares, “USDC is emerging as the tokenized dollar backbone of the modern financial system,” in conversation with @scottmelker.

The internet financial system is here and stablecoins are at the core. Register and join our Executive Insights session, What the Internet Financial System Unlocks for Banks on Jan 26 at 10:00am ET. circle.com/webinars/what-…

Beyond stablecoins, a new financial system is taking shape. What began as an innovation in digital dollars has evolved into core financial infrastructure. In just a few years, regulatory clarity, institutional adoption, and onchain technology have converged. This report

A wave of commercial expansion took shape in 2025. As regulatory clarity advanced, institutions moved from exploring stablecoins to using them in real financial workflows. @USDC, EURC, and USYC began showing up across payments, treasury, settlement, and capital markets. What

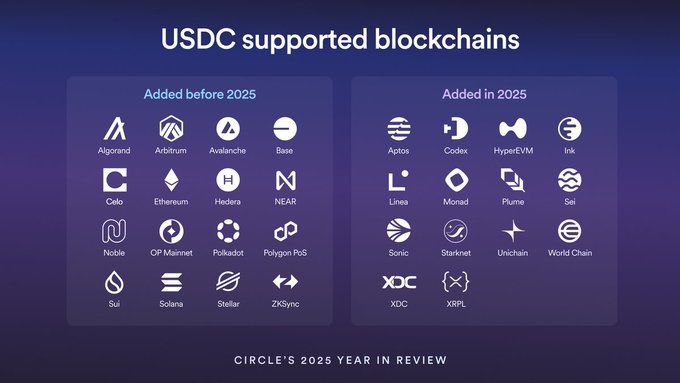

USDC’s multichain expansion accelerated in 2025. → Natively available on 30 blockchains → 14 new networks added in a single year → Built to meet institutional scale and reliability requirements The goal wasn’t just reach. It was usability. CCTP, Gateway, and xReserve work

How can stablecoins expand financial access for the world’s most underserved? Circle’s Chief Strategic Engagement Officer, Elisabeth Carpenter, shared her perspective with the World Economic Forum, exploring how regulated stablecoins are already being used to widen access to

Stablecoins are emerging as foundational building blocks in the broader tokenization of real world assets. @ddisparte speaks on USDC becoming the onchain dollar infrastructure of the modern financial system with @scottmelker on The Wolf Of All Streets.

Capital markets are moving onchain. → 3x YoY growth in @USDC share of spot trading volume as of Sep 30, 2025 → Stablecoins powering settlement and market liquidity → 24/7 markets beyond legacy banking hours What was once conceptual is taking flight.

At @wef, @jerallaire discussed the growing role of stablecoins in the global financial system on a panel moderated by @gerardtbaker. As stablecoin transfers surpass traditional transfers, the focus has shifted from experimentation to infrastructure reshaping payments,

Trust is the foundation of any financial system. As regulatory clarity accelerated in 2025, institutions increasingly looked for digital assets that could operate inside clear, enforceable rules. Circle was already built for that environment, with fully reserved stablecoins,

As billions of AI agents enter the global economy, the financial system must operate at internet speed and scale. At @wef, @jerallaire on why stablecoins are the only infrastructure built for that future.

🏦 Stablecoin Payments Surge 70% Following GENIUS Act

Institutional adoption of stablecoins for payments has increased 70% since the GENIUS Act established federal regulatory framework for payment stablecoins in the U.S. **Key developments:** - Real-time cross-border settlement now operational - Programmable treasury and cash management capabilities deployed - Global liquidity accessible without traditional banking infrastructure The legislation provided regulatory clarity that enabled institutions to integrate digital dollars into operational workflows. USDC is among the stablecoins facilitating these payment rails.

Circle Executive Outlines Vision for Programmable Financial Infrastructure at NY Fed Conference

Circle's Sunil Sharma presented the company's vision for global finance at the New York Fed's 2025 FX Market Structure Conference. **Key Points:** - Circle is building infrastructure for an **open, programmable global financial system** - Focus on moving money and settlement onto internet-native rails - USDC positioned as foundational technology for this transition - Emphasis on **automated trust mechanisms** to reduce counterparty risk Sharma's remarks signal institutional recognition of stablecoin infrastructure, with Circle making its case directly to traditional finance stakeholders at a Federal Reserve event.

EURC gains traction as MiCA compliance drives euro stablecoin adoption

**EURC is emerging as a preferred euro-denominated stablecoin** as Europe's MiCA regulations take effect. The compliant digital asset is being used for onchain payments and treasury operations. - EURC enables users to move, hold, and settle euros on blockchain networks - Demand for MiCA-compliant euro stablecoins has increased significantly - The asset is integrating traditional euro liquidity into decentralized finance infrastructure This follows earlier reports showing euro stablecoins doubling in market cap after MiCA implementation, with EURS and EURC leading adoption. The regulatory framework appears to be creating clarity that supports institutional and retail use of euro-backed digital assets.

🌐 VelaFi Joins Circle Payments Network

**VelaFi has integrated with Circle Payments Network (CPN)**, enabling real-time settlement using USDC and EURC stablecoins across global corridors. **Key capabilities unlocked:** - Enterprise payments - Treasury management and liquidity operations - Multi-currency settlement VelaFi operates across Asia, the US, and Latin America, connecting customers to compliance-driven settlement through a single CPN integration. This follows recent CPN expansion by Saber into EU and India payment corridors. CPN launched in April 2025 as Circle's infrastructure for 24/7 stablecoin-powered cross-border payments.

Circle Launches Crosschain Forwarding Service on Mainnet

Circle has launched its **crosschain forwarding service** for CCTP (Cross-Chain Transfer Protocol) on mainnet. The fully managed service automates destination-chain execution for crosschain transactions. **Key features:** - Reduces end-to-end transfer speed - Lowers operational costs and third-party risk - Improves developer and user experience **Supported networks include:** Arbitrum, Avalanche, Base, Ethereum, HyperEVM, Ink, Linea, Monad, Optimism, Polygon, Sei, Sonic, Unichain, and World Chain, with more expected. Circle plans to expand the forwarding service to Circle Gateway, Bridge Kit, and more flexible forwarding capabilities in coming months. The service previously launched on testnet in late January. Developers can start building: [developers.circle.com/cctp/concepts/forwarding-service](http://developers.circle.com/cctp/concepts/forwarding-service)